- Home

- »

- Consumer F&B

- »

-

Lactose-free Butter Market Size, Share & Trends Report 2030GVR Report cover

![Lactose-free Butter Market Size, Share & Trends Report]()

Lactose-free Butter Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature, By Type (Salted, Unsalted), By Packaging (Tub, Stick), By Source, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-431-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lactose-free Butter Market Summary

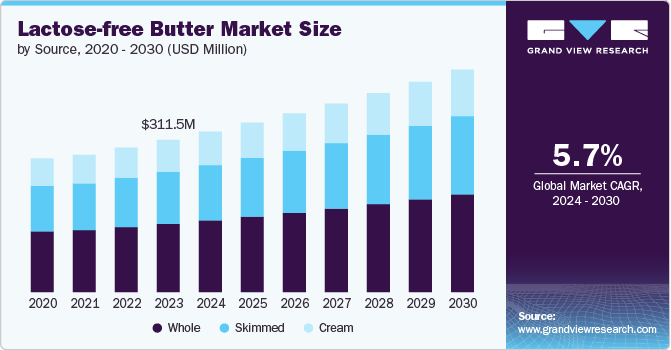

The global lactose-free butter market size was estimated at USD 311.5 million in 2023 and is expected to reach USD 458.9 million by 2030, growing at a CAGR of 5.7% from 2024 to 2030. The demand and consumption of lactose-free butter are on the rise, driven by a growing awareness of lactose intolerance.

Key Market Trends & Insights

- North America accounted for a revenue share of 25.8% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 6.5% from 2024 to 2030.

- By nature, the conventional segment accounted for a share of 69.4% in 2023.

- By type, the salted segment accounted for a share of 72.1% in 2023.

- By source, the whole segment accounted for a revenue share of 44.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 311.5 Million

- 2030 Projected Market Size: USD 458.9 Million

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

Many consumers are becoming increasingly conscious of the digestive discomfort caused by lactose, leading them to seek out lactose-free alternatives. This awareness, combined with the general trend toward healthier eating habits, is encouraging more people to choose products that align with their dietary needs, including lactose-free butter.

Product availability has also significantly improved, with lactose-free butter becoming more accessible in supermarkets and specialty stores. This increased availability makes it easier for consumers to find and purchase these products. In addition, manufacturers are investing in product innovation, creating lactose-free butter with better taste, texture, and performance in cooking and baking. These innovations make lactose-free butter a more appealing option for a broader range of consumers.

The rise of the broader dairy-free and plant-based product segments also supports the growth of the market. Consumers who are exploring dairy-free alternatives may opt for lactose-free butter as part of their diet. In addition, the increasing demand for premium and specialty food products plays a role in this trend. Lactose-free butter is often positioned as a premium offering, appealing to consumers willing to spend more for products that meet their specific dietary requirements.

Moreover, the aging population contributes to the demand for lactose-free butter, as lactose intolerance tends to increase with age. As more people experience lactose intolerance, the market for lactose-free dairy products, including butter, is expected to continue expanding. Increased awareness and education about the condition are also leading more consumers to make informed choices about their food, further driving the market growth.

Nature Insights

Conventional lactose-free butter accounted for a share of 69.4% in 2023. Conventional lactose-free butter offers the same versatility in cooking and baking as regular butter. As consumers increasingly look for lactose-free options that do not compromise on taste or functionality, conventional lactose-free butter is gaining favor. As awareness of lactose intolerance spreads, more consumers are seeking out lactose-free dairy products, including butter, to avoid digestive issues. This rising awareness is a significant driver of demand.

Organic lactose-free butter is expected to grow at a CAGR of 6.1% from 2024 to 2030. Consumers are increasingly concerned about the environmental impact of food production. Organic farming practices, which are more sustainable and eco-friendly, are driving demand for organic products, including lactose-free butter. As more people become aware of lactose intolerance and its effects on digestion, the demand for lactose-free alternatives, including butter, is rising. When combined with the preference for organic products, this creates a strong demand for organic lactose-free butter.

Type Insights

Salted lactose-free butter accounted for a share of 72.1% in 2023. It provides a richer and more flavorful experience, making it a preferred choice for those who enjoy the taste of traditional salted butter but need a lactose-free option. It is often favored in cooking and baking for its ability to enhance the taste of various dishes. The availability of a lactose-free version allows consumers with lactose intolerance to enjoy the same culinary benefits without compromising on flavor.

Unsalted lactose-free butter is expected to grow at a CAGR of 6.2% from 2024 to 2030. Health-conscious consumers who want to control their sodium intake often prefer unsalted butter. The availability of a lactose-free version allows those with lactose intolerance to make healthier choices without compromising their dietary needs. As the market for specialty dietary products expands, unsalted lactose-free butter is becoming more popular among consumers seeking both lactose-free and low-sodium options. This product caters to those with specific dietary restrictions.

Source Insights

Whole lactose-free butter accounted for a revenue share of 44.6% in 2023. Whole butter contains more fat, which is a desirable quality for those looking to incorporate healthy fats into their diet. The availability of whole lactose-free butter appeals to health-conscious consumers who want to maintain a higher fat intake without lactose. Diet trends such as keto and low-carb diets, which emphasize high-fat consumption, are driving demand for whole butter. Lactose-free versions cater to those following these diets while managing lactose intolerance.

Skimmed lactose-free butter is anticipated to grow at a CAGR of 6.2% from 2024 to 2030. Skimmed lactose-free butter offers a lower-calorie alternative to regular butter, making it appealing to health-conscious consumers who want to reduce their fat intake while managing lactose intolerance. As more people focus on weight management and healthier eating habits, skimmed lactose-free butter provides a solution for those looking to balance their dietary fat intake without giving up butter entirely.

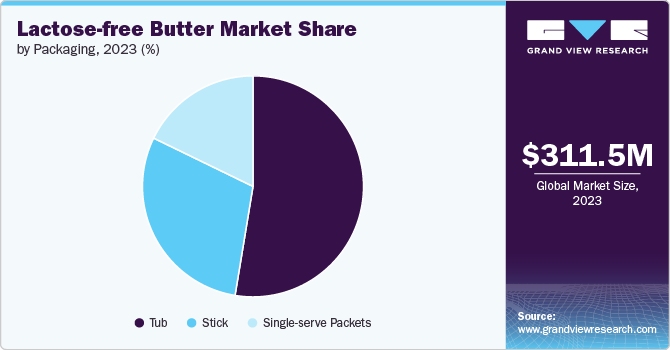

Packaging Insights

Tub accounted for a share of 52.6% in 2023. Butter in a tub is often softer and easier to spread, allowing consumers to use just the right amount without the need for cutting or slicing. This feature is particularly useful for those who want to manage their butter intake more precisely. As consumers lead busier lifestyles, there is a growing preference for ready-to-use products that save time in the kitchen. Lactose-free butter in a tub fits this need, providing a quick and easy option for spreading, cooking, or baking.

Stick is expected to grow at a CAGR of 6.2% from 2024 to 2030. Butter sticks are pre-measured, making it easy for consumers to use the exact amount needed for recipes. This precision is particularly important in baking, where accurate measurements are crucial. Butter sticks are easy to store in the refrigerator and take up less space compared to tubs. The individually wrapped sticks also help maintain freshness and prevent the butter from absorbing other odors in the fridge, which is a significant advantage for consumers.

Distribution Channel Insights

Foodservice accounted for a revenue share of 72.1% in 2023. Many food service providers are expanding their menus to include specialty items that cater to various dietary needs, including lactose-free options. Lactose-free butter is increasingly being used in cooking, baking, and as a condiment to meet the preferences of health-conscious and lactose-intolerant customers.

Retail is anticipated to grow at a CAGR of 6.1% from 2024 to 2030. The trend towards healthier eating and dietary management is driving demand for lactose-free products. Consumers who are health-conscious or managing lactose intolerance are more likely to purchase lactose-free butter from retail outlets to align with their dietary preferences. Retailers are expanding their product offerings to include a wider range of lactose-free options, including butter. This increased availability in grocery stores and supermarkets makes it more accessible for consumers to choose lactose-free butter as part of their regular shopping routine.

Regional Insights

The lactose-free butter market in North America accounted for a revenue share of 25.8% in 2023 of the global market. The trend towards healthier eating and special diets, such as gluten-free and dairy-free diets, is driving the demand for lactose-free products in North America. Lactose-free butter fits well with these trends as it allows individuals to enjoy butter without experiencing digestive discomfort.

U.S. Lactose-free Butter Market Trends

The lactose-free butter market in the U.S. is increasing. There is a growing awareness of lactose intolerance and its symptoms among consumers. As more people recognize they have lactose intolerance, they seek lactose-free alternatives, including butter. In addition, advances in food technology have improved the taste and quality of lactose-free butter, making it a more appealing option for those who are lactose intolerant or prefer dairy alternatives.

Europe Lactose-free Butter Market Trends

The lactose-free butter market in Europe is expected to grow at a CAGR of 6.0% during the forecast period. Europe's diverse culinary traditions and dietary preferences are leading to a demand for specialized food products. Lactose-free butter fits well with various European diets, including those that emphasize low-lactose or dairy-free options. Lactose-free butter offers a solution for those who want to enjoy butter without the adverse effects of lactose.

Asia Pacific Lactose-free Butter Market Trends

The lactose-free butter market in Asia Pacific is anticipated to grow at a CAGR of 6.5% from 2024 to 2030. The expanding middle class and increasing exposure to Western diets and culinary practices are leading to higher butter consumption. As people adopt more Western-style diets, there is a need for lactose-free options to accommodate those who are lactose intolerant.

Key Lactose-free Butter Company Insights

The market for lactose-free butter is characterized by competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Lactose-free Butter Companies:

The following are the leading companies in the lactose-free butter market. These companies collectively hold the largest market share and dictate industry trends.

- Land O'Lakes, Inc.

- Lactalis Group

- Arla Foods

- Ornua (Kerrygold)

- Organic Valley

- Bertolli (by Deoleo)

- Miyoko's Creamery

- Daiya Foods

- Upfield

- Challenge Dairy Products

Recent Developments

-

In July 2024,Challenge Butter, a well-known butter brand, launched a lactose-free butter product nationwide. This new offering aims to meet the needs of consumers who are lactose intolerant but still want to enjoy the taste and functionality of butter. The product is designed to provide the same high-quality taste as regular butter while being suitable for those with lactose sensitivities.

Lactose-free Butter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 328.3 million

Revenue forecast in 2030

USD 458.9 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, type, source, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and UAE

Key companies profiled

Land O'Lakes, Inc., Lactalis Group, Arla Foods, Ornua (Kerrygold), Organic Valley, Bertolli (by Deoleo), Miyoko's Creamery, Daiya Foods, Upfield, Challenge Dairy Products

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Lactose-free Butter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels. It provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lactose-free butter market report based on nature, type, source, packaging, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Salted

-

Unsalted

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Cream

-

Skimmed

-

Whole

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Tub

-

Stick

-

Single-serve Packets

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global lactose-free butter market size was estimated at USD 311.5 million in 2023 and is expected to reach USD 328.3 million in 2024.

b. The global lactose-free butter market is expected to grow at a compounded growth rate of 5.7% from 2024 to 2030 to reach USD 458.9 million by 2030.

b. Salted lactose-free butter accounted for a market share of 72.1% in 2023. Many consumers prefer salted butter because it eliminates the need to add extra salt to recipes or at the table. Lactose-free salted butter offers this convenience to those who are lactose intolerant, driving its demand.

b. Some key players operating in lactose-free butter market include Land O'Lakes, Inc., Lactalis Group, Arla Foods, Ornua (Kerrygold), and others.

b. Key factors that are driving the market growth include rising lactose intolerance among people and increasing health consciousness

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.