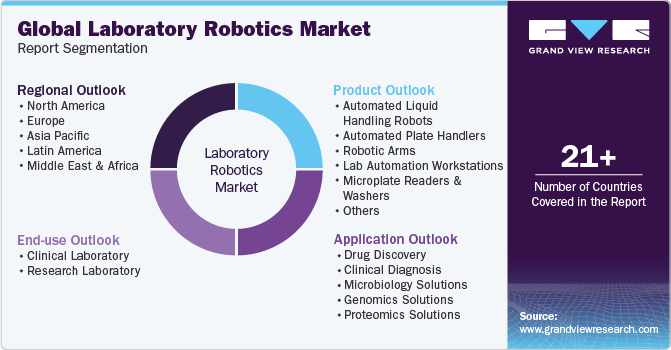

Laboratory Robotics Market Size, Share & Trends Analysis Report By Product (Automated Liquid Handling Robots, Automated Plate Handlers), By Application (Drug Discovery), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-314-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Laboratory Robotics Market Size & Trends

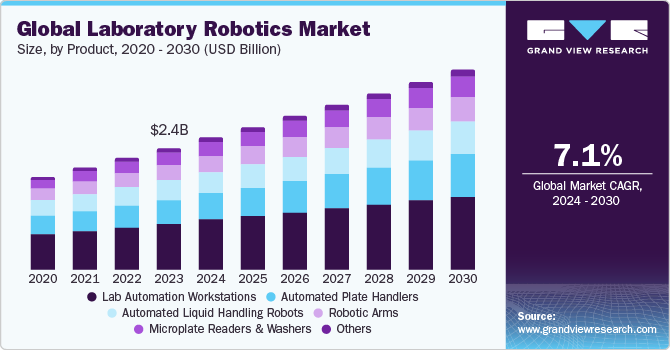

The global laboratory robotics market size was estimated at USD 2.35 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. The increasing demand for efficient & cost-effective laboratory operations, the need for automation in high-throughput testing, and the growing adoption of robotic systems in healthcare industry are some of the key drivers of the market.

In addition, advancements in technology, such as artificial intelligence and machine learning, are propelling the development of sophisticated robotic systems. For instance, in January 2023, Insilico Medicine, an AI-driven drug discovery company, unveiled its 6th generation Intelligent Robotics Lab, designed to further expedite AI-driven drug discovery processes. This fully automated, AI-powered robotics laboratory specializes in target discovery, compound screening, and translational research. These innovations facilitate more complex tasks and data analysis, further boosting market growth.

Moreover, the surge in research and development activities, especially within the life sciences sector, is significantly driving the demand for laboratory robotics. As R&D efforts intensify, there is a pressing need for enhanced efficiency, precision, and scalability in laboratory operations. For instance, in December 2023, ABB Robotics and XtalPi formed a partnership to develop a series of automated laboratory workstations. These new, automated laboratories aim to enhance the productivity of R&D processes in biopharmaceuticals, chemistry, and new energy materials. Laboratory robotics provide automated solutions for tasks such as sample handling, compound screening, and data analysis, thereby accelerating research processes and reducing human error. This demand is further amplified by the growing complexity of experiments and the need for high-throughput screening in drug discovery, genomics, and biotechnology, making laboratory robotics indispensable in modern research environments.

In addition, the necessity for cost-effective solutions in laboratories to optimize operational expenses and enhance productivity is driving the adoption of robotic systems. Laboratories are under increasing pressure to deliver accurate and timely results while managing budget constraints. Robotic systems offer a compelling solution by automating repetitive tasks, reducing labor costs, and minimizing errors. This automation improves throughput and allows skilled personnel to focus on more complex and value-added activities. Furthermore, the scalability and consistency provided by robotics enable laboratories to handle larger volumes of work efficiently, making them an attractive investment for cost-conscious research and clinical facilities.

Furthermore, the rising demand for automation in laboratory processes is a key driver of growth in the laboratory robotics market. Automation significantly enhances efficiency, accuracy, and reproducibility, which are crucial for modern laboratories. This is particularly important for high-throughput screening, where large volumes of samples need to be processed quickly and accurately. Automated systems streamline workflows, reduce human error, and ensure consistent results, meeting the increasing demand for precision and speed in research and clinical applications. As a result, laboratories are increasingly adopting robotic solutions to stay competitive and maintain high standards of quality.

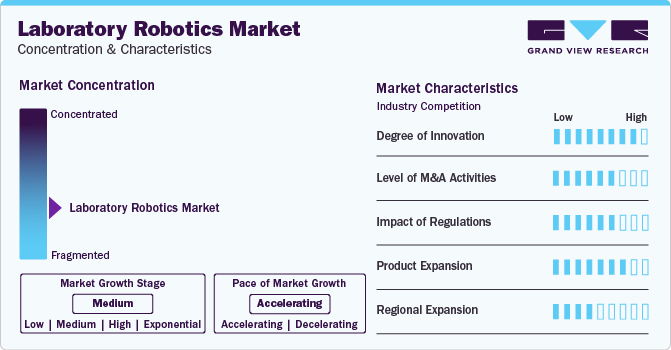

Market Concentration & Characteristics

The degree of innovation in the laboratory robotics market is high, driven by advancements in AI, machine learning, and precision automation. Companies are continuously developing sophisticated robotic systems that enhance efficiency, accuracy, and reproducibility in laboratory processes. Innovations such as AI-powered robotics, advanced sensors, and integrated software solutions are transforming workflows and enabling new capabilities in research and diagnostics.

Regulation significantly impacts the laboratory robotics market by ensuring safety, efficacy, and standardization. Compliance with stringent regulations, such as those from the FDA and EMA, ensures that robotic systems meet high-quality standards, particularly in pharmaceutical and clinical settings. Regulatory guidelines also drive innovation, prompting manufacturers to develop advanced, reliable, and compliant technologies. However, navigating complex regulatory landscapes can increase development costs and timeframes.

The laboratory robotics market is witnessing a notable level of merger and acquisition (M&A) activities as companies seek to expand their product portfolios, enhance technological capabilities, and gain market share. In December 2023, Hudson and Art Robbins, a manufacturer of laboratory automation solutions acquired Tomtec, a company specializing in automated liquid handling instruments. This acquisition enables firms to access new markets, augment their R&D capabilities, and strengthen their competitive positions in the rapidly evolving landscape of laboratory automation and robotics.

Product expansion in the laboratory robotics market is driven by the introduction of advanced robotic systems catering to diverse applications such as high-throughput screening, sample preparation, and assay development. For instance, in May 2023, Opentrons unveiled its Opentrons Flex robot, representing a new era of accessible liquid-handling lab robots. Engineered to be both cost-effective and easy to program, this innovative technology aims to democratize advanced lab automation, making it accessible to laboratories of all sizes and empowering a broader community of researchers with sophisticated automation capabilities. Companies are innovating to offer modular, customizable solutions that meet the evolving needs of laboratories.

Global expansion in the laboratory robotics market is fueled by increasing adoption across diverse industries and regions. Companies are expanding their presence through strategic partnerships, collaborations, and distribution agreements to penetrate new markets and capitalize on emerging opportunities in pharmaceuticals, biotechnology, academia, and healthcare sectors worldwide.

Product Insights

The lab automation workstations segment held the largest share of 37.8% in 2023. Increasing demand for streamlined laboratory processes, driven by the need for higher throughput and efficiency, is a primary growth driver. Moreover, advancements in robotics technology, such as improved precision and flexibility, are expanding the capabilities of automated workstations, further fueling market growth. Additionally, the rising adoption of lab automation solutions is contributing to the expanding market size. Furthermore, increasing strategic initiatives adopted by market players are driving market growth.In 2022, XtalPi, an AI technology company, acquired more than 100 GoFa cobots to establish automated laboratory workstations at its testing center in China.

The automated plate handlers segment is projected to grow fastest in the coming years largely attributed to advancements in technology. These advancements have led to the development of highly efficient and versatile plate handling systems capable of handling various types of plates with precision and speed. For instance, in February 2023, Automata introduced the LINQ platform, designed to completely automate workflows including automated plate handlers and the movement of labware across all laboratory environments. The integration of advanced features such as robotic arms, vision systems, and sophisticated software has significantly improved the throughput and accuracy of plate handling operations. As laboratories increasingly seek to automate and streamline their processes, the demand for automated plate handlers continues to rise, further driving market growth.

Application Insights

The drug discovery segment held the largest share of 28.8% in 2023, due to several key factors. There's an increasing demand for innovative drugs to address various diseases, driving extensive research and development efforts in pharmaceutical & biotechnology companies. For instance, in August 2021, Exscientia established a new 26,000 square foot robotic laboratory at Milton Park, Oxfordshire. The laboratory is focused on automating chemistry and biology processes to speed up drug discovery. This achievement has allowed the company to accomplish its goal of developing drugs using AI and manufacture them using robots. In addition, advancements in technology, such as artificial intelligence and machine learning, are revolutionizing drug discovery by enabling predictive modeling and virtual screening, further boosting the adoption of laboratory robotics.

The clinical diagnosis segment shows significant growth during the forecast period. With an increasing emphasis on precision medicine and personalized healthcare, there's a growing demand for accurate and efficient diagnostic solutions. Laboratory robotics play a crucial role in automating various diagnostic processes, including sample handling, testing, and analysis, leading to faster turnaround times and improved accuracy.Furthermore, the rising prevalence of chronic diseases and the growing aging population are escalating the need for robust diagnostic capabilities. Chronic diseases such as diabetes, cancer, and cardiovascular conditions require ongoing monitoring and frequent diagnostic testing, thereby fostering market growth.

End-use Insights

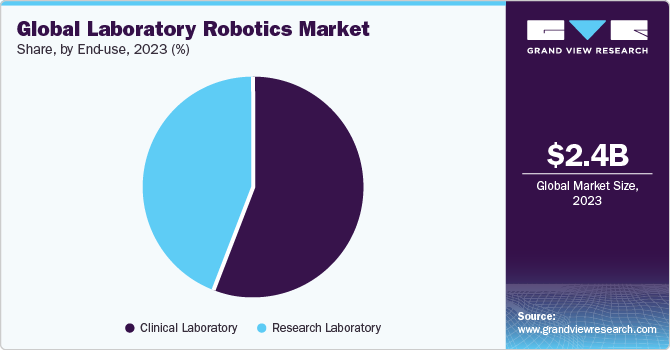

The clinical laboratory segment accounted for the largest market share of 55.9% in 2023, driven by advancements in clinical research and strong government support. Increased funding for healthcare infrastructure and research initiatives is propelling the adoption of laboratory robotic systems. These systems automate repetitive tasks, enhance precision, and improve workflow efficiency in clinical laboratories. For instance, in June 2023, United Robotics Group collaborated with Siemens and HUS Diagnostic Center. As part of this partnership, United Robotics Group is contributing to efforts to tackle the current crisis such as lab staff shortage, by unveiling umobileLAB. Developed in partnership with Siemens and HUS Diagnostic Center, uMobileLAB is designed to perform laboratory tasks. In addition, the rising prevalence of chronic diseases and the demand for large-scale diagnostic testing underscore the need for advanced automation. This combination of clinical research advancements and government backing is accelerating the growth of laboratory robotics in clinical settings.

The research laboratory segment is expected to grow fastest during the forecast period,driven by increased investments and technological advancements. Research laboratories are investing heavily in automation to enhance productivity, accuracy, and throughput of experimental processes. The adoption of laboratory robotics streamlines complex workflows, reduces human error, and accelerates data collection and analysis. For instance, in March 2024, Abbott launched, its innovative GLP Systems Track automation solutions, designed to support laboratories' high-volume needs. This new offering aims to provide greater flexibility, enabling laboratories to optimize performance and efficiency to meet the increasing demand. Furthermore, the rising demand for high-throughput screening and reproducibility in experiments is pushing laboratories to incorporate advanced robotic systems. These factors enhance the capabilities of research laboratories, driving innovation and enabling researchers to address complex scientific challenges with increased efficiency and effectiveness.

Regional Insights

North America laboratory robotics market dominated the overall global market and accounted for the 40.6% revenue share in 2023, driven by technological advancements and increasing demand for automation in laboratories. Strategic partnerships between key players are further fueling this expansion. Collaborations such as those between technology developers and research institutions enhance innovation, streamline workflows, and improve efficiency in laboratory processes.

U.S. Laboratory Robotics Market Trends

The U.S. laboratory robotics market held a significant share of North America market in 2023, driven by shortage of lab staffs. Additionally, enhanced automation technologies are boosting efficiency and accuracy in laboratory processes. For instance,in May 2024 , medical robotics company Clarapath announced a strategic collaboration with the Mayo Clinic. Addressing labor shortages, quality control issues, and rising sample volumes, SectionStar automates tissue sectioning, transfer, and quality control, using robotics and AI for standardized slide outputs and quantitative quality metrics. Increased funding in research and development further accelerates innovation, positioning the U.S. as a leader in laboratory robotics and automation solutions.

Europe Laboratory Robotics Market Trends

The Europe laboratory robotics market is experiencing significant growth, supported by increased investment and funding. Companies are receiving substantial financial backing to develop and commercialize innovative robotic solutions for laboratory automation. For instance, in January 2023, Bionomous completed its Series A funding round for EggSorter Life Science Automation, securing USD 2.7 million. The startup, headquartered in Villaz-St-Pierre, Switzerland, intends to initiate the commercialization of its EggSorter device and expand its deployment on a global scale. This funding is driving advancements in technology, enhancing efficiency, and expanding the capabilities of laboratory robotics across various sectors.

The UK laboratory robotics market is one of the major markets in the region, driven by increasing demand for automation in the life sciences sector. The need for enhanced efficiency and precision in research and diagnostics is propelling the adoption of robotic systems. Advancements in robotics technology are further supporting this growth, enabling laboratories to streamline processes and improve productivity across various life science applications.

The Germany laboratory robotics market is witnessing notable growth, propelled by advancements in technology and the presence of key market players. Innovations in robotics technology are driving efficiency and productivity in laboratory processes, particularly in pharmaceuticals and biotechnology. Major players in themarket are investing in research and development to further enhance the capabilities of laboratory robotics and meet evolving industry demands.

Asia Pacific Laboratory Robotics Market Trends

The Asia Pacific laboratory robotics market is experiencing substantial growth, fueled by increased funding and investment in innovative technologies. Key players in the region are receiving significant financial backing to develop advanced robotic solutions for laboratory automation. This investment is driving the adoption of cutting-edge robotics technology, enhancing efficiency, and expanding the market presence of laboratory robotics in various industries.

The China laboratory robotics market is driven by the increased presence and expansion of key players in the region. For instance,in December 2022, ABB inaugurated its cutting-edge robotics factory in Shanghai, China. Spanning 67,000m2, this fully automated and adaptable facility represents a USD 150 million investment by ABB. Utilizing the company's digital and automation technologies, the factory produces next-generation robots, reinforcing ABB's position as a leader in robotics and automation within China. Technological advancements in robotics are further accelerating market growth, enabling more efficient and precise laboratory automation solutions. With significant investments in research and development, China is emerging as a key hub for innovation in laboratory robotics, catering to the growing demand across various industries.

The Japan laboratory robotics market is thriving, with partnerships between industry leaders and research centers driving innovation. For instance, in April 2024, the University of Rostock and Yaskawa have agreed to extend their collaboration for the advancement of robot-based solutions in laboratory automation. Collaborations aim to develop advanced robotic solutions tailored to the needs of laboratories in pharmaceuticals, biotechnology, and academia. These partnerships bolster Japan's position as a key player in the global laboratory robotics market.

Latin America Laboratory Robotics Market Trends

The Latin America laboratory robotics market is experiencing notable growth, driven by the expansion efforts of key players in the region. With increased investments and technological advancements, Latin America is witnessing a surge in the adoption of laboratory robotics. This expansion is positioning Latin America as an emerging market for innovative laboratory automation solutions.

The Brazil laboratory robotics market is experiencing significant growth propelled by technological innovations. With increasing research in robotics, Brazil is witnessing the emergence of cutting-edge robotic solutions tailored for laboratory automation. These advancements are revolutionizing laboratory processes, enhancing efficiency, accuracy, and throughput, and positioning Brazil as a key player in the global laboratory robotics market.

Middle East & Africa Laboratory Robotics Market Trends

The laboratory robotics market in MEA is experiencing growth. The rising number of laboratories in this region is driving demand for automated solutions to enhance efficiency and accuracy in various scientific processes, positioning the region as an emerging market for laboratory robotics.

The Saudi Arabia laboratory robotics market is anticipated to expand in the forecast period, supported by favorable government initiatives. With initiatives aimed at advancing technology and innovation, the Saudi Arabian government is fostering the growth of the laboratory robotics sector. This support is driving investments, research, and development, positioning Saudi Arabia as a key player in the global laboratory robotics market.

Key Laboratory Robotics Company Insights

The competitive scenario in the laboratory robotics market is highly competitive, with key players such as Peak Analysis & Automation; PerkinElmer Inc.; Thermo Fisher Scientific Inc.; Hudson Robotics; Anton Paar GmbH; Beckman Coulter, Inc.; Siemens Healthcare Private Limited; AB Controls, Inc.; Abbott; Biomérieux holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Laboratory Robotics Companies:

The following are the leading companies in the laboratory robotics market. These companies collectively hold the largest market share and dictate industry trends.

- Peak Analysis & Automation

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Hudson Robotics

- Anton Paar GmbH

- Beckman Coulter, Inc.

- Siemens Healthcare Private Limited

- AB Controls, Inc.

- Abbott

- Biomérieux

Recent Developments

-

In April 2024, Multiply Labs, a robotics company specializing in automated manufacturing systems for individualized drugs, announced an upcoming collaboration with Stanford Medicine’s Laboratory for Cell & Gene Medicine (LCGM). This partnership aims to showcase the potential of automation technology in the manufacturing of cell therapies.

-

In March 2024, INDUS Holding AG acquired Berlin-based Gestalt Robotics, a company specializing in custom AI-based automation solutions for industrial applications. Gestalt Robotics' portfolio includes advanced image processing and control technology driven by artificial intelligence.

-

In January 2024, Bruker Corporation acquired Chemspeed Technologies, a company specializing in vendor-agnostic automated laboratory R&D. Chemspeed focuses on modular automation and robotics solutions for pharmaceutical drug formulation. Strategic acquisitions enable firms to access new markets, augment their R&D capabilities, and strengthen their competitive positions in the rapidly evolving landscape of laboratory automation and robotics.

Laboratory Robotics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.55 billion |

|

Revenue forecast in 2030 |

USD 3.86 billion |

|

Growth rate |

CAGR of 7.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Peak Analysis & Automation; PerkinElmer Inc.; Thermo Fisher Scientific Inc.; Hudson Robotics; Anton Paar GmbH; Beckman Coulter, Inc.; Siemens Healthcare Private Limited; AB Controls, Inc.; Abbott; Biomérieux |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laboratory Robotics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global laboratory robotics market report on the basis of product, application, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Liquid Handling Robots

-

Automated Plate Handlers

-

Robotic Arms

-

Lab Automation Workstations

-

Microplate Readers and Washers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery

-

Clinical Diagnosis

-

Microbiology Solutions

-

Genomics Solutions

-

Proteomics Solutions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Laboratory

-

Research Laboratory

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory robotics market size was estimated at USD 2.35 billion in 2023 and is expected to reach USD 2.55 billion in 2024.

b. The global laboratory robotics market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 3.86 billion by 2030.

b. The drug discovery segment held the largest share of 28.8% in 2023, due to several key factors. There's an increasing demand for innovative drugs to address various diseases, driving extensive research and development efforts in pharmaceutical and biotechnology companies.

b. Some key players operating in the market include Key companies profiled Peak Analysis & Automation; PerkinElmer Inc. ; Thermo Fisher Scientific Inc. ; Hudson Robotics; Anton Paar GmbH; Beckman Coulter, Inc.; Siemens Healthcare Private Limited ; AB Controls, Inc.; Abbott; Biomérieux

b. The increasing demand for efficient and cost-effective laboratory operations, the need for automation in high-throughput testing, and the growing adoption of robotic systems in healthcare industry are some of the key drivers of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."