- Home

- »

- Homecare & Decor

- »

-

Landscape Lighting Market Size And Share Report, 2030GVR Report cover

![Landscape Lighting Market Size, Share & Trends Report]()

Landscape Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (LED Lights, High-Intensity Discharge Lamps), By Product (Path Lights, Flood Lights, Wall Lights), By Operation, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-440-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Landscape Lighting Market Summary

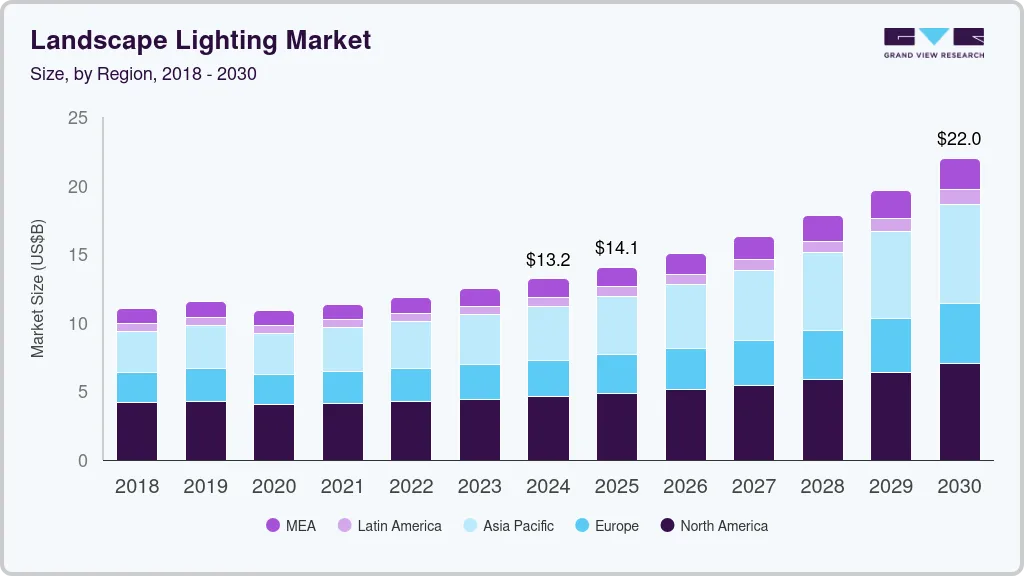

The global landscape lighting market size was estimated at USD 13.20 billion in 2024 and is projected to reach USD 22.01 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. The growth of the landscape lighting market is driven by increasing demand for outdoor aesthetics, energy-efficient solutions, and enhanced home security.

Key Market Trends & Insights

- North America landscape lighting market accounted for a market share of around 35% in 2023.

- The landscape lighting market in the U.S. accounted for a market share of around 75% in 2023 in the North American market.

- By type, landscape LED lighting accounted for a share of around 45% in 2023.

- By product, path lights accounted for a market share of about 27% in 2023.

- By application,the demand for landscape lighting in commercial application accounted for a market share of about 60% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 13.20 Billion

- 2030 Projected Market Size: USD 22.01 Billion

- CAGR (2025-2030): 8.9%

- North America: Largest market in 2023

As homeowners and businesses prioritize creating visually appealing outdoor spaces, lighting plays a key role in showcasing landscapes, gardens, and architectural features. Rising awareness of eco-friendly solar-powered lighting, alongside a trend toward outdoor living spaces like patios and gardens, also contributes to market expansion.The shift toward energy-efficient lighting, especially LED technology, is significantly driving the landscape lighting market by offering several key advantages. LED lights consume less energy while providing high luminosity, which appeals to both residential and commercial consumers aiming to reduce energy costs. Their longer lifespan reduces the need for frequent replacements, cutting down on maintenance expenses, making them ideal for outdoor use where access may be challenging. Additionally, LED lights support sustainable practices, a growing demand in landscaping. Their adaptability in designs also allows for more creative and customizable lighting solutions, further fueling growth in the market.

Moreover, the emphasis on safety and crime deterrence through well-lit outdoor spaces is a key factor in the landscape lighting market. Security-oriented lighting solutions, such as floodlights, path lights, and motion-sensor lights, are increasingly sought after by homeowners and businesses to enhance visibility and reduce the risk of break-ins. These lights provide practical safety benefits by illuminating walkways and entry points and also are vital component of modern landscape design. The growing awareness of security measures has led to increased demand for durable, energy-efficient outdoor lighting, further boosting market growth.

Innovation in the landscape lighting market is largely driven by advancements in smart lighting and energy-efficient technologies, allowing companies to offer more versatile and sustainable solutions, favoring the market growth. For instance, Philips Hue has introduced smart outdoor lighting systems that integrate with home automation platforms, offering consumers app-based control over color, intensity, and scheduling. This innovation appeals to tech-savvy homeowners seeking to personalize their outdoor environments while reducing energy usage. Additionally, integrating solar-powered LEDs in products from companies like Ring has expanded eco-friendly options, addressing growing consumer demand for sustainable and cost-effective landscape lighting solutions. These innovations are reshaping the competitive landscape, offering new growth avenues.

Type Insights

Landscape LED lighting accounted for a share of around 45% in 2023.LEDs consume significantly less electricity compared to traditional lighting options, translating into reduced utility bills and a lower environmental impact. Their durability and extended operational life minimize the frequency and cost of replacements, making them a cost-effective choice in the long term. Additionally, the versatility of LED technology allows for a wide range of design options and customizable features, such as color changing and dimming capabilities, which cater to diverse aesthetic preferences and functional needs. These benefits collectively enhance the appeal of LED landscape lighting, driving its widespread adoption.

The demand for fluorescent landscape lights is expected to grow at CAGR of 9.2% from 2024 to 2030. Fluorescent lights, particularly in the form of compact fluorescent lamps (CFLs) and linear tubes, offer an affordable alternative to more expensive lighting technologies while delivering ample brightness and energy efficiency. Their ability to provide consistent and broad-spectrum light makes them ideal for environments requiring high visibility and uniform illumination, such as office spaces, retail settings, and warehouses. Additionally, advancements in fluorescent technology, such as improved color rendering and reduced mercury content, are enhancing their appeal and sustainability, thus supporting their continued relevance in the landscape lighting market.

Product Insights

Path lights accounted for a market share of about 27% in 2023. Path lights provide essential illumination for walkways and garden paths, reducing the risk of accidents and enhancing visibility during nighttime hours. Their integration into landscape designs also adds a decorative element, highlighting architectural features and creating inviting outdoor spaces. The versatility of path lights, with options ranging from solar-powered models to those with adjustable brightness and color temperatures, caters to diverse consumer preferences and needs. As homeowners and property managers increasingly prioritize safety and curb appeal, the demand for path lights continues to grow.

The demand for deck & step lights is anticipated to grow at a CAGR of 11.0% from 2024 to 2030. These lights illuminate stairs, decks, and outdoor pathways, significantly reducing the risk of tripping and improving nighttime navigation. Their ability to create a warm, inviting atmosphere makes outdoor areas more enjoyable and usable after dark, while also highlighting architectural features and design elements. Additionally, advancements in energy-efficient LED technology and the availability of solar-powered options have made deck and step lights more accessible and cost-effective, further fueling their popularity among homeowners seeking to enhance the safety and ambiance of their outdoor environments.

Application Insights

The demand for landscape lighting in commercial application accounted for a market share of about 60% in 2023. Effective lighting solutions are crucial for illuminating parking lots, building exteriors, and signage, which improves safety for customers and employees and deters potential security threats. Additionally, well-designed landscape lighting can significantly boost a business's curb appeal and attract more foot traffic by highlighting architectural features and creating an appealing atmosphere. The growing emphasis on energy-efficient and sustainable lighting solutions also aligns with corporate sustainability goals, further driving the adoption of advanced lighting technologies in commercial settings.

The demand for landscape lighting in residential settings is anticipated to grow at a CAGR of 9.9% from 2024 to 2030. The increase in outdoor cooking and outdoor parties significantly drives the landscape lighting market for residential settings by elevating the demand for functional and ambiance-enhancing lighting solutions. Homeowners hosting social gatherings and culinary events outdoors require effective lighting to create a comfortable and inviting atmosphere, ensuring safety and visibility for guests. Landscape lighting solutions, such as string lights, spotlights, and path lights, play a crucial role in setting the mood, highlighting key areas, and extending the usability of outdoor spaces into the evening. This trend towards enhancing outdoor living areas and entertainment spaces fuels the market for innovative and aesthetically pleasing residential lighting options.

Operation Insights

Manual landscape lighting accounted for a market share of around 70% in 2023. Manual systems offer straightforward installation and operation without the need for complex wiring or electronic controls, making them an attractive option for homeowners seeking an easy-to-manage lighting solution. Additionally, manual landscape lighting often comes at a lower upfront cost compared to automated systems, providing a budget-friendly choice while still delivering functional illumination. The lack of reliance on smart technology or external power sources also appeals to those who prefer a more traditional approach or have limited access to advanced home automation systems.

The demand for automatic landscape lighting is expected to grow at a CAGR of 10.7% from 2024 to 2030. Automated systems, which include features such as motion sensors, timers, and smart controls, offer homeowners the ability to effortlessly manage and customize the outdoor lighting. These technologies provide benefits such as improved security through motion-activated lighting and reduced energy consumption by ensuring lights are only on when needed. The integration of smart home systems allows for remote control and scheduling, further enhancing user experience and operational efficiency. As consumers increasingly prioritize automation and energy efficiency, the demand for advanced, automatic landscape lighting solutions continues to grow.

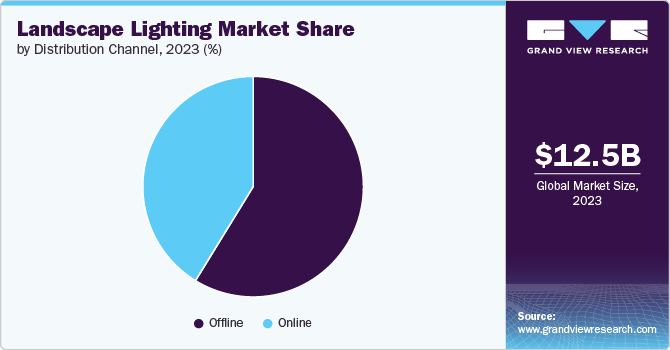

Distribution Channel Insights

Offline channel accounted for a market share of around 60% in 2023. Consumers often prefer purchasing landscape lighting from offline channels due to the tangible benefits of direct interaction and immediate product evaluation. In-store shopping allows consumers to see and test lighting products firsthand, assess quality and compatibility with their specific needs, and receive personalized advice from knowledgeable sales staff. Additionally, the opportunity to view display models and gain a better understanding of how different lighting options will look in a real-world setting helps in making informed decisions. This hands-on experience and personalized service drive the dominance of sales through offline channels.

The sale of landscape lighting through online is expected to grow at a CAGR of 9.6% from 2024 to 2030. Online shopping allows consumers to browse a wide range of lighting options from various brands and suppliers without geographical limitations, compare prices, and read customer reviews to make informed decisions. Additionally, the ease of online ordering, combined with features like home delivery and the ability to quickly access detailed product information and specifications, enhances the overall shopping experience. The digital shopping environment caters to a growing preference for convenience and accessibility, thereby driving the growth of online sales in the landscape lighting market.

Regional Insights

North America landscape lighting market accounted for a market share of around 35% in 2023 in the global market. Factors including increased consumer focus on outdoor aesthetics, heightened awareness of home security, and a growing trend towards outdoor living and entertainment spaces drives the market in the region. Homeowners are investing in landscape lighting to enhance the beauty and functionality of their outdoor areas, creating inviting environments for social gatherings and extending the usability of outdoor spaces. Additionally, concerns about safety and security prompt investments in well-lit exteriors to deter crime and ensure safe navigation.

U.S. Landscape Lighting Market Trends

The landscape lighting market in the U.S. accounted for a market share of around 75% in 2023 in the North American market. Homeowners and businesses increasingly invest in sophisticated lighting solutions to elevate their outdoor environments, creating visually appealing and functional spaces for recreation and security. Major brands such as Philips Hue, Kichler Lighting, and Hunter Industries are leading the market by offering innovative products that include smart technology and energy-efficient options, catering to the demand for both aesthetic enhancement and operational cost savings. The integration of advanced features such as automation and remote control capabilities, coupled with a focus on sustainable solutions, further fuels market growth and consumer interest in high-quality landscape lighting in the U.S.

Asia Pacific Landscape Lighting Market Trends

The landscape lighting market in Asia Pacific accounted for revenue share of around 28% of global revenue in 2023. In the Asia Pacific region, the growth of landscape lighting is driven by rapid urbanization, increasing disposable incomes, and a rising interest in enhancing outdoor spaces. Countries like China, India, and Japan are experiencing significant expansion in residential and commercial developments, leading to greater demand for sophisticated lighting solutions. In China and India, the surge in luxury housing and commercial properties fuels the need for both aesthetic and functional outdoor lighting. In Japan, a focus on integrating advanced technologies and energy-efficient solutions supports market growth. Additionally, the growing popularity of outdoor entertainment and lifestyle enhancements across the region further drives demand for innovative landscape lighting products.

Europe Landscape Lighting Market Trends

The Europe landscape lighting market is expected to grow a CAGR of 9.2% from 2024 to 2030. European consumers and businesses are increasingly adopting advanced lighting solutions that offer both environmental benefits and cost savings, such as LED and solar-powered systems. The focus on creating visually appealing outdoor spaces is also a significant driver, with landscape lighting being used to highlight architectural features and enhance garden and public area designs. Additionally, stringent regulations and incentives promoting energy efficiency and sustainability contribute to the market's growth. Countries like Germany, the UK, and France are at the forefront of these trends, leading the way in adopting innovative and eco-friendly lighting technologies.

Key Landscape Lighting Company Insights

The landscape lighting market is characterized by a diverse array of players, ranging from established global brands to innovative niche companies. Key players include Philips Hue, Kichler Lighting, and Hunter Industries, known for their extensive product lines and technological advancements in smart and energy-efficient lighting solutions. Companies like Cree, Inc., and Acuity Brands also contribute with their focus on high-performance LED technologies.

Additionally, niche players such as Sol-Lux and Aurora Lighting offer specialized solutions like solar-powered and customizable lighting options. The market is marked by strong competition on the basis of innovation, energy efficiency, and design, with companies constantly developing new products to meet evolving consumer preferences and regulatory standards. Partnerships, acquisitions, and strategic alliances are common strategies used by companies to expand their market presence and enhance their product offerings.

Key Landscape Lighting Companies:

The following are the leading companies in the landscape lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Signify Holding.

- Kichler Lighting LLC.

- SGH company (Cree LED)

- Acuity Brands, Inc.

- Hubbell

- OSRAM GmbH

- Zumtobel Group

- Virtual Extension

- Eaton

- SAVANT TECHNOLOGIES LLC. (GE)

Recent Developments

-

In July 2024, Kichler Lighting unveiled its latest collections aimed at enhancing outdoor ambiance and style. The new product line includes a range of sophisticated outdoor lighting solutions, such as elegant path lights, versatile wall sconces, and durable floodlights, designed to complement various exterior settings. These collections emphasize both aesthetic appeal and functionality, incorporating features like weather-resistant materials and energy-efficient LED technology. Kichler's latest offerings aim to provide homeowners with the ability to create inviting and stylish outdoor environments, while also ensuring long-lasting performance and ease of maintenance.

-

In January 2024, Signify announced the launch of new Philips Hue outdoor lighting solutions, designed to offer flexibility in customizing lighting experiences. The latest products include a range of modular outdoor fixtures that allow users to create personalized lighting setups tailored to their outdoor spaces. These innovations enable users to mix and match different types of lights-such as spotlights, wall lights, and path lights-while integrating seamlessly with existing smart home systems. The new Philips Hue outdoor lighting line emphasizes adaptability and ease of installation, catering to the growing consumer demand for versatile and customizable outdoor lighting solutions.

Landscape Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.05 billion

Revenue forecast in 2030

USD 22.01 billion

Growth rate (Revenue)

CAGR of 8.9% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, distribution channel, operation, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Signify Holding; Kichler Lighting LLC.; SGH company (Cree LED); Acuity Brands, Inc.; Hubbell; OSRAM GmbH; Zumtobel Group; Virtual Extension; Eaton; and SAVANT TECHNOLOGIES LLC. (GE)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Landscape Lighting Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global landscape lighting market report based on type, product, application, distribution channel, operation, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

LED Lights

-

Plasma Lamps

-

High-Intensity Discharge Lamps

-

Fluorescent Lights

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Path Lights

-

Accent Lights

-

Flood Lights

-

Up-Down Lights

-

Wall Lights

-

Deck & Step Lights

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global landscape lighting market was estimated at USD 12.49 billion in 2023 and is expected to reach USD 13.20 billion in 2024.

b. The global landscape lighting market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 22.01 billion by 2030.

b. North America dominated the landscape lighting market with a share of around 35% in 2023. The landscape lighting market in North America is driven by the growing demand for outdoor aesthetics, security enhancements, and the adoption of energy-efficient, smart lighting solutions.

b. Key players in the landscape lighting market are Signify Holding; Kichler Lighting LLC.; SGH company (Cree LED); Acuity Brands, Inc.; Hubbell; OSRAM GmbH; Zumtobel Group; Virtual Extension; Eaton; and SAVANT TECHNOLOGIES LLC. (GE).

b. Key factors that are driving the landscape lighting market growth include increasing demand for outdoor aesthetics, energy-efficient LED technology, smart lighting systems, and a focus on home security and safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.