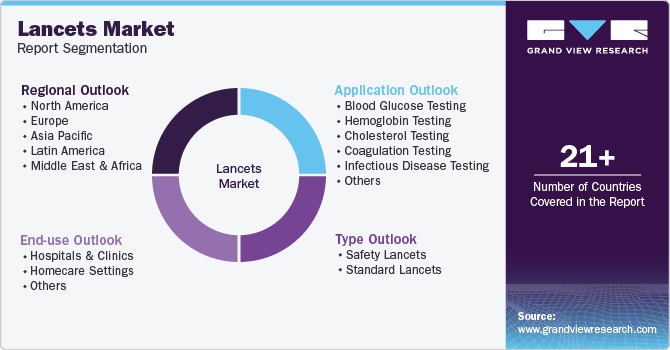

Lancets Market Size, Share & Trends Analysis Report By Type (Safety Lancets, Standard Lancets, Specialty Lancets), By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-209-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Lancets Market Size & Trends

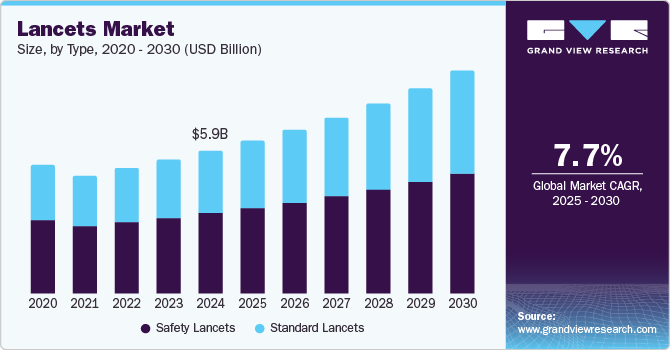

The global lancets market size was valued at USD 5.90 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. The increasing prevalence of diabetes, the rising proportion of the geriatric population, and their susceptibility to diabetes are major factors driving the growth of this market. In addition, increasing incidence of infectious diseases, increasing awareness regarding advanced diabetes treatment, and emphasis on homecare add to the market growth.

According to the IDF Diabetes Atlas, approximately 37 million adults, or one in ten worldwide, suffered from diabetes in 2021, and this number is estimated to grow to about 643 million by 2030 and 783 million by 2045. This expected rise in diabetes patients will likely increase the need for diabetes management tools and drive market growth.

In addition, the information published by the World Health Organization suggested that the proportion of people aged 60 and above is expected to rise to 1.4 billion by 2030 and 2.1 billion by 2050. In older adults, the deficiency of insulin secretion develops with age, and increasing insulin resistance leads to a higher risk of developing diabetes. According to an article published by the Endocrine Society in January 2022, about 33% of older adults aged 65 and over have diabetes. Therefore, the increasing proportion of the geriatric population and their susceptibility to diabetes is further likely to drive demand for lancets over the forecast period.

Moreover, the rising incidence of various diseases, including contagious and non-contagious diseases, such as typhoid, cholera, and swine, is another factor driving the growth of the lancets market. This increasing incidence of diseases is likely to drive the need for constant blood monitoring and testing and further drive the market demand for lancets.

Type Insights

Safety lancets accounted for the largest share of 56.4% in 2024 as they are easily available compared to other lancets due to their affordability and low exposure to infections enabled by them. This increases the accessibility of safety lancets, driving the segment growth. Safety lancets are also portable due to their unexposed needles, which adds to their demand. In addition, these lancets are preferably used for in-home diabetic monitoring, as well as in hospitals and clinics. This also drives the introduction and launch of new and innovative products. For instance, in June 2021, Greiner Bio-One announced the launch of its MiniCollect PIXIE, which can be used for gentle capillary blood collection from infants.

The standard lancets segment is expected to grow at the fastest CAGR of 8.4% over the forecast period. Factors such as high patient compliance, especially in the geriatric population, contribute to the market growth. In addition, increased awareness regarding the importance of self-monitoring, combined with advancements in lancet technology that reduce pain and enhance user comfort, is further expected to drive market demand.

Application Insights

The blood glucose testing segment accounted for the largest market share of 41.1% in 2024. The rising prevalence of diabetes and increasing awareness regarding self-monitoring blood glucose are major factors driving market growth. According to a study published in the National Library of Medicine in April 2023, blood glucose monitoring can help identify patterns in the fluctuation of blood glucose (sugar) levels as a response to medications, diet, and other pathological processes. This increases the need for constant glucose monitoring to improve treatment options, which is likely to drive the segment demand with rising cases of diabetes.

The hemoglobin testing segment is expected to register the fastest CAGR of 8.1% over the forecast period from 2025 to 2030. Hemoglobin testing is essential for diagnosing various medical conditions, such as anemia. The increasing prevalence of anemia worldwide, especially in underdeveloped and developing regions where nutritional deficiencies are common, drives the demand for lancets for early detection and intervention. For instance, according to a study published by the National Library of Medicine in December 2021, the prevalence of anemia in sub-Saharan Africa was around 64.1% among children under five.

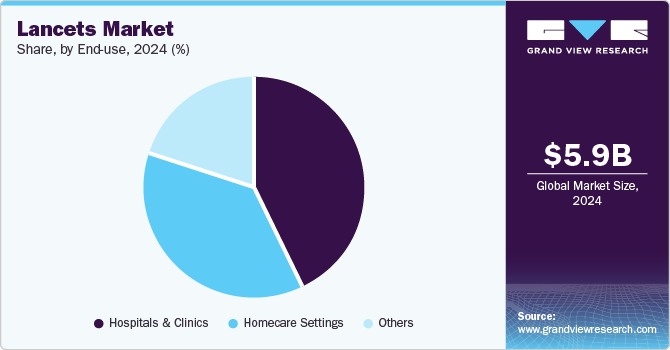

End-use Insights

The hospitals and clinics segment dominated the market in 2024. The increasing number of patients who have diabetes and the incidence of infectious diseases and other diseases requiring blood testing kits are majorly driving the segment growth. Hospitals and clinics rely on lancets for routine blood glucose testing, hemoglobin checks, and other point-of-care tests, further expected to drive the segment growth.

The homecare settings segment is projected to grow at the fastest CAGR over the forecast period. The increasing awareness about self-monitoring blood glucose and the availability of various lancet devices are major factors driving the market growth. In addition, the cost of measuring blood glucose levels at home is very low, and more patients prefer to monitor their blood glucose levels at home. These factors are expected to drive the segment growth over the forecast period.

Regional Insights

North American lancets market accounted for the largest market revenue share of 36.4% in 2024 attributed to a large patient pool in the region, government initiatives, favorable reimbursement policies, and rising healthcare expenditure on diabetes in the region. For instance, according to IDF Diabetes Atlas, diabetes-related health expenditure was estimated to be around USD 11,779 per person in the U.S. in 2021, which is expected to rise to USD 12,073.0 by 20230 and USD 12,184.8 by 2045.

U.S. Lancets Market Trends

The U.S. lancets market held a dominant position in 2024 due to the increasing healthcare expenditure, technological advancements in the region, and increasing awareness and access to advanced diagnosis and treatment solutions. According to the Centers for Medicare and Medicaid Services, the healthcare expenditure in the U.S. increased to USD 4.5 trillion or USD 13,493 in 2022. This increasing expenditure is likely to add to the advancements in the healthcare sector and drive market growth.

Europe Lancets Market Trends

The Europe lancets market is expected to grow significantly owing to the advanced healthcare infrastructure, the rising prevalence of chronic diseases, including diabetes, and the increasing proportion of the geriatric population, which increases the need for regular blood testing. For instance, according to the information published by the World Health Organization (WHO), about 1 in every 10 people in the EHO European region is estimated to have diabetes by 2045. This increasing number of diabetes patients in the region is expected to drive market growth over the forecast period.

The UK lancets market is expected to grow significantly over the forecast period owing to the accessibility of healthcare services provided by the National Health Services (NHS) and the well-established healthcare system. The increasing awareness of chronic diseases and the high demand for diagnostics and testing services are also expected to drive the demand for lancets in the country.

The Germany lancets market held a substantial market share in 2024 owing to the advanced healthcare infrastructure and increasing emphasis on preventive healthcare and chronic disease management in the country, which are driving the demand for lancets in the market. In addition, the well-established regulatory framework in the country ensures patient safety, which is also driving the market growth.

Asia Pacific Lancets Market Trends

The Asia Pacific lancets market is anticipated to grow at the fastest CAGR over the forecast period. This growth is attributed to the improving healthcare infrastructure, the presence of a large patient pool that requires a diagnostic test for treatment, and the increasing proportion of the geriatric population in the region. For instance, according to the Asian Development Bank, one in four people in the region is expected to be 60 years and over by 2050. In addition, the rising incidence of infectious diseases such as arboviral diseases, including dengue, Zika, West Nile, malaria, and chikungunya, is further expected to drive the demand for lancing devices.

The China lancets market accounted for a significant market share in 2024 due to the rising prevalence of diabetes, rapid urbanization, and increasing health awareness among its population. For instance, according to a study published by the National Library of Medicine in July 2022, the prevalence rate of diabetes in people aged 65 and above in China was 18.80%. In contrast, awareness and control rates were 77.1% and 41.3%, respectively. The increasing number of people with diabetes and government initiatives to improve disease management and early diagnosis drive demand for blood glucose monitoring devices, including lancets.

The Japan lancets market is expected to grow rapidly owing to an increasing aging population, the high prevalence of chronic conditions such as diabetes, and a strong healthcare system that emphasizes regular health monitoring. For instance, according to an article published by The World Economic Forum in September 2023, more than 1 in 10 people in Japan were aged 80 or over.

Key Lancets Company Insights

Some of the key companies operating in the lancets market include BD, Roche Diagnostics, Medline Industries, LP., MTD Medical Technology and Devices, B. Braun SE, and Terumo Medical Corporation. These players focus on developing advanced products, expansion, mergers, and acquisitions to gain a competitive edge in the market.

-

BD is a global medical technology company operating across several segments, including diabetes care, medication management, infection prevention, and diagnostics. The company offers a wide range of products, including lances such as the BD Microtainer contact-activated lancet, which can be used for blood collection using fingerstick.

-

Roche Diagnostics is a global healthcare company that develops various medical tests and digital tools to help healthcare professionals diagnose and treat diseases. The company also provides lancets, such as the Roche Diagnostics ACCU-CHEK Safe-T-Pro Plus Lancet.

Key Lancets Companies:

The following are the leading companies in the lancets market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Roche Diagnostics

- Medline Industries, LP.

- EQT AB

- MTD Medical Technology and Devices

- B. Braun SE

- Terumo Medical Corporation

- Owen Mumford

- Arkray

- AgaMatrix

- Nipro Europe Group Companies.

Recent Developments

-

In March 2023, Astellas Pharma Inc. entered into an agreement with Roche Diabetes Care Japan Co., Ltd. to develop and commercialize the Accu-Chek Guide Me blood glucose monitoring system of Roche that provides high accuracy combined with BlueStar*1.

Lancets Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.31 billion |

|

Revenue forecast in 2030 |

USD 9.15 billion |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

BD; Roche Diagnostics; Medline Industries, LP.; MTD Medical Technology and Devices; B. Braun SE; Terumo Medical Corporation; Owen Mumford; Arkray; AgaMatrix; Nipro Europe Group Companies. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lancets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lancets market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Safety Lancets

-

Standard Lancets

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blood Glucose Testing

-

Hemoglobin Testing

-

Cholesterol Testing

-

Coagulation Testing

-

Infectious Disease Testing

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals and Clinics

-

Homecare Settings

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."