Laboratory Gas Generators Market Size, Share & Trends Analysis Report By Product (Nitrogen, Hydrogen, Zero Air, Purge Gas), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-342-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Laboratory Gas Generators Market Trend

The global laboratory gas generators market size was USD 448.6 million in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. The market is driven by a combination of technological advancements, increasing demand for on-site gas generation solutions, and the increasing adoption of analytical instruments in the life science, chemical, and petrochemical industries.

A key driver contributing to the market's expansion is the growing need for precise and consistent gas supply in laboratory settings. Conventional methods of gas procurement, such as cylinder-based systems, are often plagued by logistical challenges, including transportation, storage, and handling. Laboratory gas generators provide a convenient alternative, enabling users to generate gases on-site as needed, thereby reducing downtime and ensuring continuous workflow efficiency.

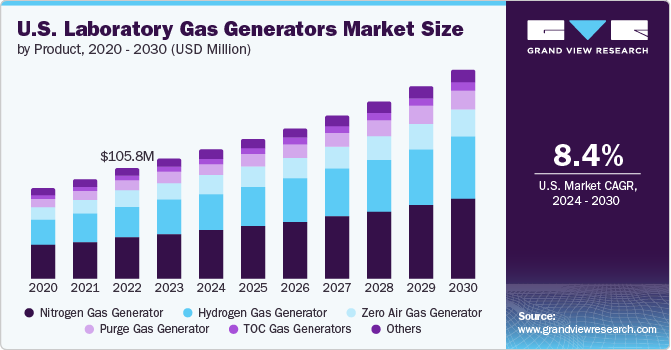

The U.S. market is characterized by robust growth driven by the adoption of advanced analytical techniques in pharmaceutical, biotechnology, chemical, and environmental industries, necessitating reliable and on-demand gas supply solutions. This trend is particularly observed in chromatography applications, where nitrogen, hydrogen, and zero-air generators are essential for maintaining instrument performance and accuracy.

Nitrogen gas generators represent a significant segment of the U.S. market, driven by their indispensable role in gas chromatography and sample preparation applications. In addition, nitrogen gas generators contribute to sustainability efforts by minimizing carbon emissions associated with gas transportation and storage.

Increasing emphasis on workplace safety and regulatory compliance has prompted laboratories to transition away from traditional gas supply methods, such as compressed gas cylinders, towards safer and more efficient on-site gas generation systems. Gas generators offer numerous benefits, including reduced handling risks, improved workplace ergonomics, and better control over gas purity and flow rates.

Advancements in gas generation technologies have led to the development of more efficient and compact systems, offering improved performance and reliability. Membrane separation, pressure swing adsorption (PSA), and electrolysis are some of the leading technologies utilized in modern gas generators, allowing the production of high-purity gases tailored to specific laboratory requirements.

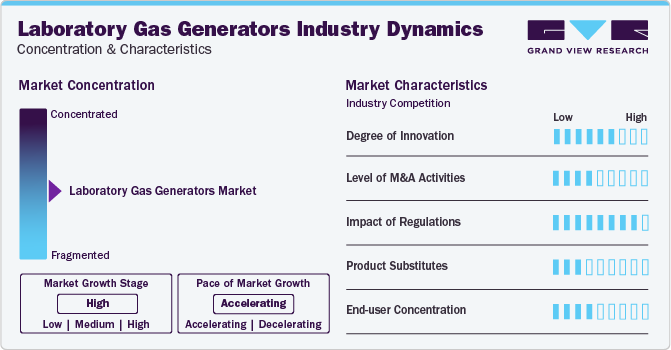

Market Concentration & Characteristics

The market growth stage is high, with an accelerating pace. Laboratory gas generators industry is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as geographical expansions, product launches, and mergers & acquisitions, to strengthen their position in the global market.

The laboratory gas generator industry is also characterized by a high level of product launch activity by leading players. This is owing to numerous factors, including the increasing reach of their products in the market and augmenting the availability of their products & services in diverse geographical areas. Key market players adopting this organic growth strategy include Peak Scientific Instruments, Parker Hannifin Corp., Angstrom Advanced Inc., Linde plc., and Erre Due S.p.a.

The market is poised for continued expansion, supported by ongoing investments in research and development, increasing demand for analytical instrumentation, and the growing recognition of the benefits offered by on-site gas generation technologies. As laboratories strive to enhance productivity, efficiency, and sustainability, the demand for reliable and cost-effective gas supply solutions is expected to remain strong, driving market growth and innovation in the years to come.

Regulations play a crucial role in shaping the market, influencing product design, manufacturing processes, safety standards, and environmental considerations. Compliance with Occupational Safety and Health Administration (OSHA) regulations ensures that laboratory gas generator manufacturers prioritize safety features in their products, such as gas leak detection systems, pressure relief valves, and fail-safe mechanisms. National Fire Protection Association (NFPA) codes and standards address fire safety, explosion prevention, and hazardous materials handling in laboratory settings.

Product Insights

The nitrogen gas generator segment led the market in 2023 with the largest revenue share. Nitrogen gas generators have widespread use in applications such as gas chromatography, sample preparation, liquid chromatography-mass spectrometry, and purge gas for analytical instruments. The adoption of nitrogen gas generators is driven by their ability to provide high-purity nitrogen on-demand, eliminating the need for gas cylinder handling and storage.

Hydrogen gas generators are also witnessing increased adoption in the laboratory market, particularly for flame ionization detection in gas chromatography and fuel gas for hydrogen fuel cell applications. These generators offer a safer alternative to storing and handling compressed hydrogen cylinders, mitigating the risk of accidents and ensuring a continuous supply of hydrogen gas for analytical instruments. Further, other gas generators, such as helium, argon, and zero air generators, cater to specific niche applications in laboratories, including gas chromatography-mass spectrometry, gas analysis, leak detection, and semiconductor manufacturing.

Application Insights

The gas chromatography application segment led the market in 2023. Nitrogen and hydrogen gas generators are significantly used in numerous gas chromatography analytical applications for carrier and fuel gases. Advancements like GC-MS and hyphenated techniques require precise gas flows and purity, driving demand for specialty gas generators. Portable gas chromatography units coupled with compact gas generators are expected to have increasing use in field analysis and environmental monitoring.

Growing Liquid Chromatography-Mass Spectrometry (LC-MS) field, crucial for drug discovery and metabolomics, drives the need for high-purity nitrogen and helium gas generators for nebulization and collision gas. Furthermore, gas generators that seamlessly integrate with LC-MS systems for optimal performance and ease of use are expected to gain traction over the forecast period. Real-time gas analysis in various industries utilizes gas generators for a continuous supply of specific gases required for accurate measurements. Generators producing ultra-high purity gases are crucial for detecting low-level contaminants in environmental and industrial settings.

End-use Insights

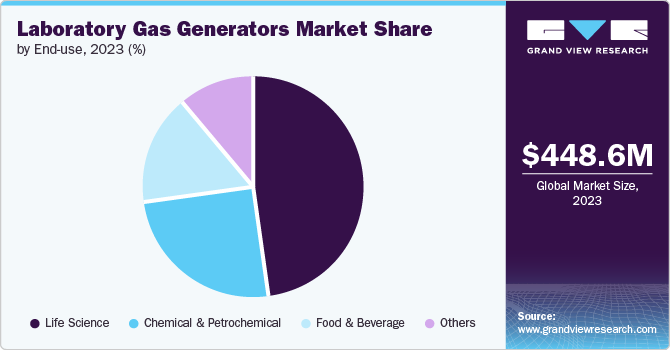

The life science sector represents a significant end use segment for laboratory gas generators, driven by the increasing demand for analytical instruments in drug discovery, development, and quality control processes. Gas chromatography, mass spectrometry, cell culture, fermentation, and drug discovery rely heavily on gas generators. Rising R&D spending, personalized medicine advancements, and stricter drug regulations fuel market growth.

Furthermore, the food and beverage, environmental, and academic research sectors are also adopting gas generators to support numerous applications, including mass spectrometry, gas chromatography, sample preparation, and environmental analysis. Furthermore, in the chemical industry, nitrogen gas generators are used to neutralize or remove oxygen that is present in numerous chemical manufacturing processes.

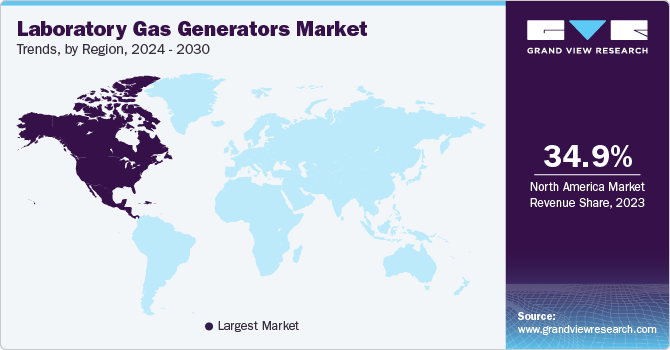

Regional Insights

The laboratory gas generators market in North America dominated globally in 2023 and accounted for 34.9% of the global revenue share. Increased investment in industries like pharmaceuticals, biotechnology, and food & beverage in the U.S., Canada, and Mexico fuels the demand for reliable and consistent gas supply, thereby driving the demand for the gas generator market.

Canada Laboratory Gas Generators Market Trends

The laboratory gas generators market in Canada is driven by flourishing life science industry in the country. Canada's growing life science and research sector, particularly in areas like pharmaceuticals, biotechnology, and environmental sciences, fuels the demand for reliable gas sources. Furthermore, strict regulations mandating high-purity gases for analytical techniques favor the adoption of generators over traditional cylinders.

Europe Laboratory Gas Generators Market Trends

The laboratory gas generators market in Germany is poised for substantial growth, driven by its robust life science industries, stringent regulations, and strong R&D focus. According to the Biotechgate 2022 report, Germany has more than 4019 companies, of which 66% are categorized as R&D services companies. Continuous investment in diverse research fields fuels the demand for advanced gas solutions for varied analytical testing applications.

Asia Pacific Laboratory Gas Generators Market Trends

The laboratory gas generators market in China is positively impacted by the growing life science sector and is anticipated to grow over the forecast period. China's booming life sciences sector, fueled by an aging population and rising wealth, is attracting investors in the laboratory and manufacturing space for pharmaceutical and healthcare companies. These firms require specialized fit-outs with high-spec equipment, driving demand for laboratory gas generators, as the world's second-largest pharmaceutical market with spending expected to reach USD 195 billion by 2027.

Central & South America Laboratory Gas Generators Market Trends

The laboratory gas generators market in Brazil is expected to grow significantly over the forecast period owing to the booming healthcare sector, government R&D support, and stricter safety regulations. Demand for reliable gas sources in pharmaceuticals, biotechnology, and environmental testing drives the need for generators over traditional cylinders. Challenges like upfront costs and user awareness exist, but strategic investments in competitive pricing, educational campaigns, and local expertise can increase product penetration in Brazil's life sciences sector.

Middle East & Africa Laboratory Gas Generators Market Trends

Laboratory gas generators market in Saudi Arabia is driven by significant investments in oil & gas, pharmaceuticals, and biotech industries for high-purity gases for diverse applications. Notably, the government's national biotech strategy aims to transform the country into a global biotech hub by 2040, aligning with the broader Vision 2030 plan to establish Saudi Arabia as a regional leader in this field. Such initiatives are poised to significantly fuel the laboratory gas generators market over the forecast period.

Key Laboratory Gas Generators Company Insights

The laboratory gas generators industry is a dynamic arena where established global players and regional competitors vie for dominance. In addition, key players strive to differentiate their offerings through technological innovation, product customization, and strategic partnerships. As competition intensifies and customer preferences evolve, companies must continuously innovate and adapt to stay ahead in this dynamic and rapidly growing market.

Key Laboratory Gas Generators Companies:

The following are the leading companies in the laboratory gas generators market. These companies collectively hold the largest market share and dictate industry trends.

- Peak Scientific Instruments

- PerkinElmer Inc.

- Linde plc.

- VICI DBS

- Dürr Technik GmbH & Co. KG

- Erre Due S.p.a.

- Tisch Environmental, Inc.

- CLAIND srl

- Isolcell

- OXYMAT

Recent Developments

-

In September 2023, Claind announced the opening of a new factory in Suzhou, China. This facility will initially focus on producing the Plinius, a next-generation nitrogen generator known for its Pressure Swing Adsorption (PSA) technology. The Plinius guarantees an extended operational lifespan and exceptional purity levels of up to 99.999%, making it ideal for various laboratory and industrial applications.

-

In July 2023, Peak Scientific Instruments introduced nitrogen gas generation solutions with the release of the Corona 1010A. This innovative solution delivers high-purity, filtered nitrogen gas, empowering various applications with a reliable and potent source. It is capable of delivering flows up to 5 liters per minute at pressures reaching 80psi.

-

In March 2023, Linde Engineering announced the opening of a new office in Allentown, Pennsylvania to bolster its U.S. presence. This 50-person engineering and execution center aligns with existing regional locations and leverages Allentown's renowned universities to recruit diverse talent.

-

In March 2022, Peak Scientific Instruments announced the expansion of manufacturing facilities in Glasgow. The expansion saw the footprint nearly double, increasing from 8,500 square feet to 12,500 square feet. This strategic move aims to achieve multiple objectives to increase production and enhance capacity to meet increasing demand.

Laboratory Gas Generators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 481.1 million |

|

Revenue forecast in 2030 |

USD 777.4 million |

|

Growth rate |

CAGR of 8.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Spain, Italy, China, Japan, India, South Korea, Australia, Argentina, Brazil, Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

Peak Scientific Instruments, PerkinElmer Inc., Linde plc., VICI DBS, Dürr Technik GmbH & Co. KG, Erre Due S.p.a., Tisch Environmental, Inc., CLAIND srl, Isolcell, OXYMAT |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laboratory Gas Generators Market Report Segmentation

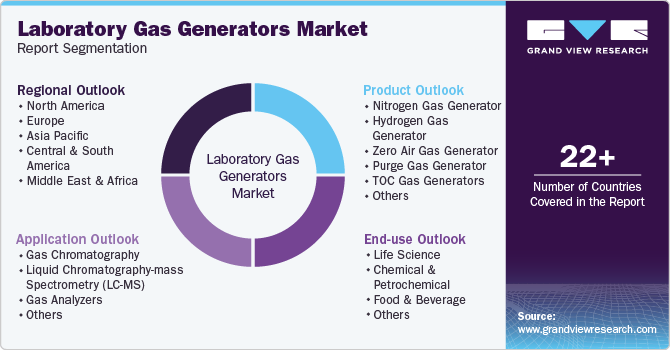

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory gas generators market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nitrogen Gas Generator

-

Hydrogen Gas Generator

-

Zero Air Gas Generator

-

Purge Gas Generator

-

TOC Gas Generators

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas Chromatography

-

Liquid Chromatography-mass Spectrometry (LC-MS)

-

Gas Analyzers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Science

-

Chemical & Petrochemical

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global laboratory gas generators market size was estimated at USD 448.6 million in 2023 and is expected to be USD 481.1 million in 2024.

b. The global laboratory gas generators market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 777.4 million by 2030.

b. North America led the market and accounted for 34.9% of the global revenue share in 2023. Growing life science and research sector, particularly in areas like pharmaceuticals, biotechnology, and environmental sciences, fuels demand for gas generators in the region.

b. Some of the key players operating in the laboratory gas generators market include Peak Scientific Instruments, PerkinElmer Inc., Linde plc., VICI DBS, Dürr Technik GmbH & Co. KG, Erre Due S.p.a., Tisch Environmental, Inc., CLAIND srl, Isolcell, OXYMAT.

b. The market is driven by growing safety concerns related to the use of conventional gas cylinders, the growing importance of analytical techniques in drug and food approval processes, and increasing R&D spending in the life science sector.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."