Lactate Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Chargeable Lactate Meters), By Application (Sports, Medical), By End Use (Hospitals And Clinics), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-311-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Lactate Monitoring Devices Market Trends

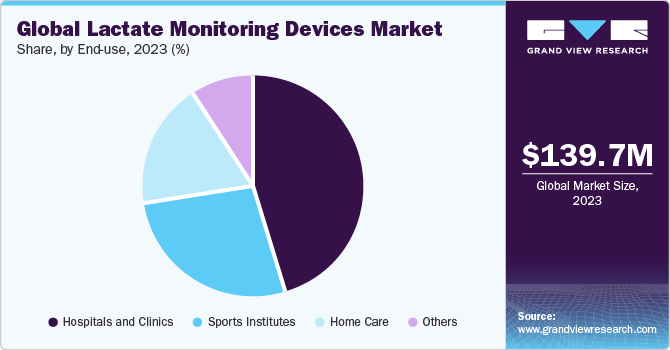

The global lactate monitoring devices market size was estimated at USD 139.7 million in 2023 and is anticipated to grow at a CAGR of 8.6% from 2024 to 2030. The growth is attributed to the increasing awareness about the benefits of monitoring lactate in sports & healthcare, the rise in the need for point-care tests, and the growing adoption of remote patient monitoring & telemedicine.

Moreover, an increase in the application of home-based healthcare, and an aging population is further anticipated to propel the market growth. Currently, there are over 40 million people in the U.S. alone above 65 years and the number is expected to double by 2050. Japan provides potential growth opportunities to this market due to the presence of the highest geriatric population in the country. According to WHO, the percentage of the geriatric population is expected to reach 22.0% by 2050.

Furthermore, the growing cases of lifestyle-related disorders including cardiovascular diseases and diabetes are projected to drive the demand for lactate monitoring devices.For instance, according to the PCR online, CVD continues to be the primary cause of death among both men and women worldwide. As of 2023, the global population is 8 billion, with approximately 620 million individuals living with heart and circulatory diseases. Each year, approximately 60 million people worldwide develop heart or circulatory diseases.

The growing technological advancements in lactate monitoring devices resulting user-friendly and portable products expanding the potential consumer base. Modern devices are equipped with advanced sensors and algorithms that provide more reliable measurements of lactate levels in the body. This increased accuracy is crucial for athletes, healthcare professionals, and individuals monitoring their fitness levels or health conditions. For instance, K’Watch Athlete by PKvitality is the world’s first real-time lactate monitor designed to allow athletes and trainers to significantly improve training and performance while reducing the risk of injuries. All in a sleek, high-quality wearable that can be worn as an armband or watch.

Moreover, the rising need for point-care testing. Point-of-care testing (POCT) offers the advantage of rapid results regardless of location. To further enhance its benefits, POCT is being advanced in conjunction with the Internet of Medical Things (IoMT). This integration allows for seamless collection, recording, and management of POCT results over a network. IoMT not only improves the utility of POCT as a testing tool but also facilitates its integration into diagnostic and health management systems. By leveraging IoMT, individuals can conveniently access their test results in real-time, enabling personalized diagnosis and treatment tailored to their specific health needs. This advancement holds significant promise for disease prevention and overall health maintenance.

The adoption of remote patient monitoring (RPM) and telemedicine has been steadily growing due to technological advancements and the benefits they offer to both patients and healthcare providers. These technologies have evolved significantly over time, transforming the way healthcare is delivered and managed which further drives the demand for lactate monitoring devices. Furthermore, governments of various nations funded for telehealth to accelerate the use of digital tools during the COVID-19 pandemic. For instance, in December 2021, the Australian government invested around USD 9.8 billion during the pandemic to deliver better telehealth, providing better healthcare and medication to the citizens.

Moreover, the increasing application of home-based healthcare highly contributes to the market. In the U.S. the number of individuals over the age of 65 continues to grow significantly, there is a corresponding increase in demand for healthcare services tailored to older adults. Home-based care offers a convenient and comfortable option for seniors who may have difficulty accessing traditional healthcare facilities due to mobility issues or other limitations.

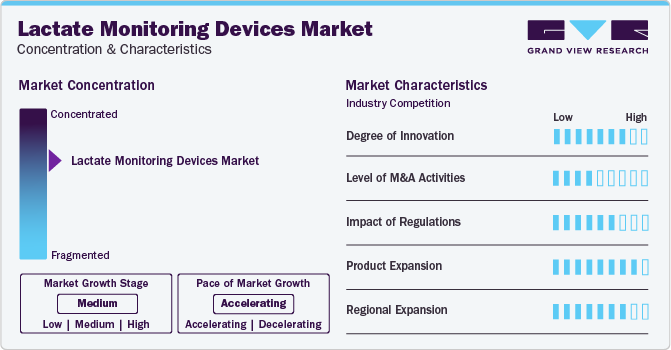

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The lactate monitoring devices industry is characterized by a high degree of innovation. In recent years, the market has witnessed a significant degree of innovation. This innovation is driven by advancements in technology, research, and the development of new products. Companies are constantly striving to introduce novel products and delivery methods to meet the evolving needs and preferences of consumers.

The most promising non-invasive technique for lactate monitoring is through the analysis of interstitial fluid using wearable biosensors. This approach employs various sensing technologies, including electrochemical, optical, electromagnetic, and semiconductor-based sensors. For instance, electrochemical sensors utilize enzymes or redox mediators to catalyze the oxidation of lactate ions and generate an electrical signal proportional to the lactate concentration.

The lactate monitoring devices industry is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Companies operating in the healthcare technology sector have been engaging in M&A activities to expand their product portfolios, enhance their technological capabilities, and gain a competitive edge in the market. several key players in the industry acquiring smaller firms specializing in lactate monitoring devices to strengthen their market position and drive growth. For instance, in September 2021, EKF Diagnostics Holdings plc. completed the acquisition of Advanced Diagnostic Laboratory LLC (ADL Health), a Texas-based PCR-focused testing laboratory.

Regulations play a crucial role in shaping the global market. The Food and Drug Administration (FDA) regulates lactate monitoring devices under the category of in vitro diagnostic devices. These regulations cover aspects such as analytical and clinical performance, labeling requirements, and quality system regulations. For instance, the FDA requires that lactate monitoring systems must be accurate, precise, and reliable with a measurement range that covers clinically relevant lactate concentrations.In sports science applications, there are no specific regulatory bodies overseeing the development and use of continuous lactate monitoring systems. However, organizations such as the International Olympic Committee (IOC) and the World Anti-Doping Agency (WADA) have guidelines regarding the use of such technologies in doping control programs.

Product expansion is a key strategy employed by companies operating in the market to cater to diverse consumer needs and preferences. Manufacturers have been focusing on expanding their product lines to cater to different user needs and preferences. This expansion includes the introduction of wearable lactate monitors, wireless connectivity features for real-time data tracking, improved accuracy through advanced sensor technologies, and enhanced software capabilities for data analysis and interpretation. The increasing demand for personalized health monitoring solutions has also driven the product expansion in lactate monitoring devices, with companies investing in research and development to bring innovative products to the market.

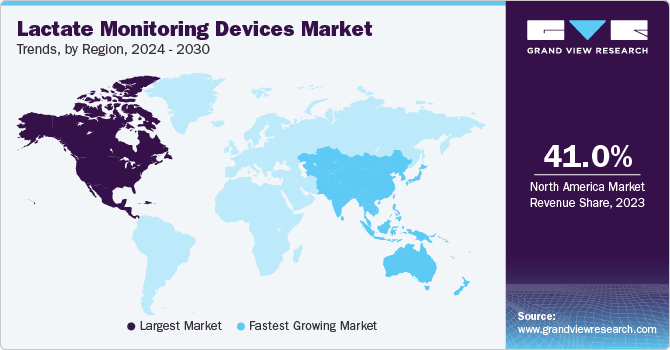

The global lactate monitoring devices market has been experiencing significant regional expansion due to various factors such as increasing urbanization, rising disposable income, changing lifestyles, and growing awareness about hygiene. In regions like North America and Europe, where there is a strong focus on healthcare innovation and sports science, the demand for lactate monitoring devices has been particularly high.

Additionally, emerging markets in Asia-Pacific and Latin America are also experiencing a surge in the adoption of these devices as healthcare infrastructure improves and awareness about the benefits of lactate monitoring grows. The increasing availability of advanced technologies and the rising prevalence of conditions such as sepsis, shock, and metabolic disorders further contribute to the expansion of the market for lactate monitoring devices on a global scale.

Product Insights

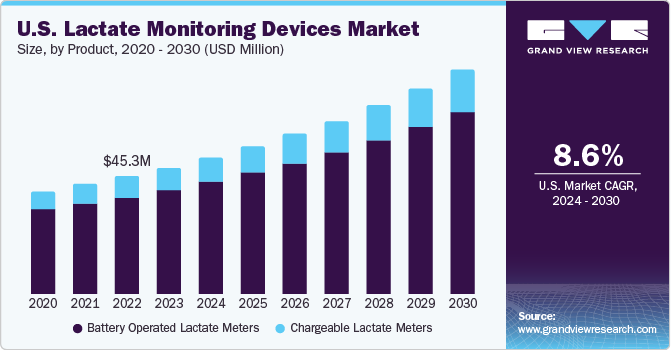

The battery-operated lactate meters segment accounted for the largest market share of 82.2% in 2023. The growth is attributed to its ease of portability and use in various settings, including sports fields, clinics, and hospitals. Battery-operated lactate meters do not require a direct power source and their portability enables healthcare professionals, coaches, and athletes to perform lactate testing on the go without being restricted by power outlets. Moreover, Battery-operated lactate meters often provide fast turnaround times for results, allowing for immediate decision-making in sports training or patient care scenarios.

The chargeable lactate meters segment is expected to grow at the fastest CAGR of 9.3% during the forecast period. The need for portable and efficient point-of-care testing systems that can provide quick and accurate lactate measurements directly at the patient’s bedside. These devices offer fast turnaround times, require minimal blood samples, and are user-friendly, making lactate testing practical and affordable in various healthcare settings such as emergency departments, intensive care units, and medical units.

Application Insights

The sports segment accounted for the largest market share of 58.9% in 2023. The growth is attributed to the need to optimize athletic performance and training regimens. These devices measure lactate levels in athletes, providing valuable insights into their metabolic state during exercise. Athletes from various disciplines such as distance running, swimming, and cycling all benefit from monitoring their lactate levels to optimize their training plans. Training plans typically include a combination of long runs at sustainable paces for building endurance and shorter, faster intervals for improving speed and stamina. Lactate monitoring devices help athletes track their progress by measuring changes in their lactate threshold over time.

The medical segment is expected to grow at the fastest CAGR of 9.5% during the forecast period owing to the predictive value in critical care settings, monitoring tissue perfusion and oxygen delivery, and optimization of recovery strategies. Lactate levels serve as valuable prognostic indicators in critical care settings, such as intensive care units (ICUs) and emergency departments. Moreover, Lactate monitoring devices are essential for evaluating tissue perfusion and oxygen delivery in various clinical scenarios, including trauma, cardiac arrest, and circulatory shock. In addition, real-time monitoring of lactate levels enables healthcare providers to tailor resuscitation strategies based on individual patient needs.

End-use Insights

The sports institutes segment accounted for the largest market share of 45.5% in 2023. The adoption rate of these devices is higher in sports institutes. The lactate threshold testing is essential for athletes to optimize their training and competition performance. Lactate threshold is the point at which an athlete’s body begins to produce lactic acid faster than it can be removed, leading to fatigue and decreased performance. By monitoring lactate levels during exercise, coaches and trainers can identify an athlete’s lactate threshold and adjust training programs accordingly.

The homecare segment is expected to grow at the fastest CAGR of 9.1% during the forecast period. The growth is attributed to the increasing prevalence of chronic diseases, such as diabetes and heart conditions, and the growing trend towards remote patient monitoring and self-management. These devices can be easily integrated into home healthcare systems, allowing patients to test their lactate levels regularly without having to visit hospitals or clinics frequently.Furthermore, many insurance companies are recognizing the benefits of home healthcare services and are offering reimbursement for related expenses, including lactate meters.

Regional Insights

North America dominated the market with a revenue share of 41.0% in 2023. Expansion of the lactate monitoring devices industry in this region is driven by rising prevalence of chronic diseases, quick acceptance of technological device improvements, and rising elderly population. For instance, the CDC reports that each year in the US, over 795,000 people experience a stroke, with ischemic stroke accounting for 87% of cases.

U.S. Lactate Monitoring Devices Market Trends

The U.S. lactate monitoring devices market held the largest share in 2023, in the North American region, owing to aging population of older individuals. According to a Population Reference Bureau article published in January 2024, the projected growth indicates that the number of Americans aged 65 and older is anticipated to rise from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Simultaneously, the share of the total population represented by the 65-and-older age group is expected to rise from 17% to 23%. Moreover, as per the American Heart Association, about 70% of individuals aged 70 and above are anticipated to experience cardiovascular disease (CVD), which is one of the key factors contributing to cognitive disabilities.

Europe Lactate Monitoring Devices Market Trends

The lactate monitoring devices market in Europe is expected to witness lucrative growth over the forecast period. The growth is driven by the increasing emphasis on personalized and preventive healthcare. The demand for continuous and non-invasive monitoring solutions has been rising due to the growing prevalence of chronic diseases and the need for real-time health data. Lactate monitoring devices offer a valuable tool in critical care settings, enabling healthcare professionals to track patients’ metabolic status, particularly in intensive care units where elevated lactate levels can indicate tissue hypoxia and sepsis.

UK lactate monitoring devices market held a significant share in Europe. The drivers for lactate monitoring devices stem from the increasing recognition of the importance of monitoring lactate levels in various health conditions, including ME/CFS and COVID-19. With post-exertional malaise (PEM) being a significant symptom in these conditions, there is a growing need for continuous and accurate monitoring of lactate levels to better understand and manage the impact of anaerobic respiration on individuals’ health. The development of advanced technologies such as continuous lactate monitoring systems based on percutaneous microneedle arrays offers a promising solution to enable real-time tracking of lactate concentrations in the body. These devices provide valuable insights into abnormal increases in anaerobic respiration, mitochondrial dysfunction, and impaired oxygen delivery to cells, which are key factors associated with ME/CFS and the COVID-19 pandemic.

The lactate monitoring devices market in Germany is a major contributor to the European market. The demand for continuous and non-invasive monitoring techniques, such as those for lactate levels, has been growing due to the need for real-time data to guide clinical decision-making and improve patient outcomes. Furthermore, the focus on optimizing healthcare delivery and resource utilization in Germany has led to a greater interest in innovative monitoring solutions like lactate sensors to enhance patient care while potentially reducing healthcare costs associated with traditional monitoring methods.

Asia Pacific Lactate Monitoring Devices Market Trends

Asia Pacific lactate monitoring devices market is expected to grow at the fastest CAGR of 9.4% during the forecast period. The increasing prevalence of conditions such as sepsis, shock, and other critical illnesses can lead to elevated lactate levels in the body. These conditions require close monitoring of lactate levels to assess tissue perfusion and guide treatment decisions. Additionally, the growing awareness among healthcare professionals about the importance of early detection and management of lactate abnormalities is fueling the demand for reliable and accurate lactate monitoring devices in Asia Pacific.

The lactate monitoring devices market in China held the largest revenue share and is expected to grow fastest. The increasing focus on healthcare and technological advancements in the country. With a growing awareness of the importance of early detection and monitoring of medical conditions, including those related to lactate levels, there is a rising demand for efficient and accurate diagnostic tools. Additionally, the emphasis on preventive healthcare and personalized medicine is driving the need for point-of-care devices that can provide real-time lactate measurements. Furthermore, as China aims to enhance its healthcare infrastructure and services, incorporating advanced monitoring technologies like lactate monitoring devices becomes essential to improve patient outcomes and overall healthcare quality in the country.

Australia lactate monitoring devices market is expected to show a lucrative growth owing to the growing emphasis on sports performance and fitness monitoring. Athletes and fitness enthusiasts are increasingly seeking ways to optimize their training regimens and improve their performance, leading to a rising demand for tools that can provide real-time data on lactate levels. Additionally, healthcare professionals in Australia are recognizing the importance of lactate monitoring in managing conditions such as sepsis, heart failure, and shock. The ability to quickly and accurately measure lactate levels can aid in early detection of complications and guide treatment decisions, driving the adoption of monitoring devices in clinical settings.

The lactate monitoring devices market in India is expected to show a lucrative growth. The rising prevalence of lifestyle diseases such as diabetes and obesity in the country. These conditions often lead to metabolic imbalances, including elevated lactate levels, making continuous monitoring crucial for effective management. Additionally, the growing interest in fitness and sports activities among the Indian population has created a demand for wearable technologies that can track performance metrics, including lactate levels, during exercise. The integration of lactate monitoring into wearable health devices aligns with the country’s shift towards personalized and proactive healthcare solutions, driving the adoption of such technologies in the Indian market.

Latin America Lactate Monitoring Devices Market

Latin America lactate monitoring devices market expansion is fueled by the presence of economic development and government initiatives for developing an inclusive infrastructure. Major players compete in offering innovative, user-friendly, and technologically advanced solutions. However, challenges such as affordability & uneven healthcare access in some regions may hinder widespread adoption. Growing life expectancy & awareness about home healthcare services, and rising demand for medical devices for long-term care are key factors expected to boost the market growth over the forecast period.

The lactate monitoring devices market in Brazil is expected to grow significantly owing to the growth of lactate monitoring devices has been steadily increasing in recent years. With advancements in veterinary medicine and a greater emphasis on critical care for people, the adoption of blood lactate monitoring as a diagnostic tool has become more widespread. Hospitals, clinics, and specialty practices across Brazil are incorporating handheld lactate readers into their standard protocols for managing critically ill patients. These devices, such as blood glucose meters, provide quick and accurate measurements of blood lactate levels, allowing veterinarians to assess perfusion status and oxygenation of cells in real-time. The availability of these point-of-care instruments has revolutionized the way healthcare professionals approach emergency cases, enabling them to make timely interventions based on lactate levels and improve patient outcomes.

MEA Lactate Monitoring Devices Market

MEA lactate monitoring devices market has witnessed significant advancements in recent years. Continuous Lactate Monitoring Systems based on Percutaneous Microneedle Arrays (MEA) have emerged as a promising technology for real-time and continuous monitoring of lactate levels. The development of non-invasive sensors for lactate monitoring, including those based on electrochemical, optical, electromagnetic, and semiconductor technologies, has expanded the options for continuous monitoring in critical care settings. The advancements in MEA-based lactate monitoring devices offer improved accuracy, sensitivity, and patient comfort, making them valuable tools in healthcare for managing conditions where lactate levels play a crucial role.

The lactate monitoring devices market in South Africa witnessed a significant increase in demand for lactate monitoring devices. the increasing recognition of the importance of lactate threshold testing in sports performance and athletic training. South Africa’s sports community has embraced lactate monitoring technology. In addition, universities and research institutions have also invested in lactate monitoring technology to advance scientific understanding of exercise physiology and athletic performance its ability to provide valuable insights into an athlete’s performance and training status. The adoption of lactate monitoring technology in South Africa is further supported by government initiatives aimed at promoting sports science research and development. For instance, the Department of Science and Innovation (DSI) has launched several funding programs to support research projects focused on improving athletic performance through advanced technologies like lactate monitoring.

Saudi Arabia lactate monitoring devices is growing at a rapid rate owing to the rising prevalence of chronic diseases such as diabetes and cardiovascular disorders, which necessitate regular monitoring of lactate levels to manage these conditions effectively. According to the International Diabetes Federation, 4,274.1 thousand people were diagnosed with diabetes in 2021, and 7,537.3 thousand people are expected to be diagnosed by 2045. Thus, the increasing prevalence of chronic diseases is propelling the market in Saudi Arabia. Additionally, the increasing awareness among healthcare professionals about the importance of early detection and intervention in critical illnesses has led to a greater adoption of lactate monitoring devices in clinical settings across the country.

Key Lactate Monitoring Devices Company Insights

The market is a dynamic and competitive industry with several key players vying for market share. The companies in this market are focusing on research and development, along with strategic partnerships and product launches. The commitment to advancing care through technological innovations has contributed to a substantial market share in the mobile cardiac telemetry systems market.

Key Lactate Monitoring Devices Companies:

The following are the leading companies in the lactate monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- PKvitality

- TECOM Analytical Systems

- EKF Diagnostics

- Nova Biomedical

- Sensa Core Medical

- ARKRAY, Inc.

- VivaCheck Biotech

Recent Developments

-

In January 2023, 908 Devices Inc. introduced MAVEN, a device designed for real-time monitoring and management of glucose and lactate levels in cell culture and fermentation processes.

-

In April 2023, the NCBI stated that PKvitality (France) is developing a technology where a sensor is embedded in the back of a watch to measure glucose and lactate every 5 minutes and is aiming to launch the product in 2024.

-

In January 2024, molab.me updated that IDRO’s is aimed to launch its product in April 2024 which appears highly achievable, especially considering the existing utilization of the lactate patch in scientific studies and product demonstrations, setting them apart from other companies.

-

In August 2023, the researchers of Birla Institute of Technology & Science of Hyderabad and Pilani introduced technology for detection and management of diabetes. A group of researchers has introduced a portable system utilizing 3D printing technology to analyze glucose and lactate levels present in sweat samples.

Lactate Monitoring Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 150.7 million |

|

Revenue forecast in 2030 |

USD 247.6 million |

|

Growth rate |

CAGR of 8.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

PKvitality; TECOM Analytical; EKF Diagnostics; Nova Biomedical; Sensa Core Medical; ARKRAY, Inc.; VivaCheck Biotech |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

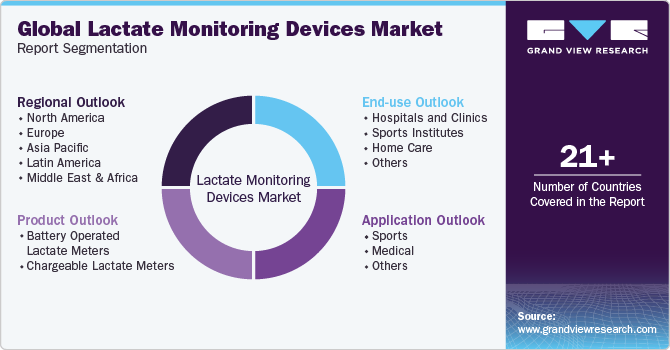

Global Lactate Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lactate monitoring devices market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chargeable Lactate Meters

-

Battery Operated Lactate Meters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports

-

Medical

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Sports Institutes

-

Home Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lactate monitoring devices market size was estimated at USD 139.7 million in 2023 and is expected to reach USD 150.7 million in 2024

b. The global lactate monitoring devices market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 247.6 by 2030.

b. North America dominated the market with a revenue share of 41.0% in 2023. Expansion of the lactate monitoring devices industry in this region is driven by rising prevalence of chronic diseases, quick acceptance of technological device improvements, and rising elderly population.

b. Some prominent players in the lactate monitoring devices market are PKvitality, TECOM Analytical, EKF Diagnostics, Nova Biomedical, Sensa Core Medical, ARKRAY, Inc., VivaCheck Biotech

b. The growth is attributed to the increasing awareness about the benefits of monitoring lactate in sports & healthcare, rise in the need of point-care tests, and growing adoption remote patient monitoring & telemedicine.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."