- Home

- »

- Homecare & Decor

- »

-

Landscaping Service Market Size And Share Report, 2030GVR Report cover

![Landscaping Service Market Size, Share & Trends Report]()

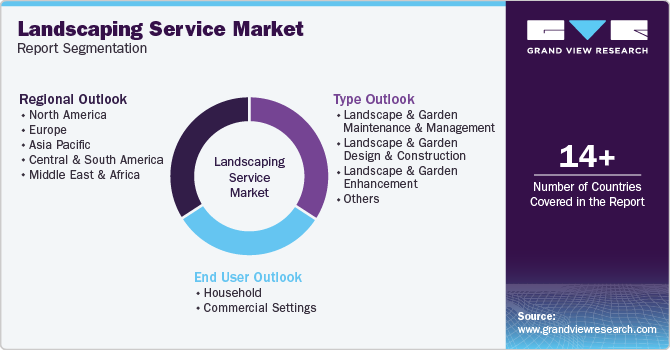

Landscaping Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Landscape & Garden Maintenance & Management, Landscape & Garden Design & Construction), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-046-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Landscaping Service Market Summary

The global landscaping services market size was estimated at USD 330.58 billion in 2024 and is projected to reach USD 484.79 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. Rapid urbanization, coupled with extensive infrastructure projects, is significantly propelling the demand for professional landscaping services.

Key Market Trends & Insights

- The landscaping services market in North America accounted for a market share of 47.55% in 2024.

- In 2024, the U.S. landscaping services market held share of 83.92% of the North American market.

- Based on type, the landscape and garden maintenance segment captured a revenue share of 43.69% in 2024.

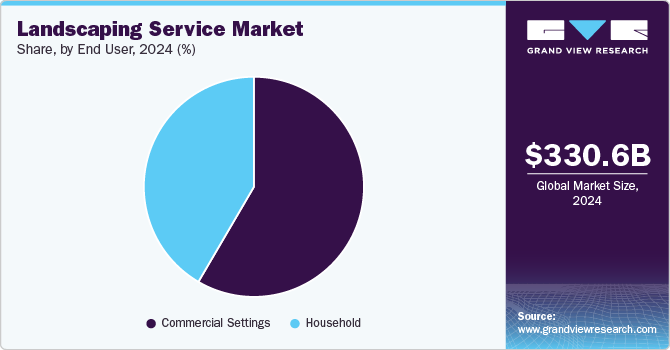

- Based on end user, the commercial settings accounted for a revenue share of 58.42% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 330.58 Billion

- 2030 Projected Market Size: USD 484.79 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

As cities expand, the need for aesthetic green spaces and well-maintained outdoor environments becomes critical, driving investment in landscaping solutions for both residential and commercial properties.

The market has experienced steady growth in recent years, driven by increased demand for aesthetically pleasing outdoor spaces, both in residential and commercial sectors. Key growth drivers include rising disposable incomes, which allow homeowners and businesses to invest in lawn care and garden enhancements, and growing awareness of environmental sustainability, leading to an uptick in eco-friendly landscaping practices. Furthermore, a surge in urbanization has intensified the need for green spaces in cities, driving demand for landscape design and maintenance.

The market has growth potential, particularly in the adoption of sustainable landscaping and smart technology. With climate change concerns, businesses and homeowners are increasingly turning to eco-friendly services like xeriscaping (water-conserving landscapes) and the use of native plants. Moreover, the incorporation of smart irrigation systems and robotic lawnmowers is revolutionizing the way landscaping is maintained.

The market is growing robustly in both the residential and commercial sectors, albeit with different dynamics. The residential sector benefits from increasing homeownership and a rising trend toward outdoor living spaces like patios and backyard gardens. A report by the National Association of Landscape Professionals (NALP) indicates that over 75% of U.S. homeowners invested in outdoor upgrades in 2022. Meanwhile, the commercial sector is driven by corporate sustainability initiatives and urban development projects, which require large-scale landscaping. The growing demand for eco-friendly office campuses and commercial complexes with green spaces is fueling growth.

The growing demand for smart landscaping solutions, such as automated irrigation systems and AI-driven lawn care technology, presents new growth opportunities for service providers. These technologies offer greater efficiency, water conservation, and cost savings, appealing to both commercial clients. For instance, smart irrigation systems consider weather patterns and soil conditions to optimize water usage, leading to potential water savings of up to 30%. Companies that integrate these advanced systems into their service offerings can tap into the rising demand for tech-driven, sustainable landscaping solutions.

Type Insights

The landscape and garden maintenance segment captured a revenue share of 43.69% in 2024. Landscape and garden maintenance is essential for preserving the aesthetic value and overall health of outdoor spaces. A well-maintained garden enhances curb appeal, creating a welcoming atmosphere and increasing property value. Regular upkeep, including mowing, trimming, and planting seasonal flora, ensures a vibrant and inviting appearance. Beyond looks, garden maintenance also offers practical benefits like preventing weed infestation and controlling pests, which keeps the landscape clean, safe, and functional for families. Regular attention to the garden ensures it remains a valuable, beautiful extension of the home.

The landscape & garden design & construction segment is expected to grow at a CAGR of 7.4% from 2025 to 2030. Upgrading gardens and outdoor spaces can significantly increase a home's value by enhancing its aesthetic appeal, functionality, and buyer desirability. Features like patios, decks, and professional landscaping can add as much as 10-20% to the resale value, with an ROI of 66% to 500%, depending on the type of upgrade and quality of the work. For example, patios and decks not only create additional usable space but also make the property more attractive to buyers seeking outdoor living areas. Similarly, landscaping, particularly with mature plants, trees, and an irrigation system, offers long-term curb appeal that helps drive up the home’s value.

These trends bode well for the landscape & garden design and construction market, as more homeowners are investing in outdoor spaces to boost property value and appeal to potential buyers. As professional landscaping services can add up to USD 10,000 or more to a home’s listing price, the demand for skilled landscape designers and contractors continues to rise.

End User Insights

Commercial settings accounted for a revenue share of 58.42% in 2024. Landscaping services for residential settings are vital for enhancing property value and aesthetics. A well-maintained lawn and thoughtfully designed garden can increase curb appeal, attracting potential buyers and boosting the home's resale value. Homeowners also benefit from improved outdoor living spaces, adding privacy, usability, and personal enjoyment. Moreover, landscaping helps address functional issues such as drainage, reducing flood risks, and improving water management. With the added value, both in equity and day-to-day quality of life, investing in landscaping services provides consumers with long-term financial and lifestyle benefits.

The household segment is expected to grow at CAGR of 7.0% from 2025 to 2030. Marketplace booking platforms aggregate various cycling tours, accommodations, and services, allowing tourists to browse and compare options all in one place. This setup streamlines the booking process, saving time for travelers who can review itineraries, pricing, and customer reviews to make informed decisions. Additionally, many marketplace platforms offer secure payment methods, customer support, and flexible cancellation policies, giving travelers peace of mind when booking.

Regional Insights

The landscaping services market in North America accounted for a market share of 47.55% in 2024 in the global market. This cultural affinity for well-maintained lawns has helped make North America a major market for landscaping services. Homeowners, businesses, and institutions alike invest heavily in landscaping to ensure their properties reflect aesthetic appeal, organization, and care. The desire for pristine lawns has given rise to a robust industry, with Americans spending heftily on lawn care. The demand is fueled by the perception that green spaces contribute to property value and enhance the overall quality of life. As cities and suburbs expand, so does the need for regular landscaping services.

U.S. Landscaping Services Market Trends

In 2024, the U.S. landscaping services market held share of 83.92% of the North American market. Homeowners increasingly seek functional and visually appealing landscapes, adding elements like patios, gardens, and eco-friendly lawns to extend living areas outdoors. Additionally, commercial properties and municipalities invest in landscaping to improve aesthetics, reduce environmental impact, and create inviting public spaces. As environmental awareness grows, more clients request sustainable features, such as native plants and efficient irrigation, driving demand for specialized landscaping expertise.

Europe Landscaping Services Market Trends

The landscaping services market in Europe accounted for a share of 28.62% in 2024. Landscaping services in Europe are evolving to meet the diverse needs of both residential and commercial clients, offering solutions that range from garden design to long-term maintenance. The demand for professional landscaping is driven by a growing appreciation for outdoor aesthetics, with homeowners and businesses seeking to enhance their outdoor spaces. Environmental concerns are also influencing trends, with sustainable practices like water conservation and native plant integration becoming key priorities. Despite economic pressures such as inflation, the industry continues to cater to varying budgets, focusing on creating functional and beautiful landscapes that align with regional climates and preferences.

Asia Pacific Landscaping Services Market Trends

Asia Pacific landscaping services market is expected to grow at a CAGR of 5.5% from 2025 to 2030. As cities across the Asia Pacific increasingly focus on sustainable urban development, the demand for landscaping services has surged. Governments and urban planners are engaging landscaping professionals to design and implement green spaces that align with environmental policies. In cities like Shanghai, substantial investments are being made into low-carbon urban projects and ecosystem protection, creating a growing need for landscaping expertise to bring these green initiatives to life. This trend reflects a broader shift towards environmentally conscious urban planning across the region, with landscaping services playing a pivotal role in transforming cityscapes.

Key Landscaping Service Company Insights

Some of the major companies operating in the market are BrightView Holdings, Inc., Yellowstone Landscape., Gothic Landscape, Inc., Ruppert Landscape, and U.S. Lawns. These key companies are focusing on taking major initiatives to strengthen their market position and offer landscaping services, designs, and consultancy to customers across the world.

Key Landscaping Service Companies:

The following are the leading companies in the landscaping service market. These companies collectively hold the largest market share and dictate industry trends

- BrightView Holdings, Inc.

- Yellowstone Landscape.

- Gothic Landscape, Inc.

- Ruppert Landscape

- U.S. Lawns.

- Clintar

- Chapel Valley Landscape Company.

- Landscape Workshop LLC.

- The Grounds Guys.

- Asia Flora & Landscape Sdn. Bhd.

Recent Developments

-

In July 2024, Landscape Workshop announced the acquisition of Nature Coast Landscape Services, a Florida-based commercial landscaping company. This acquisition expands Landscape Workshop's presence in the Florida market and enhances its service offerings. The deal is part of Landscape Workshop's growth strategy, allowing the company to strengthen its footprint in the Southeast region and provide more comprehensive landscape services to its clients.

-

In July 2024, Ruppert Landscape, backed by private equity firm Knox Lane, announced the acquisition of The Greenery of Charleston, a commercial landscaping company based in South Carolina. This acquisition strengthens Ruppert Landscape's presence in the Charleston area and further expands its commercial landscape services portfolio. The deal reflects Ruppert's ongoing growth strategy, aiming to enhance its market reach and capabilities in the landscaping industry.

-

In July 2024, Phoenix Pro Landscaping announced the launch of its new WaterWise Landscaping Program in Gilbert, Arizona. This initiative focuses on creating sustainable, water-efficient landscapes designed to conserve water in the region's arid climate. The program offers services such as xeriscaping, drought-resistant plant selection, and advanced irrigation systems to help homeowners and businesses reduce water usage. The WaterWise program is part of Phoenix Pro Landscaping’s efforts to promote environmentally friendly landscaping solutions that align with the community’s growing need for water conservation.

Landscaping Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 350.39 billion

Revenue forecast in 2030

USD 484.79 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end user, region.

Regional Scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; South Africa; and Brazil

Key companies profiled

BrightView Holdings, Inc.; Yellowstone Landscape.; Gothic Landscape, Inc.; Ruppert Landscape; U.S. Lawns.; Clintar; Chapel Valley Landscape Company.; Landscape Workshop LLC.; The Grounds Guys.; Asia Flora & Landscape Sdn. Bhd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Landscaping Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global landscaping services market report based on the type, end user, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Landscape & Garden Maintenance & Management

-

Landscape & Garden Design & Construction

-

Landscape & Garden Enhancement

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Commercial Settings

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global landscaping services market was estimated at USD 330.58 billion in 2024 and is expected to reach USD 350.39 billion in 2025.

b. The global landscaping services market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 484.79 billion by 2030.

b. North America dominated the landscaping services market with a share of around 47.5% in 2024. This is owing to the high-income groups like corporate investors and major business owners, picturesque landscapes around residential properties and large offices, corporate campuses, and business buildings are becoming more and more popular as it helps to create a prominent and luxurious image.

b. Some of the key players operating in the landscaping services market include Yellowstone Landscape; BrightView Holdings Inc (BrightView); Chapel Valley Landscape Company; Denison Landscaping; CLINTAR; Gothic Landscape, Inc.; Lawn Doctor Inc.; Asia Flora & Landscape Sdn. Bhd.; Ruppert Landscape; and Mainscape, Inc.

b. Key factors that are driving the landscaping services market growth include the rising popularity of organic gardening and accessibility to high-tech landscaping products as a result of rapid industrialization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.