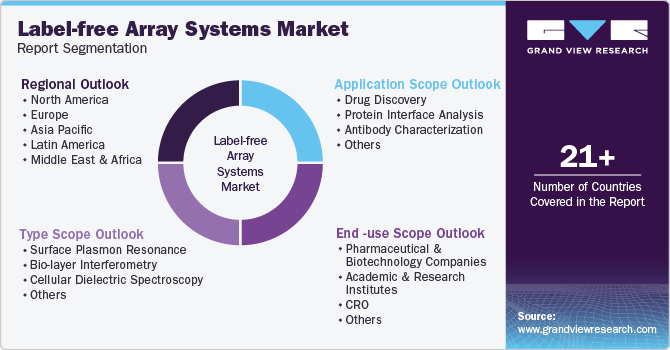

Label-free Array Systems Market Size, Share & Trends Analysis Report By Type (Surface Plasmon Resonance, Bio-layer Interferometry, Cellular Dielectric Spectroscopy), By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-037-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Label-free Array Systems Market Trends

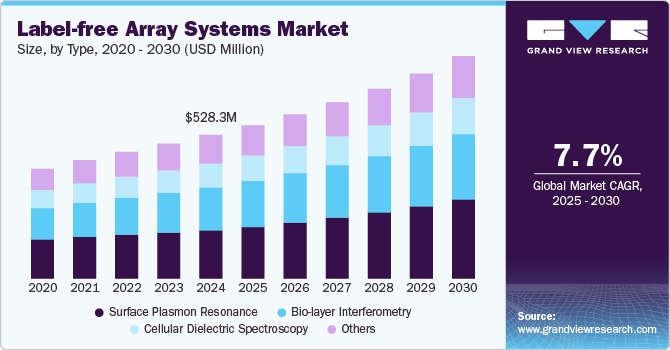

The global label-free array systems market size was estimated at USD 528.3 million in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. The increasing demand for personalized medicine, as well as a variety of other factors such as the prevalence of chronic diseases, increased research activities in biomedical science, the need for high-throughput screening, and the demand for cost-effective and efficient systems.

Label-free detection technology, also known as label-free sensing or label-free analysis, has emerged as a powerful tool in biological research. Unlike traditional biosensors that rely on fluorescent or other labels for detection, label-free methods utilize optics-based biosensors to convert biological binding events into real-time signals without the need for any artificial markers. This technique enables the monitoring of binding changes, such as when an analyte binds to a ligand immobilized on a biosensor surface, without the interference of synthetic labels. The key advantage of label-free technology lies in its ability to preserve the native conformation and biological activity of the ligand, offering insights that are more physiologically relevant compared to labeled approaches. Furthermore, it avoids the potential pitfalls of nonspecific binding arising from fluorescently labeled proteins or enzyme-conjugated antibodies, making it especially valuable when dealing with complex, unpurified samples containing numerous components beyond the analyte of interest.

A significant benefit of label-free technology is the ability to perform dynamic, real-time monitoring of molecular interactions, a feature that traditional methods, which typically only provide endpoint results, cannot offer. This capability enables researchers to conduct kinetic and affinity analysis, as well as assess binding specificity, providing a level of depth and precision that is crucial for various biological investigations. For example, real-time interaction analysis allows scientists to observe and quantify the binding rates and dissociation constants of molecules, which can be pivotal in drug discovery, diagnostics, and even in the study of complex biological systems such as cell signaling pathways. One of the notable advancements in label-free technology has been in the field of high-throughput screening (HTS), where Bruker’s launch of the timsTOF MALDI PharmaPulse system on February 7, 2022, represents a milestone in label-free, ultra-high-throughput screening (uHTS) for drug discovery. This platform combines high-speed mass spectrometry with Trapped Ion Mobility Spectrometry (TIMS) to provide deep, unbiased HTS capabilities. By utilizing the collisional cross-section (CCS) in ion mobility, the timsTOF MPP can separate isobars and even isomers at unprecedented speeds, which enables greater specificity in assays, even in complex biological matrices. The system boasts a dual MALDI/ESI ion source and a 10 kHz smartbeam 3D laser that enhances throughput and assay speed, making it ideal for high-volume drug discovery applications.

This technology is not just confined to drug discovery. It opens up new possibilities for probing molecular interactions in a way that was previously unattainable with labeled methods. For instance, it can be used to explore endogenous targets and multi-component pathways in cellular backgrounds, offering a more accurate representation of how these processes occur naturally in the body. As a result, label-free technologies are increasingly being adopted in a variety of fields, from cancer research to the development of vaccines and biologics, due to their ability to provide insights that are closer to real biological conditions.

Label-free methods have also found significant applications in point-of-care diagnostics, particularly for infectious diseases. The COVID-19 pandemic highlighted the need for rapid, cost-effective diagnostic tools that could operate in non-laboratory settings. In response, researchers have turned to label-free technologies to develop innovative solutions for detecting the virus. For example, in January 2023, a team of professionals from various institutions collaborated to develop a microelectrode array-based impedimetric immunosensor designed to identify and monitor COVID-19 antibodies. This sensor, which uses label-free technology, offers a potential solution for point-of-care testing, providing a quick and accurate means of diagnosing infections without the need for complex laboratory equipment. The success of such projects demonstrates the versatility and growing potential of label-free detection techniques in addressing urgent healthcare challenges.

Type Insights

Surface plasmon resonance held the major share of the label-free array system market in 2024 with 33.54%. The largest market share is attributed to high R&D investments by prominent market players. In addition, the increasing risk of lifestyle-related chronic diseases is anticipated to drive clinical urgency to incorporate these systems, thus propelling the label-free array system market over the forecast period. For instance, Sartorius offers a range of solutions to meet the global demand for vaccine research, antibody fragment characterization, and whole-cell biologics.

Along with that, bio-layer interferometry is widely employed in numerous applications. However, the primary application is considered to be drug discovery and development. It is a highly preferable technique, since it is fully automated, fast, and require minimal intervention by the users. It also an optimal approach for measuring the interactions between macromolecular through assessing the interference patterns.

End-use Insight

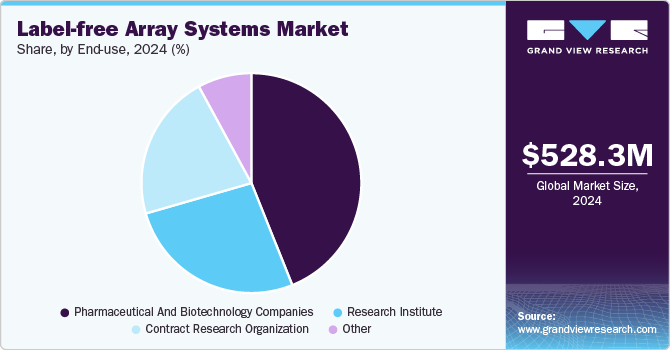

Pharmaceutical and biotechnology companies segment is expected to have the largest proportion of the market share in 2024 with 43.9%. The major firms are also investing in R&D to provide products and services for the early detection and management of chronic diseases. As a result, organizations are embracing improved analytical technologies, propelling the worldwide label-free array system market. The assessment of biomolecular interactions through label-free array systems along with study of drugs interactions, holds great importance in pharmaceutical segment.

The contract research organization segment is expected to witness the considerable growth with CAGR at 9.9%. Contract Research Organizations (CROs) are playing a crucial role by adopting label-free technologies to enhance biomolecular interaction analysis, enabling real-time, kinetic, and affinity evaluations. These technologies allow CROs to provide better data with reduced complexity, making them a valuable asset in research and development across biotechnology and pharmaceutical sectors. The absence of labels further reduces background noise, enhancing the accuracy of assays.

Application Insights

Protein interface analysis is expected to capture a considerable market share with 35.0% in 2024. Owing to the limitations of labeling strategies, the development of reliable, sensitive, and label-free arrays is drawing substantial attention. For instance, Proteon XPR36 by Bio-Rad is a protein interaction array system based on SPR technology to identify and monitor interactions of biomolecular for assessing label-free interactions.

The drug discovery segment showcased a significant growth rate during the forecasted period in 2024. The label-free analytical approach allows real-time and high-resolution monitoring of kinetic interaction. Accurate data of kinetics are important in drug development since it assists in identifying and isolating therapeutic molecules for their target. This can shorten the timespan to discover, and streamline the selection of ideal candidates for drugs with optimal chances of success downstream.

Regional Insights

North America label-free array systems market accounted for the largest revenue share of 46.8% in 2024, owing to the presence of major companies, extensive government funding, and increased research activities in the region. In addition, the use of antibody characterization in research programs by universities in the U.S. and Canada. These have accelerated the progress in the biotechnology sector, thereby increasing the demand for high-throughput analytical technology solutions in laboratory workflows. North America is expected to maintain its market dominance over the forecast period owing to the rapid adoption of advanced technological solutions, high investments in R&D, and rising wages of skilled personnel in this region.

U.S. Label-free Array Systems Market Trends

The U.S. label-free array systems market dominates the global market due to significant advancements in biotechnology and pharmaceutical research. Increasing applications in drug discovery, biomolecular interactions, and disease biomarker detection contribute to the market growth. The presence of major players like GE Healthcare and Agilent Technologies also fuels market expansion.

Europe Label-free Array Systems Market Trends

Europe label-free array systems market is experiencing steady growth particularly due to the increased use of surface plasmon resonance (SPR) technology and advances in biomolecular research. The region is focusing on enhancing pharmaceutical R&D capabilities, with increasing government and private sector investments.

The UK label-free array systems market is benefiting from growing research initiatives and the adoption of new technologies in biotechnology, particularly in the pharmaceutical sector. The demand for high-throughput screening in drug discovery is increasing, leading to a steady rise in the adoption of label-free array systems.

France label-free array systems market is seeing growth driven by investments in drug discovery and diagnostics. Label-free technologies are being increasingly used for biomolecular interaction studies, with research institutions and pharmaceutical companies leveraging these systems for new applications.

Germany label-free array systems market plays a significant role in the European market due to its strong pharmaceutical and biotechnology industries. The country's focus on developing advanced diagnostic and drug development technologies is enhancing the demand for label-free array systems.

Asia Pacific Label-free Array Systems Market Trends

Asia Pacific label-free array systems is projected to experience significant market growth, driven by rising healthcare investments and an increasing demand for advanced diagnostic technologies in drug discovery. Key markets in this region include Japan, China, and India, where adoption of label-free technologies in academic research and drug development is on the rise.

The label-free array systems in China is gaining traction due to significant investments in biotechnology and drug discovery research. The country’s focus on precision medicine and enhanced diagnostic technologies is accelerating the adoption of these systems. Additionally, China’s large pharmaceutical market is increasing demand for high-throughput screening tools, including label-free technologies.

Japan has a strong biotechnology research environment, contributing to the adoption of label-free array systems, particularly in drug discovery and biomolecular interactions. The country's emphasis on advanced diagnostic technologies is driving the market forward.

Latin America Label-free Array Systems Market Trends

In Latin America, the adoption of label-free array systems is expanding, particularly in Brazil, where pharmaceutical and biotech industries are seeing increasing investments. The region’s focus on improving healthcare infrastructure and research capabilities is fueling demand.

Brazil is a key player in Latin America, experiencing growth in the use of label-free technologies for drug discovery and biomolecular research. The increasing research funding and demand for personalized medicine are likely to boost market adoption.

MEA Label-free Array Systems Market Trends

The MEA label-free array systems market is witnessing an increase in the adoption of label-free array systems, spurred by growing healthcare investments and advancements in research capabilities. Countries like Saudi Arabia are prioritizing biotechnology and diagnostic technologies, contributing to market growth.

Saudi Arabia's healthcare sector is embracing advanced diagnostic technologies, and the adoption of label-free array systems is growing. The government’s focus on expanding medical research and biotechnology initiatives is contributing to this trend.

Key Label-free Array Systems Company Insights

Label-free array systems have become increasingly popular and are used by a wide range of companies, from small startups to large multinational corporations. companies are engaged in the development, manufacturing, and marketing of label-free array systems and their accessories to meet the requirements of various industries. For instance, ForteBio is a leading provider of label-free array systems, such as the Octet Red system, which is a label-free, real-time biosensor used to study protein-protein interactions, protein-ligand interactions, and protein stability. The system is widely used in pharmaceutical and biotechnology research to aid in the discovery and development of new drugs and is marketed and sold by Pall ForteBio in the United States.

Key Label-free Array Systems Companies:

The following are the leading companies in the label-free array systems market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Merck KGaA

- Danaher Corporation

- Bio-Rad Laboratories Inc.

- F. Hoffmann-La Roche AG

- Becton Dickinson and Company

- Sartorius AG

Recent Developments

-

In February 2023, Agilent Technologies has integrated its xCelligence RTCA HT (real-time cell analysis high-throughput) platform with the BioTek BioSpa 8 Automated Incubator, enhancing workflow automation for critical applications in immuno-oncology, virology, and vaccine development. This combination enables label-free high-throughput potency assays crucial for immuno-oncology research, along with high-throughput viral cytopathic effect (CPE) assays used in vaccine development. The integration is designed to streamline complex assay processes, offering more efficient and automated solutions for researchers in these rapidly advancing fields. This development highlights Agilent's commitment to providing cutting-edge tools to support innovation in the biotechnology and healthcare industries

-

In April 2022, Sartorius has expanded its portfolio in the label-free biosensing market with the launch of the Octet SF3, a Surface Plasmon Resonance (SPR) system. This marks the first SPR system under the Octet brand, which was previously known for Bio-Layer Interferometry (BLI) technology. With this launch, Sartorius becomes the only company offering both BLI and SPR technologies under a single recognized brand. This positions Sartorius as a key player in providing customers with advanced, fluidic-free, label-free technologies for real-time biomolecular interaction analysis. This expansion strengthens their presence in the rapidly growing label-free detection market.

Label-free Array Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 564.04 million |

|

Revenue forecast in 2030 |

USD 818.41 million |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Illumina, Inc.; Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; PerkinElmer, Inc.; Merck KGaA; Danaher Corporation; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Becton; Dickinson and Company; and Sartorius AG. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Label-free Array Systems Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented label-free array system based on type, application, end-use, and region.

-

Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Surface Plasmon Resonance

-

Bio-layer Interferometry

-

Cellular Dielectric Spectroscopy

-

Others

-

-

Application Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery

-

Protein Interface Analysis

-

Antibody Characterization

-

Others

-

-

End-user Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

CRO

-

Others

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global label-free array systems market size was estimated at USD 528.3 million in 2024 and is expected to reach USD 564.04 million in 2025.

b. The global label-free array systems market is expected to grow at a compound annual growth rate of 7.73% from 2025 to 2030 to reach USD 818.41 million by 2030.

b. North America dominated the label-free array systems market with a share of 46.79% in 2024. This is attributable to presence of major companies, extensive government funding, and an increase in research activities in the region.

b. Some key players operating in the label-free array system market include Illumina, Inc., Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., PerkinElmer, Inc., Merck KGaA, Danaher Corporation, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche AG, Becton, Dickinson and Company, and Sartorius AG

b. Key factors that are driving the market growth include increasing demand for personalized medicine, as well as a variety of other factors such as the prevalence of chronic diseases, increased research activities in biomedical science, the need for high-throughput screening, and the demand for cost-effective and efficient systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."