KSA Cement Market Size, Share & Trends Analysis Report By Product (Portland Cement, White Cement), By End Use (Residential Buildings, Non-residential Buildings), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-432-9

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

KSA Cement Market Size & Trends

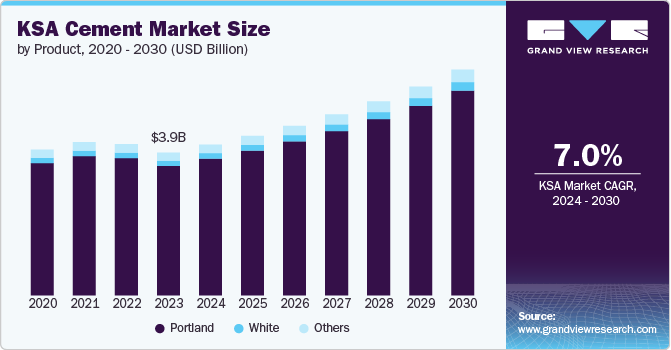

The KSA cement market size was estimated at USD 3.99 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. This market is driven by its rising application in the construction industry in the country owing to the country's ambitious Vision 2030 initiative, which focuses on extensive infrastructure and urban development. The rapid urbanization and expansion of major cities, coupled with a surge in population, are fueling a robust demand for residential and commercial construction. Additionally, ongoing economic diversification efforts and increased private sector investments in real estate and construction further stimulate product consumption.

The Saudi Vision 2030 plan is a significant catalyst for the product market. This blueprint for economic diversification and modernization includes extensive infrastructure projects such as new highways, bridges, airports, and public transportation systems. These large-scale projects require substantial amounts of product, driving up demand and fostering industry growth. Notable examples include the development of the King Abdulaziz International Airport expansion and the Red Sea Project, which necessitate high volumes of product for construction.

Rapid urbanization in Saudi Arabia, particularly in major cities like Riyadh, Jeddah, and Dammam, is a major driver of product demand. The ongoing expansion and modernization of urban areas lead to increased construction of residential, commercial, and mixed-use developments. As new residential neighborhoods and commercial centers are built to accommodate a growing urban population, the demand for products continues to rise.

Moreover, Saudi Arabia's efforts to reduce its economic reliance on oil are resulting in significant investments across various sectors, including real estate, tourism, and entertainment. This diversification strategy includes the development of new business hubs, tourism destinations, and recreational facilities, all of which require considerable product for construction. Projects like the NEOM city and the Red Sea tourism developments are prime examples of initiatives driving product consumption.

The Saudi Arabian product market faces several restraints that could impact its growth trajectory. One significant challenge is the volatility of raw material prices, particularly for key inputs like clinker, limestone, and gypsum. Fluctuations in these costs can lead to increased production expenses and affect profit margins for product manufacturers. Additionally, the industry is grappling with overcapacity issues, which can lead to intense competition and pricing pressures among producers.

Product Insights

Portland cement dominated the market with a revenue share of 90.8% in 2023 owing to its essential role in modern infrastructure and building projects. The product is renowned for its versatility and strength, Portland cement is used in a wide array of applications including residential, commercial, and industrial construction. Its ability to form strong, durable concrete makes it ideal for structural applications like bridges, roads, and high-rise buildings.

Portland cement is primarily composed of clinker, a granular material produced by heating limestone and other materials in a kiln to high temperatures. The main components of the product include calcium silicates, calcium aluminates, and calcium ferrites. The most common types of Portland are Type I, Type II, Type III, and Type IV.

The production of products is energy-intensive and contributes to greenhouse gas emissions, primarily due to the calcination process and the use of fossil fuels. Consequently, there is a growing emphasis on sustainability within the industry, with efforts focused on reducing carbon emissions, utilizing alternative fuels, and incorporating supplementary cementitious materials like fly ash or slag to enhance the environmental footprint of product production.

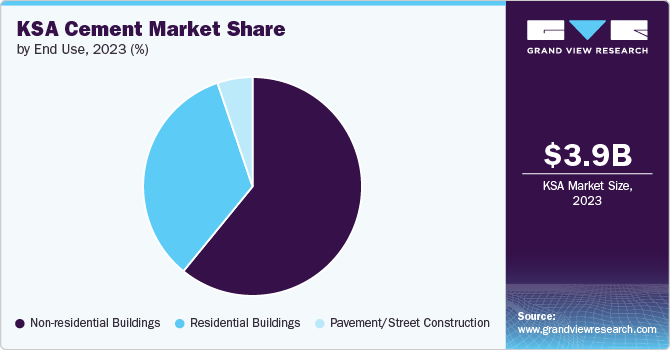

End Use Insights

Non-residential buildings dominated the market with a revenue share of 60.9% in 2023 owing to rising demand for commercial buildings, such as office spaces, retail centers, and hotels in the country. Industrial buildings, including factories, warehouses, and logistics centers, also contribute significantly to product demand.

In the Saudi Arabian cement market, the residential building sector is a crucial area of application, significantly influencing overall cement demand. Residential buildings, including single-family homes, apartment complexes, and housing developments, account for a substantial portion of cement consumption in the region.

Key KSA Cement Company Insights

Some key players operating in the market include Saudi Cement, Najran Cement, Yanbu Cement, Arabian Cement, and Qassim Cement among others.

- Yanbu Cement Company (YCC) is a prominent cement producer in Saudi Arabia, distinguished as the largest cement manufacturer in the Western Region. This Saudi joint-stock company has a total installed capacity exceeding 7.0 million tons of clinker and a cement dispatch capability surpassing 10.0 million tons annually. With a paid-up capital of SR 1.575 billion, Yanbu Cement ranks among the top 50 companies in the region. Its production facilities are situated at Ras Baridi, along the Red Sea coast, approximately 70 kilometers northwest of the Port of Yanbu.

Key KSA Cement Companies:

- Saudi Cement

- Najran Cement

- Yanbu Cement

- Arabian Cement

- Qassim Cement

- Al Safwa Cement

- Saudi White Cement

- City Cement

- Eastern Province Cement

- Tabuk Cement

Recent Developments

-

In July 2024, NEOM projects are set to receive cement worth SR104 million ($27.7 million) through a partnership between Saudi Arabia's Al Jouf Cement Co. and Italy's Webuild SpA. The agreement, lasting 41 months, involves supplying cement for various developments within NEOM, which is a $500 billion giga-project located at the northern tip of the Red Sea. The partnership is expected to positively impact Al Jouf's financial statements starting from the third quarter of this year.

KSA Cement Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.20 billion |

|

Revenue forecast in 2030 |

USD 6.30 billion |

|

Growth rate |

CAGR of 7.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million tons, revenue in USD million/ billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use |

|

Regional scope |

Middle East & Africa |

|

Country scope |

Saudi Arabia |

|

Key companies profiled |

Saudi Cement; Najran Cement; Yanbu Cement; Arabian Cement; Qassim Cement; Al Safwa Cement; Saudi White Cement; City Cement; Eastern Province Cement; Tabuk Cement |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

KSA Cement Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the KSA cement market report-based product and end use.

-

Product Type Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Portland Cement

-

White Cement

-

Others

-

-

End Use Type Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Residential Buildings

-

Non-residential Buildings

-

Pavement/Street Construction

-

Frequently Asked Questions About This Report

b. The global KSA cement market size was estimated at USD 3.99 billion in 2023 and is expected to reach USD 4.21 billion in 2024.

b. The global KSA cement market is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030 to reach USD 6.30 billion by 2030.

b. Portland cement dominated the KSA cement market with a revenue share of 90.8% in 2023 owing to its essential role in modern infrastructure and building projects.

b. Some key players operating in the KSA cement market include Saudi Cement, Najran Cement, Yanbu Cement, Arabian Cement, Qassim Cement, Al Safwa Cement, Saudi White Cement, City Cement, Eastern Province Cement, and Tabuk Cement

b. The key factors that are driving the KSA cement market growth are rapid urbanization and expansion of major cities in the country, coupled with a surge in population, which are fueling a robust demand for residential and commercial construction.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."