- Home

- »

- Nutraceuticals & Functional Foods

- »

-

L-Citrulline Market Size, Share And Growth Report, 2030GVR Report cover

![L-Citrulline Market Size, Share & Trends Report]()

L-Citrulline Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Capsules, Tablets, Powders), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy & Drug Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-382-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

L-Citrulline Market Size & Trends

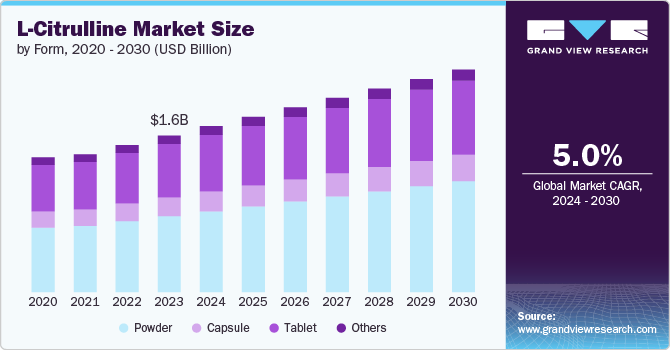

The global L-citrulline market size was estimated at USD 1,601.7 million in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030.L-citrulline is a non-essential amino acid commonly taken as a dietary supplement for its various health benefits. It acts as a precursor to L-arginine, which is key in producing nitric oxide, a compound essential for vasodilation and improved blood flow. Among athletes and fitness enthusiasts, L-citrulline is favored for its potential to boost exercise performance, lessen muscle soreness, and enhance recovery.

The increasing adoption of L-citrulline across various industries and its growing use in the production of active pharmaceutical ingredients (APIs) in the healthcare sector will offer numerous growth opportunities for the L-citrulline market during the forecast period. This growth is driven by the many benefits of L-citrulline, including its use in energy drinks, foods, and beverages, as well as its capability to aid in the early detection of chronic diseases.

The expanding use of L-citrulline across different industries and its rising application in manufacturing active pharmaceutical ingredients (APIs) within the healthcare sector are expected to provide significant growth opportunities for the L-citrulline market during the forecast period. This market expansion is fueled by the numerous advantages of L-citrulline, such as its inclusion in energy drinks, foods, and beverages, and its potential for early detection of chronic diseases.

L-citrulline is gaining popularity for its use in food production and beverage applications. Its benefits, such as enhancing exercise performance, reducing muscle soreness, and improving recovery, make it a sought-after ingredient in energy drinks, nutritional supplements, and various health-related food products. This trend reflects the growing consumer demand for functional foods and beverages that offer additional health benefits.

As disposable incomes rise in emerging nations, consumers find themselves with more money to allocate towards wellness and health products, including dietary supplements containing L-citrulline. This increased financial capacity allows individuals to prioritize their health and well-being, driving demand for products that promise various health benefits.

Form Insights

Capsule segment dominated the market and accounted for a share of 48.49% in 2023. Capsules are portable and easy to carry, making them a convenient option for consumers who want to take their supplements on the go.As more people become health-conscious and seek effective dietary supplements, the demand for convenient and user-friendly supplement forms such as capsules increases. They mask the taste of L-citrulline, which can be unpalatable in its raw, powdered form. This makes capsules a more appealing option for those sensitive to taste. Moreover, they often have a longer shelf life compared to powders because they are less exposed to air and moisture, which can degrade the active ingredients.

Powdered segment substitute segment is expected to grow at a CAGR of 5.5% from 2024 to 2030. Powdered L-citrulline can be easily mixed into various beverages such as water, juice, or smoothies. This makes it convenient for consumers to incorporate into their daily routines without the need for additional preparation or specialized equipment. Powdered forms allow for precise dosage control. Users can adjust the amount of L-citrulline they consume based on their specific needs, whether it's for general health maintenance or to support intensive physical training.

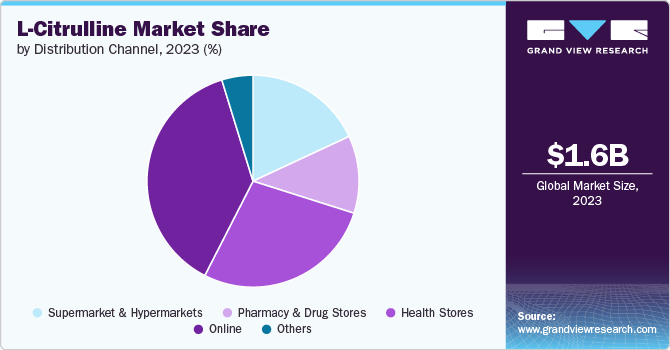

Distribution Channel Insights

The online segment accounted for a revenue share of 37.72% in 2023. Online stores are always open, allowing consumers to purchase L-citrulline at any time, which is especially appealing for those with busy schedules. Theseplatforms can reach consumers in remote or underserved areas where physical stores may not be available. Many online stores offer regular discounts, promotions, and subscription services, which can reduce the overall cost for consumers. Also, they offer subscription models for L-citrulline, ensuring a regular supply without the need for repeated purchases.

The supermarkets & hypermarkets segment is expected to grow at a CAGR of 5.0% from 2024 to 2030. Supermarkets and hypermarkets often create private label products in collaboration with supplement brands. This allows them to offer high-quality supplements at lower prices compared to national brands. Moreover, supermarkets and hypermarkets leverage joint marketing campaigns with supplement brands to promote these products. This includes in-store promotions, advertisements, and digital marketing. For example, Walmart’s collaboration with Spring Valley has resulted in a wide range of affordable supplements, including those containing L-citrulline, tailored to various health needs.

Regional Insights

The L-Citrulline market in North America captured a revenue share of over 32.87% in the market. The rising consumer awareness and preference for nutritional supplements and fortified food products have driven the consumption of L-citrulline in the region. Its crucial role in supporting overall health, including metabolism and cardiovascular function, has made it popular among health-conscious consumers in North America. In addition, the region's strong healthcare infrastructure and stringent regulatory framework have supported market growth by ensuring product safety and efficacy standards. Manufacturers are also increasingly tailoring these supplements to target specific demographics and address particular health concerns.

U.S. L-Citrulline Market Trends

The L-citrulline market in the U.S. is experiencing intense competition due to significant product innovation across various categories, including food production, beverages, pharmaceuticals, and cosmetics. The increased consumption of L-citrulline in the U.S. can be attributed to several factors and trends. Consumers are increasingly seeking dietary supplements that can complement their active lifestyles and promote overall well-being. This interest is fueled by rising awareness of the role amino acids play in various physiological functions, as well as by scientific research highlighting their potential health benefits.

Europe L-Citrulline Market Trends

The L-Citrulline market in Europe is expected to experience substantial growth in the coming years. This growth trajectory is propelled by several factors, including ongoing product innovations that cater to the increasing consumer demand for health and wellness solutions.

European consumers are increasingly prioritizing products that support overall well-being, which has led to a rising interest in dietary supplements containing non-essential amino acids such as L-Citrulline. These amino acids are recognized for their potential benefits in enhancing physical performance, promoting cardiovascular health, and aiding in muscle recovery after exercise. Moreover, advancements in formulation techniques and product development have resulted in a diverse range of L-Citrulline products available in the market. These innovations include different dosage forms such as capsules, powders, and liquid formulations, as well as combinations with other bioactive ingredients to target specific health concerns.

Asia Pacific L-Citrulline Market Trends

The L-Citrulline market in Asia Pacific is expected to witness a CAGR of 6.0% from 2024 to 2030. China and India, in particular, are significant contributors to the demand for nutritional supplements due to their large populations and expanding middle class. Consumers in these countries are becoming more health-conscious and are seeking products that can enhance physical performance, support cardiovascular health, and aid in recovery from physical exertion. Furthermore, Southeast Asia presents untapped potential for the L-Citrulline market. Countries in this region, such as Indonesia, Thailand, Vietnam, and Malaysia, are witnessing economic growth, urbanization, and a shift towards healthier lifestyles among their populations. This demographic transition is driving the demand for dietary supplements and functional foods that offer health benefits, including those derived from L-Citrulline.

Key L-Citrulline Company Insights

The L-Citrulline market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key L-Citrulline Companies:

The following are the leading companies in the l-citrulline market. These companies collectively hold the largest market share and dictate industry trends.

- NOW Foods

- BulkSupplements

- GNC (General Nutrition Centers)

- Primaforce

- Pure Encapsulations

- Jarrow Formulas

- Glanbia plc

- Nutricost

- Doctor’s Best

- Life Extension

Recent Developments

-

In November 2022, Food Specialities Limited (FSL), in partnership with leading international food ingredient solution providers, showcased an array of new products and award-winning technologies at Gulfood Manufacturing. Among these innovations were four novel micronutrient premixes from SternVitamin, Germany, designed to enhance the nutritional value of food and beverages. One of the standout offerings is SternEnergize, a premix formulated specifically for pre-workout consumption. This scientifically designed premix provides a comprehensive combination of vitamins, minerals, branched-chain amino acids, L-taurine, L-citrulline, L-arginine, and natural caffeine.

-

In January 2021, Taiho Convenience Stores Co., Ltd. announced the launch of Rismitas, a functional food designed to address the common issue of cold hands, particularly prevalent among women. This amino acid is believed to play a crucial role in maintaining warmth in the hands, specifically focusing on the center of the back of the hands and wrists, during colder temperatures. The product aims to provide relief and comfort to individuals experiencing this common discomfort associated with cold weather.

L-Citrulline Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,698.0 million

Revenue forecast in 2030

USD 2,276.0 million

Growth rate

CAGR of 5.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in metric tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand South Korea; Brazil; South Africa

Key companies profiled

NOW Foods; BulkSupplements; GNC (General Nutrition Centers); Primaforce; Pure Encapsulations; Jarrow Formulas; Glanbia plc; Nutricost; Doctor’s Best; Life Extension

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global L-Citrulline Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global L-Citrulline market report based on form, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Powders

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket & Hypermarkets

-

Pharmacy and Drug Stores

-

Health Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global L-citrulline market size was estimated at USD 1,601.7 million in 2023 and is expected to reach USD 1,698.0 million in 2024.

b. The global L-citrulline market is expected to grow at a compounded growth rate of 5.0% from 2024 to 2030 to reach USD 2,276.0 million by 2030.

b. The capsules segment dominated the L-citrulline market with a share of 48.49% in 2023. Capsules are portable and easy to carry, making them a convenient option for consumers who want to take their supplements on the go. They mask the taste of L-citrulline, which can be unpalatable in its raw, powdered form.

b. Some key players operating in the L-citrulline market include NOW Foods, BulkSupplements, GNC (General Nutrition Centers), Primaforce, Pure Encapsulations, Jarrow Formulas, and Glanbia plc

b. Key factors that are driving the market growth include the increasing adoption of L-citrulline across various industries and its growing use in the production of active pharmaceutical ingredients (APIs) in the healthcare sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.