Laboratory Proficiency Testing Market Size, Share & Trends Analysis Report By Industry (Clinical Diagnostics, Pharmaceuticals, Microbiology, Cannabis), By Technology (Cell Culture, PCR, Immunoassays), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-287-3

- Number of Report Pages: 195

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Laboratory Proficiency Testing Market Trends

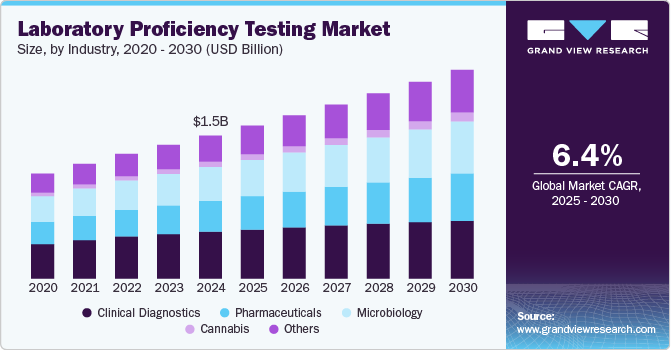

The global laboratory proficiency testing market size was estimated at USD 1.46 billion in 2024 and is expected to grow at a CAGR of 6.43% from 2025 to 2030, driven by multiple factors shaping various sectors such as water testing, cannabis testing, and food safety. One of the key growth drivers is the increasing focus on water testing to identify micropollutants, contaminants, and microorganisms in freshwater and wastewater. Common microbial contaminants include Legionella, Legionella pneumophila, Salmonella, enterococci, E. coli, Pseudomonas aeruginosa, coliforms, and staphylococci. Proficiency testing is critical in water microbiology as it ensures laboratories can reliably detect and quantify such contaminants. Through blind sample distribution, proficiency testing programs evaluate a laboratory’s capability to perform accurate and consistent water quality analysis, thus safeguarding public health.

In addition to microbial testing, laboratory proficiency testing also plays an essential role in measuring endotoxin and pyrogen levels in water, particularly for pharmaceutical manufacturing, medical device production, and dialysis. These toxic substances, originating from bacteria, can have severe health implications. Laboratories must demonstrate their competence in using advanced methods such as Limulus Amebocyte Lysate (LAL) assays to ensure precision in endotoxin detection. Reliable results from such testing are vital for meeting regulatory standards and ensuring water safety.

Further expanding the market, proficiency testing is used in environmental science to determine groundwater age using tritium, helping map aquifer reserves and assess vulnerability to surface contamination. According to the International Atomic Energy Agency (IAEA), only about half of the 78 laboratories conducting tritium testing currently meet the necessary analytical standards. Initiatives like the IAEA’s 2020 training program aim to improve global testing capabilities. Moreover, new product launches continue to create market opportunities. For instance, in March 2022, BIPEA introduced a new Proficiency Testing Scheme (PT 35d) for microbiological water testing, enabling labs to measure yeast and mold levels in freshwater.

The legalization and increasing acceptance of medical cannabis in many countries, including the U.S., has significantly amplified the demand for laboratory proficiency testing. This testing is essential to ensure the safety, potency, and regulatory compliance of cannabis products. With the expansion of the cannabis industry, laboratories must demonstrate accurate performance in areas such as potency determination, pesticide residue analysis, microbial contamination, and heavy metal detection.

Cannabis testing labs employ advanced technologies like mass spectrometry, gas chromatography, and High-Pressure Liquid Chromatography (HPLC), as well as molecular tools like nucleic acid sequencing and Quantitative Polymerase Chain Reaction (qPCR) to assay for biological and chemical contaminants. The rising demand for high-potency cannabis, coupled with regulatory mandates, has led to the proliferation of dedicated cannabis testing laboratories. Proficiency testing enables these labs to validate their methodologies and maintain high standards, contributing to consumer safety and overall industry credibility.

Another critical growth factor is the increasing global incidence of foodborne illnesses, which is creating a heightened demand for laboratory testing and validation. According to the World Health Organization (WHO), foodborne illnesses affect approximately 600 million people annually, leading to around 420,000 deaths. Children under five years old account for 40% of this burden, experiencing approximately 125,000 deaths each year. These diseases are caused by a wide range of contaminants, including bacteria like Vibrio cholerae, Listeria, E. coli, and Salmonella; viruses; parasites such as Cryptosporidium and Entamoeba histolytica; and chemical agents like heavy metals and toxins.

In 2024, the U.S. had a sharp spike in foodborne illness outbreaks, with nearly 1,400 reported cases-98% of which were linked to just 13 significant outbreaks involving Listeria, Salmonella, and E. coli. Notably, a Listeria outbreak from frozen supplemental shakes led to 12 deaths across 21 states. These alarming figures have intensified regulatory scrutiny and underscored the necessity for enhanced food testing and quick recall capabilities.

Food production intensification, climate change, and international trade are accelerating the spread of foodborne pathogens while evolving consumer preferences for fresh, minimally processed foods increase exposure risks. In this context, laboratory proficiency testing is vital to validate testing protocols and uphold food safety standards. Moreover, technological innovations such as AI and blockchain are improving traceability and response times, further driving the need for rigorous laboratory validation.

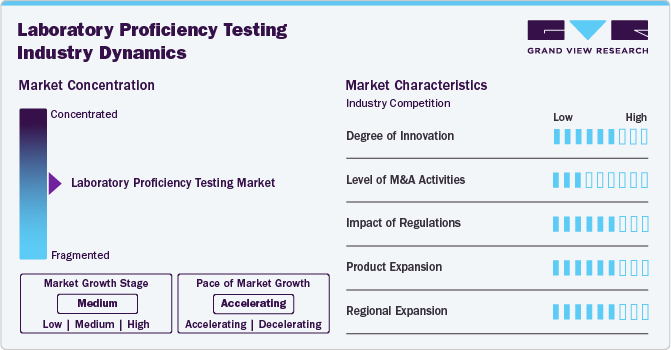

Market Concentration & Characteristics

The market is evolving with technological advancements like AI-driven analytics, molecular diagnostics, and high-throughput testing platforms. Innovative proficiency testing schemes tailored for emerging fields such as cannabis, genomics, and environmental monitoring are transforming quality assurance. These innovations enable more accurate, efficient, and scalable PT services, enhancing laboratory capabilities and ensuring compliance with global standards.

Mergers and acquisitions in the market are moderately active, driven by the need for technological capabilities, geographic diversification, and broader test portfolios. Key players are acquiring smaller PT providers to enhance offerings and consolidate market share. These strategic deals allow access to new customer bases, advanced methodologies, and expansion into niche testing areas, thereby fueling overall market growth.

Strict regulatory frameworks significantly influence the market. Accreditation bodies like ISO, CLIA, and CAP require routine proficiency testing for compliance. Regulatory mandates ensure laboratories meet minimum quality standards, promoting PT as a necessary service. With a global emphasis on data integrity, public health, and patient safety, regulatory compliance is a major growth driver for LPT providers across all industries.

The introduction of new and specialized PT schemes for clinical diagnostics, cannabis, food safety, and water quality drives market growth. Custom programs tailored to unique industry needs, such as microbiological testing or advanced chemical assays, enable laboratories to demonstrate competence in niche areas. Continuous product expansion ensures relevance, competitive advantage, and the ability to meet evolving customer and regulatory demands.

Growing demand for laboratory accreditation in emerging economies like Asia-Pacific, Latin America, and Africa is driving regional expansion. International proficiency providers are establishing local partnerships, regional labs, and training centers to meet compliance standards and support public health initiatives. Regional diversification not only broadens customer reach but also helps standardize testing practices globally, promoting market sustainability and long-term growth.

Industry Insights

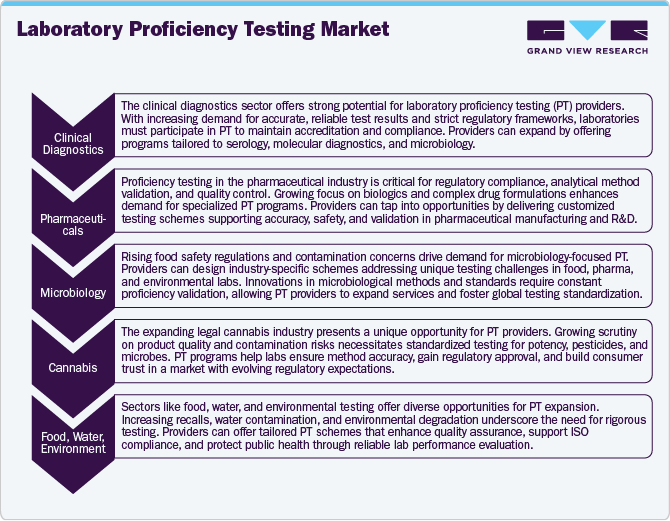

The clinical diagnostics segment accounted for the largest market share of 32.73% in 2024, driven by the widespread adoption of proficiency testing (PT) to minimize errors and ensure the accuracy and quality of diagnostic results. PT is critical in clinical diagnostics, often serving as a mandatory requirement for CLIA certification-an essential regulatory approval for legal laboratory operations. Acknowledging the importance of PT, the Centers for Medicare and Medicaid Services (CMS) proposed updates to PT requirements under CLIA regulations in July 2022. Clinical diagnostic laboratories have shown a lower incidence of diagnostic errors compared to hospitals, largely due to the routine implementation of PT as part of robust quality management systems. With the increasing complexity of diagnostic procedures and the rising demand for early and accurate disease detection, PT has become vital for maintaining high standards and ensuring reliable outcomes across clinical diagnostics.

The cannabis segment is projected to register the fastest CAGR during the forecast period, fueled by the rapid expansion of the cannabis industry, growing approvals of cannabis-derived products, and the rising number of laboratories offering cannabis-specific proficiency testing (PT). Several strategic initiatives and collaborations are driving quality control and standardization in this space. For example, in May 2022, AOAC INTERNATIONAL partnered with Signature Science to develop PT materials specifically for cannabis testing. Additionally, in April 2023, the Trust in Testing initiative launched national cannabis testing standards aimed at improving consistency, reliability, and trust in laboratory results. Beyond fulfilling regulatory requirements, PT programs play a pivotal role in creating uniform testing protocols and harmonizing laboratory practices across the cannabis sector. This standardization ensures data consistency and helps guarantee that cannabis products meet stringent safety and quality benchmarks, whether for medical, recreational, or industrial use. Participation in PT programs enables cannabis testing laboratories to validate their analytical capabilities, enhance operational accuracy, and reinforce credibility-ultimately supporting the sector’s growth and regulatory alignment.

Technology Insights

The cell culture segment led the market with a 26.82% revenue share in 2024. Its substantial market presence is largely due to the widespread application of cell culture techniques for detecting infectious microorganisms. The increased uptake of cell culture-based products has driven the adoption of these technologies, maximizing microbial strain culture yields. Such tests are crucial for preserving the accuracy and integrity of laboratory processes, ensuring both safety and efficacy for cell culture-derived products, and complying with regulatory standards in the pharmaceutical and healthcare sectors. Additionally, the growing use of cell culture-based therapeutics, including monoclonal antibodies, has further bolstered the demand for cell culture testing, which is essential for optimizing microbial strain cultures, ensuring product consistency, and maintaining quality control during biopharmaceutical production.

The chromatography segment is projected to experience the fastest growth rate over the forecast period. Reliability & safety for quality control in pharmaceutical & biotechnology are increasing the segment demand, motivating key market players to adopt chromatography technology to offer laboratory proficiency testing services. For instance, the PHARMASSURE scheme provided by LGC offers High-Performance Liquid Chromatography (HPLC) proficiency testing tailored to meet the specialized demands of the pharmaceutical industry.

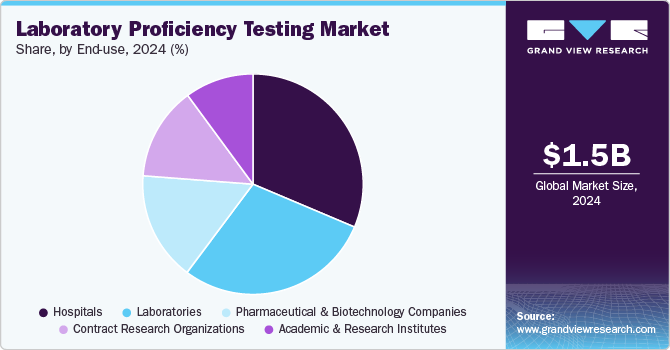

End-use Insights

The hospital segment dominated the market with a revenue share of 31.36% in 2024, owing to the increasing need for regular competence evaluation in hospitals. Hospital laboratories are required to deliver accurate results, making regular competence evaluation crucial. Moreover, the increasing number of tests offered by hospitals is further expected to drive the demand for PT. Moreover, developed countries commonly practice proficiency testing programs, with hospitals offering convenient insurance coverage, making them the preferred choice for patients. Moreover, regular participation in proficiency testing enables laboratories to validate evaluating methodologies, identify areas for improvement, and uphold the highest standards of accuracy in diagnostic procedures.

The contract research organizations segment is expected to grow at the fastest rate over the forecast period. This rapid expansion is driven by the increasing adoption of outsourced services in healthcare, a growing focus on R&D, and strict regulatory guidelines governing clinical trials. Emerging economies like India and China have become key hubs for CRO activities, further propelling the demand for proficiency testing. With intensifying emphasis on research and stringent FDA mandates for clinical trials, laboratory proficiency testing within CROs is gaining importance. By incorporating proficiency testing programs, CROs can ensure accurate and reliable laboratory analyses, meet regulatory standards, standardize processes, improve data quality, and enhance their reputation as research partners. This, in turn, supports advancements in research and delivers more trustworthy clinical trial outcomes.

Regional Insights

North America laboratory proficiency market dominated the global market, with a share of 44.39% in 2024. The region’s dominance can be attributed to the existence of established pharmaceutical & diagnostics industries, stringent regulatory framework related to laboratory accreditation, and the growing adoption of laboratory competence evaluation. Moreover, the presence of leading market players such as the American Proficiency Institute, College of American Pathologists, and Bio-Rad Laboratories, Inc., and well-established healthcare infrastructure are key drivers for the market in the region.

U.S. Laboratory Proficiency Testing Market Trends

The laboratory proficiency testing market in the U.S. is driven by a vast network of accredited laboratories that must comply with strict proficiency testing requirements to sustain their accreditation. In North America, the U.S. dominates the market due to over 200,000 laboratories operating nationwide. Notably, while hospital-based laboratories represent just 5% of this total, they account for approximately 55% of all tests performed. Compliance with Clinical Laboratory Improvement Amendments (CLIA) guidelines, which mandate certification based on testing complexity, further intensifies the demand for proficiency testing.

Europe Laboratory Proficiency Testing Market Trends

The laboratory proficiency testing market in Europe is expanding due to the growing number of applications and the launch of new programs. The region holds the second-largest market share by revenue, following North America, and is projected to experience a strong CAGR in the coming years. Increased research funding and the presence of key market players are significant drivers of this growth. Additionally, organizations like Eurachem are actively promoting quality practices across Europe.

The UK laboratory proficiency testing market is being propelled by the nation's significant role in the European market, underpinned by robust research and development advancements. The rising emphasis on R&D, particularly within the biopharmaceutical and pharmaceutical sectors, is intensifying the demand for proficiency testing services. Strategic partnerships between pharmaceutical companies and industry players are further elevating quality assurance and laboratory proficiency. A notable instance occurred in September 2020 when Diaceutics PLC announced three new collaborations on its DXRX platform. The company partnered with external quality assessment organizations, including the Canadian Pathology Quality Assurance - Assurance Qualité Canadienne en Pathologie (CPQA-AQCP), the European Molecular Genetics Quality Network (EMQN CIC), and the Nordic Immunohistochemical Quality Control (NordiQC), to establish global best practices in diagnostic testing and ensure high in-lab quality assurance standards.

The laboratory proficiency testing market in Germany is fueled by one of Europe’s most robust healthcare systems and advanced infrastructure. The widespread use of automated laboratory equipment necessitates meticulous maintenance and standardization to achieve accurate results, thereby increasing demand for proficiency testing services. Organizations like Kunststoff-Institut für die mittelständische Wirtschaft NRW GmbH and IfEP GmbH has bolstered this market by offering specialized testing solutions, including proficiency programs for computerized tomography focused on coordination determination. Additionally, the growing emphasis on food and water quality and sterility-exacerbated by the SARS-CoV-2 pandemic-has spurred laboratory expansion. With over 100 pharmaceutical companies in Germany required to perform routine testing of raw materials and finished products to meet FDA standards, proficiency testing remains an essential element of quality assurance in the country.

Asia Pacific Laboratory Proficiency Testing Market Trends

The laboratory proficiency testing market in the Asia Pacific is experiencing significant growth, driven by the expansion of the pharmaceutical and biopharmaceutical industries, increased funding, and improved laboratory infrastructure. The region is attracting major investments from global pharmaceutical companies, further fueling demand for standardized testing. In March 2024, Novo Nordisk announced a USD 556 million investment to expand its manufacturing capacity in China. These developments emphasize the growing importance of quality control and regulatory compliance, increasing the need for proficiency testing in laboratories.

Japan laboratory proficiency testing market is experiencing significant growth. As one of the largest such markets in the Asia-Pacific region, Japan is propelled by its rapidly aging population, escalating healthcare demands, and ongoing advancements in diagnostic technologies. With an increase in age-related diseases, there is a heightened need for accurate and high-quality diagnostic services. This drive for precise and efficient laboratory testing is boosting the demand for proficiency testing and accreditation programs across a range of sectors, including clinical diagnostics, pharmaceuticals, food, and cosmetics.

The laboratory proficiency testing market in China is witnessing substantial growth, driven by increasing healthcare expenditure, rising prevalence of chronic diseases, and rapid expansion of the biopharmaceutical sector. According to a study by the UK’s NHS, China's healthcare expenditure is projected to reach USD 25.2 billion by 2027, reflecting the country’s commitment to enhancing its medical and diagnostic infrastructure. With the largest population in the world, China is experiencing a surge in chronic diseases such as Alzheimer’s disease, COPD, breast cancer, and prostate cancer, leading to an increasing demand for advanced, high-precision diagnostic laboratories. The need for accredited and reliable laboratories is growing as healthcare providers strive for accurate disease management and early detection.

Latin America Laboratory Proficiency Testing Market Trends

The laboratory proficiency testing market in Latin America is witnessing significant growth, largely driven by increasing government support for quality assurance in laboratory testing. Governments across the region are investing in proficiency testing programs to enhance the accuracy and reliability of diagnostic results, ensuring compliance with international standards. For instance, in 2023, Colombia developed and implemented a national proficiency test (PT) for SARS-CoV-2 detection using PCR. This initiative involved distributing test samples to 121 laboratories and assessing their ability to detect both low and high levels of viral RNA. The results demonstrated a high level of proficiency, with 98.3% of laboratories achieving satisfactory performance.

The Brazil laboratory proficiency testing market is expanding, driven by initiatives from organizations focused on improving laboratory accuracy and the rapid growth of the pharmaceutical sector. Programs led by international and national organizations are enhancing testing standards, ensuring laboratories meet global quality benchmarks. One key player in this space is the International Atomic Energy Agency (IAEA), which conducts laboratory proficiency testing and interlaboratory comparisons (ILCs). These programs help assess and improve the quality of analytical results from laboratories worldwide, including those in Brazil. By participating in such initiatives, Brazilian laboratories enhance their credibility and ensure the reliability of their testing processes.

Middle East and Africa Laboratory Proficiency Testing Market Trends

The laboratory proficiency testing market in the Middle East and Africa (MEA) is witnessing rapid expansion, fueled by economic growth and increasing healthcare investments. The growing need for accurate and reliable diagnostic testing is driving the adoption of proficiency testing services, ensuring laboratories adhere to global quality and regulatory standards. A key factor propelling market growth is the rising emphasis on regulatory compliance and laboratory accreditation. The accreditation of Algeria’s National Institute of Criminalistics and Criminology of the Gendarmerie Nationale (NICC/GN) by the Organisation for the Prohibition of Chemical Weapons (OPCW) in July 2024 underscores the region’s commitment to upholding international quality benchmarks.

The Saudi Arabia laboratory proficiency testing market is witnessing substantial growth, driven by advancements in healthcare infrastructure, stringent regulatory compliance, and innovations in medical diagnostics. As part of Vision 2030, Saudi Arabia is also focusing on developing its mining and minerals industry, with vast geological resources valued at over USD 2.5 trillion. This economic diversification aligns with the country's broader goal of enhancing medical services, fostering technological advancements, and maintaining high healthcare standards.

Key Laboratory Proficiency Testing Company Insights

Key market players are adopting market strategies, such as new product launches, collaborations, and geographical expansions, to increase their global footprint. For instance, in January 2023, BIPEA introduced a novel proficiency test in surface microbiology, expanding its range of offerings. This new test allows professionals in the field to enhance their expertise and proficiency in surface microbiology analysis. Moreover, in April 2022, NSI Lab partnered with Spex and USP testing, offering a comprehensive solution for professionals to evaluate their capabilities & meet regulatory requirements in the pharmaceutical industry.

Key Laboratory Proficiency Testing Companies:

The following are the leading companies in the laboratory proficiency testing market. These companies collectively hold the largest market share and dictate industry trends.

- LGC Limited

- Bio-Rad Laboratories, Inc.

- Randox Laboratories Ltd.

- QACS - The Challenge Test Laboratory

- Merck KGaA

- Weqas

- BIPEA

- NSI Lab Solutions

- Absolute Standards, Inc.

- INSTAND

Recent Developments

-

In February 2025, Cormay Diagnostics partnered with the Randox International Quality Assessment Scheme (RIQAS) to provide world-class External Quality Assessment (EQA) programs. This partnership enables the evaluation of Cormay Diagnostics' IVD solutions within one of the world's largest EQA frameworks, engaging over 70,000 laboratories globally.

-

In November 2024, CAP launched a new Proficiency Testing (PT) report aimed at in vitro diagnostics (IVD) companies. The initiative is designed to better understand and meet customer needs, enhancing overall testing quality and accuracy in the diagnostic landscape.

-

In June 2024, BIPEA introduced the experimental PT 56A program, focusing on microbiology in flours with artificial contamination. This initiative is intended to improve laboratory performance by enhancing the detection of microbial contaminants in flour samples, thereby boosting food safety and quality control.

Laboratory Proficiency Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.56 billion |

|

Revenue forecast in 2030 |

USD 2.13 billion |

|

Growth rate |

CAGR of 6.43% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Industry, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait, |

|

Key companies profiled |

LGC Limited; Bio-Rad Laboratories, Inc.; Randox Laboratories Ltd.; QACS - The Challenge Test Laboratory; Merck KGaA; Weqas; BIPEA; NSI Lab Solutions; Absolute Standards, Inc.; INSTAND |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laboratory Proficiency Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory proficiency testing market report on the basis of industry, technology, end-use, and region:

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Diagnostics

-

Clinical chemistry

-

Immunochemistry

-

Hematology

-

Oncology

-

Molecular Diagnostics

-

PCR

-

Others

-

-

Coagulation

-

Others

-

-

Pharmaceuticals

-

Biological Products

-

Vaccines

-

Blood

-

Tissues

-

-

Others

-

-

Microbiology

-

Pathogen testing

-

Sterility testing

-

Endotoxin & pyrogen testing

-

Growth promotion testing

-

Others

-

-

Cannabis

-

Medical

-

Non-Medical

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Culture

-

Spectrometry

-

Polymerase Chain Reaction

-

Chromatography

-

Immunoassays

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Contract Research Organizations

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Laboratories

-

Independent Laboratories

-

Specialty Laboratories

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory proficiency testing market size was estimated at USD 1.46 billion in 2024 and is expected to reach USD 1.56 billion in 2025.

b. The global laboratory proficiency testing market is expected to grow at a compound annual growth rate of 6.43% from 2025 to 2030 to reach USD 2.13 billion by 2030.

b. Clinical diagnostics dominated the laboratory proficiency testing market with a share of 33.33% % in 2024. This is attributable to laboratory proficiency testing procedures being a common practice for quality management of clinical diagnostics.

b. Some key players operating in the laboratory proficiency testing market include LGC Limited, American Proficiency Institute, College of American Pathologists, QACS - The Challenge Test Laboratory, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., RCPA, and Merck & Co., Inc.

b. Key factors that are driving the laboratory proficiency testing market growth include increasing focus on water testing, legalization of medical cannabis & growing number of cannabis testing laboratories, increasing outbreaks of foodborne illnesses, and rising cases of chemical contamination of foods.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."