- Home

- »

- Medical Devices

- »

-

Knee Braces Market Size & Share, Industry Report, 2030GVR Report cover

![Knee Braces Market Size, Share & Trends Report]()

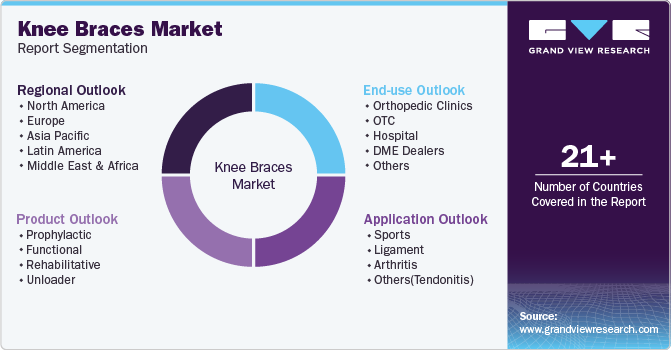

Knee Braces Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Prophylactic, Functional, Rehabilitative, Unloader), By Application (Sports, Ligament), By End-use (Orthopedic Clinics, OTC), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-918-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Knee Braces Market Summary

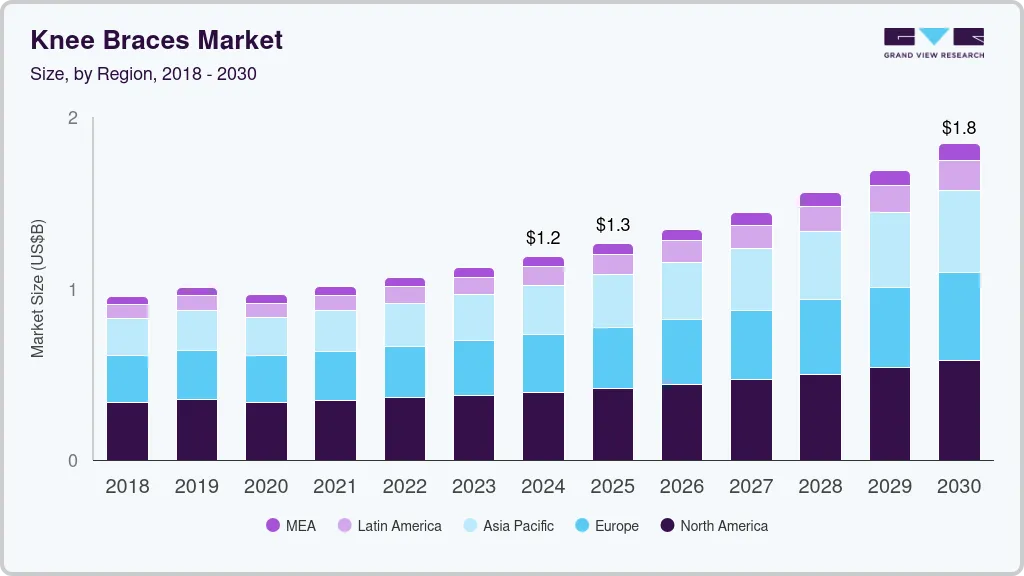

The global knee braces market size was estimated at USD 1,185.8 million in 2024 and is projected to reach USD 1,845.7 million by 2030, growing at a CAGR of 7.9% from 2025 to 2030. The rise in osteoarthritis (OA) cases, orthopedic knee surgeries, athletic injuries and other knee related injuries are fueling the growth of the knee brace industry.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Argentina is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, functional accounted for a revenue of USD 390.9 million in 2024.

- Functional is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,185.8 Million

- 2030 Projected Market Size: USD 1,845.7 Million

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2024

For instance, according to the Centers for Disease Control and Prevention (CDC), over 32.5 million individuals in the U.S. live with OA. Moreover, OA affects over 500 million people and, globally, around 7% of the world’s population.

Moreover, rising awareness regarding OA-related pain is helping increase product penetration. The World Health Organization (WHO) declared OA a significant global health issue. The post-operative complications of Total Knee Replacement (TKR) surgeries are also restricting the patients from undergoing such surgeries. Patients are more comfortable wearing braces, which is anticipated to provide significant growth opportunities for the knee braces industry over the forecast period.

The growing prevalence of acute and chronic conditions, such as arthritis and sports injuries, boosts the demand for knee braces. Several companies in the market are actively involved in initiatives to enhance product offerings and expand their market presence, which is anticipated to contribute to the overall market growth. For instance, in January 2024, Enovis (DJO, LLC), a MedTech company, introduced the DonJoy ROAM OA knee brace for patients with OA or other knee instability and pain.

In addition, the rise in road accidents has pushed the market growth. For instance, according to the Government of Canada, the data published by the National Collision Database (NCDB), the total number of road accident injuries increased to 118,853 in 2022, up 9.5% from 2021. In addition, the increasing number of elderly individuals across the globe leads to a higher demand for these products, as older individuals are more susceptible to musculoskeletal problems. The growing prevalence of orthopedic surgeries contributes to the boosted need for postoperative bracing solutions

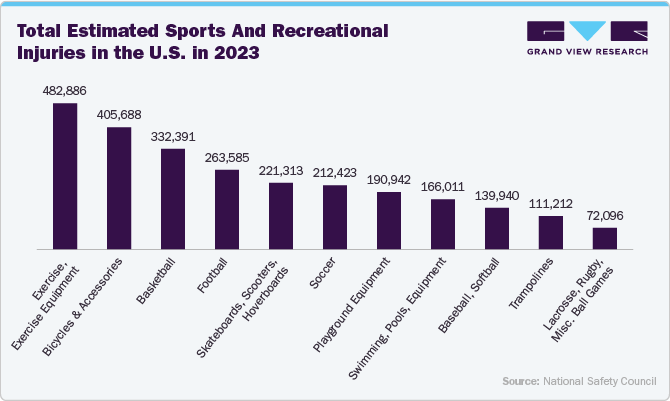

Furthermore, the rise in sports-related injuries by people engaging in physical activities drives the demand for knee braces. For instance, according to The Johns Hopkins University, in the U.S., around 3.5 million injuries happen annually due to sports activity. Furthermore, knee braces provide benefits such as improved knee stability and function. They are also used to prevent undesirable movements during sports activities. These advantages are contributing to market growth.

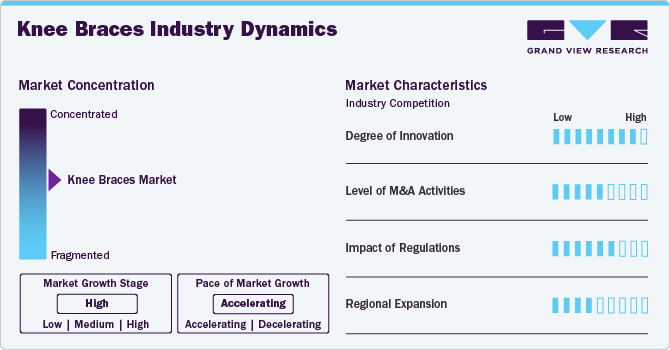

Market Concentration & Characteristics

The global knee braces market is characterized by a high degree of innovation, owing to rising investments in product development and growing research activities. Technological innovations facilitate the customization of braces, catering to individual patient requirements and enhancing treatment effectiveness.

The knee braces market is characterized by medium merger and acquisition activity.For instance, in May 2022, Enovis (DJO, LLC) acquired the assets of Outcome-Based Technologies, LLC, which include the CryoKnee knee brace and EXCYABIR hip brace, to improve its product portfolio in braces. This strategy enables companies to increase their capabilities, expand their product portfolios, and strengthen competency.

Regulatory guidelines established by various authorities significantly influence market growth. For instance, the European Union Commission has introduced new regulations for medical devices sold in the EU, including braces. The European market must undergo a comprehensive regulatory process to improve patient safety and implement stringent post-market surveillance.

Several market players are expanding their business by launching new products to strengthen their market position and portfolio. For instance, in February 2024, EVS Sports, a motocross knee brace company, introduced top-performance knee braces designed for superior protection and performance.

Product Insights

By product, the functional braces segment accounted for the largest market share of 30.9% in 2024 and is anticipated to grow at fastest CAGR over the forecast period, owing to effectiveness and wide acceptance of the product. These braces are used for providing stability during anteroposterior and rotational forces. Braces are recommended after an anterior cruciate ligament (ACL) injury to reduce any additional injury after ACL reconstruction. Research studies published in 2023 by Northwestern Medicine and Northwestern Memorial HealthCare reported that women experience two to eight times more ACL injuries than men. Thus, such an increase in ACL injuries fuels the segment growth.

Prophylactic braces are expected to register a significant CAGR during the forecast period. As more individuals recognize the importance of wearing supportive braces during sports, there is an increasing need for preventive measures to avoid injuries. Furthermore, with an aging population, a higher number of arthritis patients utilize the assistance and steadiness provided by prophylactic braces. For instance, in May 2024, McDavid, a sports medicine company, launched an NRG knee brace featuring Spring Hinge Joint Assist technology. It reduces stress on knees by up to 25%.

Application Insights

By application, the arthritis segment accounted for the largest market share of 31.0% in 2024, owing to the increasing product adoption along with rising disease prevalence. There is a high demand for knee braces that help increase stability, alleviate pain, and assist with daily tasks for people with arthritis. Moreover, with growing awareness of the advantages of knee braces for arthritis, the market is expected to grow over the forecast period. For instance, as per the 2022 National Health Survey (NHS) conducted by the Australian Bureau of Statistics (ABS) (ABS 2023), it is estimated that around 3.7 million individuals (15%) in Australia were living with arthritis in 2022.

The sports segment is anticipated to grow at the fastest CAGR during the forecast period. The growing number of sports-related injuries and participation in sports activities, along with the need for rehabilitation, are projected to fuel the segment’s expansion. These devices help speed up the healing process, offer assistance for osteoarthritis in the knee, and decrease knee discomfort, which is essential for athletes who want to recover quickly and get back to their sport. For instance, according to the National Health Service (NHS), around 2 million individuals in the UK end up in Accident & Emergency departments annually due to sports injuries.

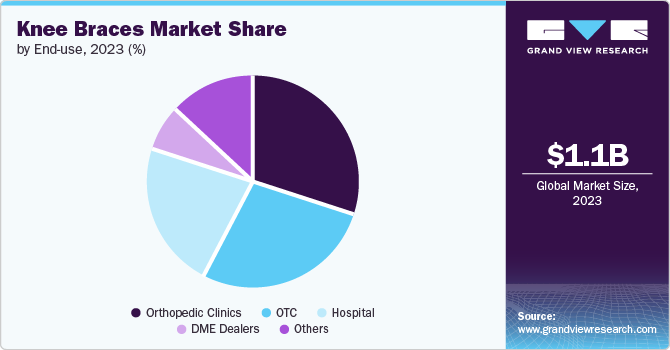

End-use Insights

By end use, the orthopedic clinics segment accounted for the largest market share of 29.6% in 2024. This growth is attributed to the presence of established clinics, with state-of-the-art devices and innovative technologies, offering streamlined orthopedic processes in developed and developing economies. Moreover, a rise in the number of orthopedic clinics and physicians boosts the segment growth. For instance, the American Academy of Orthopaedic Surgery (AAOS) reports that approximately 25,500 orthopedic surgeons practice in the U.S.

The OTC segment is anticipated to register the fastest CAGR growth over the forecast period. An increasing number of older adults are experiencing higher rates of joint issues, such as osteoarthritis, which necessitates regular visits and care in a comfortable outpatient setting. The emphasis on personalized treatment and recovery offered by specialized orthopedic centers is a key factor driving their growth in the orthopedic healthcare industry.

Regional Insights

North America knee braces market dominated the market in 2024 with the largest revenue share of 33.4%. The rising occurrence of orthopedic knee issues such as osteoarthritis and meniscal injuries drives the knee braces industry growth. For instance, according to ACREU 2023, based on CCHS 2019-2021 data, 1 in 5 people in Canada had arthritis, with a prevalence comparison to other chronic diseases from CCHS 2021.

U.S. Knee Braces Market Trends

The U.S. knee braces market dominated the market with the largest share in 2024. The rise in healthcare spending and growing cases of ACL injuries are expected to drive market growth in the region. For instance, according to data published by Medscape in October 2024, an estimated 200,000 ACL-related injuries occur annually in the U.S.

Europe Knee Braces Market Trends

The knee braces market in Europe is expected to witness significant growth over the forecast period. The market is expected to grow due to factors such as greater healthcare spending and a growing geriatric population with a higher incidence of osteoarthritis, osteoporosis, bone injuries, & obesity.

UK knee braces market is anticipated to register a considerable growth rate during the forecast period. owing to an increase in medical tourism and an increasing number of sports injuries. Moreover, the older population in the UK is at a higher risk for degenerative conditions that necessitate knee surgeries. The National Health Service (NHS) stated that more than 20 million individuals in the UK, almost one-third of the population, have musculoskeletal conditions such as arthritis.

Asia Pacific Knee Braces Market Trends

The Asia Pacific knee braces market is anticipated to be the fastest-growing region over the forecast period, owing to improved healthcare infrastructure, high untapped opportunities, rising interest of companies in expanding their presence in this region, and continuous R&D activities by key market players for better innovative products.

India knee braces market is anticipated to register a considerable growth rate during the forecast period. The higher occurrence of osteoarthritis, particularly in weight-bearing joints such as the knees and hips, boosts the market's growth in the country. For instance , according to an article published by the International Journal of Health Sciences and Research in October 2023, the prevalence of knee osteoarthritis in India is 22-39%.

Latin America Knee Braces Market Trends

Latin America knee braces market is expected to witness considerable growth over the forecast period. Factors such as the rising prevalence of arthritis and rapidly improving healthcare infrastructure, increasing healthcare awareness among individuals, and technological advancements in emerging economies are anticipated to contribute to market growth.

Brazil knee braces market is anticipated to register a considerable growth rate during the forecast period. Increasing focus on sports and physical activity in the country drives market growth. For instance, a study published by the NIH in 2023, titled "Injuries and Complaints in the Brazilian National Men's Volleyball Team: A Case Study," analyzed 41 athletes during a specific timeframe. It was found that 12 of these athletes sustained a total of 28 injuries, while 38 reported 402 complaints regarding various issues. The increase in injury cases is anticipated to contribute to market growth.

Middle East and Africa Knee Braces Market Trends

Middle East and Africa knee braces industry is anticipated to register a considerable growth rate during the forecast period owing to the region’s rapidly increasing geriatric population, rising prevalence of chronic diseases, grants supporting R&D efforts, increasingly busy & sedentary lifestyle, and rising funding.

UAE knee braces market is anticipated to register a considerable growth rate during the forecast period. The market growth is expected to be driven by the increasing prevalence of osteoarthritis in the country. For instance , according to an article published by the Middle East Journal of Rehabilitation and Health Studies in May 2024, the prevalence of knee osteoarthritis ranges from 1.4% to 25.8% in the UAE.

Key Knee Braces Company Insights

Key participants in the knee bracesmarket are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Knee Braces Companies:

The following are the leading companies in the knee braces market. These companies collectively hold the largest market share and dictate industry trends.

- Breg, Inc.

- Bauerfeind USA Inc.

- Ottobock

- Össur

- TYNOR ORTHOTICS

- Enovis (DJO, LLC)

- Mueller Sports Medicine, Inc.

- Weber Orthopedic LP. DBA Hely & Weber.

- McDavid.

- Dicarre LLC

Recent Developments

-

In May 2024, Nea International bv/Push Sports, a provider of orthopedic braces, introduced a new line of eight sports braces, including the Kicx Ankle Brace, specially developed for football.

-

In January 2022, Zynex, a pioneering medical technology firm focused on creating and selling non-invasive devices for pain relief, rehabilitation, and patient monitoring, revealed that it was expanding its range of pain and rehabilitation products to include post-operative and osteoarthritis (OA) knee braces.

-

In September 2021, Össur, a worldwide leader in the orthotics and prosthetics (O&P) sector, introduced the REBOUND ACL brace, specifically created to support patients in their recovery from an anterior cruciate ligament (ACL) injury.

-

In June 2020, DJO, a prominent global supplier of medical technologies, launched DonJoy X-ROM Post-Op Knee Brace. The X-ROM brace assists patients in their recovery after ACL repairs and various other knee operations.

Knee Braces Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.26 billion

Revenue forecast in 2030

USD 1.85 billion

Growth rate

CAGR of 7.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Breg, Inc.; Bauerfeind USA Inc.; Ottobock; Össur; TYNOR ORTHOTICS; Enovis (DJO, LLC); Mueller Sports Medicine, Inc.; Weber Orthopedic LP.; DBA Hely & Weber.; McDavid.; Dicarre LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Knee Braces Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global knee braces market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prophylactic

-

Functional

-

Rehabilitative

-

Unloader

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sports

-

Ligament

-

Arthritis

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Orthopedic Clinics

-

OTC

-

Hospital

-

DME Dealers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

UAE

-

South Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global knee braces market size was estimated at USD 1.19 billion in 2024 and is expected to reach USD 1.26 billion in 2025.

b. The global knee braces market is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2030 to reach USD 1.85 billion by 2030.

b. Arthritis segment dominated the market in 2024 with the largest revenue share of 31.0%, owing to the increasing product adoption along with rising disease prevalence.

b. Some key players operating in the knee braces market include Breg, Inc., Bauerfeind USA Inc., Ottobock, Össur, TYNOR ORTHOTICS, Enovis (DJO, LLC), Mueller Sports Medicine, Inc., Weber Orthopedic LP. DBA Hely & Weber., McDavid., Dicarre LLC.

b. The rise in osteoarthritis (OA) cases, orthopedic knee surgeries, athletic injuries and other knee related injuries are fueling the growth of the knee brace industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.