- Home

- »

- HVAC & Construction

- »

-

Land Survey Equipment Market Size And Share Report, 2030GVR Report cover

![Land Survey Equipment Market Size, Share & Trends Report]()

Land Survey Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Application, By End-use, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-390-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Land Survey Equipment Market Summary

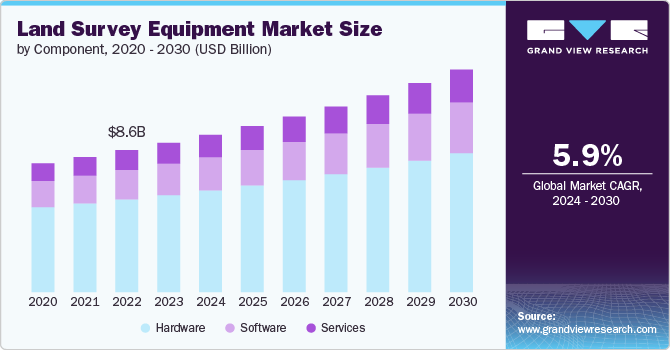

The global land survey equipment market size was estimated at USD 9.1 billion in 2023 and is projected to reach USD 13.50 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The global surge in construction and infrastructure projects is a major growth driver.

Key Market Trends & Insights

- Asia Pacific land survey equipment market dominated the global market and accounted for 35.5% in 2023.

- China leads the market, fueled by its ambitious Belt and Road Initiative and extensive domestic infrastructure efforts.

- Based on component, the hardware segment led the market and accounted for 65.0% of the global revenue in 2023.

- Based on application, the layout points segment accounted for the largest market revenue share in 2023.

- Based on end-use, the commercial segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.1 Billion

- 2030 Projected Market Size: USD 13.50 Billion

- CAGR (2024-2030): 5.9%

- Asia Pacific: Largest market in 2023

Governments and private sectors are investing heavily in the development of roads, bridges, airports, and other public utilities. Accurate land surveys are essential for these projects to ensure proper planning, design, and execution. Surveying equipment such as GNSS systems and total stations plays a critical role in providing precise measurements and geospatial data. The increasing complexity of modern infrastructure demands high-quality surveying tools, leading to sustained growth in this market.

Technological innovations in the field of land surveying have significantly enhanced the accuracy and efficiency of survey processes. Advanced GNSS systems provide real-time positioning with high precision, which is crucial for many surveying applications. The advent of drones has revolutionized aerial surveying by offering faster data collection over large areas with minimal human intervention. Laser scanning technology allows for detailed 3D mapping of terrains and structures, facilitating better analysis and decision-making. These technological advancements are making land surveying more effective and less time-consuming, driving the adoption of modern surveying equipment.

Rapid urbanization is another key factor fueling the demand for land survey equipment. As cities expand and new urban areas are developed, there is a constant need for detailed land surveys to support planning and development activities. Urban planners and developers rely on accurate geospatial data to design efficient layouts and infrastructure. Frequent land surveys are required to monitor changes and ensure compliance with zoning regulations and environmental standards. The ongoing trend of urbanization, particularly in emerging economies, is expected to continue driving the market growth.

Precise land surveys are crucial for accurately resolving property disputes and clearly establishing legal boundaries. These surveys provide detailed and exact measurements of land, which help in determining the true extent and limits of property ownership. Accurate surveys prevent encroachments and ensure that all parties have a clear understanding of their property lines, reducing the potential for conflicts. They also serve as legal documents that can be used in court to support claims and settle disagreements. Furthermore, precise land surveys are essential for proper land development, urban planning, and infrastructure projects, ensuring that all constructions and developments adhere to legal and regulatory standards.

The growing emphasis on environmental conservation and disaster management is emerging as a significant driver for the land survey equipment market. Accurate land surveys are critical for monitoring natural resources, assessing environmental impact, and planning conservation efforts. Additionally, in the wake of natural disasters such as earthquakes, floods, and hurricanes, precise geospatial data is essential for effective response and recovery operations. Survey equipment such as drones and GNSS systems are instrumental in mapping affected areas, guiding rescue missions, and rebuilding infrastructure. As climate change intensifies the frequency and severity of natural disasters, the need for reliable and advanced land survey equipment for environmental and disaster management is becoming increasingly vital.

Component Insights

Based on component, the hardware segment led the market and accounted for 65.0% of the global revenue in 2023. The segment growth can be attributed to the continuous advancements in technology, enhancing the precision and reliability of surveying tools. Innovations in GNSS systems, total stations, and drones are providing more accurate and efficient data collection, making them indispensable for modern surveying tasks. The demand for robust and durable hardware is rising, especially for use in challenging environments such as construction sites and remote agricultural fields. Additionally, the integration of advanced sensors and improved battery life in these devices is further boosting their adoption across various industries.

The software segment is expected to register significant growth from 2024 to 2030. The increasing need for advanced data processing and analysis is a significant factor contributing to the market growth. Modern survey software offers sophisticated features for 3D modeling, geospatial analysis, and data integration, which are essential for accurate and comprehensive land surveys. The trend of digitalization and the use of cloud-based platforms are making it easier for surveyors to store, share, and access data in real-time, enhancing collaboration and efficiency. Furthermore, the development of user-friendly interfaces and automated workflows is simplifying complex surveying tasks, driving the adoption of advanced software solutions in the market.

Application Insights

The layout points segment accounted for the largest market revenue share in 2023. The segment growth is driven by the increasing complexity and precision requirements of construction and infrastructure projects. Accurate layout points are essential for ensuring that structures are built according to design specifications, reducing errors and rework. The adoption of advanced tools such as GNSS systems and total stations is enhancing the accuracy and efficiency of layout point marking. Moreover, the integration of digital blueprints and real-time data-sharing capabilities is streamlining the layout process, leading to faster project completion and cost savings.

The monitoring segment is expected to grow significantly from 2024 to 2030. The monitoring segment is gaining traction due to the growing need for continuous observation and analysis of land and structural changes. Infrastructure projects, especially in urban areas, require ongoing monitoring to ensure stability and safety. Advanced survey equipment such as laser scanners and drones provides high-resolution data for real-time monitoring of shifts, deformations, and environmental impacts. Additionally, the increasing emphasis on disaster preparedness and environmental conservation is driving the demand for monitoring solutions that can provide timely and accurate data to mitigate risks and manage resources effectively.

End-use Insights

The commercial segment accounted for the largest revenue share in 2023. The increasing demand for accurate and efficient surveying solutions across various industries such as construction, agriculture, and mining is a major factor contributing to the segment growth. Businesses are investing in advanced survey equipment to enhance precision in project planning and execution, thereby reducing costs and improving outcomes. The adoption of technologies such as GNSS systems, drones, and laser scanners is enabling commercial enterprises to undertake complex surveying tasks with greater ease and accuracy. Additionally, the integration of these tools with digital platforms for data management and analysis is further boosting their utility and appeal in the commercial sector.

The service providers segment is expected to grow significantly from 2024 to 2030. The segment is experiencing growth due to the rising need for specialized surveying services across different sectors. Companies offering surveying services are increasingly relying on state-of-the-art equipment to deliver precise and reliable results to their clients. The trend towards outsourcing surveying tasks to expert service providers is driven by the need for high-quality data and the expertise required to operate advanced equipment. Furthermore, service providers are leveraging the latest software solutions to enhance data processing, visualization, and reporting, thereby offering comprehensive and value-added services to their customers.

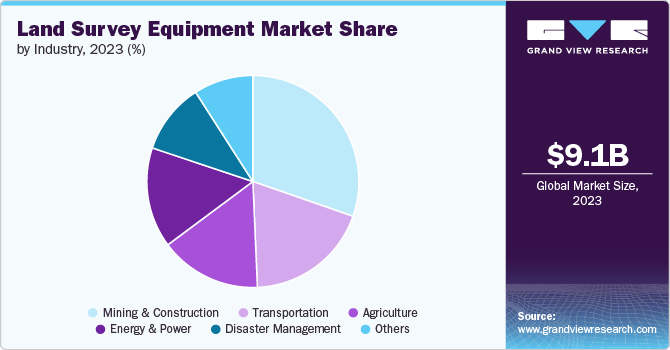

Industry Insights

The mining & construction segment accounted for the largest revenue share in 2023. The growing need for precision and efficiency in large-scale projects is a significant factor contributing to the segment’s growth. Advanced surveying tools such as GNSS systems, and laser scanners are essential for accurate site measurements, layout planning, and monitoring structural integrity. The increasing complexity of mining operations and construction projects demands high-precision equipment to ensure safety, compliance, and optimal resource utilization. Furthermore, technological advancements like automated workflows and real-time data integration are enhancing the productivity and accuracy of surveying tasks in these industries.

The agriculture segment is expected to grow significantly from 2024 to 2030. In the agriculture segment, the demand for land survey equipment is driven by the growing adoption of precision farming techniques. Accurate land surveys are crucial for optimizing field layouts, planning irrigation systems, and managing crop health. Advanced tools such as GNSS systems and drones are being used to gather detailed geospatial data, which helps farmers make informed decisions to enhance yield and efficiency. Additionally, the push towards sustainable farming practices is increasing the need for precise land measurements to ensure efficient use of resources and minimize environmental impact.

Regional Insights

Asia Pacific land survey equipment market dominated the global market and accounted for 35.5% in 2023. The rapid pace of urbanization in the region is driving a heightened demand for land surveying services. Rising infrastructure projects, particularly in China and India, are propelling the need for advanced surveying technologies. Additionally, growing investments in smart city initiatives across Southeast Asia are further boosting demand. China leads the market, fueled by its ambitious Belt and Road Initiative and extensive domestic infrastructure efforts, while India is also experiencing significant growth due to its expanding construction sector and government-driven adoption of digital mapping and GIS technologies for urban planning.

North America Land Survey Equipment Market Trends

The land survey equipment market in North America is anticipated to register significant growth from 2024 to 2030. In North America, the market growth is driven by ongoing advancements in technology and a robust demand for high-precision surveying tools. The region's focus on infrastructure modernization and urban development necessitates the adoption of cutting-edge equipment. Additionally, the increasing integration of Geographic Information Systems (GIS) and automation in surveying processes is fueling market growth. Government investments in infrastructure projects and smart city initiatives further support the market expansion in North America.

U.S. Land Survey Equipment Market Trends

The land survey equipment market in the U.S. is anticipated to register significant growth from 2024 to 2030. Technological advancements, such as the integration of drones and advanced GIS systems, are enhancing surveying capabilities and accuracy across the U.S.

Europe Land Survey Equipment Market Trends

The land survey equipment market in Europe is poised for significant growth from 2024 to 2030. The region's commitment to smart infrastructure and urban planning is driving the demand for advanced surveying solutions. Additionally, regulatory frameworks and government policies aimed at improving land management and urban development are contributing to market growth. The adoption of integrated surveying systems and advancements in data collection technologies are also key trends influencing the European market.

Key Land Survey Equipment Company Insights

Key market players are focusing on advancing technology and expanding their product portfolios to capture a significant share of the growing demand. Key players are also investing heavily in innovation to enhance the precision and efficiency of their equipment, incorporating features such as GPS integration, 3D scanning, and advanced data analytics. Strategic partnerships, product launches, and acquisitions are common strategies among these companies to broaden their market reach and leverage complementary technologies.

For instance, in October 2022, Trimble unveiled the Trimble Ri, the newest addition to its line of advanced robotic total stations. This innovative instrument is designed to enhance accessibility to total station technology for the construction industry. The Trimble Ri will be available in various configurations to support a wide range of workflows, including MEP, concrete, steel, and general contracting tasks. The base models can be upgraded remotely through annual subscription licenses and tailored software options.

Key Land Survey Equipment Companies:

The following are the leading companies in the land survey equipment market. These companies collectively hold the largest market share and dictate industry trends.

- STONEX Srl,

- Trimble Inc.

- Hexagon AB

- Shanghai Huace Navigation Technology Ltd.

- GUANGDONG KOLIDA INSTRUMENT CO., LTD.

- VI Instruments

- Hi-Target

- SUZHOU FOIF CO LTD.

- TOPCON CORPORATION

Land Survey Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.55 billion

Revenue forecast in 2030

USD 13.50 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, industry region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

STONEX Srl; Trimble Inc.; Hexagon AB; Shanghai Huace Navigation Technology Ltd.; GUANGDONG KOLIDA INSTRUMENT CO., LTD.; VI Instruments; Hi-Target; SUZHOU FOIF CO LTD.; TOPCON CORPORATION

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Land Survey Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the land survey equipment market report based on component, application, end-use, industry, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

GNSS Systems

-

Total Stations & Theodolites

-

Levels

-

3D Laser Scanners

-

Unmanned Aerial Vehicles (UAVs)

-

Others

-

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Inspection

-

Monitoring

-

Volumetric Calculations

-

Layout Points

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Defense

-

Service Providers

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Energy & Power

-

Mining & Construction

-

Agriculture

-

Disaster Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global land survey equipment market size was estimated at USD 9.06 billion in 2023 and is expected to reach USD 9.55 billion in 2024.

b. The global land survey equipment market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 13.50 billion by 2030.

b. Asia Pacific dominated the land survey equipment market with a share of 35.5% in 2023. The rapid pace of urbanization in the region is driving a heightened demand for land surveying services.

b. Some key players operating in the land survey equipment market include STONEX Srl, Trimble Inc., Hexagon AB, Shanghai Huace Navigation Technology Ltd., GUANGDONG KOLIDA INSTRUMENT CO., LTD., VI Instruments, Hi-Target, SUZHOU FOIF CO LTD., and TOPCON CORPORATION.

b. Key factors that are driving the market growth include rapid urbanization and the global surge in construction and infrastructure projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.