- Home

- »

- Homecare & Decor

- »

-

Kitchenware Market Size And Share, Industry Report, 2033GVR Report cover

![Kitchenware Market Size, Share & Trend Report]()

Kitchenware Market (2026 - 2033) Size, Share & Trend Analysis Report By Product (Cookware, Bakeware, Tableware), By Application, By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-939-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kitchenware Market Summary

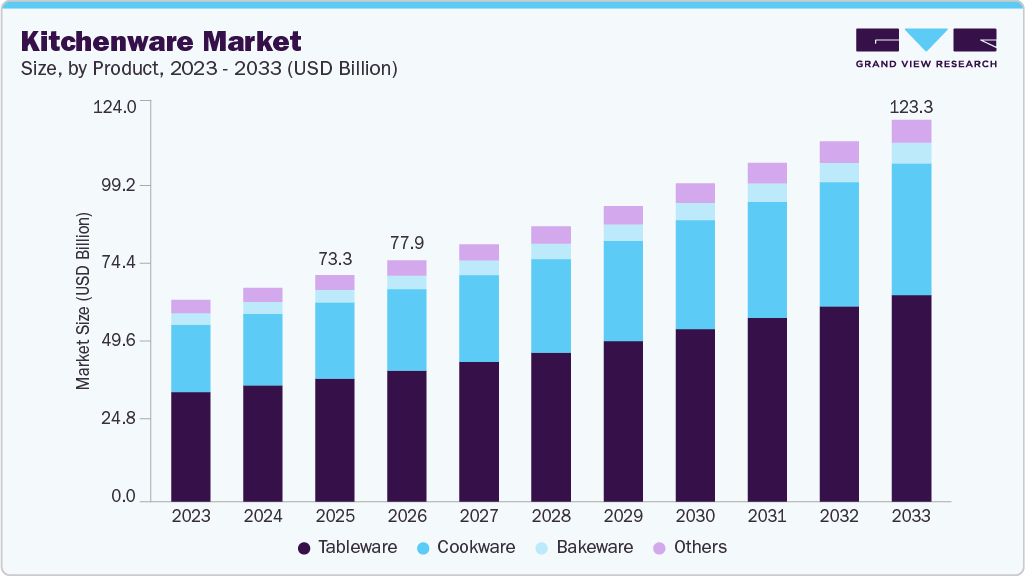

The global kitchenware market size was estimated at USD 73.26 billion in 2025 and is projected to reach USD 123.33 billion by 2033, growing at a CAGR of 6.8% from 2026 to 2033. As people around the world embrace cooking not just as a necessity but also as a recreational and cultural activity, the demand for high-quality kitchen tools has increased.

Key Market Trends & Insights

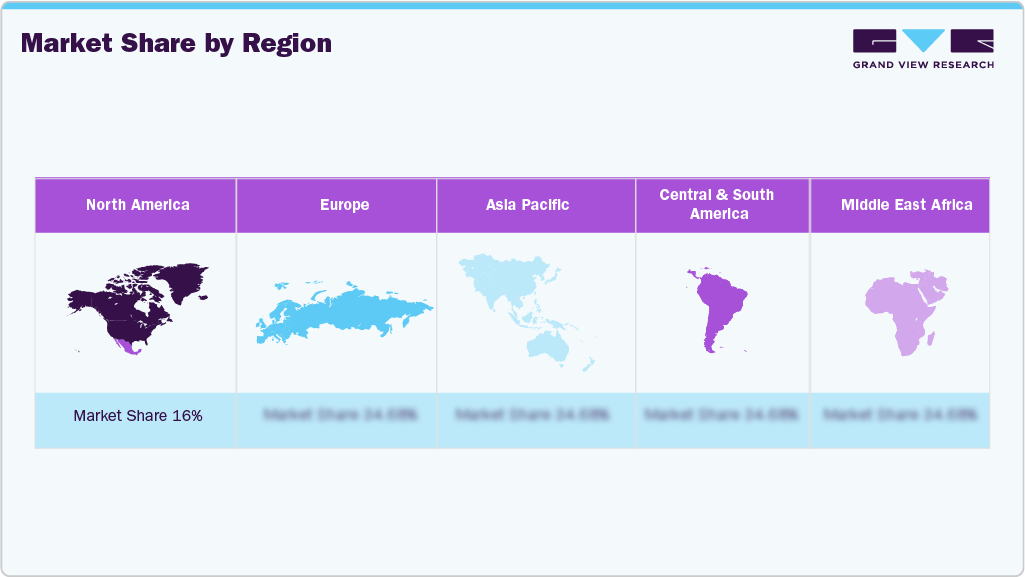

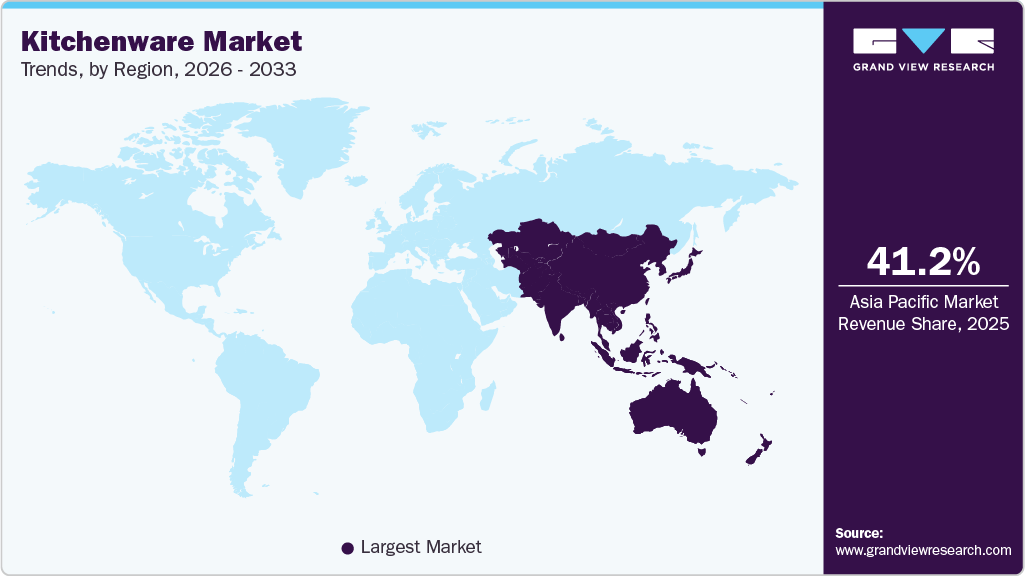

- By region, Asia Pacific led the market with a share of 41.2% in 2025.

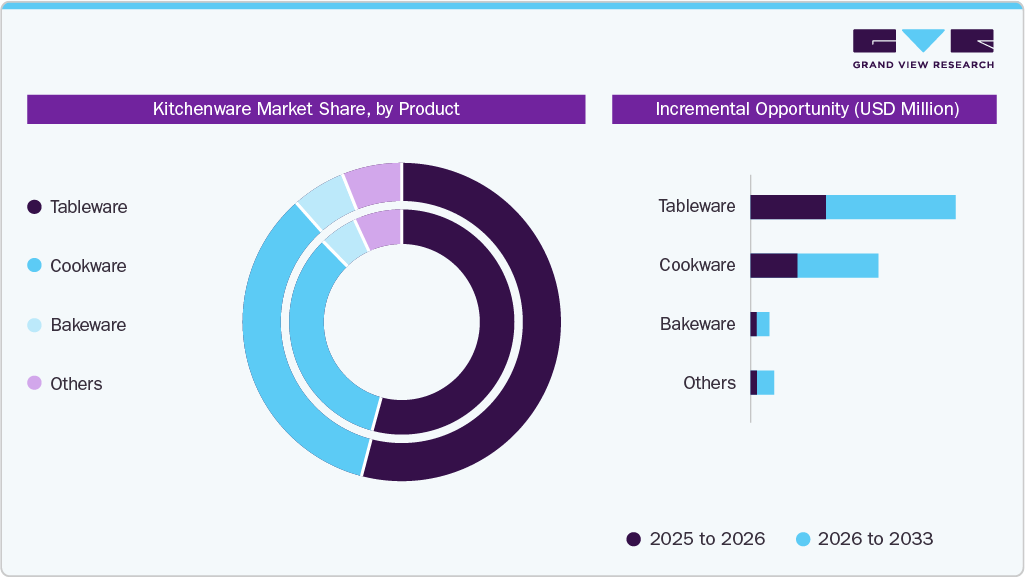

- By product, tableware led the market and accounted for a share of 54.3% in 2025.

- By application, residential led the market and accounted for a share of 68.0% in 2025.

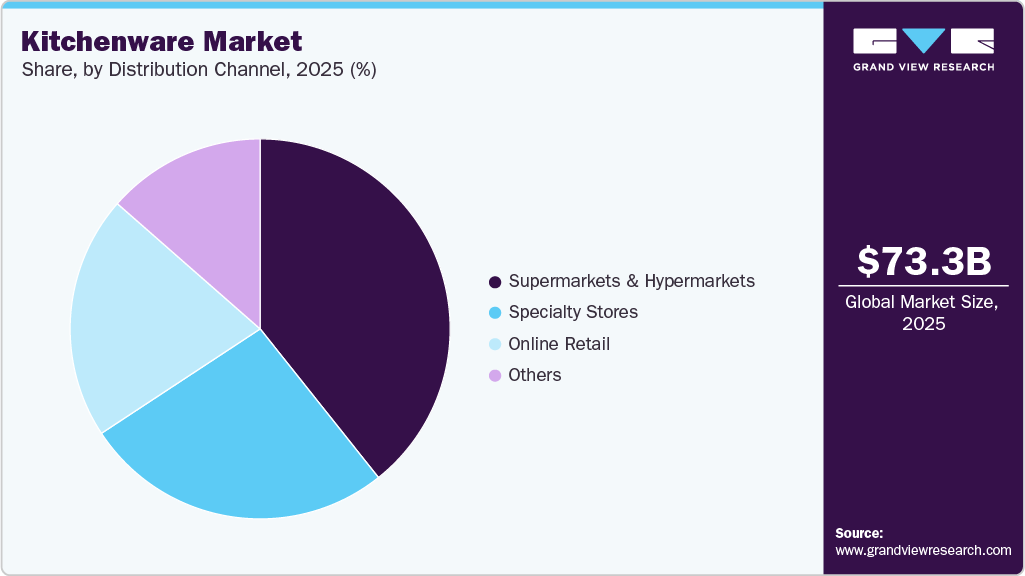

- By distribution channel, supermarkets & hypermarkets led the market and accounted for a share of 39.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 73.26 Billion

- 2033 Projected Market Size: USD 123.33 Billion

- CAGR (2026- 2033): 6.8%

- Asia Pacific: Largest market in 2025

This shift is largely influenced by a growing desire to prepare meals that are both healthier and more personalized. Consumers are investing in well-crafted cookware, utensils, serveware, and table accessories that enhance their culinary experiences, elevate food presentation, and reflect their taste.This growing emphasis on kitchenware products reflects a deeper shift in consumer values. People are placing higher importance on long-term quality, aesthetic harmony, and responsible consumption. As a result, there is a move away from disposable or generic kitchen items in favor of curated pieces that contribute to a well-organized, visually appealing kitchen. Retailers are adapting by offering themed collections and bundling options that cater to specific lifestyles and cooking habits, thereby further driving engagement and loyalty.

According to the National Frozen and Refrigerated Foods Association (NFRA), 64% of Americans prefer to cook at home to save money and better manage their budgets. The 2023 report showed that 81% of consumers prepared the majority of their meals at home. With increased cooking confidence developed during the pandemic, many are seeking fresh ideas to prepare healthier meals at home.

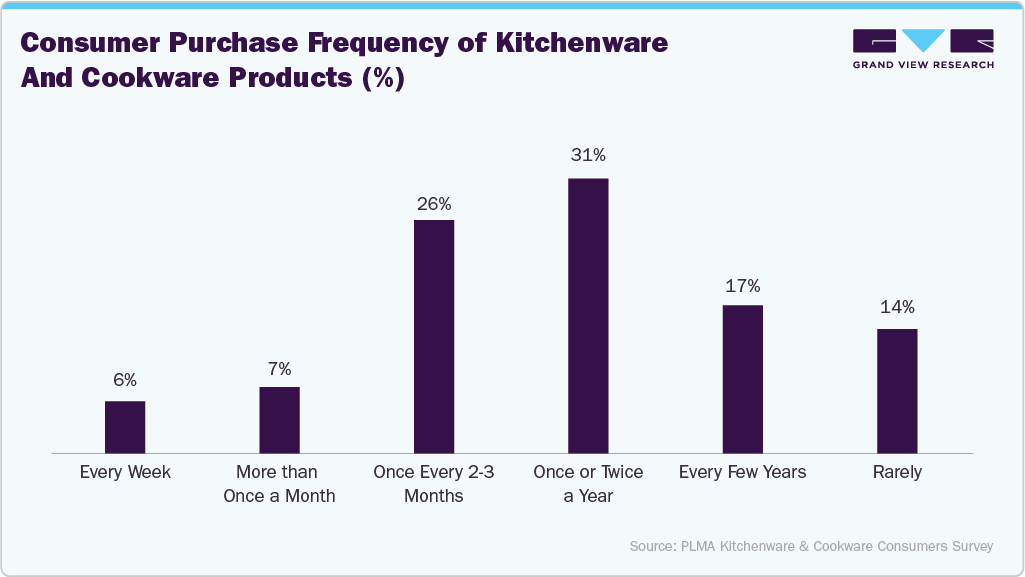

The increasing popularity of home cooking and baking has significantly contributed to a growing demand for kitchenware. As more individuals embrace the idea of preparing meals and baked goods from scratch, the demand for reliable, efficient, and high-quality kitchen tools naturally expands. People spending more time in their kitchens require kitchenware that not only supports a wide range of cooking and baking techniques but also enhances the overall experience, making the process smoother and more enjoyable. This increased engagement in in-home culinary activities leads consumers to upgrade or broaden their kitchenware collections, seeking items that can help them achieve consistent and satisfying results.

As food service establishments expand and multiply, there is a growing need for durable, efficient, and often aesthetically pleasing kitchen equipment. Commercial kitchens, in particular, require high-capacity cookware, specialized appliances, and advanced preparation tools that can handle bulk cooking without compromising on quality or safety. This has stimulated demand for a wide range of products, from stainless steel utensils and heat-resistant cookware to sophisticated appliances such as combi-ovens and induction cooktops. Moreover, innovations in kitchenware are now being tailored to meet the unique requirements of the professional culinary environment, including energy efficiency, ease of maintenance, and compliance with food safety regulations.

Social media has transformed kitchens into lifestyle spaces, leading individuals to seek out beautifully designed and Instagram-worthy kitchenware. There is a marked preference for modern, minimalist styles as well as handcrafted and artisanal pieces that add character and charm to everyday dining. At the same time, a growing awareness of sustainability has driven demand for eco-friendly kitchenware made from bamboo, recycled metals, and plant-based materials, catering to environmentally conscious consumers.

In addition, the aesthetic value of kitchen tools and tableware has grown in importance due to the rise of open kitchens, chef’s tables, and social media trends. Presentation is now a crucial aspect of dining, leading restaurants and hotels to invest in premium-grade serving dishes, artisanal tableware, and branded cutlery. This demand for visually appealing and functional kitchenware has encouraged manufacturers to collaborate with designers and chefs to produce items that are not only practical but also visually captivating. As a result, kitchenware has evolved from mere tools of necessity to integral elements of the overall dining experience, reflecting brand identity and elevating customer satisfaction.

Product Insights

Tableware accounted for the largest market share of 54.3% in 2025. The tableware segment, comprising dinnerware, flatware, stemware, and related accessories, is witnessing high demand, driven by lifestyle changes, rising disposable incomes, and evolving consumer preferences toward aesthetic and functional dining experiences. Dinnerware, including plates, bowls, and serving dishes, remains the highly preferred category, with consumers favoring materials such as porcelain, bone china, and stoneware for their blend of elegance and durability. The shift toward casual dining and minimalistic aesthetics has also boosted the popularity of earthy tones, matte finishes, and artisanal styles. As consumers increasingly seek to elevate everyday meals and social dining at home, there is a growing demand for well-designed, durable, and often eco-conscious tableware products.

The cookware is expected to grow at a CAGR of 7.2% from 2026 to 2033. The demand for cookware is growing significantly across the globe, driven by a surge in home cooking, health-conscious eating habits, and the desire for efficient and multifunctional kitchen tools. Within this landscape, the cookware segment encompassing pressure cookers, pots and pans, and microwave-safe cookware has emerged as a significant contributor to market growth. The rising popularity of pressure cookers is attributed to their efficiency and time-saving attributes, catering to consumers seeking convenient cooking methods. Technological advancements have led to the development of modern pressure cookers with enhanced safety features and programmable options, including electric variants like Instant Pots.

Application Insights

Kitchenware use in residential accounted for the largest market revenue share of 68.0% in 2025. This growing inclination toward home-cooked meals has spurred demand for a variety of kitchenware products, including cookware, bakeware, cutlery, utensils, and food storage solutions. Urbanization and the rising number of nuclear households have been key contributors to this trend. As more people establish independent residences, especially in emerging economies, the need for complete kitchen setups has surged. This has translated into growing sales of multi-functional, easy-to-use, and space-efficient kitchenware. Functionality, aesthetics, and sustainability increasingly shape consumer preferences. There's a notable shift toward eco-friendly, non-toxic, and durable materials, such as cast iron, stainless steel, and BPA-free plastics.

The use of kitchenware in commercials is expected to grow at a CAGR of 7.2% from 2026 to 2033. As more people experiment with gourmet cooking, baking, and meal preparation inspired by social media, cooking shows, and home-based food businesses, they are seeking durable, high-performance tools that deliver restaurant-level results. The demand for commercial kitchenware is experiencing strong growth, closely tied to the expansion of the restaurant and foodservice industry. According to data from the National Restaurant Association (NRA), U.S. foodservice sales grew by 8.6% from 2022 to 2023, surpassing $1 trillion for the first time. Sales are projected to rise another 5.4% in 2024, reaching $1.1 trillion.

Distribution Channel Insights

Sales of kitchenware through supermarkets & hypermarkets held the largest revenue share, accounting for a share of 39.3% in 2025. The growth is attributed to consumers increasingly prioritizing convenience, affordability, and immediate availability in everyday home purchases. These large-format retail stores allow shoppers to bundle kitchenware purchases with routine grocery trips, reducing the need for separate store visits. Supermarkets and hypermarkets also benefit from competitive pricing, frequent promotions, and private-label offerings, making basic and mid-range kitchen tools more accessible to price-sensitive consumers. Additionally, the growing trend of home cooking and meal preparation, especially among urban households, has increased impulse and planned purchases of cookware and utensils placed in high-traffic aisles.

Sales of kitchenware through online retail are expected to grow at a CAGR of 7.4% over the forecast period. E-commerce platforms allow buyers to instantly compare brands, materials, and prices, access detailed product reviews, and benefit from frequent discounts and doorstep delivery advantages that traditional retail often cannot match. The growth of urban households, dual-income families, and home cooking trends, supported by social media and influencer-driven recipe content, has further accelerated online demand. In addition, improved logistics, easy return policies, and the expansion of direct-to-consumer (DTC) brands have strengthened consumer confidence in purchasing kitchenware products online, making digital channels a preferred and fast-growing route to market.

Regional Insights

The kitchenware industry in North America accounted for a share of 16.9% in 2025. Consumer preferences for kitchenware lean heavily toward timeless, traditional designs in North America. Innovation in form or multi-functionality does not typically rank high in consumer priority. Instead, practical design elements such as riveted handles made of durable materials like steel are favored. Additionally, there is a notable preference for kitchenware in darker shades, such as black, gray, and metal tones, while red is often used sparingly for accent purposes. Manufacturers are working to introduce more contemporary and culturally diverse kitchenware products to appeal to the American market. For instance, in September 2023 launch by Williams Sonoma Inc., a leading design-focused and eco-conscious home retailer. The company introduced an exclusive kitchenware line in collaboration with Stanley Tucci, featuring GreenPan’s advanced ceramic non-stick coating. The Tucci by GreenPan collection draws inspiration from Italian craftsmanship and is exclusively available at Williams Sonoma.

U.S. Kitchenware Market Trends

The kitchenware industry in the U.S. has witnessed a notable shift toward energy-efficient infrastructure and construction practices. This transition has significantly boosted the demand for induction cooktops in residential settings, which in turn has increased the revenue generated from induction-compatible kitchenware products in the country. Prominent U.S.-based suppliers such as Meyer Corp. (Meyer International) continue to offer a wide variety of non-stick kitchenware products tailored to the evolving needs of American households.

Europe Kitchenware Market Trends

The kitchenware industry in Europe is expected to grow at a CAGR of 6.2% from 2026 to 2033. The growing focus on sustainability and green living in European countries, such as Germany, Italy, and Spain, has contributed to the increasing popularity of induction cooktops. With the European Commission (EC) emphasizing sustainable construction practices in all member countries of the European Union (EU), there has been a significant increase in smaller houses and modular kitchens. Consequently, these factors have contributed to the growth in the adoption of induction-compatible kitchenware products with space-efficient designs. Kitchenware products market vendors based in the region, such as Cristel and Groupe SEB, offer a comprehensive range of induction kitchenware in several designs and finishes.

Asia Pacific Kitchenware Market Trends

The kitchenware industry in the Asia Pacific accounted for a share of 41.2% in 2025. Recently, single-person households have been the fastest-growing household type, due to both long-term demographic trends and increasing economic independence. The growing popularity of single-person households in the coming years is expected to create significant demand for kitchenware. The continuous expansion of the residential sector, increasing number of home remodeling and renovation projects, and rising disposable income are likely to generate significant demand for kitchenware products over the forecast period.

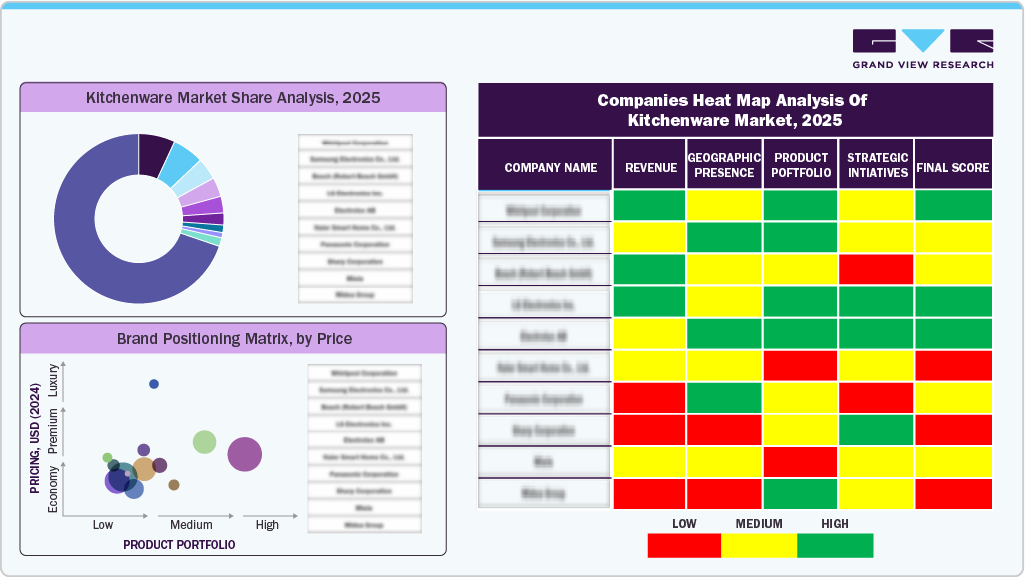

Key Kitchenware Company Insights

Some of the key companies in the market include GROUPE SEB, Wilh. Werhahn KG., Target Brands, Inc., Meyer International, and Fissler, among others. The market presents moderate to high entry barriers due to the presence of leading market players and the requirement of high setup costs. The market is further driven by innovation in designs, mergers and acquisitions, and joint ventures. The key manufacturers are making high investments in research and development to gain an edge over their competitors.

-

In January 2025, Tefal and the Paul Bocuse brand collaborated to launch a premium cookware collection that marries French culinary tradition with modern innovation. This partnership aims to make professional-grade cookware accessible to home chefs worldwide. The collection features 12 essential kitchen items, including frypans, woks, sauté pans, saucepans with lids, and a stewpot crafted from high-quality materials such as uncoated 18/10 stainless steel and aluminum with a durable non-stick Titanium coating. The riveted gilded brass handle is a distinctive feature, inspired by one of Monsieur Paul Bocuse's historic collections, symbolizing durability and elegance.

-

In February 2025, TTK Prestige announced plans to expand its retail footprint by 30% over the next four years, aiming to capitalize on increased consumer spending spurred by recent government income tax relief measures. Currently operating approximately 680 stores across 375 towns, the company intends to enhance its presence in large urban and smaller cities, where consumption is rising. This expansion aligns with broader trends in India's home and household goods sector.

-

In February 2025, Tramontina and Indian precision manufacturing firm Aequs announced a joint venture to establish a cookware manufacturing facility in India. This collaboration aims to combine Aequs's advanced manufacturing capabilities with Tramontina's extensive cookware production expertise, catering to domestic and international markets. The partnership is expected to bolster India's manufacturing sector and expand Tramontina's global footprint.

Key Kitchenware Companies:

The following are the leading companies in the kitchenware market. These companies collectively hold the largest market share and dictate industry trends.

- Groupe SEB

- Wilh. Werhahn KG.

- Target Brands, Inc.

- Meyer International Holdings Limited

- Fissler

- Tramontina

- Newell Brands, Inc.

- SCANPAN

- TTK Prestige Ltd.

- The Vollrath Company, LLC

Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 77.95 billion

Revenue forecast in 2033

USD 123.33 billion

Growth rate

CAGR of 6.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Groupe SEB; Wilh. Werhahn KG.; Target Brands, Inc.; Meyer International Holdings Limited; Fissler; Tramontina; Newell Brands, Inc.; SCANPAN; TTK Prestige Ltd.; The Vollrath Company, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kitchenware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global kitchenware market report on the basis of product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microware Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks

-

Cooking Tools

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global kitchenware market size was estimated at USD 73.26 billion in 2025 and is expected to reach USD 77.95 billion in 2026.

b. The global kitchenware market is expected to grow at a compound annual growth rate of 6.8% from 2026 to 2033 to reach USD 123.33 billion by 2033.

b. Tableware accounted for the largest market share of 54.3% in 2025. The tableware segment, comprising dinnerware, flatware, stemware, and related accessories, is witnessing high demand, driven by lifestyle changes, rising disposable incomes, and evolving consumer preferences toward aesthetic and functional dining experiences.

b. Some key players operating in the kitchenware market include Boffi, Scavolini S.p.a, Tupperware, Viners, Chasseur, Kenwood Limited, TTK Prestige Ltd., Miele, Whirlpool Corp., and Kitchenaid, among others.

b. Key factors that are driving the market growth include rising disposable incomes and changing lifestyles of consumers, along with increasing number of middle & high income households.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.