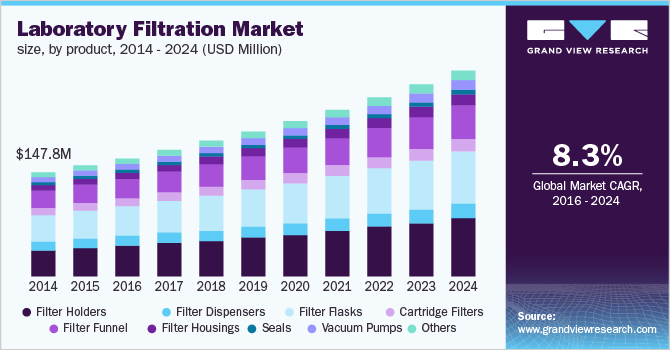

Laboratory Filtration Market Analysis by Product (Filtration Media, Membrane Filters, Filter Papers, and others), By Technology and Segment Forecasts To 2024

- Report ID: 978-1-68038-939-5

- Number of Report Pages: 111

- Format: PDF

- Historical Data: 2010-2012

- Forecast Period: 2016 - 2024

- Industry: Bulk Chemicals

Report Overview

The global laboratory filtration market size to be valued at USD 3.6 billion by 2024 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% during the forecast period. The increasing application of filtration technology in pharmaceutical, biopharmaceutical, and food & beverage industries and the rising demand for more efficient filters are the key factors accentuating the market growth. Filtration products offer sterilized filtration, bioburden reduction, air filtration, oil and gas filtration, and membrane filtration. The novel technologies are being developed by manufacturers for large volume filtration taking place in pharmaceutical and biopharmaceutical companies.

For instance, particulate filter, a product from 3M Purification, Inc. featured with advanced pleat technology increases the filtration surface area, while maintaining standard filter dimensions.

Laboratory filtration finds its application in various fields such as drug discovery and development, microbial analysis, virus removal, research laboratories, and water purification treatment plants. The increasing demand for high throughput filtration products during the down streaming process, growing usage of analytical instruments, and the introduction of sophisticated filtration methods for ultra-purification are expected to propel the growth over the forecast period. Macherey-Nagel and some other companies such as GE Healthcare and Hahnemühle offer a dynamic range of ash-less filter papers and qualitative filter papers that are designed for quantitative routine analysis and general laboratory filtration processes.

The cases suffering from water-borne diseases such as cholera, diarrhea, and typhoid have increased by two-fold since 2005 in sub-African countries, as a result of which there is an increase in demand of filters with improved filtration capacity and efficiency. A new range of filter membranes such as Nalgene by Thermo Fisher Scientific is preferred among researchers for microbial analysis.

Laboratory Filtration Market Trends

The increasing expenditure on Research and Development is likely to drive the market during the projected period. For instance, in 2020, GVS Filter Technology in Europe reinvested 6% of its total sales in the R&D of technologically innovative filters. Moreover, increased support from government organizations in the form of funds is encouraging laboratory filter manufacturers to upgrade their existing product lineup. For instance, the European Union funded the GVS Sud Srl company from the European Regional Development Fund. This fund was allocated for the development of two multifunctional, biomimetic filters capable of capturing pathogens, leukocytes, and potassium ions from the blood.

Furthermore, the surge in demand for advanced membrane filtration systems along with the increasing number of laboratories in emerging countries is propelling the market growth. For instance, according to the International Laboratory Accreditation Cooperation (ILAC), there are around 85,000 laboratories operating globally as of 2021. The rise in demand for healthcare facilities is anticipated to cater to the market demand during the forecast period.

Lack of infrastructural facilities in emerging nations, along with the high initial capital required to start production facilities, are among the major restraints slowing down the market growth. However, increasing product development and innovation due to technological advancements is expected to propel market growth during the projected period.

Product Insights

The product portfolio of market is segmented into filtration media, filtration assemblies, and filtration accessories. The filtration media segment includes membrane filters that accounted for the largest market share in 2015. This large share is presumed to be a result of their increasing application in microbial analysis, microfiltration, and ultrafiltration.

The capsule filters segment, on the other hand, is estimated to witness significant growth over the decade with a CAGR of over 7.3%. These filters provide a reliable filtrate by retention of very small microorganisms and harmful particles.

Microfiltration assemblies held the largest market share within the filtration assemblies segment in 2015. Widespread usage of microfiltration assemblies in food and beverage industry for quality check is one of the major factors attributing to its dominance.

Technology Insights

Reverse osmosis, ultrafiltration, vacuum filtration, nanofiltration, and microfiltration are the key technologies of the market. The microfiltration segment dominated this sector in 2015. Microfiltration technology is the removal of particles through a micro porous medium named membrane filter.

Micro filters are widely used for cold sterilization of API and enzymes and for the separation of solid-liquid phases in various industries. It is highly used in fractionalizing milk protein applications. Applications include cell harvesting from fermentation broths, fractionation of milk proteins, corn syrup clarification and CIP chemical recovery.

Ultrafiltration is one of the fastest-growing technologies and is expected to witness a significant CAGR over the forecast period. The ultrafiltration segment offers benefits such as gentle product treatment, easier handling, and lower energy consumption over the conventional methods. The increasing adoption of ultrafiltration in food processing industry, water purification systems, and protein bioseparation is predicted to enhance the market growth.

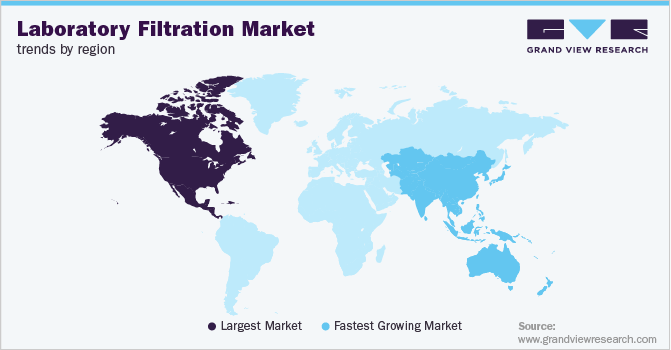

Regional Insights

Around half of the global market was captured by North America in 2015. North America is the prime market for laboratory filtration products, owing to the presence of key filtration product manufacturers, the establishment of well-developed laboratories, and the increasing government funding for basic research.

Increasing target diseases and rising need for therapeutics are the major factors attributing to a large base of target population in North America. Furthermore, the increasing industrialization and availability of new products strengthen the adoption rate of the laboratory filtration products in the region

The Asia Pacific region is anticipated to witness flourishing growth over the forecast period because of the increasing number of key players focusing on setting up their operational facilities in these regions, presence of a large number of generic drug manufacturing industries, and the growing initiatives of food and beverage companies on launching quality products.

Key Companies & Market Share Insights

Some major players in the laboratory filtration market include Merck Millipore, Sigma-Aldrich, GE Healthcare, Thermo Fisher Scientific, Sartorius Group, 3M Purification, Inc., Cantel Medical Corporation, and Macherey-Nagel Gmbh & Co. KG. They are actively involved in updating their range of filtration products in an attempt to improve their market position and earn high profits.

For instance, GE Healthcare has developed quartz filters such as Whatman QM_B quartz, microfiber filters, Whatman QM-A quartz MF, and Whatman QM-H, which are used for filtering air samples.

Recent Developments

-

In Dec 2021, Sartorius announced the acquisition of 62.5% shares of Automated Lab Solutions GmbH (ALS) till Jan 03, 2022. The company aims to acquire the remaining share of 37.5% by 2026. The primary objective of Sartorius behind this acquisition is to expand its bio-analytics portfolio.

-

In May 2022, Merck KGaA announced the expansion of its filtration and membrane manufacturing facility situated in Ireland. The facility, located in Carrigtwohill, is expected to witness an investment of €440 million for its capacity maximization; additionally, a new manufacturing facility is to be constructed in Cork, Ireland

-

In Jan 2022, 3M announced an investment of USD 470 million to expand its facility located in Clinton, Tennessee. This development is expected to enhance its sustainability and improve consumer response time. Furthermore, 3M has outlined plans to invest in its fast-growing products - Command Brand adhesive strips and Filtrete air filters

Laboratory Filtration Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2024 |

USD 3.6 billion |

|

Growth rate |

CAGR of 8.3% from 2016 to 2024 |

|

Base year for estimation |

2015 |

|

Forecast period |

2016 - 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2016 to 2024 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; China; Japan; Brazil; South Africa |

|

Key companies profiled |

Merck Millipore; Sigma-Aldrich; GE Healthcare; Thermo Fisher Scientific; Sartorius Group; 3M Company; Cantel Medical Corporation; Macherey-Nagel Gmbh& Co. Kg. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laboratory Filtration Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2015 to 2024. For the purpose of this study, Grand View Research has segmented the laboratory filtration market on the basis of product, technology, and region:

-

Product Outlook, by Revenue (USD Million, 2015 - 2024)

-

Filtration Media

-

Membrane Filters

-

Filter Paper

-

Quartz Filter

-

Cellulose Filter Papers

-

Glass Microfiber Filter Papers

-

-

Syringe Filters

-

Syringeless Filters

-

Capsule Filters

-

Filtration Microplates

-

Other Filtration Media

-

Filtration Assemblies

-

-

Ultrafiltration Assemblies

-

Microfiltration Assemblies

-

Vacuum Filtration Assemblies

-

Reverse Osmosis Assemblies

-

Other Filtration Assemblies

-

-

Filtration Accessories

-

Filter Holders

-

Filter Dispensers

-

Filter Flasks

-

Cartridge Filters

-

Filter Funnels

-

Filter Housings

-

Seals

-

Vacuum Pumps

-

Other Laboratory Filtration Accessories

-

-

-

Technology Outlook (USD Million, 2013 - 2024)

-

Microfiltration

-

Nanofiltration

-

Vacuum Filtration

-

Ultrafiltration

-

Reverse Osmosis

-

-

Regional Outlook, by Revenue (USD Million, 2013 - 2024)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

-

Latin America

- Brazil

-

MEA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."