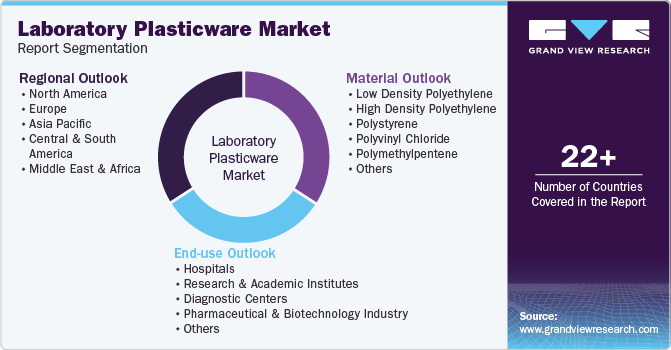

Laboratory Plasticware Market Size, Share & Trends Analysis Report By Material (Low Density Polyethylene, High Density Polyethylene, Polystyrene, Polyvinyl Chloride, Polymethylpentene), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-421-4

- Number of Report Pages: 172

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Laboratory Plasticware Market Size & Trends

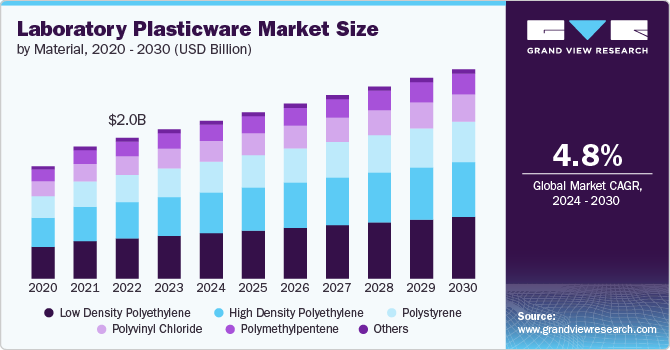

The global laboratory plasticware market size was valued at USD 2.13 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The rise in research and development activities in pharmaceuticals, biotechnology, and healthcare is expected to drive the demand for laboratory plasticware.

One of the prominent trends in the laboratory plasticware industry is the emerging popularity and increasing adoption of plasticware in laboratories. The development of new polymers with higher chemical resistance, transparency, and durability has improved laboratory plasticware performance.

Drivers, Opportunities & Restraints

The global market has witnessed significant growth in recent years, driven by rising demand for products and advancements in technology. Laboratory plasticware refers to the many plastic-based instruments, containers, and equipment used in laboratories across a variety of scientific, medical, and industrial applications. Laboratory plasticware is widely used in a variety of scientific, medical, and industrial laboratories due to its versatility, durability, and affordability.

The laboratory plasticware industry presents numerous prospects for growth and innovation, fueled by changing industry demands, technological advancements, and developing worldwide trends. The fast industrialization, expansion of the pharmaceutical and biotechnology sectors, and increased research activity in emerging economies such as China, India, and Brazil give considerable growth potential.

However, the market faces various challenges. Governments and environmental organizations are increasingly calling for stronger limits on plastic manufacture, usage, and disposal. The extensive use of disposable plasticware in laboratories generates a substantial amount of plastic trash, prompting concerns about environmental sustainability. This is expected to restrain market growth in the coming years.

Material Insights

Based on material, the Low Density Polyethylene (LDPE) segment dominated the market with a revenue share of 28.65% in 2023. LDPE is known for its flexibility and softness, making it an ideal material for objects that require resistance to bending and tension. LDPE-based laboratory plasticware is frequently used because of its versatility, low cost, and dependability in a variety of laboratory environments. Moreover, the growth of R&D activities in biotechnology, pharmaceuticals, and clinical diagnostics is a key driver of the LDPE laboratory plasticware market.

HDPE is another significant material that is expected to grow significantly over the forecast period. HDPE is a cost-effective polymer because of its cheap production costs and ease of manufacture. The increase in diagnostic testing and healthcare activities is likely to promote the demand for HDPE-based laboratory plasticware goods such as sample containers, test tubes, and reagent bottles.

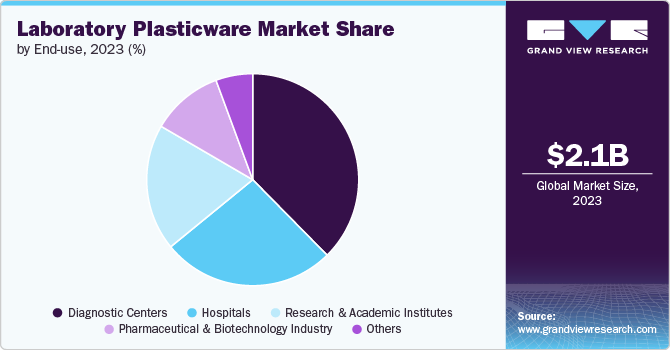

End-use Insights

Based on end use, Diagnostic Centers led the market with a revenue share of 37.62% in 2023. The rising need for diagnostic tests, fueled by reasons such as an aging population, chronic diseases, and preventative health measures, necessitates the use of a diverse variety of laboratory plasticware, including sample containers, test tubes, and culture plates. This is expected to boost the product demand in the industry.

The hospital segment is expected to grow at a significant CAGR over the forecast period. The rise of diagnostic services, such as molecular diagnostics, microbiology, and immunology, necessitates the use of specialized plasticware that can handle a wide range of samples and reagents is driving the market growth in the end-use industry. The increasing number of patients and diagnostic tests performed in hospitals is predicted to drive up demand for laboratory plasticware such sample containers, test tubes, and pipette tips.

Regional Insights

North America laboratory plasticware market is growing as the region has a well-established infrastructure and culture that promotes technological innovation, leading to increased adoption of advanced products in the medical & healthcare industry. The growth of research in a wide range of fields, including biotechnology, environmental science, materials science, and pharmaceuticals, mandates the usage of specialized plasticware in research and academic institutions. The expansion of research and technology institutions in North America, including biotech clusters and innovation hubs, adds to the demand for specialized laboratory plasticware.

U.S. Laboratory Plasticware Market Trends

The laboratory plasticware market in the U.S. dominated the North American market, and is expected to grow at a significant rate in the coming years. The use of advanced laboratory technology, such as automation systems, high-throughput screening, and sophisticated analytical instruments is expected to drive the demand for laboratory plasticware in the country.

Asia Pacific Laboratory Plasticware Market Trends

The laboratory plasticware market in Asia Pacific dominated the global market and accounted for the largest revenue share of over 32% in 2023. Rapid economic expansion in countries such as China, India, and Southeast Asia, which promotes spending in healthcare, research, and manufacturing, is predicted to fuel demand for laboratory plasticware. Furthermore, the expansion of industrial sectors such as pharmaceuticals, chemicals, and manufacturing increases the demand for laboratory plasticware used in quality control, research, and production operations.

Europe Laboratory Plasticware Market Trends

The laboratory plasticware market in Europe is experiencing significant growth due to several key drivers. The rise of Europe's pharmaceutical industry, including medication development and manufacture, is expected to drive the demand for laboratory plasticware used in research, development, and quality control.

Key Laboratory Plasticware Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Thermo Fisher Scientific, Duran Group, Corning Inc., Technosklo Ltd., ISOLAB, and Peninsula Plastics. The market is categorized as a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Laboratory Plasticware Companies:

The following are the leading companies in the laboratory plasticware market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Duran Group

- Corning Inc.

- Technosklo Ltd.

- ISOLAB

- Peninsula Plastics

- VITLAB GmbH

- Gerresheimer

- Eppendorf AG

- Eurofins

Recent Developments

-

In December 2023, Eppendorf SE Hamburg established a collaboration with Neste to enhance the development of laboratory products manufactured from plastic renewable raw materials. The strategic relationship enabled the development of a new range of renewable plastic lab consumables called Eppendorf consumables BioBased.

-

In October 2023, Berry introduced the first 20 and 25 liter containers comprising 35% recycled material, which have received UN approval for the transport of hazardous commodities for five of the six model liquids in the UN assessment. The addition of these additional containers to the company's famous Optimum range will help businesses accomplish their sustainability goals while also meeting customer demand for more sustainable packaging alternatives.

Laboratory Plasticware Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.25 billion |

|

Revenue forecast in 2030 |

USD 2.99 billion |

|

Growth rate |

CAGR of 4.8% from 2024 to 2030 |

|

Base Year |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons; revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast; revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Material, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; The Netherlands; Denmark; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Thermo Fisher Scientific, Duran Group, Corning Inc., Technosklo Ltd., ISOLAB, Peninsula Plastics, VITLAB GmbH, Gerresheimer, Eppendorf AG, Eurofins |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laboratory Plasticware Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory plasticware market report on the basis of material, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Low Density Polyethylene (LDPE)

-

High Density Polyethylene (HDPE)

-

Polystyrene

-

Polyvinyl Chloride (PVC)

-

Polymethylpentene (PMP)

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Research & Academic Institutes

-

Diagnostic Centers

-

Pharmaceutical & Biotechnology Industry

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

The Netherlands

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global laboratory plasticware market size was valued at USD 2.13 billion in 2023 and is expected to reach USD 2.25 billion in 2024.

b. The global laboratory plasticware market is expected to grow at a CAGR of 4.8% from 2024 to 2030, reaching USD 2.99 billion by 2030.

b. Based on material, the Low-Density Polyethylene (LDPE) segment led the market with the largest revenue share of 28.65% in 2023. LDPE-based laboratory plasticware is frequently used because of its versatility, low cost, and dependability in a variety of laboratory environments. The growth of R&D activities in biotechnology, pharmaceuticals, and clinical diagnostics is a key driver of the LDPE laboratory plasticware market.

b. Key players operating in the laboratory plasticware market include Thermo Fisher Scientific, Duran Group, Corning Inc., Technosklo Ltd., ISOLAB, Peninsula Plastics, among others

b. The rise in research and development activities in pharmaceuticals, biotechnology, and healthcare is expected to drive the demand for laboratory plasticware.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."