Laboratory Equipment Market Size, Share & Trends Analysis Report By Product (General, Analytical, Clinical, Support, Specialty), By End-use (Research Institutions, Healthcare, Veterinary), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-134-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Laboratory Equipment Market Size & Trends

The global laboratory equipment market size was estimated at USD 28.03 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.62% from 2023 to 2030. Rising investments and government research funding to support research activities are likely to boost the demand. For instance, in May 2023, the UK government decided to continue funding of USD 131.15 million for upgrading the UK’s research infrastructure and creating new opportunities for new scientific breakthroughs. This research will provide support for the scientists and researchers. These investments and government research funds are used to promote scientific research initiatives, which in turn is anticipated to foster market growth.

The increasing growth of the biotechnology and pharmaceutical industries is another factor driving the market growth. As the biotechnology and pharmaceutical industries expand, there is a greater demand for advanced and specialized laboratory equipment to support their research, development, and manufacturing processes. These industries use several different types of lab equipment, depending on the lab’s purpose.

Technological advancements in the field of laboratory equipment is expected to contribute to the growth in the coming years. Technological advancements have significantly improved the capabilities, efficiency, and functionality of laboratory equipment. To improve workflows and efficiency, automation technologies are being incorporated into laboratory equipment, such as robotics and advanced software systems. For instance, in April 2022, BYK-Gardner USA launched a new Benchtop Spectrophotometer, the color2 view, a combination of a Fluorimeter and spectrophotometer that opens completely new perspectives for managing color quality and ensuring long-term color stability.

In Feb 2022, INTEGRA Biosciences AG launched the ASSIST PLUS pipetting robot with a D-ONE single-channel pipetting module. This system efficiently automates time-consuming activities including sample normalization, serial dilutions, and hit picking. Similarly, in April 2021, Eppendorf introduced multipurpose Centrifuge 5910 Ri to boost efficiency in the laboratory. The new Centrifuge 5910 Ri offers scientists with advanced features that accelerate and simplify the centrifugation steps of their workflow.

Product Insights

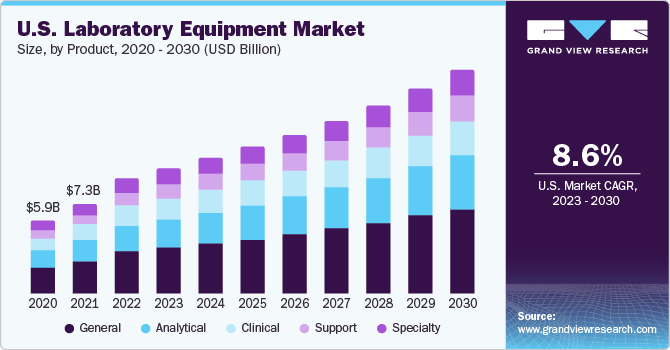

General laboratory equipment dominated the market and accounted for the largest revenue share of 31.07% in 2022. The segment is expected to continue its dominance over the forecast period. The general equipment is designed to meet a variety of laboratory needs. Such equipment has a wide range of applications and experiments, making it a versatile choice for several research fields. In November 2022, CIQEK launched a new electron microscope, the SEM3300, a tungsten filament scanning electron microscope. Similarly, in Sep 2019, OHAUS introduced the new 400 series of portable water analysis meters.

The analytical laboratory equipment market is expected to grow at the fastest CAGR over the forecast period. Researchers use analytical instruments, such as chromatography systems, spectroscopy devices, and mass spectrometers, to investigate and understand complex chemical and biological phenomena. Advancements in these analytical technologies enable researchers to achieve greater sensitivity, resolution, and efficiency in their experiments.

End-use Insights

The healthcare segment held the largest revenue share of 43.08% in 2022. Due to the rising demand for diagnostic tests, medical research, and medication development, the healthcare sector is one of the biggest consumers of laboratory equipment. The need for reliable and accurate laboratory equipment is crucial for healthcare providers to monitor patient health, diagnose disease, and develop new treatments. The healthcare sector makes significant investments in R&D projects to advance medical knowledge, develop new therapies, and enhance patient care.

Laboratory equipment are necessary for conducting experiments, analyzing samples, and studying various aspects of diseases and treatments. For instance, in Jan 2023, Siemens Healthineers launched a laboratory equipment immunoassay instrument research & development center in Swords, Ireland to focus on unlocking breakthrough innovations in lab equipment used to find cancer, blood disorders, and infectious diseases.

The veterinary segment is expected to grow at the fastest CAGR over the forecast period. Veterinary medicine encompasses a broad range of diagnostic and research activities that require specialized lab equipment. Veterinary diagnostics have advanced, enabling early detection and requiring accurate diagnosis of diseases in animals. Lab equipment such as analyzers for hematology, chemistry, and molecular diagnostics is crucial for diagnosing infections, evaluating organ function, and managing chronic diseases in animals.

Regional Insights

North America held the largest market share of 38% in 2022 and is expected to continue its dominance over the forecast period. The regional growth can be attributed to the robust healthcare infrastructure, advanced diagnostic capabilities, presence of key biotech & pharmaceutical companies, and high research & development activities. For instance, according to a report published in September 2021, by Pharmaceutical Research and Manufacturers of America, biopharmaceutical companies invested about USD 591 billion in research & development till 2021.

Furthermore, the presence of key market players and the frequent development of new products are driving the growth of the market. For instance, in September 2021, The Baker Company, Inc., launched ReCO2ver, a cell culture incubator that will benefit in the fields of microbiology, cell culture, and biological safety even more.

The regulatory environment in the region, including stringent quality standards & regulations for diagnostic testing, drives the adoption of high-quality lab equipment. Compliance with regulations such as the Food and Drug Administration (FDA) and Clinical Laboratory Improvement Amendments (CLIA) requirements influences the demand for lab equipment that meets the specified standards.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period owing to the technological advancements in the healthcare industry. The region is known for its early adoption of innovative laboratory technologies, such as molecular diagnostic techniques, automated systems, and advanced diagnostic platforms. These advancements are anticipated to accelerate the demand for advanced laboratory equipment. For instance, in February 2022, Agilent Technologies, Inc. acquired advanced artificial intelligence (AI) technology developed by virtual control, to boost lab productivity.

Key Companies & Market Share Insights

Key companies focus on research and development to increase their products which will help the lab equipment market to grow even more. Market players are also taking strategic initiatives to grow their worldwide footprints, with key market developments such as mergers and acquisitions, collaborations, product launches, partnerships, and joint ventures. For instance, in June 2023, Waters Corporation and Sartorius AG extended their collaboration to offer a wide range of bioanalytical solutions for downstream biomanufacturing. Some prominent players in the global laboratory equipment market include:

-

Sartorius AG

-

Bio-Rad Laboratories, Inc.

-

FUJIFILM Holdings Corporation

-

Thermo Fisher Scientific Inc.

-

Agilent Technologies, Inc.

Laboratory Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 30.06 billion |

|

Revenue forecast in 2030 |

USD 50.27 billion |

|

Growth rate |

CAGR of 7.62% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors & trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

EarlySign; Cancer Center.ai; Microsoft; Flatiron; Path AI; Therapixel; Tempus; Paige AI, Inc.; Kheiron Medical Technologies Limited; SkinVision |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Laboratory Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory equipment market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

General

-

Analytical

-

Clinical

-

Support

-

Specialty

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Institutions

-

Healthcare

-

Veterinary

-

Others

-

-

Regional Outlook (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory equipment market size was valued at USD 28.03 billion in 2022 and is expected to reach USD 30.06 billion in 2023.

b. The global laboratory equipment market is expected to grow at a compound annual growth rate of 7.62% from 2023 to 2030 to reach USD 50.27 billion by 2030.

b. North America dominated the laboratory equipment market with a share of 37.7% in 2022. This is attributable to the increasing growth of biotechnology and pharmaceutical companies, and the presence of key players in the region.

b. Key companies operating in the laboratory equipment market are Sartorius AG, Bio-Rad Laboratories, Inc., FUJIFILM Holdings Corporation, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Waters Corporation, Bruker Corporation, Danaher Corporation, PerkinElmer Inc., and Shimadzu Corporation.

b. Key factors that are driving the laboratory equipment market growth include technological advancements, increasing Research & Development (R&D) activities, rising demand for diagnostic testing, and stringent regulations & quality standards.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."