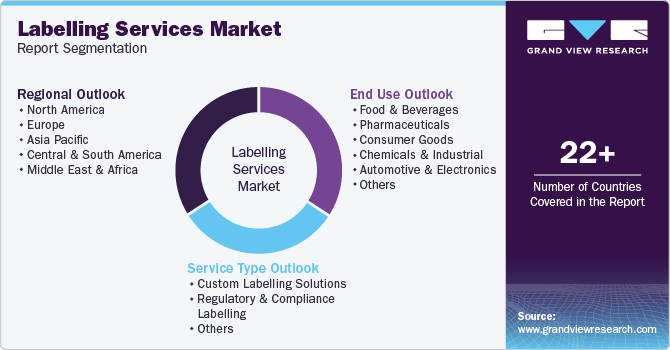

Labelling Services Market Size, Share & Trends Analysis Report By Service Type (Custom Labelling Solutions, Regulatory & Compliance Labelling), By End Use (Food & Beverages,Pharmaceuticals), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-514-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Labelling Services Market Size & Trends

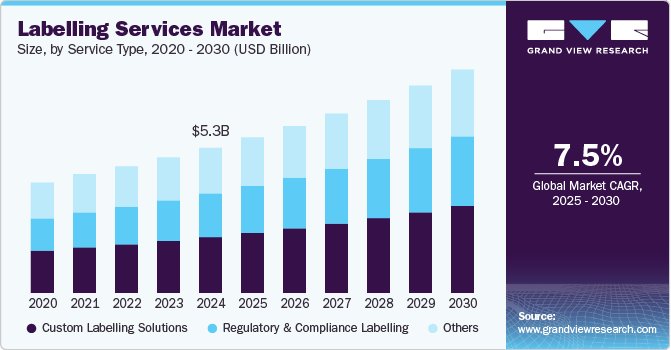

The global labelling services market size was valued at USD 5,270 million in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. The global labeling services market is expanding at a rapid pace, driven by regulatory compliance, e-commerce growth, technological advancements, sustainability trends, and increasing consumer demand for transparency. As businesses continue to innovate and adapt to evolving market conditions, the need for smart, customized, and eco-friendly labeling solutions will only continue to rise.

Companies investing in automation, RFID, digital printing, and sustainable materials are well-positioned to capitalize on this growing demand and gain a competitive edge in the market.

Governments and regulatory bodies worldwide are imposing stricter labeling standards to ensure product safety, authenticity, and transparency. Industries such as pharmaceuticals, food & beverages, and chemicals require detailed labeling to comply with regulations set by organizations like the FDA (U.S.), EU FIC (Europe), CFDA (China), and FSSAI (India). Labels must contain essential information such as ingredients, nutritional facts, expiration dates, and safety warnings. In addition, the growing focus on track-and-trace solutions, particularly in pharmaceutical and medical device industries, is driving demand for RFID-enabled, barcoded, and serialized labels to meet global supply chain transparency requirements.

The rapid expansion of e-commerce and digital retail platforms has significantly increased the demand for logistics and shipping labels. Companies such as Amazon, Alibaba, and Flipkart rely heavily on barcodes, QR codes, and RFID labels to streamline inventory management, warehouse operations, and last-mile delivery tracking. With global e-commerce sales projected to grow, businesses are investing in advanced labeling solutions to improve efficiency, reduce errors, and enhance customer experience through features like return labels, smart tracking, and anti-counterfeiting measures.

Modern consumers are more health-conscious and environmentally aware, driving the need for clear, informative, and sustainable labeling solutions. Shoppers expect detailed product information, including organic certifications, sustainability claims, allergen warnings, and ethical sourcing details. This demand has led to the widespread adoption of smart labels, including QR codes and NFC technology, which allow consumers to access in-depth product information via their smartphones. In addition, brands are focusing on personalized and visually appealing labels to enhance customer engagement and reinforce trust.

The labeling industry is undergoing a technological transformation with the rise of smart labeling solutions. Companies are integrating RFID, NFC, and blockchain-based labels to enable real-time tracking, authentication, and anti-counterfeiting measures. The adoption of variable data printing (VDP) and digital printing technologies allows businesses to create custom, high-quality, and cost-effective labels in smaller batches, reducing waste and improving flexibility. These innovations cater to industries such as luxury goods, pharmaceuticals, and high-end electronics, where counterfeit prevention and product authentication are critical.

Service Type Insights

The service type segment recorded the largest market revenue share of over 38.5% in 2024. Custom labeling solutions are experiencing significant demand as businesses seek unique, brand-enhancing, and consumer-engaging labels tailored to their specific needs. In an increasingly competitive market, companies recognize that product labels are critical touchpoints that influence consumer purchasing decisions and reinforce brand identity.

With the rise of e-commerce, direct-to-consumer (DTC) brands, and niche product categories, businesses are investing in custom labeling solutions to enhance brand visibility. Variable data printing (VDP) and digital printing technologies allow companies to create high-quality, customized labels in small batches, catering to niche markets such as craft beverages, boutique cosmetics, and specialty foods. This personalization trend is also visible in industries like luxury goods, electronics, and automotive, where unique serial codes, holographic labels, and security features are used to prevent counterfeiting and strengthen brand authenticity.

Moreover, governments and industry regulators are continuously tightening labeling requirements to ensure consumer safety, product authenticity, and environmental responsibility. Compliance with these evolving regulations has made regulatory and compliance labeling an essential service, particularly in highly regulated industries such as pharmaceuticals, food & beverages, chemicals, and medical devices.

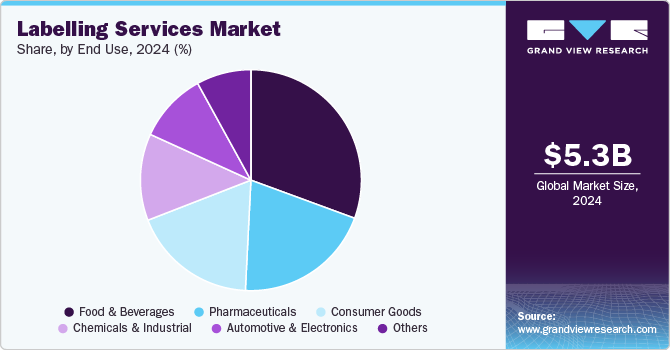

End Use Insights

The food & beverages industry segment recorded the largest market share of over 30.6% in 2024. This is attributed to strict government regulations, growing consumer awareness, and the shift toward sustainable packaging. Governments and health organizations worldwide are implementing stringent food labeling laws to ensure safety, traceability, and informed purchasing decisions. Governments have mandated clear, standardized labels that provide critical information about ingredients, allergens, expiration dates, and nutritional content. For instance, in the U.S., the FDA Nutrition Facts Labeling Rule requires clearer calorie counts, added sugars disclosure, and adjusted serving sizes. Similarly, the EU Food Information Regulation (EU FIC) enforces allergen declarations and country-of-origin labeling (COOL).

Furthermore, the pharmaceutical industry is one of the most highly regulated sectors, requiring detailed, traceable, and tamper-proof labeling to ensure patient safety, regulatory compliance, and counterfeit prevention. Governments worldwide have introduced track-and-trace systems, making specialized labeling services crucial for drug manufacturers. This is expected to propel the industry demand for labeling services at the fastest CAGR of 8.1% over the coming years.

Regional Insights

North America labelling services market dominated globally and accounted for the largest revenue share of over 33.9% in 2024. It is anticipated to grow at a CAGR of 7.1% over the forecast period. This region is a mature and highly regulated market for labeling services, with industries such as pharmaceuticals, food & beverages, chemicals, and retail demanding highly standardized, compliant, and sustainable labeling solutions. Government bodies like the FDA (Food and Drug Administration), USDA (U.S. Department of Agriculture), and EPA (Environmental Protection Agency) have implemented stringent labeling requirements to ensure product transparency and consumer safety.

U.S. Labelling Services Market Trends

Thelabelling services industry in the U.S. is primarily driven by regulatory compliance. The FDA’s Nutrition Facts Labeling Rule requires brands to display calorie counts clearly, added sugars, and serving sizes, increasing the demand for updated, digital, and high-accuracy labeling solutions. Similarly, the Drug Supply Chain Security Act (DSCSA) mandates track-and-trace serialization for pharmaceuticals, leading to the widespread adoption of RFID, QR codes, and tamper-proof security labels.

Asia Pacific Labeling Services Market Trends

The Asia Pacific labelling services industry is experiencing the fastest growth in the labeling services market, driven by rapid industrialization, booming e-commerce, and evolving regulatory frameworks. Countries like China, India, Japan, and South Korea have emerged as global manufacturing hubs, increasing the demand for industrial, pharmaceutical, and logistics labeling solutions.

The China labelling services industry growth is driven by industrial expansion, strict government regulations, and the rise of digital commerce. The Chinese government has implemented stricter labeling laws across sectors like food, pharmaceuticals, chemicals, and exports, fueling the demand for compliance-driven, high-security, and intelligent labeling solutions.

Europe Labelling Services Market Trends

Europe labelling services industry has some of the strictest labeling regulations in the world, making it a key driver of demand for compliance-based and sustainable labeling solutions. The European Food Information Regulation (EU FIC) mandates that food products carry clear ingredient lists, allergen warnings, and country-of-origin labeling (COOL), increasing the need for detailed and multilingual food labels. In addition, the European Medicines Agency (EMA) enforces serialization mandates under the Falsified Medicines Directive (FMD), requiring pharmaceutical companies to implement unique barcodes, tamper-proof packaging, and tracking labels to prevent counterfeit drugs.

The labelling services industry in Germany is primarily driven by regulatory compliance across industries. The EU Falsified Medicines Directive (FMD) requires German pharmaceutical companies to implement tamper-proof, serialized, and traceable labeling systems, increasing demand for security-enhanced barcodes, holographic seals, and RFID-based authentication labels. Similarly, Germany’s strict food labeling laws under the European Food Information Regulation (EU FIC) mandate detailed ingredient lists, allergen disclosures, and front-of-pack nutrition labeling, boosting demand for multi-lingual and high-precision printed labels.

Key Labelling Services Company Insights

The global labelling services industry exhibits intense competition among both established manufacturers and emerging players. Key industry players dominate significant market share through their extensive product portfolios, strong R&D capabilities, and established distribution networks. These companies frequently engage in strategic initiatives such as mergers, acquisitions, and product innovations to maintain their competitive edge.

- In November 2024, Celegence’s CAPTIS won the Innovation Award at the prestigious TOPRA Awards for Regulatory Excellence 2024. The award, sponsored by fme US, recognizes outstanding achievements in the successful implementation of innovative ideas within the regulatory affairs profession.

Key Labelling Services Companies:

The following are the leading companies in the labelling services market. These companies collectively hold the largest market share and dictate industry trends.

- Celegence

- Freyr Solutions

- TransPerfect

- FineLine

- Resource Label Group

- General Data Company, Inc.

- Arrow System Inc.

- Tailored Label Products, Inc

Labelling Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5,649.9 million |

|

Revenue forecast in 2030 |

USD 8,111.1 million |

|

Growth Rate |

CAGR of 7.5% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, end use, region |

|

States scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Key companies profiled |

Celegence, Freyr Solutions, TransPerfect, FineLine, Resource Label Group, General Data Company, Inc., Arrow System Inc., Tailored Label Products, In |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Labelling Services Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global labelling services market report based on service type, end use, and region:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Custom Labelling Solutions

-

Regulatory & Compliance Labelling

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Consumer Goods

-

Chemicals & Industrial

-

Automotive & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global labelling services market size was estimated at USD 5,270 million in 2024 and is expected to reach USD 5,649.9 million in 2025.

b. The global labelling services market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 8,111.1 million by 2030.

b. The custom labelling solutions service type segment dominated the labelling services market with a share of 38.5% in 2024 as businesses seek unique, brand-enhancing, and consumer-engaging labels tailored to their specific needs.

b. Some of the key players operating in the labelling services market include Celegence, Freyr Solutions, TransPerfect, FineLine, Resource Label Group, General Data Company, Inc., Arrow System Inc., and Tailored Label Products, In

b. The key factors that are driving the labelling services market include several key factors, including increasing regulatory requirements, advancements in technology, rising consumer awareness, and expanding industries such as e-commerce, food & beverages, and pharmaceuticals.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."