- Home

- »

- Advanced Interior Materials

- »

-

Laminated Busbar Market Size, Share & Growth Report 2030GVR Report cover

![Laminated Busbar Market Size, Share & Trends Report]()

Laminated Busbar Market Size, Share & Trends Analysis Report By Material (Copper, Aluminum), By End Use (Utilities, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-380-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Laminated Busbar Market Size & Trends

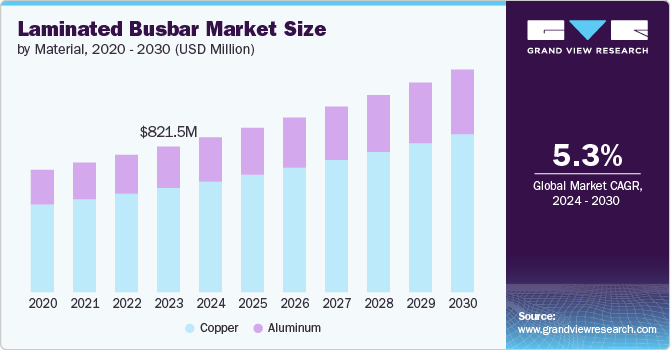

The global laminated busbar market size was estimated at USD 821.5 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The automotive industry is rapidly transitioning towards electric mobility, driven by stringent emissions regulations and growing consumer demand for eco-friendly vehicles. Laminated busbars play a critical role in EVs by efficiently managing and distributing electrical power between batteries, power electronics, and other components. Their ability to reduce inductance and improve thermal management makes them ideal for high-power applications in EVs, thus driving their demand.

The global shift towards renewable energy sources such as solar and wind power has led to increased investments in renewable energy infrastructure. Laminated busbars are essential components in power conversion and distribution systems used in renewable energy installations. They provide reliable and efficient connections between inverters, transformers, and other electrical components, ensuring optimal performance and energy efficiency. As renewable energy capacity continues to expand, so does the demand for laminated busbars.

The development of advanced power electronics, including inverters, converters, and rectifiers, has spurred the demand for laminated busbars. These components are used in various industries, including industrial automation, aerospace, telecommunications, and data centers. Laminated busbars offer superior electrical performance, reduced parasitic inductance, and improved thermal management, which are crucial for the efficient operation of power electronic systems. As power electronics technology advances, the need for high-performance laminated busbars grows.

Moreover, laminated busbars offer several advantages over traditional wire and cable systems, including improved electrical performance, reduced inductance, and enhanced thermal management. These characteristics contribute to better power distribution, increased system efficiency, and enhanced safety. The ability of laminated busbars to minimize electrical noise and interference also makes them suitable for sensitive applications in medical devices, telecommunications, and aerospace. The growing emphasis on electrical performance and safety across industries is a key driver for the laminated busbar market.

The increasing adoption of industrial automation and robotics in manufacturing and production processes is driving the demand for laminated busbars. These busbars provide reliable and efficient power distribution in automated systems, ensuring smooth and uninterrupted operation. Their compact design and ability to handle high current loads make them suitable for use in industrial machinery, robotics, and automated assembly lines. As industries continue to automate and modernize, the demand for laminated busbars is expected to rise.

Material Insights

The copper led the market with the largest revenue share of 71.6% in 2023 and is forecasted to grow at a significant CAGR from 2024 to 2030. Copper is known for its excellent electrical conductivity, which is significantly higher than that of aluminum and other materials. This high conductivity allows copper laminated busbars to efficiently transmit large amounts of electrical current with minimal losses. This efficiency is crucial in applications where power integrity and energy efficiency are paramount, such as in data centers, renewable energy installations, and industrial machinery.

Moreover, copper has superior thermal conductivity compared to other materials, enabling it to effectively dissipate heat generated during the operation of electrical systems. This thermal management capability helps prevent overheating and improves the reliability and lifespan of electrical components. In high-power applications, such as electric vehicles and power electronics, effective heat dissipation is essential, making copper laminated busbars a preferred choice.

Furthermore, copper has natural corrosion-resistant properties, which help maintain the integrity and performance of laminated busbars over time. This corrosion resistance is crucial in environments exposed to moisture, chemicals, or other corrosive agents. The longevity and reliability provided by copper busbars reduce maintenance requirements and improve the overall lifecycle cost of electrical systems.

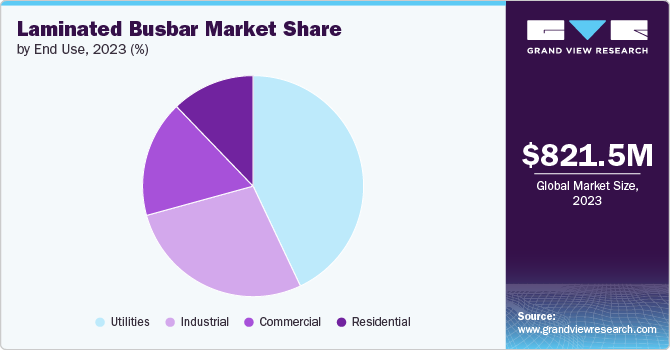

End Use Insights

The utilities dominated the market with the revenue share of 43.0% in 2023. This is expected to grow at the highest CAGR of 5.7% from 2024 to 2030. Utilities are under constant pressure to deliver reliable power with minimal losses. Laminated busbars are designed to reduce electrical resistance and inductance, leading to lower energy losses during power transmission and distribution. This efficiency is essential in maintaining a stable and reliable electricity supply, which is a core requirement for utilities. The superior conductivity and reduced electrical noise contribute to their growing adoption in this sector.

Another key advantage is their excellent thermal management capabilities. The design of these busbars allows for efficient heat dissipation, which is crucial for high-power applications commonly found in utility operations. Effective thermal management helps prevent overheating and enhances the overall reliability and longevity of electrical equipment.

The modular design of laminated busbars simplifies installation and maintenance compared to traditional cabling systems. Pre-fabricated busbars reduce installation time and complexity, which can lead to significant cost savings. Moreover, the ease of maintenance and the potential for rapid replacements or upgrades are appealing to utilities looking to minimize downtime and ensure continuous power delivery.

Regional Insights

The North America laminated busbar market dominated the market with the highest revenue share in 2023. Countries in North America, such as the U.S. and Canada are heavily investing in renewable energy projects to reduce carbon emissions and transition to a sustainable energy future. Laminated busbars play a critical role in solar and wind power installations by ensuring efficient power conversion and distribution. Their ability to reduce energy losses and enhance system reliability makes them a preferred choice for these applications.

U.S. Laminated Busbar Market Trends

The U.S. is undertaking significant infrastructure modernization efforts, including upgrades to the power grid, transportation systems, and industrial facilities. Laminated busbars offer a reliable and efficient solution for power distribution in these projects, supporting the need for enhanced electrical performance and safety.

Europe Laminated Busbar Market Trends

European countries are at the forefront of the renewable energy transition, with substantial investments in solar, wind, and other sustainable energy sources. Laminated busbars are essential components in renewable energy systems, facilitating efficient power conversion and distribution. The EU's commitment to reducing carbon emissions and promoting green energy is a major driver for the growing demand for laminated busbars.

Asia Pacific Laminated Busbar Market Trends

Asia-Pacific countries are significantly investing in renewable energy projects to meet their growing energy demands and reduce dependence on fossil fuels. Laminated busbars are crucial in these projects for efficient power distribution and conversion, supporting the region's shift towards sustainable energy sources.

Key Laminated Busbar Company Insights

Some key players operating in the market include Schaeffler Technologies AG & Co. KG and OTICS Corp

-

Eaton Corporation PLC is a diversified global power management company. This provides energy-efficient solutions to manage electrical, hydraulic, and mechanical power more effectively, safely, and sustainably. Eaton serves a wide range of industries including utilities, industrial, commercial, residential, IT, and data centers, automotive, and aerospace.

-

Ryoden Kasei Co. Ltd is a Japanese company specializing in the manufacturing and sale of plastic products, primarily for the automotive industry to several categories such as interior and exterior plastic parts, functional components and systems, safety-related plastic parts and decorative & aesthetic components.

Molex is one of the emerging market participants in the market.

-

Molex caters to several industries including agricultural machinery, appliances, automotive, drug delivery solutions, electrical & power, home energy storage, in vitro diagnostics, industrial automation, Medtech, mobile devices, networking, power for data center, servers & storage, telecommunications, wearables, and wireless infrastructure.

Key Laminated Busbar Companies:

The following are the leading companies in the laminated busbar market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton Corporation PLC

- Ryoden Kasei Co. Ltd

- Methode Electronics Inc

- Rogers Corporation

- Mersen SA

- Sun.King Power Electronics Group Ltd

- Zhuzhou CRRC Times Electric Co. Ltd

- Amphenol Corporation

- Shanghai Eagtop Electronic Technology Co. Ltd

- Molex LLC

Recent Developments

-

In December 2020, Amphenol Corporation, which is a global provider of high-technology interconnect, antenna, and sensor solutions signed an agreement to acquire MTS Systems, a leading global supplier of advanced test systems, motion stimulators, and precision sensors.

-

In 2020, OEM Automatic Ltd. has agreed to acquire Zoe Dale Ltd. through which OEM Automatic can increase its product portfolio by expanding the utilization of technical advice to deliver the best solutions for their application.

Laminated Busbar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 872.8 million

Revenue forecast in 2030

USD 1.25 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use , region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Ryoden Kasei Co. Ltd; Methode Electronics Inc; Rogers Corporation; Mersen SA; Sun.King Power Electronics Group Ltd; Zhuzhou CRRC Times Electric Co. Ltd; Amphenol Corporation;

Shanghai Eagtop Electronic Technology Co. Ltd; Molex LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laminated Busbar Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global laminated busbar market based on the material, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Copper

-

Aluminum

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Utilities

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global laminated busbar market size was estimated at USD 821.5 million in 2023 and is expected to reach USD 872.8 million in 2024.

b. The global laminated busbar market is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030 to reach USD 1.25 billion by 2030.

b. Among material, copper accounted for the largest market in 2023 with a revenue share of 71.7% as Copper is known for its excellent electrical conductivity, which is significantly higher than that of aluminum and other materials.

b. Some key players operating in the laminated busbar market include Ryoden Kasei Co. Ltd, Methode Electronics Inc, Rogers Corporation, Mersen SA, Sun.King Power Electronics Group Ltd, Zhuzhou CRRC Times Electric Co. Ltd, Amphenol Corporation, Shanghai Eagtop Electronic Technology Co. Ltd, Molex LLC

b. The key factors that are driving the laminated busbar market growth is Laminated busbars play a critical role in EVs by efficiently managing and distributing electrical power between batteries, power electronics, and other components

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."