- Home

- »

- Plastics, Polymers & Resins

- »

-

Kraft Paper Bag Market Size, Share & Growth Report, 2030GVR Report cover

![Kraft Paper Bag Market Size, Share & Trends Report]()

Kraft Paper Bag Market (2025 - 2030) Size, Share & Trends Analysis Report By Paper (Brown Kraft Paper, White Kraft Paper), By Product (Pasted Valve, Sewn Open Mouth, Flat Bottom), By Thickness (1 Ply, 2 Ply), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-482-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kraft Paper Bag Market Summary

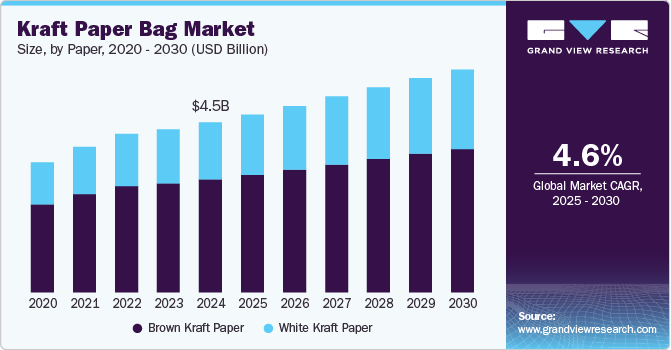

The global kraft paper bag market size was estimated at USD 4.50 billion in 2024 and is projected to reach USD 5.89 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. Consumers are becoming more eco-conscious and actively seeking brands that prioritize sustainability in their packaging.

Key Market Trends & Insights

- Asia Pacific kraft paper bag market dominated the global market and accounted for the largest revenue share of 45.07% in 2024.

- The U.S. kraft paper bags market accounted for the largest market revenue share in North America of 72.1% in 2024.

- Based on product, pasted valve segment dominated the overall market with a revenue market share of over 24.5% in 2024.

- Based on end use, food service segment dominated the overall market with a revenue market share of over 26.5% in 2024.

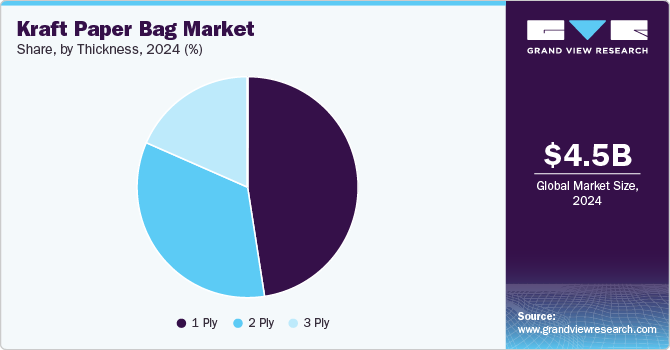

- Based on thickness, 1 Ply segment dominated the market and accounted for largest revenue share of over 47.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.50 Billion

- 2030 Projected Market Size: USD 5.89 Billion

- CAGR (2025-2030): 4.6%

- Asia Pacific: Largest market in 2024

With their natural, unbleached appearance and minimalistic design, Kraft paper bags are often seen as a more sustainable and environmentally responsible option than synthetic materials.Brands and retailers that use kraft paper bags can strengthen their sustainability credentials, attract ecologically aware customers, and improve their market competitiveness. In addition, the food and beverage industry play a significant role in driving the demand for kraft paper bags.

As the sector continues to focus on reducing its environmental footprint, kraft paper bags for packaging dry food products, takeaway items, and bakery goods have surged. These bags are often preferred for handling heavy loads, resisting moisture, and providing excellent printability for branding and labeling. The organic and natural appeal of kraft paper bags also aligns with the growing trend of health-conscious and eco-friendly consumer preferences in food packaging. As the food and beverage industry embraces sustainable packaging solutions, the demand for kraft paper bags is expected to continue to rise.

Online retail has become a major part of the global economy, and with it, the need for sustainable packaging solutions has grown. E-commerce companies increasingly opt for kraft paper bags for packaging goods such as clothing, books, and electronics due to their strength and ability to protect items during shipping. Furthermore, kraft paper bags offer a cost-effective solution for e-commerce businesses that want to reduce their environmental impact while maintaining an attractive, branded packaging option. As online shopping continues to grow, so does the demand for eco-friendly and durable kraft paper bags.

Paper Insights

Based on paper type, the global market for kraft paper bag has been segmented into brown and white kraft paper. Brown kraft paper dominated the overall market with a revenue market share of over 66.4% in 2024. Brown kraft paper, made from wood pulp through a sulfate or kraft process, is durable and versatile and contributes significantly to reducing the carbon footprint compared to plastic alternatives. This growing awareness of environmental impact has bolstered the demand for brown kraft paper bags, especially in food packaging, retail, and e-commerce sectors.

White kraft paper is anticipated to register the fastest CAGR over the forecast period. White kraft paper is perceived as a premium product due to its clean, bright appearance and smooth surface, making it suitable for high-end packaging. This preference is particularly evident in food and beverage, luxury goods, and retail industries, where packaging quality plays a crucial role in shaping consumer perceptions and experiences.

Product Insights

Based on product, pasted valve dominated the overall market with a revenue market share of over 24.5% in 2024. The pasted valve bags are designed with a valve at the top, sealed after filling with the product. This feature makes them especially useful for packaging powdered, granular, and liquid products. These bags are ideal for transporting flour, cement, animal feed, and various granular chemicals, further expanding their application base.

Pasted open mouth is anticipated to register the fastest CAGR over the forecast period. Pasted open mouth bags are popular for their easy filling and sealing ability, making them ideal for a wide range of applications, particularly in the food, agricultural, and industrial sectors. The demand for these bags has grown as industries seek reliable, cost-effective, eco-friendly packaging solutions. As sustainability continues to take center stage, the preference for kraft paper bags, which are biodegradable and recyclable, is increasing, directly benefiting the pasted open mouth segment.

Thickness Insights

Based on the thickness, the market is segmented into 1 Ply, 2 Ply, and 3 Ply. 1 Ply segment dominated the market and accounted for largest revenue share of over 47.5% in 2024. 1 ply kraft paper bags are more affordable to produce than multi-ply bags, making them a sustainable option for businesses aiming to reduce packaging costs. As companies seek to minimize their overall operational expenses, the demand for lower cost but functional packaging solutions continues to rise. The lightweight nature of 1-ply bags also contributes to lower transportation costs, making them an economically viable choice for businesses looking to optimize their supply chain efficiency.

2 Ply is anticipated to register the fastest CAGR of 5.3% over the forecast period. The strength of 2 ply construction makes these bags ideal for carrying heavier items or multiple products without compromising integrity during transit. Retailers increasingly opt for these durable options as they enhance customer satisfaction through reliable delivery experience.

End-use Insights

Based on end use, the market has been segmented into food service, retail, pharmaceutical, e-commerce, and others. Food service dominated the overall market with a revenue market share of over 26.5% in 2024. As consumers seek convenience and sustainability, food service providers increasingly turn to kraft paper bags as a preferred packaging solution. This shift is driven by the need for eco-friendly alternatives to plastic, which have come under scrutiny for their environmental impact. The versatility of kraft paper bags and their ability to meet regulatory requirements and consumer preferences positions them favorably in the food service sector.

The pharmaceutical segment is expected to witness robust growth with a CAGR of 6.6% over the forecast period. Ensuring the safety and integrity of pharmaceutical products is critical, as tampering or contamination can lead to significant health risks. When used with additional security features such as adhesive seals, inner liners, or moisture barriers, Kraft paper bags offer an effective means to safeguard pharmaceutical products during storage and transportation. As the pharmaceutical sector becomes increasingly concerned with preventing counterfeit products and ensuring product authenticity, the use of tamper-evident packaging like kraft paper bags is expected to rise.

Regional Insights

North America kraft paper bags market accounted for a market revenue share of 20.8% in 2024. Many states and municipalities across North American countries have implemented bans or restrictions on plastic bags, encouraging businesses to transition to eco-friendly alternatives like kraft paper bags. These regulatory measures promote sustainability and create a favorable market environment for kraft paper products. As legislation evolves, more regions will likely adopt similar policies, boosting the demand for kraft paper bags.

U.S. Kraft Paper Bag Market Trends

The U.S. kraft paper bags market accounted for the largest market revenue share in North America of 72.1% in 2024. As concerns about plastic pollution rise, consumers and businesses increasingly turn to paper-based alternatives. Kraft paper bags, made from recycled and renewable materials, are more sustainable than plastic bags, which take centuries to decompose and contribute significantly to environmental harm. Many U.S. states and cities have enacted plastic bag bans or imposed taxes on plastic bags, further incentivizing the switch to paper packaging.

Europe Kraft Paper Bag Market Trends

Europe kraft paper market is anticipated to grow significantly over the forecast period. As concerns about plastic pollution escalate, many European countries have implemented stringent regulations against single-use plastics. For instance, the European Union’s directive to reduce plastic waste has led to a significant shift towards sustainable packaging solutions, including kraft paper bags. Consumers are increasingly opting for eco-friendly products, which has prompted retailers and manufacturers to adopt kraft paper bags as a viable alternative. This trend is evident in various sectors, from grocery stores to fashion retailers, where brands actively promote their commitment to sustainability through recyclable and biodegradable packaging.

Germany is one of the leading countries in Europe in terms of green policies and sustainability efforts, including initiatives under the European Union's Green Deal. Companies across various sectors, including retail, food service, and e-commerce, are increasingly adopting kraft paper bags as part of their commitment to reducing environmental impact. This shift is helping drive the demand for kraft paper bags as consumers and businesses seek to meet sustainability targets.

Asia Pacific Kraft Paper Bag Market Trends

Asia Pacific kraft paper bag market dominated the global market and accounted for the largest revenue share of 45.07% in 2024. As online shopping continues to surge, especially in countries such as China and India, there is a rising need for effective and sustainable packaging solutions. Kraft paper bags are increasingly used for packaging products in the retail and e-commerce sectors due to their durability, cost-effectiveness, and sustainability.

As the middle class expands, there is a growing appetite for packaged goods, particularly in the convenience food sector. Kraft paper bags are often used for snacks, fast food, and takeaway meals because they balance cost-effectiveness, durability, and eco-friendliness. These bags are functional and offer a premium feel that appeals to consumers willing to pay more for sustainable packaging.

Key Kraft Paper Bag Company Insights

The competitive environment of the market is marked by the presence of several major players, including Mondi Group, International Paper Company, and WestRock Company, who dominate the global market with their extensive product portfolios and advanced technologies. These companies compete on factors such as innovation, sustainability, and cost efficiency, focusing on developing eco-friendly packaging solutions to meet the increasing demand for sustainable packaging. Moreover, increasing production capacity and expansion initiatives are undertaken by major players to gain a competitive edge in the market.

-

In February 2024, Mondi Group announced an expansion in the production of its EcoWicketBags, made from strong kraft paper, a move aimed at addressing the growing demand for sustainable packaging solutions in the home and personal care (HPC) sector. This initiative is particularly relevant for diapers and feminine hygiene items requiring robust packaging.

Key Kraft Paper Bag Companies:

The following are the leading companies in the kraft paper bag market. These companies collectively hold the largest market share and dictate industry trends.

- Mondi Group

- Smurfit Kappa Group

- WestRock Company

- Georgia-Pacific LLC

- International Paper Company

- Seaman Paper Company

- BillerudKorsnäs

- SHAMROCK

- Nordic Paper

- PaperKraft Industries

- Ronpak

- Huhtamäki Oyj

- Novolex (Bagcraft, Duro Bag Brand)

- Prompac LLC

- B&H Bag Company

Kraft Paper Bag Market Report Scope

Report Attribute

Details

Market size in 2025

USD 4.72 billion

Revenue forecast in 2030

USD 5.89 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in million units and CAGR from 2025 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Paper, product, thickness, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Saudi Arabia; South Africa

Key companies profiled

Mondi Group, Smurfit Kappa Group, WestRock Company, Georgia-Pacific LLC, International Paper Company, Seaman Paper Company, BillerudKorsnäs, SHAMROCK, Nordic Paper, PaperKraft Industries, Ronpak, Huhtamäki Oyj, Novolex (Bagcraft, Duro Bag Brand), Prompac LLC, and B&H Bag Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kraft Paper Bag Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kraft paper bag market report on the basis of paper, product, thickness, end use, and region:

-

Paper Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

Brown Kraft Paper

-

White Kraft Paper

-

-

Product Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

Sewn Open Mouth

-

Pinched Bottom Open Mouth

-

Pasted Valve

-

Pasted Open Mouth

-

Flat Bottom

-

Others

-

-

Thickness Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

1 Ply

-

2 Ply

-

3 Ply

-

-

End-use Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

Food Service

-

Retail

-

Pharmaceutical

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global kraft paper bag market size was estimated at USD 4.50 billion in 2024 and is expected to reach USD 4.71 billion in 2025.

b. The global kraft paper bag market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030, reaching USD 5.89 billion by 2030.

b. Browncraft paper dominated the kraft paper bag market with a share of 66.3% in 2024, owing to the rising global demand for convenience and ready-to-eat food products

b. Some of the key players operating in the kraft paper bag market include Mondi Group, Smurfit Kappa Group, WestRock Company, Georgia-Pacific LLC, International Paper Company, Seaman Paper Company, BillerudKorsnäs, SHAMROCK, Nordic Paper, PaperKraft Industries, Ronpak, Huhtamäki Oyj, Novolex (Bagcraft, Duro Bag Brand), Prompac LLC, and B&H Bag Company

b. The key factors driving the kraft paper bag market are the growing consumer demand for eco-friendly packaging and the rise of online shopping and retail packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.