- Home

- »

- Medical Devices

- »

-

Laboratory Consumables Market Size, Industry Report, 2030GVR Report cover

![Laboratory Consumables Market Size, Share & Trends Report]()

Laboratory Consumables Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pipettes & Tips, Vials & Containers), By Application (Clinical Diagnostics, Pharma & Biopharma Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-489-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laboratory Consumables Market Summary

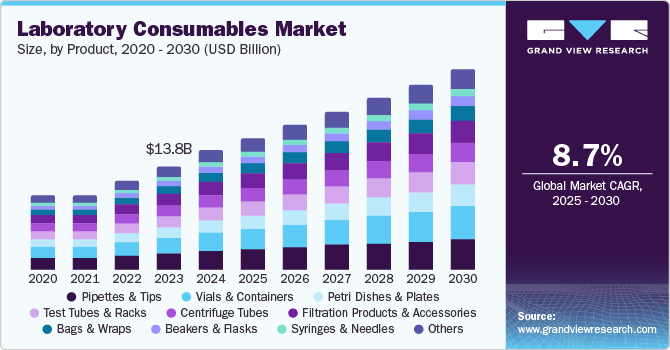

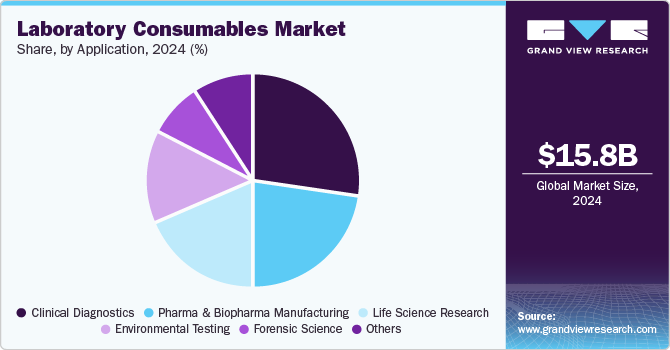

The global laboratory consumables market size was estimated at USD 15.8 billion in 2024 and is projected to reach USD 26.58 billion by 2030, growing at a CAGR of 8.65% from 2025 to 2030. The market is primarily driven by increased funding and investments in R&D activities within the pharmaceutical and biotechnology sectors, increasing partnerships & collaborations, and growing initiatives toward sustainable solutions.

Key Market Trends & Insights

- North America laboratory consumables market dominated the global industry and accounted for a 36.25% revenue share in 2024.

- The laboratory consumables market in the U.S. held a significant share of the North American market in 2024.

- Based on product, the vials & containers segment held the largest share of 15.06% in 2024.

- Based on application, the clinical diagnostics segment held the largest share of 27.22% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.8 Billion

- 2030 Projected Market Size: USD 26.58 Billion

- CAGR (2025-2030): 8.65%

- North America: Largest market in 2024

For instance, in June 2024, Eppendorf SE released a press release stating that in order to become more sustainable, future laboratory consumables made from plastic must be manufactured using renewable or recycled raw materials.

Steady growth is anticipated in the coming years due to the consistent and reliable availability of laboratory equipment. For instance, in October 2023, the Government of Canada announced a significant investment to strengthen domestic biomanufacturing supply chains. Quebec's Minister of Economy, Innovation and Energy, along with Minister of Health Christian Dubé, unveiled a USD 22.25 million (Canadian Dollar 29.77 million) investment from the Strategic Innovation Fund to support Pharmascience Inc.'s USD 88.21 million (Canadian Dollar 119.33 million) project. The Asia Pacific region has emerged as the leading contributor to this growth, fueled by rising adoption of clinical diagnostic testing, higher disposable incomes, expanded research, development, and innovation activities, and increasing awareness of disease prevention and early detection.

The demand for laboratory products is growing due to technological advancements in chemical and biological research. The rising number of clinical laboratory tests and life science research activities is driving the need for laboratory disposable products. A growing focus on enhancing healthcare outcomes has led to the adoption of advanced laboratory equipment for quicker and more precise diagnosis and treatment, further propelling the growth of the laboratory equipment and disposables market. Additionally, the market is expected to sustain consistent demand as procurement managers in the pharmaceutical and healthcare sectors prioritize a steady supply of essential laboratory devices and equipment.

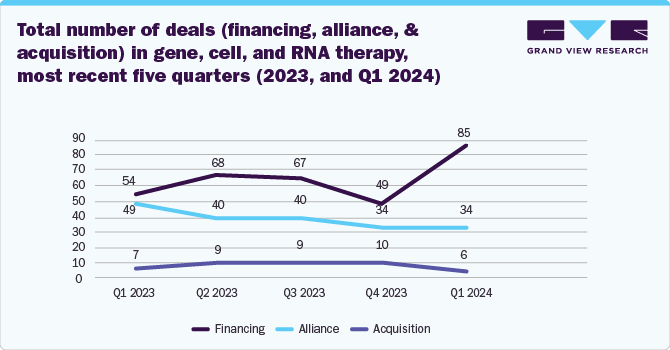

Moreover, the industry is driven by ongoing advancements in biopharmaceuticals, gene therapies, and personalized medicine, which are increasing the demand for high-quality laboratory products. For instance, in January 2024, SCHOTT Pharma announced the launch of new vials for mRNA and gene therapy. These new vials are optimized for deep-cold storage of drugs.

Notably, in November 2023, STEMart launched new Filter Testing Services tailored for pharmaceutical and medical device manufacturers. These services are designed to verify the performance of filters used in manufacturing processes, ensuring product safety and efficacy. By addressing critical quality and compliance requirements, such innovations are helping manufacturers maintain stringent standards, further fueling growth in the laboratory consumables market. This reflects the sector's commitment to supporting cutting-edge research and quality-driven manufacturing processes.

Technological advancements are revolutionizing laboratory capabilities, enabling scientists and personnel to work with greater accuracy and efficiency. The widespread adoption of automation, miniaturization, artificial intelligence, and smart technologies is making lab operations more streamlined and effective. However, the increasing demand for faster results has created a need for laboratories to be both agile and adaptable. Optimizing the procurement process is a critical strategy for laboratory managers aiming to enhance productivity. Laboratory suppliers are simplifying product selection and procurement to meet these demands.

Innovative laboratory equipment is also driving increased utilization. Modern instruments feature intuitive user interfaces for ease of use, such as BrandTech Scientific, Inc.'s electronic pipettes with touchscreen operation and automated tip ejection. These devices incorporate smartphone-like screens for seamless functionality. Similarly, in October 2022, Waters introduced the Extraction+ Connected Device, a software-controlled tool for the Waters Andrew+ Pipetting Robot. This innovation automates the processing of biological, food, forensic, and environmental samples using solid-phase extraction (SPE), further exemplifying the impact of advanced technology on laboratory operations.

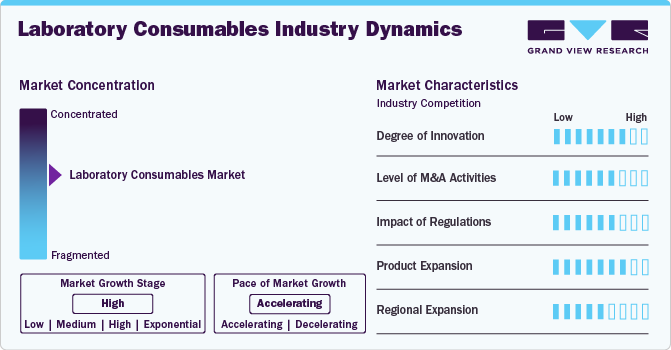

Market Concentration & Characteristics

The industry demonstrates a high degree of innovation, driven by advancements such as automation, artificial intelligence, miniaturization, and smart technologies. For instance, in October 2023, Sartorius, part of The Life Science Group, launched the Picus 2 Electronic Pipette, the newest member of its electronic pipette range. Featuring enhanced connectivity and outstanding performance, the Picus 2 establishes a new benchmark for efficiency, allowing for precise and repeatable dispensing in biopharmaceutical and quality control applications. Modern instruments now feature user-friendly interfaces, enhanced precision, and automation capabilities, such as touchscreen pipettes and robotic sample processors. These innovations improve efficiency, accuracy, and adaptability, meeting the evolving needs of scientific research and diagnostics while streamlining laboratory operations.

Regulations significantly impact the industry by ensuring product safety, quality, and compliance. Strict standards, especially in healthcare and pharmaceuticals, drive innovation and the development of high-quality equipment and disposables. Compliance requirements also influence procurement decisions, encouraging suppliers to provide certified products that meet regulatory benchmarks, thereby fostering trust and consistency in critical research and diagnostic applications.

Mergers and acquisitions (M&A) activity is robust, driven by the need for portfolio expansion, technological innovation, and market consolidation. Companies strategically acquire specialized firms to enhance capabilities in automation, diagnostics, and life sciences. These activities enable market leaders to strengthen global reach, streamline supply chains, and cater to the growing demand for advanced laboratory solutions.

Product expansion is accelerating, fueled by advancements in technology and evolving research needs. Companies are introducing innovative solutions, such as automated systems, smart devices, and eco-friendly disposables, to meet diverse scientific and diagnostic applications. For instance, in April 2024, Asahi Kasei announced the launch of a membrane system for producing Water for Injection (WFI), a sterile water used in the preparation of injections. This expansion enhances efficiency, precision, and sustainability, enabling laboratories to adapt to increasing workloads and complex analytical demands across various industries.

Global expansion is driven by rising research activities, healthcare advancements, and increased demand for diagnostic tools worldwide. Key players are strengthening their presence in emerging markets, particularly in Asia-Pacific, through partnerships, distribution networks, and localized manufacturing. This expansion supports diverse scientific needs, addresses regional healthcare challenges, and capitalizes on growing investments in life sciences and biotechnology.

Product Insights

The vials & containers segment held the largest share of 15.06% in 2024, driven by increasing demand for sustainable and functional packaging solutions. For instance, in October 2024, Berry Global introduced ClariPPil bottles, a fully recyclable, high-performance alternative to traditional colored PET pill bottles. These innovative containers offer a reduced carbon footprint, improved recyclability, and enhanced product protection while maintaining excellent functionality and visual appeal. Such advancements align with the industry's focus on sustainability and efficiency, making vials and containers a crucial segment for supporting research, diagnostics, and pharmaceutical packaging needs across global markets.

The pipettes and tips segment is witnessing robust growth, driven by the expansion of manufacturing and R&D facilities worldwide. For instance, in March 2024, AdhexPharma S.A.S. announced its plans for a state-of-the-art facility in Chenôve, France. This initiative highlights AdhexPharma's continued dedication to innovation and sustainability within the pharmaceutical sector. Increasing research activities in biotechnology, pharmaceuticals, and diagnostics are fueling demand for high-quality pipetting solutions. Advanced designs, such as ergonomic and automated pipettes, are enhancing efficiency and precision in liquid handling. Additionally, the rising establishment of R&D units is boosting the need for disposable and reusable pipette tips, further driving market expansion. This growth reflects the critical role of pipettes and tips in supporting accurate, reliable laboratory workflows across various scientific and industrial applications.

Application Insights

The clinical diagnostics segment held the largest share of 27.22% in 2024, fueled by advancements in diagnostic technologies and an increasing focus on early disease detection. The rising prevalence of chronic and infectious diseases has heightened the demand for accurate and rapid diagnostic tools. Laboratories are adopting innovative equipment, such as automated analyzers and molecular diagnostic platforms, to enhance testing efficiency and reliability. Additionally, expanding healthcare infrastructure and growing awareness about preventive healthcare are further propelling the market. This growth underscores the critical importance of clinical diagnostics in delivering precise, timely results that support better patient outcomes and effective disease management.

The pharma & biopharma manufacturing segment is expected to grow at a significant rate over the forecast period, propelled by increasing investments in drug development and biologics production. Rising demand for personalized medicine, vaccines, and biopharmaceuticals is boosting the need for specialized laboratory equipment and consumables. Laboratories are leveraging advanced technologies for quality control, formulation development, and process optimization. Additionally, the growth of contract manufacturing organizations (CMOs) and research activities is further enhancing market demand. As pharma and biopharma manufacturing scales to meet global healthcare needs, the demand for reliable laboratory products to ensure compliance, efficiency, and precision continues to rise steadily.

Regional Insights

North America laboratory consumables market dominated the global industry and accounted for a 36.25% revenue share in 2024. Several factors drive this expansion, including rising demand for precision in medical research, diagnostics, and pharmaceutical manufacturing. Biotechnology and pharmaceutical industries are expanding rapidly, pushing for innovations in laboratory consumable technology. Innovations in filter technologies, such as single-use filtration systems, membrane filters, and nanofiltration, enhance filtration efficiency and reduce cross-contamination risks. The trend toward sustainable production also drives the development of eco-friendly filter materials. For instance, in June 2024, Cytiva (Danaher Corporation) launched Supor Prime sterilizing-grade filters, tailored to meet the specific filtration needs of customers producing high-concentration biologic drugs.

U.S. Laboratory Consumables Market Trends

Thel aboratory consumables market in the U.S.held a significant share of the North American market in 2024. Regulatory requirements by the FDA and other agencies, emphasizing stringent contamination control, drive the adoption of pharmaceutical filters. In response, companies are investing heavily in R&D to develop innovative filtration solutions, such as single-use filtration systems, membrane filters, and nanofiltration, which enhance efficiency and reduce production costs. In September 2024, Solventum’s Bioprocessing Filtration Business launched the 3M Harvest RC Centrate Chromatographic Clarifier, an addition to the 3M Harvest RC Chromatographic Clarifier platform. This new solution simplifies clarification process development, reduces risks during technology transfers, and easily integrates into existing infrastructures, accelerating time to market. This innovation drives efficiency, cost-effectiveness, and better patient outcomes.

Europe Laboratory Consumables Market Trends

The laboratory consumables market in Europe is experiencing notable growth, driven by increased investment and expansion from global key players, alongside strong government support. Major companies are expanding their operations and manufacturing capacities in Europe to meet the rising demand for advanced medical technologies, fueled by the region's aging population and the prevalence of chronic diseases. For instance, in March 2023, 3M announced plans to invest USD 146.0 million to expand its capabilities in biopharma filtration technology. This investment will encompass facility and equipment upgrades, as well as the creation of 60 full-time positions across 3M’s manufacturing sites in Europe. Investments in cutting-edge sectors such as diagnostics, surgical tools, and wearable health technologies are particularly significant.

The UK laboratory consumables market is one of the major markets in the region, driven by innovation, advanced technology, and strong government support. The development of cutting-edge pipetting technologies, such as electronic and automated pipettes, has improved accuracy, speed, and ease of use in laboratories. For instance, in March 2024, Alpha Laboratories Ltd. introduced Picus 2, the latest innovation in electronic pipetting technology from Sartorius. Picus 2 is designed to revolutionize the pipetting experience, offering unmatched precision, speed, and connectivity and setting a new benchmark for laboratory pipettes.

The laboratory consumables market in Germany is witnessing notable growth. Key factors include the rising prevalence of cardiovascular and chronic diseases, along with a growing geriatric population. Additionally, increased R&D spending, driven by the highly regulated and sensitive nature of pharmaceutical development, is expected to boost revenue generation in the country.

Asia Pacific Laboratory Consumables Market Trends

The laboratory consumables market in Asia Pacific is experiencing robust growth due to significant investments in pharmaceutical manufacturing and expansions into the region. Major pharmaceutical companies are establishing and expanding manufacturing units in countries like China, India, and Southeast Asia to meet the rising demand for other medical devices. For instance, in January 2024, AbbVie announced a USD 223.0 million expansion of its biologics manufacturing facility in Singapore, increasing its drug-substance capacity by 24,000 liters. The expansion project is set to begin immediately, with completion expected by 2026.

China laboratory consumables market is expanding notably due to the expansion of pharmaceutical and biologics manufacturing in the country. Major pharmaceutical companies are increasing their production capacities in China to meet the rising demand for advanced therapies, particularly in biologics.

The laboratory consumables market in Japan is expanding significantly, driven by the expansion of global and domestic players in the country. Japan is a global leader in the pharmaceutical and biotechnology industries, making it a strategic location for companies seeking to expand their presence in the other medical device sector. For instance, in May 2024, Asahi Kasei Corp. announced the completion of Asahi Kasei Medical's assembly plant for virus-removal filters in Nabeela, Japan. Asahi Kasei Medical's bioprocess business includes the production of Panova virus-removal filters and equipment utilized in the manufacturing of biotherapeutics.

Latin America Laboratory Consumables Market Trends

The laboratory consumables market in Latin America is growing due to the expansion of pharmaceutical industries and the increasing prevalence of chronic disorders like cancer. Latin America has seen significant investment in healthcare and pharmaceutical infrastructure, with companies expanding their operations to meet the rising demand for medical treatments.

Middle East & Africa Laboratory Consumables Market Trends

The laboratory consumables market in the Middle East & Africais poised for significant growth driven by several factors. The increasing prevalence of chronic diseases and a rising focus on healthcare quality are spurring demand for advanced medical technologies. In addition, growing investments in healthcare infrastructure and research and development are enhancing the capabilities of local manufacturers.

Saudi Arabia laboratory consumables market is expanding rapidly, driven by increasing healthcare needs and research advancements. A significant factor contributing to this growth is the high prevalence of chronic diseases such as diabetes. According to the International Diabetes Federation (IDF), Saudi Arabia had a 17.7% prevalence of diabetes among adults in 2021, with 4,274,100 total cases

Key Laboratory Consumables Company Insights

The scenario in the laboratory consumables market is highly competitive, with key players such as Abbott Laboratories; Danaher Corporation; Bio-Rad Laboratories; Merck KGaA; Eppendorf SE; Corning Incorporated; Agilent Technologies; QIAGEN; Waters; Thermo Fisher Scientific, Inc.; Bruker; Sysmex Corporation; Shimadzu Corporation; Parker-Hannifin Corporation; Sartorius AG; Eaton; PerkinElmer Inc. holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Laboratory Consumables Companies:

The following are the leading companies in the laboratory consumables market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Danaher Corporation

- Bio-Rad Laboratories

- Merck KGaA

- Eppendorf SE

- Corning Incorporated

- Agilent Technologies

- QIAGEN

- Waters

- Thermo Fisher Scientific, Inc.

- Bruker

- Sysmex Corporation

- Shimadzu Corporation

- Parker-Hannifin Corporation

- Sartorius AG

- Eaton

- PerkinElmer Inc.

- Berry Global Inc

- SCHOTT Pharma

- Amneal Pharmaceuticals LLC

- Eli Lilly and Company

- METTLER TOLEDO

- Other Prominent Players

Recent Developments

-

In September 2024, SCHOTT Pharma, one of the leaders in pharmaceutical drug containment and delivery solutions, joined forces with Gerresheimer AG (and Stevanato Group S.p.A. to form a strategic alliance called the "Alliance for RTU." This collaboration aims to promote the market adoption of Ready-to-Use (RTU) vials and cartridges.

-

In September 2024, Opentrons Labworks, Inc. introduced the Opentrons Flex Prep robot, featuring innovative no-code software. This new system enables users to easily configure a pipetting task and execute the workflow directly via Flex Prep's touchscreen interface, streamlining lab automation processes.

-

In August 2024, Eli Lilly and Company announced that Zepbound (tirzepatide) is now available in 2.5 mg and 5 mg single-dose vials for self-pay patients with an on-label prescription. This move significantly increases the supply of Zepbound in response to high demand. The single-dose vials are offered at a discount of 50% or more compared to the list price of other incretin (GLP-1) medications for obesity. This new option will help millions of adults struggling with obesity gain access to the medication they need, particularly those who are ineligible for the Zepbound savings card program, lack employer coverage, or need to self-pay outside of insurance.

-

In August 2024, Amneal Pharmaceuticals, Inc. announced that it has received approval from the U.S. Food and Drug Administration (FDA) for its Abbreviated New Drug Application (ANDA) for Propofol Injectable Emulsion USP. The approved formulations include 200 mg/20 mL (10 mg/mL), 500 mg/50 mL (10 mg/mL), and 1,000 mg/100 mL (10 mg/mL) in single-dose vials.

-

In June 2024, Cytiva (Danaher Corporation) announced the launch of its Supor Prime sterilizing grade filters, the latest addition to its extensive filtration portfolio.

-

In May 2024, Hamilton unveiled its latest innovation, ZEUS X1. This cutting-edge system is designed for effortless OEM integration, combining Hamilton's advanced CO-RE II technology with groundbreaking air displacement pipetting technology.

-

In January 2024, SCHOTT Pharma announced the launch of new vials for mRNA and gene therapy.

-

In September 2023, Sartorius Life Science Group announced the launch of the Picus 2 Electronic Pipette, the newest enhancement to its line of electronic pipettes. With its cutting-edge connectivity features and outstanding performance, the Picus 2 establishes a new benchmark for efficient and consistent dispensing in biopharmaceutical and quality control applications.

-

In June 2023, 3M announced a USD 150 million investment to enhance its biopharma filtration capabilities. This investment will fund equipment upgrades and facility improvements in Europe, aimed at accelerating the company's ability to deliver and develop critical filtration equipment for biological processes, bioprocessing, and small molecule applications.

Laboratory Consumables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.56 billion

Revenue forecast in 2030

USD 26.58 billion

Growth Rate

CAGR of 8.65% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, UK, Mexico, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Abbott Laboratories; Danaher Corporation; Bio-Rad Laboratories; Merck KGaA; Eppendorf SE; Corning Incorporated; Agilent Technologies; QIAGEN; Waters; Thermo Fisher Scientific, Inc.; Bruker; Sysmex Corporation; Shimadzu Corporation; Parker-Hannifin Corporation; Sartorius AG; Eaton; PerkinElmer Inc., Berry Global Inc, SCHOTT Pharma

Amneal Pharmaceuticals LLC, Eli Lilly and Company, METTLER TOLEDO, and Other Prominent Players.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Consumables Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory consumables market report on the basis of product, application and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pipettes & Tips

-

Vials & Containers

-

Petri Dishes & Plates

-

Test Tubes & Racks

-

Centrifuge Tubes

-

Filtration Products & Accessories

-

Bags & Wraps

-

Beakers & Flasks

-

Syringes & Needles

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Diagnostics

-

Pharma & Biopharma Manufacturing

-

Life Science Research

-

Environmental Testing

-

Forensic Science

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory consumables market size was valued at USD 15.84 billion in 2024 and is expected to reach USD 17.56 billion 2030.

b. The global laboratory consumables market is projected to grow at a compound annual growth rate (CAGR) of 8.65% from 2025 to 2030 to reach USD 26.58 billion by 2030.

b. The vials & containers segment accounted for the the largest share of 15.06% in 2024 and is projected to grow fastest in the coming years, driven by increasing demand for sustainable and functional packaging solutions.

b. Abbott Laboratories; Danaher Corporation; Bio-Rad Laboratories; Merck KGaA; Eppendorf SE; Corning Incorporated; Agilent Technologies; QIAGEN; Waters; Thermo Fisher Scientific, Inc.; Bruker; Sysmex Corporation; Shimadzu Corporation; Parker-Hannifin Corporation; Sartorius AG; Eaton; PerkinElmer Inc., Berry Global Inc, SCHOTT Pharma, Amneal Pharmaceuticals LLC, Eli Lilly and Company, and METTLER TOLEDO.

b. Increasing funding and investments in R&D activities within the pharmaceutical and biotechnology sectors, growing partnerships & collaborations, and rising initiatives towards sustainable solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.