- Home

- »

- Specialty Polymers

- »

-

Lactic Acid Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Lactic Acid Market Size, Share & Trends Report]()

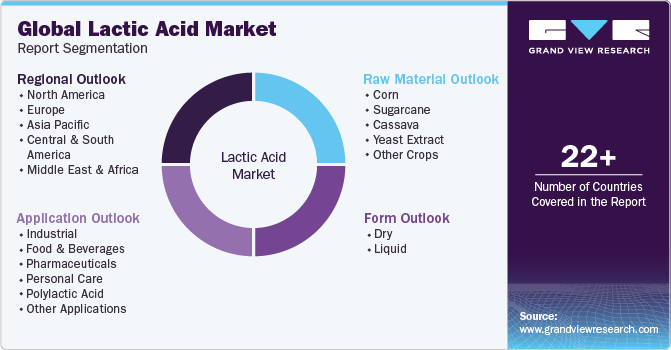

Lactic Acid Market Size, Share & Trends Analysis Report By Raw Material (Corn, Sugarcane, Cassava, Yeast Extract), By Form (Dry, Liquid), By Application, By Region, & Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-126-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Lactic Acid Market Size & Trends

The global lactic acid market size was estimated at USD 3.37 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. The usage of this form in various end use industries including pharmaceuticals, food & beverages majorly in emerging economies such as India, China, and Indonesia are anticipated to drive demand for this form over forecast period.

This product is majorly used in formation of PLA, which is a biodegradable polymer, compostable thermoplastic made from renewable sources such as fermentation processes. This chemical is Generally Recognized As Safe (GRAS) and has great market potential in food industry being recognized as harmless By United States Food & Drug Administration. It can be alternatively produced by chemical synthesis or fermentation.

It is considered as one of well-known organic acids having wide range of industrial applications. The four main applications of this form are in food, chemical, pharmaceutical, and cosmetics industries. This form is a lactic bacteria which refer to a large group of beneficial bacteria having probiotic properties. Additionally, it plays a crucial role in the preparation of wine making, pickling, sausages, curing fish, meat, vegetables baking, and preparation of fermented dairy forms.

The product is not only a significant ingredient in fermented foods, including, canned vegetables, yogurt, and butter, but is also used as a preservative in pickled vegetables and olives. This naturally occurring organic acid, is used in a variety of applications, including food & beverages, pharmaceutical, cosmetics, chemicals, and industrial.

This is a one of large-scale organic acid produced, most commonly used feedstock are carbohydrates obtained from different sources such as sugarcane, corn starch, and others. As compared to mineral variations, organic ones does not completely dissociate in water.

Market Concentration & Characteristics

The lactic acid market is a moderately consolidated market in nature due to limited players dominating the market. Companies such as Futerro; BASF SE; Galactic; Henan Jindan Lactic Acid Technology Co. Ltd.; Musashino Chemical (China) Co., Ltd.; Corbion; thyssenkrupp AG., are among the major players in the market, which indicates a concentrated market landscape.

The global lactic acid industry is experiencing significant growth due to its wide array of applications in various industries such as food and beverage, pharmaceuticals, personal care, and biodegradable polymers. One of the key factors influencing the market is government regulations promoting the use of eco-friendly and sustainable products. For instance, the European Union's regulations promoting the use of biodegradable plastics have led to an increased demand for lactic acid-based polymers, driving the market growth. Similarly, in the food and beverage industry, the FDA's approval of lactic acid as a food additive has further propelled the market expansion.

The demand for lactic acid is being driven by various factors across different industries. A major driver responsible for significant growth in lactic acid market size is its extensive application in the production of fermented foods. Lactic bacterium is widely used as a starter culture for the production of fermented foods due to its ease of fermentation and several other functional characteristics, leading to increased demand for encapsulated lactic acid in the production of dry or semi-dry sausage.

The demand is also being driven by the increasing consumer preference for natural and organic products, especially in the personal care and cosmetics industry. The rising awareness about the harmful effects of synthetic chemicals has led to a surge in the demand for lactic acid as a key ingredient in skincare and hair care products. Additionally, the availability of product substitutes such as citric acid and malic acid is influencing the market dynamics.

Lactic acid serves as a key raw material for the production of polylactic acid (PLA), a biodegradable and renewable polymer. The push for circular economies have propelled the polylactic acid market, thereby influencing the lactic acid market positively. Additionally, research and development efforts are focused on expanding the applications of such as its potential use in the production of bio-based chemicals and materials, presenting new opportunities for market players.

Raw Material Insights

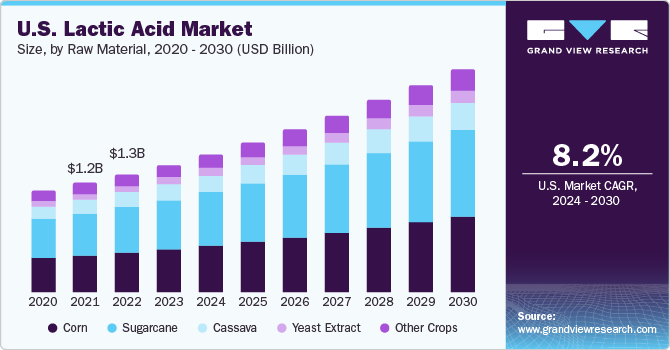

The sugarcane raw material dominated the market with a revenue share of 38.8% in 2023.This high share is attributable to abundant biomass materials availability. Raw sugar extracted from sugar beet or sugarcane is one of major feedstock used in manufacture of lactic acid. Sugarcane contributes notably to development of bioplastics and also contributes in food and biochemical industries.

Corn has emerged as a prominent raw material segment and has accounted a significant share in 2023. This share is attributable owing to its low cost, sustainability, and abundance in nature. Rising environmental concerns, sustainable processing practices, and limited supply of petroleum feedstock is anticipated to augment demand for corn based lactic acid forms over forecast period.

Yeast extract is one of most commonly used ingredients for formation of lactic acid. However high formation cost associated with this process gave rise to an alternative namely Corn Steep Liquor (CSL) derived from corn as a by-form from the corn steeping process. Demand for corn based lactic acid in food & beverages industry as a pH regulator, microbial activity enhancer and others is expected to market growth over the coming years.

Other numerous inexpensive raw materials used in formation of lactic acid are starchy & cellulosic materials such as cassava, sweet sorghum, potato, wheat, rye-barley, rice, xylan, galactan, lignin, and other filamentous fungi such as Lactic Caid Bacteria (LAB), and Rhizopus. PLA is witnessed to constitute a significant application share in the market.

Form Insights

Dry form lactic acid dominated the market in the year 2023. One of the primary drivers aiding the dry lactic acid market growth of is its usage in the formation of polylactic acid (PLA), a biodegradable polymer. PLA is widely used in packaging materials, textiles, and medical applications. Dry form is used in the formation of fermented foods such as sauerkraut, kimchi, and sour beers. It acts as a natural preservative and contributes to the unique flavors and textures of these forms. Dry form of lactic finds application in cosmetics and food & beverages industries.

Wet form of lactic acid is a colorless or yellow syrupy liquid with its own distinctive characteristics. It is miscible with water, forming a colorless solution when dissolved. It is used in cosmetics, skincare forms, and hair care formulations due to its exfoliating, moisturizing, and pH-regulating properties. It is also utilized in the flavors and fragrances industry as a souring agent, imparting a tangy flavor to various food and beverage forms. They are primarily used in pharmaceutical, dairy and textile industries.

Application Insights

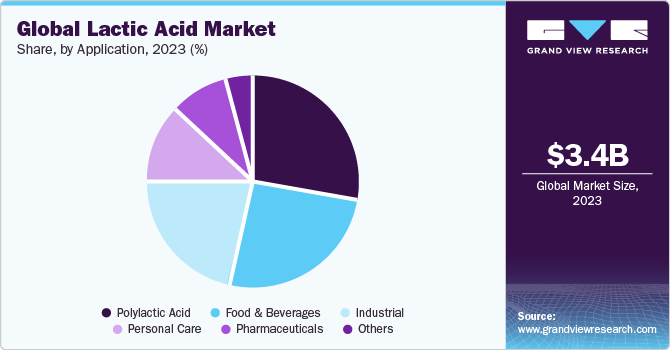

The polylactic acid application dominated the market with the highest revenue share of 28.7% in 2023.This high share is attributable to its durability, mechanical strength, and transparency as compared to other bio-degradable plastics. Rising demand for bio-degradable plastic materials, constant growth of automotive industry, and increasing demand from end-use industries are major driving factors for this application segment.

In transportation and automotive sector, numerous vehicle interior components such as interior-trim, under the hood components, and engine components are produced using light weight material. The lightweight components reduce weight of the vehicle and enhance performance, this has led to rise in demand for sustainable bioplastic material to increase fuel-economy and toughness which in turn will propel market demand for PLA.

Food & beverages emerged as second largest application segment in the year 2023. This form has ability to enhance flavor and increase the shelf life of food & beverages forms by controlling the development of pathogenic microorganisms. Owing to these properties demand for this form is anticipated to surge with its growing penetration in seafood, poultry, and meat industries.

Lactic acid serves as a vital feedstock in formation of PLA, which is further used to manufacture biodegradable plastic. These biodegradable plastics are used in numerous industries such as packaging and chemical. This form is a natural solvent used as a metal cleaning agent as well as in mechanical cleaning applications.

The pharmaceutical industry has been a key component in the growth of this form market over past few years on account of its increasing application in drug manufacturing and as an electrolyte in intravenous solutions used for supplementing the required bodily fluids. Properties of lactic acid such as metal sequestration, pH regulator, effectiveness in being a natural body constituent, and chiral intermediate in pharmaceutical forms are expected to be the key factors for its growth in the pharmaceutical industry. Personal care application segment is expected to be a key driver for this form, which can be attributed to increasing form use in skincare forms. Lactic acid-based skin moisturizers improve dry skin, remove acne scars, improve discoloration, and prevent damage to skin tissues.

Regional Insights

North America dominated the market with a revenue share of 45.2% in 2023.This high share is attributable to growing personal care, pharmaceutical, and food & beverages industries. The expanding pharmaceutical industry in the U.S. as a result of increasing expenditures on medicines is anticipated to have a positive impact on market in this region.

North America market is expected to grow on account of presence of various personal care and cosmetic companies such as Maybelline New York, Procter & Gamble, Colgate-Palmolive Company, Avon, Unilever, and Johnson & Johnson Private Limited. Moreover, the robust manufacturing base of global cosmetic manufacturers such as Procter & Gamble, Unilever and Johnson & Johnson Private Limited in the U.S. is expected to promote the demand for personal care forms. Rising demand for PLA, owing to the U.S. government efforts toward reducing carbon footprint, high demand from packaging applications, and growth of pharmaceutical and personal care industries is expected to propel growth of market over the forecast period.

Key Companies & Market Share Insights

Companies are engaging in mergers, and acquisitions, with an aim to strengthen their manufacturing capacities, form portfolio and offer a competitive form range. Manufacturing companies operating in market emphasize mainly on expanding their global footprints in an attempt to increase market shares and drive their revenues.

They are expanding formation facilities in various regions such as North America, Asia Pacific, and Europe owing to the easy availability of raw material and close proximity to raw material suppliers. For instance, In June 2023, Sulzer entered into a partnership agreement with Jindan New Biomaterials (Jindan), a prominent producer of lactic acid (LA), to facilitate the manufacturing of polylactic acid (PLA), a biobased plastic. Jindan company will leverage Sulzer's licensed PLA technology at its newly established facility in Henan Province, enabling the formation of up to 75,000 tonnes of PLA annually.

Key lactic acid Companies:

The following are the leading companies in the lactic acid market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these lactic acid companies are analyzed to map the supply network.

- BASF SE

- Galactic

- Musashino Chemical (China) Co., Ltd.

- Futerro

- Corbion

- Dow

- TEIJIN LIMITED

- NatureWorks LLC

- Henan Jindan Lactic Acid Technology Co. Ltd.

- thyssenkrupp AG

- Cellulac

- Jungbunzlauer Suisse AG

- Vaishnavi Bio Tech

- Danimer Scientific

Lactic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.37 billion

Revenue forecast in 2030

USD 5.80 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw Material, form, application

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; The Netherlands; China; India; Japan; Indonesia; Malaysia; Philippines; Australia, New Zealand; Brazil

Key companies profiled

Futerro; BASF SE; Galactic; Henan Jindan Lactic Acid Technology Co. Ltd.; Musashino Chemical (China) Co., Ltd.; Corbion; thyssenkrupp AG; Dow; Cellulac; Jungbunzlauer Suisse AG; Vaishnavi Bio Tech; TEIJIN LIMITED; Danimer Scientific; NatureWorks LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lactic Acid Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lactic acid market report based on raw material, form, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Corn

-

Sugarcane

-

Cassava

-

Yeast Extract

-

Other Crops

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Food & Beverages

-

Beverages

-

Bakery & Confectionary Products

-

Dairy Products

-

Meat Products

-

Other Food Products

-

-

Pharmaceuticals

-

Personal Care

-

PLA

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

Malaysia

-

India

-

Indonesia

-

Philippines

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global lactic acid market size was estimated at USD 3.36 billion in 2022 and is expected to reach USD 3.37 billion in 2024

b. The global lactic acid market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 5.80 billion by 2030.

b. The sugarcane raw material segment dominated the global lactic acid market and accounted for the largest revenue share of over 38.8% in 2023.

b. The polylactic acid application segment led the global lactic acid market and accounted for the largest revenue share of more than 28.7% in 2023.

b. North America dominated the lactic acid market with a share of 45.2% in 2023. This is attributable to rising consumer awareness regarding recyclability and green packaging.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Lactic Acid Market Variables, Trends & Scope

3.1. Global Lactic Acid Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Lactic Acid Market: Raw Material Outlook Estimates & Forecasts

4.1. Lactic Acid Market: Raw Material Movement Analysis, 2023 & 2030

4.2. Corn

4.2.1. Corn based Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3. Sugarcane

4.3.1. Sugarcane based Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.4. Cassava

4.4.1. Cassava Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.5. Yeast Extract

4.5.1. Yeast Extract based Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.6. Other Crops

4.6.1. Other Crops based Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 5. Lactic Acid Market: Form Outlook Estimates & Forecasts

5.1. Lactic Acid Market: Form Movement Analysis, 2023 & 2030

5.2. Dry

5.2.1. Dry Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.3. Liquid

5.3.1. Liquid Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Lactic Acid Market: Application Outlook Estimates & Forecasts

6.1. Lactic Acid Market: Application Movement Analysis, 2023 & 2030

6.2. Industrial

6.2.1. Lactic Acid Market estimates and forecast in Industrial, 2018 - 2030 (USD Million) (Kilotons)

6.3. Food & Beverages

6.3.1. Lactic Acid Market estimates and forecast, 20 18 - 2030 (USD Million) (Kilotons)

6.3.2. Beverages

6.3.2.1. Lactic Acid Market estimates and forecast in Beverages, 2018 - 2030 (USD Million) (Kilotons)

6.3.3. Bakery & Confectionary Products

6.3.3.1. Lactic Acid Market estimates and forecast in Bakery & Confectionary Products, 2018 - 2030 (USD Million) (Kilotons)

6.3.4. Dairy Products

6.3.4.1. Lactic Acid Market estimates and forecast in Dairy Products, 2018 - 2030 (USD Million) (Kilotons)

6.3.5. Meat Products

6.3.5.1. Lactic Acid Market estimates and forecast in Meat Products, 2018 - 2030 (USD Million) (Kilotons)

6.3.6. Other Food Products

6.3.6.1. Lactic Acid Market estimates and forecast in Other Food Products, 2018 - 2030 (USD Million) (Kilotons)

6.4. Pharmaceuticals

6.4.1. Lactic Acid Market estimates and forecast, 2018 - 2030 in Pharmaceuticals, (USD Million) (Kilotons)

6.5. Personal Care

6.5.1. Lactic Acid Market estimates and forecast, 2018 - 2030 in Personal Care, (USD Million) (Kilotons)

6.6. PLA

6.6.1. Lactic Acid Market estimates and forecast, 2018 - 2030 in PLA, (USD Million) (Kilotons)

6.7. Electronic Appliances

6.7.1. Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.8. Other Applications

6.8.1. Lactic Acid Market estimates and forecast in Other Applications, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Lactic Acid Market Regional Outlook Estimates & Forecasts

7.1. Regional Snapshot

7.2. Lactic Acid Market: Regional Movement Analysis, 2023 & 2030

7.3. North America

7.3.1. North America Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.3.2. North America Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.3.3. North America Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.3.4. North America Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.3.5. U.S.

7.3.5.1. U.S. Lactic Acid estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.3.5.2. U.S. Lactic Acid estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.3.5.3. U.S. Lactic Acid estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.3.5.4. U.S. Lactic Acid estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.3.6. Canada

7.3.6.1. Canada Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.3.6.2. Canada Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.3.6.3. Canada Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.3.6.4. Canada Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.3.7. Mexico

7.3.7.1. Mexico Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.3.7.2. Mexico Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.3.7.3. Mexico Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.3.7.4. Mexico Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4. Europe

7.4.1. Europe Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.2. Europe Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.2.1. Europe Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.2.2. Europe Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.2.3. Europe Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4.3. Germany

7.4.3.1. Germany Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.3.2. Germany Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.3.3. Germany Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.3.4. Germany Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4.4. France

7.4.4.1. France Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.4.2. France Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.4.3. France Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.4.4. France Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4.5. UK

7.4.5.1. UK Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.5.2. UK Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.5.3. UK Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.5.4. UK Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4.6. France

7.4.6.1. France Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.6.2. France Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.6.3. France Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.6.4. France Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4.7. Italy

7.4.7.1. Italy Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.7.2. Italy Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.7.3. Italy Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.7.4. Italy Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4.8. Spain

7.4.8.1. Spain Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.8.2. Spain Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.8.3. Spain Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.8.4. Spain Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.4.9. The Netherlands

7.4.9.1. The Netherlands Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4.9.2. The Netherlands Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.4.9.3. The Netherlands Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.4.9.4. The Netherlands Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5. Asia Pacific

7.5.1. Asia Pacific Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.2. Asia Pacific Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.3. Asia Pacific Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.4. Asia Pacific Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.5. China

7.5.5.1. China Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.5.2. China Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.5.3. China Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.5.4. China Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.6. Malaysia

7.5.6.1. Malaysia Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.6.2. Malaysia Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.6.3. Malaysia Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.6.4. Malaysia Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.7. Japan

7.5.7.1. Japan Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.7.2. Japan Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.7.3. Japan Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.7.4. Japan Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.8. India

7.5.8.1. India Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.8.2. India Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.8.3. India Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.8.4. India Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.9. Indonesia

7.5.9.1. Indonesia Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.9.2. Indonesia Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.9.3. Indonesia Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.9.4. Indonesia Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.10. Philippines

7.5.10.1. Philippines Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.10.2. Philippines Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.10.3. Philippines Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.10.4. Philippines Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.11. Australia

7.5.11.1. Australia Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.11.2. Australia Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.11.3. Australia Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.11.4. Australia Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.5.12. New Zealand

7.5.12.1. New Zealand Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5.12.2. New Zealand Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.5.12.3. New Zealand Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.5.12.4. New Zealand Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.6. Central & South America

7.6.1. Central & South America Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.2. Central & South America Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.6.3. Central & South America Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.6.4. Central & South America Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.6.5. Brazil

7.6.5.1. Brazil Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6.5.2. Brazil Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.6.5.3. Brazil Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.6.5.4. Brazil Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

7.7. Middle East & Africa

7.7.1. Middle East & Africa Lactic Acid Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7.2. Middle East & Africa Lactic Acid Market estimates and forecast, by raw material, 2018 - 2030 (USD Million) (Kilotons)

7.7.3. Middle East & Africa Lactic Acid Market estimates and forecast, by form, 2018 - 2030 (USD Million) (Kilotons)

7.7.4. Middle East & Africa Lactic Acid Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Ranking

8.4. Heat Map Analysis

8.5. Market Strategies

8.6. Vendor Landscape

8.6.1. List of raw material supplier, key manufacturers, and distributors

8.6.2. List of prospective end-users

8.7. Strategy Mapping

8.8. Company Profiles/Listing

8.8.1. Futerro

8.8.1.1. Company Overview

8.8.1.2. Financial Performance

8.8.1.3. Form Benchmarking

8.8.2. BASF SE

8.8.2.1. Company Overview

8.8.2.2. Financial Performance

8.8.2.3. Form Benchmarking

8.8.3. Galactic

8.8.3.1. Company Overview

8.8.3.2. Financial Performance

8.8.3.3. Form Benchmarking

8.8.4. Henan Jindan Lactic Acid Technology Co. Ltd.

8.8.4.1. Company Overview

8.8.4.2. Financial Performance

8.8.4.3. Form Benchmarking

8.8.5. Lattice Semiconductor Corporation

8.8.5.1. Company Overview

8.8.5.2. Financial Performance

8.8.5.3. Form Benchmarking

8.8.6. Corbion

8.8.6.1. Company Overview

8.8.6.2. Financial Performance

8.8.6.3. Form Benchmarking

8.8.7. thyssenkrupp AG

8.8.7.1. Company Overview

8.8.7.2. Financial Performance

8.8.7.3. Form Benchmarking

8.8.8. Dow

8.8.8.1. Company Overview

8.8.8.2. Financial Performance

8.8.8.3. Form Benchmarking

8.8.9. Cellulac

8.8.9.1. Company Overview

8.8.9.2. Financial Performance

8.8.9.3. Form Benchmarking

8.8.10. Jungbunzlauer Suisse AG

8.8.10.1. Company Overview

8.8.10.2. Financial Performance

8.8.10.3. Form Benchmarking

List of Tables

Table 1. Global Lactic acid market estimates and forecasts, By Raw Material, 2018 - 2030 (Kilotons)

Table 2. Global Lactic acid market estimates and forecasts , By Raw Material, 2018 - 2030 (USD Million)

Table 3. Corn based lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 4. Corn based lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 5. Sugarcane based lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 6. Sugarcane based lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 7. Cassava based lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 8. Cassava based lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 9. Yeast Extract based lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 10. Yeast Extract based lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 11. Other Crops based Lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 12. Other Crops based Lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 13. Global Lactic acid market estimates and forecasts, By Form, 2018 - 2030 (Kilotons)

Table 14. Global Lactic acid market estimates and forecasts , By Form, 2018 - 2030 (USD Million)

Table 15. Dry Lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 16. Dry Lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 17. Liquid Lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 18. Liquid Lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 19. Global Lactic acid market estimates and forecasts, By Application, 2018 - 2030 (Kilotons)

Table 20. Global Lactic acid market estimates and forecasts by Application, 2018 - 2030 (USD Million)

Table 21. Lactic acid market estimates and forecasts in Industrial Applications , 2018 - 2030 (Kilotons)

Table 22. Lactic acid market estimates and forecasts in Industrial Applications , 2018 - 2030 (USD Million)

Table 23. Lactic acid market estimates and forecasts in Food & Beverages, 2018 - 2030 (Kilotons)

Table 24. Lactic acid market estimates and forecasts in Food & Beverages, 2018 - 2030 (USD Million)

Table 25. Lactic acid market estimates and forecasts in Beverages, 2018 - 2030 (Kilotons)

Table 26. Lactic acid market estimates and forecasts in Beverages, 2018 - 2030 (USD Million)

Table 27. Lactic acid market estimates and forecasts in Bakery & Confectionary Products, 2018 - 2030 (Kilotons)

Table 28. Lactic acid market estimates and forecasts in Bakery & Confectionary Products, 2018 - 2030 (USD Million

Table 29. Lactic acid market estimates and forecasts in Dairy Products, 2018 - 2030 (Kilotons)

Table 30. Lactic acid market estimates and forecasts in Dairy Products, 2018 - 2030 (USD Million)

Table 31. Lactic acid market estimates and forecasts in Meat Products , 2018 - 2030 (Kilotons)

Table 32. Lactic acid market estimates and forecasts in Meat Products , 2018 - 2030 (USD Million)

Table 33. Lactic acid market estimates and forecasts in Other Products, 2018 - 2030 (Kilotons)

Table 34. Lactic acid market estimates and forecasts in Other Products, 2018 - 2030 (USD Million)

Table 35. North America lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 36. North America lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 37. North America lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 38. North America lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 39. North America lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 40. North America lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 41. North America lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 42. North America lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 43. U.S. lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 44. U.S. lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 45. U.S. lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 46. U.S. lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 47. U.S. lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 48. U.S. lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 49. U.S. lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 50. U.S. lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 51. Canada lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 52. Canada lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 53. Canada lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 54. Canada lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 55. Canada lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 56. Canada lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 57. Canada lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 58. Canada lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 59. Mexico lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 60. Mexico lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 61. Mexico lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 62. Mexico lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 63. Mexico lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 64. Mexico lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 65. Mexico lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 66. Mexico lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 67. Europe lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 68. Europe lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 69. Europe lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 70. Europe lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 71. Europe lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 72. Europe lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 73. Europe lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 74. Europe lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 75. Germany lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 76. Germany lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 77. Germany lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 78. Germany lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 79. Germany lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 80. Germany lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 81. Germany lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 82. Germany lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 83. UK lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 84. UK lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 85. UK lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 86. UK lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 87. UK lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 88. UK lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 89. UK lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 90. UK lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 91. France lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 92. France lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 93. France lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 94. France lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 95. France lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 96. France lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 97. France lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 98. France lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 99. Italy lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 100. Italy lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 101. Italy lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 102. Italy lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 103. Italy lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 104. Italy lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 105. Italy lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 106. Italy lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 107. Spain lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 108. Spain lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 109. Spain lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 110. Spain lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 111. Spain lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 112. Spain lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 113. Spain lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 114. Spain lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 115. The Netherlands lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 116. The Netherlands lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 117. The Netherlands lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 118. The Netherlands lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 119. The Netherlands lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 120. The Netherlands lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 121. The Netherlands lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 122. The Netherlands lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 123. China lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 124. China lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 125. China lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 126. China lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 127. China lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 128. China lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 129. China lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 130. China lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 131. India lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 132. India lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 133. India lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 134. India lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 135. India lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 136. India lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 137. India lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 138. India lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 139. Japan lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 140. Japan lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 141. Japan lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 142. Japan lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 143. Japan lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 144. Japan lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 145. Japan lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 146. Japan lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 147. Indonesia lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 148. Indonesia lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 149. Indonesia lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 150. Indonesia lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 151. Indonesia lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 152. Indonesia lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 153. Indonesia lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 154. Indonesia lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 155. Malaysia lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 156. Malaysia lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 157. Malaysia lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 158. Malaysia lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 159. Malaysia lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 160. Malaysia lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 161. Malaysia lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 162. Malaysia lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 163. Philippines lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 164. Philippines lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 165. Philippines lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 166. Philippines lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 167. Philippines lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 168. Philippines lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 169. Philippines lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 170. Philippines lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 171. Australia lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 172. Australia lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 173. Australia lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 174. Australia lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 175. Australia lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 176. Australia lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 177. Australia lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 178. Australia lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 179. New Zealand lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 180. New Zealand lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 181. New Zealand lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 182. New Zealand lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 183. New Zealand lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 184. New Zealand lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 185. New Zealand lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 186. New Zealand lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 187. Central & South America lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 188. Central & South America lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 189. Central & South America lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 190. Central & South America lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 191. Central & South America lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 192. Central & South America lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 193. Central & South America lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 194. Central & South America lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 195. Brazil lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 196. Brazil lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 197. Brazil lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 198. Brazil lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 199. Brazil lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 200. Brazil lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 201. Brazil lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 202. Brazil lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

Table 203. Middle East & Africa lactic acid market estimates and forecasts, 2018 - 2030 (Kilotons)

Table 204. Middle East & Africa lactic acid market estimates and forecasts, 2018 - 2030 (USD Million)

Table 205. Middle East & Africa lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (Kilotons)

Table 206. Middle East & Africa lactic acid market estimates and forecasts, by Raw Material, 2018 - 2030 (USD Million)

Table 207. Middle East & Africa lactic acid market estimates and forecasts, by Form, 2018 - 2030 (Kilotons)

Table 208. Middle East & Africa lactic acid market estimates and forecasts, by Form, 2018 - 2030 (USD Million)

Table 209. Middle East & Africa lactic acid market estimates and forecasts, by Application, 2018 - 2030 (Kilotons)

Table 210. Middle East & Africa lactic acid market estimates and forecasts, by Application, 2018 - 2030 (USD Million)

List of Figures

Fig 1. Market segmentation

Fig 2. Information procurement

Fig 3. Data Analysis Models

Fig 4. Market Formulation and Validation

Fig 5. Market snapshot

Fig 6. Segmental outlook- raw material, form, and application

Fig 7. Competitive outlook

Fig 8. Global Lactic acid market, 2018-2030 (USD Million) (Kilotons)

Fig 9. Value chain analysis

Fig 10. Market dynamics

Fig 11. Porter’s Analysis

Fig 12. PESTEL Analysis

Fig 13. Lactic acid market, by raw material: Key takeaways

Fig 14. Lactic acid market, by raw material: Market share, 2023 & 2030

Fig 15. Lactic acid market, by form: Key takeaways

Fig 16. Lactic acid market, by form: Market share, 2023 & 2030

Fig 17. Lactic acid market, by application: Key takeaways

Fig 18. Lactic acid market, by application: Market share, 2023 & 2030

Fig 19. Lactic acid market, by region: Key takeaways

Fig 20. Lactic acid market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Lactic Acid Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Lactic Acid Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Dry

- Liquid

- Lactic Acid Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- Other Applications

- Lactic Acid Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- North America Lactic Acid Market, By Form

- Dry

- Liquid

- North America Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- U.S.

- U.S. Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- U.S. Lactic Acid Market, By Form

- Dry

- Liquid

- U.S. Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- U.S. Lactic Acid Market, By Raw Material

- Canada

- Canada Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Canada Lactic Acid Market, By Form

- Dry

- Liquid

- Canada Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Canada Lactic Acid Market, By Raw Material

- Mexico

- Mexico Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Mexico Lactic Acid Market, By Form

- Dry

- Liquid

- Mexico Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Mexico Lactic Acid Market, By Raw Material

- North America Lactic Acid Market, By Raw Material

- Europe

- Europe Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Europe Lactic Acid Market, By Form

- Dry

- Liquid

- Europe Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Germany

- Germany Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Germany Lactic Acid Market, By Form

- Dry

- Liquid

- Germany Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Germany Lactic Acid Market, By Raw Material

- France

- France Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- France Lactic Acid Market, By Form

- Dry

- Liquid

- France Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- France Lactic Acid Market, By Raw Material

- UK

- UK Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- UK Lactic Acid Market, By Form

- Dry

- Liquid

- UK Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- UK Lactic Acid Market, By Raw Material

- Italy

- Italy Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Italy Lactic Acid Market, By Form

- Dry

- Liquid

- Italy Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Italy Lactic Acid Market, By Raw Material

- Spain

- Spain Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Spain Lactic Acid Market, By Form

- Dry

- Liquid

- Spain Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Spain Lactic Acid Market, By Raw Material

- The Netherlands

- The Netherlands Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- The Netherlands Lactic Acid Market, By Form

- Dry

- Liquid

- The Netherlands Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- The Netherlands Lactic Acid Market, By Raw Material

- Europe Lactic Acid Market, By Raw Material

- Asia Pacific

- Asia Pacific Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Asia Pacific Lactic Acid Market, By Form

- Dry

- Liquid

- Asia Pacific Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- China

- China Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- China Lactic Acid Market, By Form

- Dry

- Liquid

- China Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- China Lactic Acid Market, By Raw Material

- Japan

- Japan Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Japan Lactic Acid Market, By Form

- Dry

- Liquid

- Japan Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Japan Lactic Acid Market, By Raw Material

- Malaysia

- Malaysia Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Malaysia Lactic Acid Market, By Form

- Dry

- Liquid

- Malaysia Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Malaysia Lactic Acid Market, By Raw Material

- India

- India Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- India Lactic Acid Market, By Form

- Dry

- Liquid

- India Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- India Lactic Acid Market, By Raw Material

- Indonesia

- Indonesia Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Indonesia Lactic Acid Market, By Form

- Dry

- Liquid

- Indonesia Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Indonesia Lactic Acid Market, By Raw Material

- Philippines

- Philippines Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Philippines Lactic Acid Market, By Form

- Dry

- Liquid

- Philippines Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Philippines Lactic Acid Market, By Raw Material

- Australia

- Australia Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Australia Lactic Acid Market, By Form

- Dry

- Liquid

- Australia Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Australia Lactic Acid Market, By Raw Material

- New Zealand

- New Zealand Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- New Zealand Lactic Acid Market, By Form

- Dry

- Liquid

- New Zealand Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- New Zealand Lactic Acid Market, By Raw Material

- Asia Pacific Lactic Acid Market, By Raw Material

- Central & South America

- Central & South America Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Central & South America Lactic Acid Market, By Form

- Dry

- Liquid

- Central & South America Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Brazil

- Brazil Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Brazil Lactic Acid Market, By Form

- Dry

- Liquid

- Brazil Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Brazil Lactic Acid Market, By Raw Material

- Central & South America Lactic Acid Market, By Raw Material

- Middle East & Africa

- Middle East & Africa Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

- Middle East & Africa Lactic Acid Market, By Form

- Dry

- Liquid

- Middle East & Africa Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Beverages

- Bakery & Confectionary Products

- Dairy Products

- Meat Products

- Other Food Products

- Pharmaceuticals

- Personal Care

- PLA

- Other Applications

- Middle East & Africa Lactic Acid Market, By Raw Material

- North America

Lactic Acid Market Dynamics

Driver: Growing personal care sector

Lactic acid is widely used in the personal care industry for various purposes. It is found in products like shampoos, creams, and other body care formulations. This is because lactic acid has several beneficial characteristics, including its ability to regulate pH levels, act as an antimicrobial agent, and bind moisture to the skin. Additionally, it has skin-lightening properties, promotes collagen and elastin synthesis, and aids in exfoliation and cell renewal. The global cosmetics market is expected to experience significant growth due to various factors. One of these factors is the changing lifestyle of individuals, who are increasingly conscious about enhancing their overall appearance. Moreover, with their growing GDP, countries like India, China, Malaysia, and Sri Lanka are contributing to the expansion of the cosmetics market. To boost global sales, major cosmetic manufacturers are investing in research and development and implementing new product branding and advertising strategies. Manufacturing companies are also adopting innovative strategies, such as launching new products and designing attractive packaging to increase the sales of cosmetic products. Lactic acid is often used in cosmetic formulations as a substitute for glycolic acid. It serves as a skin enhancer and helps promote youthful-looking skin. The demand for perfumes, especially in regions like the Middle East, Latin America, and West Africa, is expected to drive the growth of the cosmetics industry in the forecast period. Men's grooming products and deodorants have also played a significant role in the expansion of the cosmetics industry. The increasing disposable income and growing awareness about personal care and hygiene are expected to drive the cosmetics industry further. Additionally, the establishment of manufacturing bases by companies like Unilever, Johnson & Johnson, and Procter & Gamble in the U.S. contributes to the growth of the cosmetics industry and, consequently, the demand for lactic acid. Furthermore, the rising demand for skincare, hair care, perfumes, deodorants, oral care, and makeup products is expected to fuel the demand for lactic acid in the coming years.

Driver: Growth in the pharmaceutical industry

Lactic acid serves multiple purposes in the pharmaceutical industry, including its use as a chiral intermediate, pH regulator, metal sequestration agent, and natural component of the human body. The pharmaceutical industry has experienced significant growth in recent years, driven by advancements in science and technology. This growth is expected to continue, particularly in emerging countries like China, India, and Brazil. The increasing demand for high-quality pharmaceutical creams and medicines, coupled with the expansion of the pharmaceutical industry, is predicted to drive the demand for lactic acid in the sector. In Europe, the pharmaceutical sector has been a valuable asset to several countries, emerging as a top-performing industry with advanced technology. This is expected to contribute to the growth of the lactic acid market in Europe. The recovery of the pharmaceutical industry in the United States is also anticipated to drive the lactic acid market during the forecast period. Market participants such as Pfizer, Johnson & Johnson, and Merck KGaA and significant research and development investments in the U.S. and Mexico are likely to propel market growth. However, these market participants face intense competition from emerging economies like Brazil, India, and China. Consequently, the expanding pharmaceutical sector is projected to stimulate the demand for lactic acid in the coming years.

Restraint: Volatile raw material prices

Lactic acid is a byproduct of the fermentation process of carbohydrates like glucose, lactose, and fructose. The prices of lactic acid have been affected by the volatility in the prices of raw materials, including sugar and tapioca starch. The cultivation of these raw materials has been severely impacted by global warming and climate changes, mainly due to irregular rainfall, resulting in a decrease in overall crop yield. The effects of El Niño in the Asia Pacific region have also contributed to the irregular rainfall patterns. The fluctuation in starch prices, caused by variations in production yield, is expected to impact the prices of lactic acid. To address these challenges, lactic acid producers are striving to improve efficiency and reduce environmental waste. Companies like Cargill, Incorporated are actively developing innovative processes that require fewer raw materials, thus reducing the production of environmentally harmful byproducts. However, lactic acid prices are anticipated to increase due to rising energy costs and packaging material expenses. Additionally, the fluctuations in raw material prices are expected to affect lactic acid prices negatively. Consequently, many companies are focusing on developing processes that utilize low-priced raw materials to minimize costs.

What Does This Report Include?

This section will provide insights into the contents included in this lactic acid market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Lactic acid market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Lactic acid market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the lactic acid market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below: