- Home

- »

- Advanced Interior Materials

- »

-

Laminar Composites Market Size And Share Report, 2030GVR Report cover

![Laminar Composites Market Size, Share & Trends Report]()

Laminar Composites Market (2024 - 2030) Size, Share & Trends Analysis Report By Manufacturing Process (Brazing, Roll Bonding), By Application (Automotive, Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-461-6

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laminar Composites Market Size & Trends

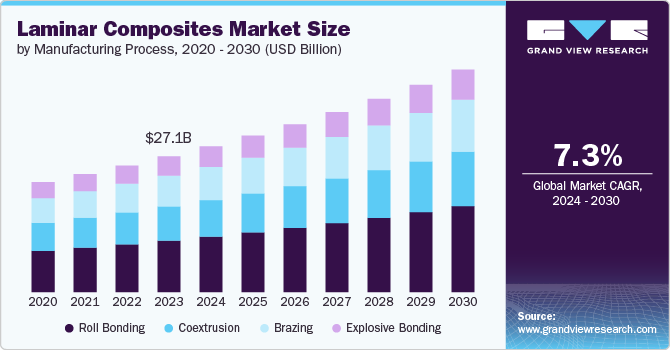

The global laminar composites market size was estimated at USD 27.11 billion in 2023 and is forecasted to grow at a CAGR of 7.3% from 2024 to 2030. The market is primarily driven by the increasing demand for lightweight and high-strength materials across various industries, including aerospace, automotive, construction, and wind energy. In the aerospace and automotive sectors, the growing need to enhance fuel efficiency and reduce emissions is pushing manufacturers to adopt laminar composites owing to their superior strength-to-weight ratio. Moreover, the growth of the renewable energy sector, particularly wind energy, is boosting the demand for laminar composites in turbine blades, as these materials offer excellent fatigue resistance, corrosion resistance, and durability, which are critical for high-performance applications.

The ongoing advancements in composite manufacturing technologies, such as resin transfer molding (RTM), automated fiber placement (AFP), and additive manufacturing are making the production of laminar composites more efficient and cost-effective. These technological advancements are enabling faster production rates, reducing material waste, and allowing for more complex and customized designs, which are essential for meeting the specific requirements of different applications. Furthermore, increasing investment in research and development to create next-generation composite materials with enhanced properties, such as improved thermal stability and damage tolerance, is further propelling market growth.

The market presents significant opportunities, particularly in the realm of sustainable and eco-friendly composites. As industries increasingly focus on reducing carbon footprints and adhering to environmental regulations, the development of bio-based and recyclable composites offers a promising growth avenue. Innovations in green composites, such as those made from natural fibers or recycled materials, are gaining traction as they provide the benefits of traditional composites while addressing environmental concerns. Additionally, the exploration of new applications in emerging sectors, such as electric vehicles (EVs), urban air mobility, and advanced infrastructure projects, offer new market opportunities for the product.

However high production costs and the complexity of manufacturing processes pose a challenge for product demand. The initial investment required for composite production is significantly higher than for conventional materials, which can deter adoption of the product, especially among small and medium-sized enterprises. The specialized equipment, skilled labor, and stringent quality control needed to produce laminar composites contribute to their high cost, making them less accessible for certain industries and applications. Additionally, the lengthy development and testing phases for new composite materials can delay time-to-market, further limiting their widespread use.

The competitive landscape of the laminar composites market is characterized by the presence of both established players and emerging companies focusing on innovation and advanced material solutions. Key players such as Hexcel Corporation, Toray Advanced Composites, JEC Group, and Evonik. dominate the market with their extensive product portfolios, strong global presence, and ongoing investments in research and development. These companies are actively engaged in strategic collaborations, mergers and acquisitions, and technological innovations to strengthen their market position and expand their product offerings to cater to diverse industry needs.

Manufacturing Process Insights

The market is segmented into brazing, coextrusion, explosive bonding, and roll bonding. Coextrusion is a manufacturing process where two or more materials are extruded simultaneously through a single die to produce a multi-layered composite material. This process allows the combination of different materials to enhance properties such as strength, barrier performance, and flexibility. Coextrusion is commonly used in packaging, automotive, and construction industries, where tailored material properties like UV resistance or impact strength are required in a single, unified product.

Brazing is anticipated to grow at the fastest rate of 7.8% over the forecast period. Brazing is a process that involves heating a filler metal above its melting point and distributing it between two close-fitting base metals by capillary action. This technique is widely used for joining dissimilar metals, creating strong, leak-proof joints without melting the base materials. Brazing is favored in applications requiring precise and clean joins, such as in the aerospace and electronics industries, due to its ability to produce smooth, corrosion-resistant connections.

Explosive bonding uses controlled explosive energy to bond two dissimilar metals at high velocities. This process creates a metallurgical bond with high strength and integrity, ideal for applications requiring corrosion resistance and durability, such as clad pipes in the oil and gas industry or bimetallic connectors in electrical applications. Explosive bonding is unique in its ability to join metals that are otherwise difficult to bond using conventional methods.

Roll bonding involves pressing two or more layers of metal together under high pressure using rollers, often at elevated temperatures, to create a strong metallurgical bond. This process is commonly used in the production of clad metals, heat exchangers, and multi-layered sheets where different material properties, such as thermal conductivity and corrosion resistance, are combined. Roll bonding is widely applied in the automotive and aerospace industries to produce lightweight, high-strength components.

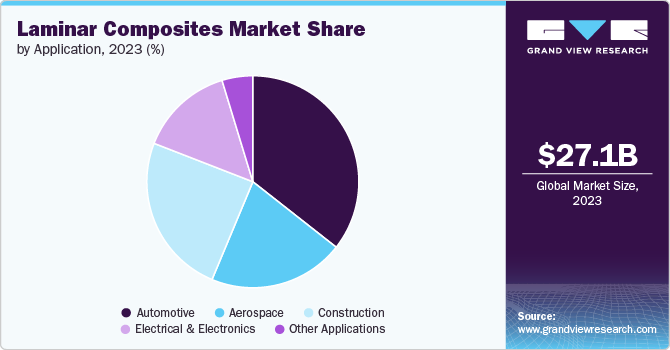

Application Insights

The market is segmented into automotive, aerospace, construction, electrical & electronics, and other applications. Among these, automotive dominated the market with a revenue share of 35.6% in 2023. This growth is attributed to the increasing adoption of laminar composites for manufacturing lightweight body panels, structural components, and under-hood parts. They help reduce vehicle weight, improve fuel efficiency, and enhance crash safety without compromising strength and durability.

Aerospace is expected to grow at the fastest CAGR of 8.1% over the forecast period. In aerospace, laminar composites are critical for building lightweight and strong aircraft components, such as fuselage sections, wings, and tail assemblies. These composites offer exceptional fatigue resistance, corrosion resistance, and the ability to withstand extreme temperatures, which are essential in demanding flight conditions. The aerospace industry's continuous pursuit of fuel efficiency and performance improvements makes laminar composites a vital material in both commercial and military aircraft.

Construction is expected to grow at 7.0% in terms of revenue from 2024 to 2030, owing to the rising residential and commercial construction projects in developing economies such as India, Brazil, and Mexico. The construction industry utilizes laminar composites for reinforcing materials, facade panels, insulation, and structural applications. Their high strength-to-weight ratio, corrosion resistance, and thermal insulation properties make them ideal for building sustainable and energy-efficient structures.

In the electrical and electronics sectors, laminar composites are used for insulating materials, printed circuit boards, and thermal management solutions. Their excellent electrical insulation properties, combined with lightweight and structural integrity, make them suitable for use in transformers, power generators, and electronic enclosures. As the demand for miniaturization and performance enhancement in electronics grows, the segment is projected to propel the market to reach USD 6.05 billion by 2030.

Regional Insights

The laminar composites market in North America is growing due to the strong presence of the aerospace and defense industries, which are major consumers of advanced composites. The region's focus on innovation, coupled with robust R&D activities, supports the development of improved composite materials tailored to specific applications. Increasing adoption of lightweight materials in automotive manufacturing to meet stringent fuel efficiency and emission standards also supports the product demand.

U.S. Laminar Composites Market Trends

The U.S. laminar composites market. is growing at a CAGR of 7.3% over the forecast period driven by its leadership in aerospace, automotive, and renewable energy sectors. The country's significant investments in technological advancements, such as automated and additive manufacturing processes, are enhancing the production efficiency and application scope of laminar composites. The country’s regulatory landscape, which promotes the use of environmentally friendly and energy-efficient materials, further accelerates market growth.

Asia Pacific Laminar Composites Market Trends

Asia Pacific laminar composites led the market with a revenue share of 37.9% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. This growth is supported by rapid urbanization, industrialization, and increasing infrastructure investments in emerging economies like China, India, and other Southeast Asian countries. The region is also experiencing high demand from end-use industries such as automotive, aerospace, construction, and wind energy, fueled by the need for lightweight, high-performance materials to enhance efficiency and sustainability.

Europe Laminar Composites Market Trends

The laminar composites market in Europe accounted for USD 6.44 billion in 2023 due to the region's commitment to sustainability, lightweight materials, and reducing environmental impact across industries. The automotive sector, particularly in countries like Germany and France, is a major driver as manufacturers strive to meet EU emissions regulations through the use of lightweight composites. In addition, the aerospace industry's continuous demand for high-performance materials to improve fuel efficiency and reduce maintenance costs also contributes significantly to market growth.

Key Laminar Composites Company Insights

Some key players operating in the market include Hexcel Corporation, Hexcel Corporation, Toray Advanced Composites:

-

Hexcel Corporation is a global manufacturer and supplier of advanced composites, including carbon fibers, reinforcements, and resin systems used in various applications like aerospace, defense, wind energy, and industrial markets. The company is known for its high-performance materials that offer lightweight solutions with superior strength, durability, and corrosion resistance.

-

Teijin Limited is a Japanese company specializing in advanced fibers and composites, serving diverse markets such as automotive, aerospace, electronics, and healthcare. Teijin's composites portfolio includes carbon fibers, aramid fibers, and thermoplastic composites known for their lightweight and high-strength properties.

Armacell International S.A., Changzhou Tiansheng New Materials Co. Ltd, and 3A Composites are some emerging participants in the market.

-

Armacell International S.A. is a leading manufacturer of flexible foam products for equipment insulation and technical foams, including innovative composite solutions. The company focuses on energy efficiency, lightweight materials, and advanced insulation solutions, expanding its footprint in the construction, automotive, and industrial markets.

-

Changzhou Tiansheng New Materials Co. Ltd is a China-based company specializing in composite materials, including various forms of laminates and high-performance films. The company has been expanding its product range and production capacity to meet the growing demand in the domestic and international markets.

Key Laminar Composites Companies:

The following are the leading companies in the laminar composites market. These companies collectively hold the largest market share and dictate industry trends.

- 3A Composites

- Armacell International S.A.

- Changzhou Tiansheng New Materials Co. Ltd

- Evonik

- Hexcel Corporation

- Honeywell International Inc

- JEC Group

- Teijin Limited

- Toray Advanced Composites

- Mitsubishi Chemical Group Corporation

Laminar Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.09 billion

Revenue forecast in 2030

USD 44.39 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Manufacturing process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

3A Composites; Armacell International S.A.; Changzhou Tiansheng New Materials Co. Ltd, Evonik; Hexcel Corporation; Honeywell International Inc; JEC Group; Teijin Limited; Toray Advanced Composites; Mitsubishi Chemical Group Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laminar Composites Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global laminar composites market report based on the application, manufacturing process, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Aerospace

-

Construction

-

Electrical & Electronics

-

Other Applications

-

-

Manufacturing Process Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brazing

-

Coextrusion

-

Explosive Bonding

-

Roll Bonding

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global laminar composites market size was estimated at USD 27.11 billion in 2023 and is expected to reach USD 29.09 billion in 2024.

b. The global laminar composites market is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030 to reach USD 44.39 billion by 2030.

b. Asia Pacific accounted for the largest revenue share of 37.9% in 2023 owing to rapid urbanization, industrialization, and increasing infrastructure investments in emerging economies such as China and India.

b. Some key players operating in the laminar composites market include 3A Composites, Armacell International S.A., Changzhou Tiansheng New Materials Co. Ltd, Evonik, Hexcel Corporation, Honeywell International Inc, JEC Group, Teijin Limited, Toray Advanced Composites, Mitsubishi Chemical Group Corporation.

b. The key factors driving the growth of laminar composites include the increasing demand for lightweight and high-strength materials across various industries, including aerospace, automotive, construction, and wind energy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.