- Home

- »

- Medical Devices

- »

-

Laboratory Mixer Market Size, Share & Trends Report, 2030GVR Report cover

![Laboratory Mixer Market Size, Share & Trends Report]()

Laboratory Mixer Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Shakers, Vortex Mixers), By End Use (Pharmaceutical And Biotechnology Companies, Research Laboratories And Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-344-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laboratory Mixer Market Summary

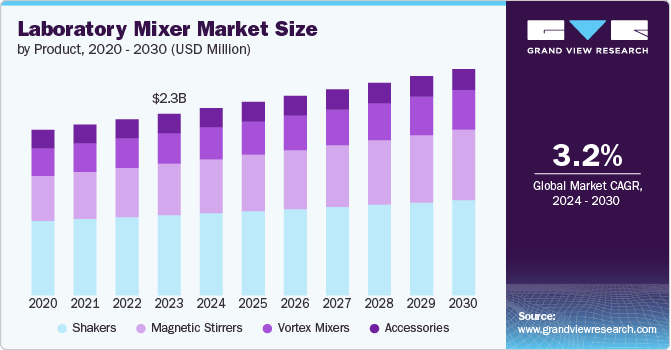

The global laboratory mixer market size was estimated at USD 2.29 billion in 2023 and is projected to reach USD 2.85 billion by 2030, growing at a CAGR of 3.2% from 2024 to 2030. This growth is attributed to increasing demand for laboratory mixers used in research and development processes in pharmaceutical, biotechnology, and chemical industries.

Key Market Trends & Insights

- North America dominated the market and accounted for a 48.50% share in 2023.

- The market in the U.S. is expected to grow substantially over the forecast period.

- By product, the shakers segment accounted for the largest revenue share in 2023.

- By end use, the pharmaceutical and biotechnology companies segment is anticipated to grow at the fastest CAGR of 5.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.29 Billion

- 2030 Projected Market Size: USD 2.85 Billion

- CAGR (2024-2030): 3.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, increasing demand for efficient and precise mixing solutions coupled with the development of more efficient and automated systems drives the market growth by improving mixing accuracy, speed, and scalability. The increasing healthcare expenditure and funding on research are likely to drive the market over the forecast period.

The market is witnessing a shift towards more efficient and automated systems, which is a significant driver for growth. Manufacturers are developing laboratory mixers and shakers with advanced features such as programmable controls, data logging capabilities, and integration with laboratory information management systems (LIMS). These automated systems reduce human error, increase productivity, and allow for more standardized processes. The trend towards high-throughput screening and parallel processing in research is also driving the demand for mixers that can handle multiple samples simultaneously. For instance, in August 2022, Admix, Inc. introduced the Benchmix 10, a compact high shear lab mixer featuring the patented Admix Rotosolver high shear mix head. This design is optimized for effectively wetting out and dispersing powders, eliminating agglomerates, and producing uniform mixtures and emulsions.

Additionally, the integration of Internet of Things (IoT) technology and artificial intelligence in laboratory equipment is enabling remote monitoring and control, predictive maintenance, and more efficient resource utilization, further boosting the appeal of modern laboratory mixer.

The pharmaceutical and biotechnology industries have seen a surge in research activities, driving a growing demand for various laboratory equipment in recent years. This trend is expected to continue, as laboratory mixers play a crucial role in research laboratories. However, small and medium-sized laboratories often face financial constraints, limiting their ability to invest in high-performance mixers, which can cost upwards of USD 7,000. In contrast, basic mixers are more affordable, priced under USD 500. This significant price difference has hindered the adoption of advanced mixers in smaller laboratories. Furthermore, laboratory mixers are built to last, with proper maintenance and operation extending their lifespan up to ten years. This durability reduces the need for frequent equipment replacements, making them a valuable investment for research teams.

Technological advancements are playing a crucial role in driving the market, particularly in the realm of laboratory mixer. Innovations in materials science have led to the development of mixers with improved durability, chemical resistance, and temperature tolerance, expanding their applications in various research fields. For instance, in June 2022, IKA introduced the groundbreaking convertible mixing device, the IKA TWISTER. This innovative device can function as a single-position magnetic stirrer or a multi-position magnetic stirrer, offering great flexibility. With one attachment, it can effectively stir small volumes, while with another attachment, it transforms into a vortex shaker. Moreover, Grant Bio Mini Magnetic Stirrer MMS-3000 provided by Grant instruments is a compact and versatile instrument designed for efficient stirring of small volumes in everyday laboratory applications, including pH measurements, extractions, and dialysis procedures. The integration of digital technologies has resulted in mixers with enhanced precision, real-time monitoring capabilities, and data analytics features. Advancements in microfluidics and nanotechnology are driving the development of miniaturized mixing systems for applications in point-of-care diagnostics and personalized medicine.

The rise in healthcare expenditure and increased funding for research activities are significant drivers for the laboratory mixer market. Governments, private organizations, and academic institutions are allocating more resources to healthcare research, drug discovery, and development of new therapies. According to a Science and Engineering Indicators in 2022, research and development (R&D) spending in the U. S. totaled an estimated $885.6 billion in current U.S. dollars. This represents a 12% increase from 2021 in nominal dollars and a 5% increase in inflation-adjusted dollars. The article further highlighted the growing role of the business sector in funding and performing U.S. R&D, especially in basic and applied research.

Product Insights

The shakers accounted for the largest revenue share in 2023. This is attributable to the fact that shakers are crucial for achieving uniform mixing, temperature control, and reaction efficiency in chemical, biological, and pharmaceutical processes. Recent developments in this segment include the introduction of advanced models with digital controls, programmable settings, and enhanced safety features, catering to the increasing demand for precision and automation. Key players such as Thermo Fisher Scientific and Eppendorf are continuously innovating their product lines, focusing on energy efficiency, ease of use, and adaptability to various laboratory environments. The future prospects for shakers and magnetic stirrers are promising, with ongoing advancements in material science and automation technologies expected to further enhance their performance and application range.

The magnetic stirrer segment is anticipated to grow at the fastest CAGR of 4.6% over the forecast period. Magnetic stirrers are characterized by their reliability, ease of use, and ability to meet safety standards. They have gained popularity over gear-driven motorized stirrers due to their increased efficiency and lack of moving external parts that can break or wear out. One of the notable examples is ‘Advanced magnetic hotplate stirrers’ by VWR. The VWR magnetic hotplate stirrers offer unparalleled performance, featuring a temperature range of up to 500°C and stirring speeds of up to 1600 rpm, ensuring precise mixing and exceptional temperature control for even the most demanding laboratory applications. The growing demand for dissolving nutrients and solids, cultivating microorganisms, and preventing suspended matter from settling is fueling the need for magnetic stirrers in various applications such as chemical synthesis, pharmaceutical manufacturing, microbiology, biotechnology, and medicine. Additionally, these stirrers are also used in dialysis, extraction, oil analysis, soil suspension, pH measurement, and sample preparation processes.

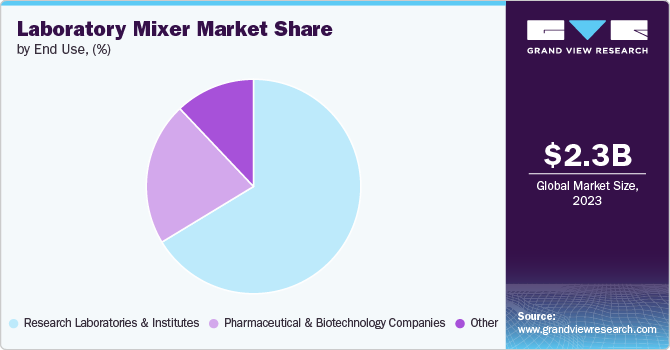

End Use Insights

The research laboratories and institutes segment dominated the end use segments with the largest market share in 2023. These institutions are at the forefront of developing new laboratory mixer techniques, applications, and methodologies, often through collaborative projects with industry partners. Recent developments in this segment focus on enhancing user interface, automation, and integration with laboratory information management systems (LIMS). Companies such as IKA and Heidolph are at the forefront, offering innovative mixers that cater to the evolving needs of research environments. The future prospects for research laboratories and institutes are positive, with growing research funding, collaborative projects, and advancements in scientific research methodologies expected to drive sustained demand for advanced laboratory mixers.

The pharmaceutical and biotechnology companies’ segment is anticipated to grow at the fastest CAGR of 5.2% over the forecast period. The rise in personalized medicine and biopharmaceuticals has increased the demand for advanced laboratory mixer systems to analyze complex biological molecules with high precision. Additionally, the growing focus on protein-based drugs and genetic therapies necessitates robust laboratory mixer methodologies for protein characterization and nucleic acid analysis. Strategic partnerships, mergers, and acquisitions within the industry further stimulate market growth by fostering innovation and expanding the application scope of laboratory mixer technologies. As these companies continue to seek more efficient and accurate diagnostic tools, their influence significantly propels the advancement and adoption of laboratory mixer techniques globally.

Regional Insights

North America dominated the market and accounted for a 48.50% share in 2023. This high share is attributable to region's robust pharmaceutical and biotechnology industries, which continuously drive demand for advanced research and development tools. The development of more efficient and automated systems in laboratory mixer is significantly driven by North America's leadership in technological innovation and its emphasis on optimizing manufacturing processes, whereas, increasing healthcare expenditure and substantial funding for research contribute to the adoption of advanced laboratory mixer, supporting innovation and product development in the region. In addition, technological advancements in North America are driven by collaborations between academic institutions and industry players, focusing on precision, scalability, and compliance with stringent regulatory standards.

U.S. Laboratory Mixer Market Trends

The market in the U.S. is expected to grow substantially over the forecast period. This is attributable to the growing presence of key players in the region involved in the development of more efficient and automated systems, further rising focus on improving productivity and ensuring compliance with stringent regulatory requirements in pharmaceutical manufacturing. In addition, technological advancements in the U.S. are propelled by collaborations between academia, government agencies, and industry leaders, aiming to achieve higher levels of precision, reliability, and sustainability in mixing processes.

Europe Laboratory Mixer Market Trends

Europe is identified as a lucrative region in this industry driven by the increasing demand for advanced mixtures due to the rising burden of chronic diseases is boosting demand for laboratory mixer, as they are essential instruments used in pharmaceutical and biotechnology R&D to develop novel therapies. Furthermore, the increasing number of research laboratories in countries like UK, Germany and rising funding for research activities are driving the demand for laboratory mixer.

Asia Pacific Laboratory Mixer Market Trends

Asia Pacific is anticipated to witness the fastest growth of 4.5% CAGR over the forecast period. This is due to increasing industry academia collaborations in countries like India, China and Japan. Rising healthcare expenditure and growing government funding for research initiatives support the adoption of advanced laboratory mixers in Asia Pacific, facilitating innovation and market growth. According to Invest 2022 highlights, the Indian biotechnology industry is expected to reach a valuation of USD 150 billion by 2025 and USD 300 billion by 2030. This growth trajectory indicates that India's biotechnology sector is booming, which is likely to drive demand for laboratory equipment, contributing to market expansion. The sector's growth is driven by rising demand both domestically and internationally. Initiatives such as Aatmanirbhar Bharat and Make In India have stimulated demand, while the global market is increasingly recognizing the efficacy of Indian vaccines and biopharmaceuticals, leading to increased overseas demand. As a result, the Indian biotechnology industry is poised to play a significant role in driving market growth.

Key Laboratory Mixer Company Insights

Some of the key players operating in the market include IKA-Werke, Eppendorf, Thermo Fisher Scientific, Shuanglong Group Co., Ltd., Bio-Rad Laboratories Inc., REMI GROUP and others. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Laboratory Mixer Companies:

The following are the leading companies in the laboratory mixer market. These companies collectively hold the largest market share and dictate industry trends.

- IKA-Werke

- Eppendorf

- Thermo Fisher Scientific

- Shuanglong Group Co. Ltd

- Bio-Rad Laboratories Inc.

- REMI GROUP

- Benchmark Scientific Inc.

- Silverson

- SARSTEDT AG & Co. KG

- Antylia Scientific.

- Corning Incorporated

- Labstac Ltd

Recent Developments

-

In April 2023, Thermo Fisher Scientific introduced the new line of Solaris Benchtop Temperature Controlled Orbital Shakers, designed to enhance reliability and sustainability in laboratories. These shakers, available in both incubated and refrigerated models, use 58% less energy than older models with traditional compressors.

-

In June 2022, IKA-Werke announced the launch of TWISTER, a pioneering convertible mixing device that can function as a single-position or multi-position magnetic stirrer.

-

In January 2022, LINXIS Group, in partnership with its financial sponsor IK Partners, is excited to announce the purchase of Shaffer, a company specializing in industrial mixers and process equipment, from Bundy Baking Solutions. The Bundy family will retain a minority stake in the business.

Laboratory Mixer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.36 billion

Revenue forecast in 2030

USD 2.85 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

IKA-Werke; Eppendorf; Thermo Fisher Scientific; Shuanglong Group Co., Ltd.; Bio-Rad Laboratories Inc.; REMI GROUP; Benchmark Scientific Inc.; Silverson; SARSTEDT AG & Co. KG; Antylia Scientific.; Corning Incorporated; Labstac Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Mixer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory mixer market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shakers

-

Orbital Shakers

-

Rollers/Rotators

-

Other Product Types

-

-

Vortex Mixers

-

Magnetic Stirrers

-

Accessories

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Research Laboratories and Institutes

-

Other End Use

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory mixer market size was estimated at USD 2.29 billion in 2023 and is expected to reach USD 2.36 billion in 2024.

b. The global laboratory mixer market is expected to grow at a compound annual growth rate of 3.2% from 2024 to 2030 to reach USD 2.85 billion by 2030.

b. The shakers accounted for largest revenue share in 2023. This is attributable to the fact that shakers are crucial for achieving uniform mixing, temperature control, and reaction efficiency in chemical, biological, and pharmaceutical processes. Recent developments in this segment include the introduction of advanced models with digital controls, programmable settings, and enhanced safety features, catering to the increasing demand for precision and automation.

b. Some of the key players operating in the global laboratory mixer market include IKA-Werke, Eppendorf, Thermo Fisher Scientific, Shuanglong Group Co., Ltd., Bio-Rad Laboratories Inc., REMI GROUP, Benchmark Scientific Inc., Silverson, SARSTEDT AG & Co. KG, Antylia Scientific., Corning Incorporated, and Labstac Ltd.

b. This growth is attributed to increasing demand for laboratory mixers used in research and development processes in pharmaceutical, biotechnology, and chemical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.