- Home

- »

- Homecare & Decor

- »

-

Kitchen Storage And Pantry Organization Products Market Report 2030GVR Report cover

![Kitchen Storage And Pantry Organization Products Market Size, Share & Trends Report]()

Kitchen Storage And Pantry Organization Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Jars And Containers, Cabinets Organizers), By Application, By Material, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-448-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kitchen Storage And Pantry Organization Products Market Summary

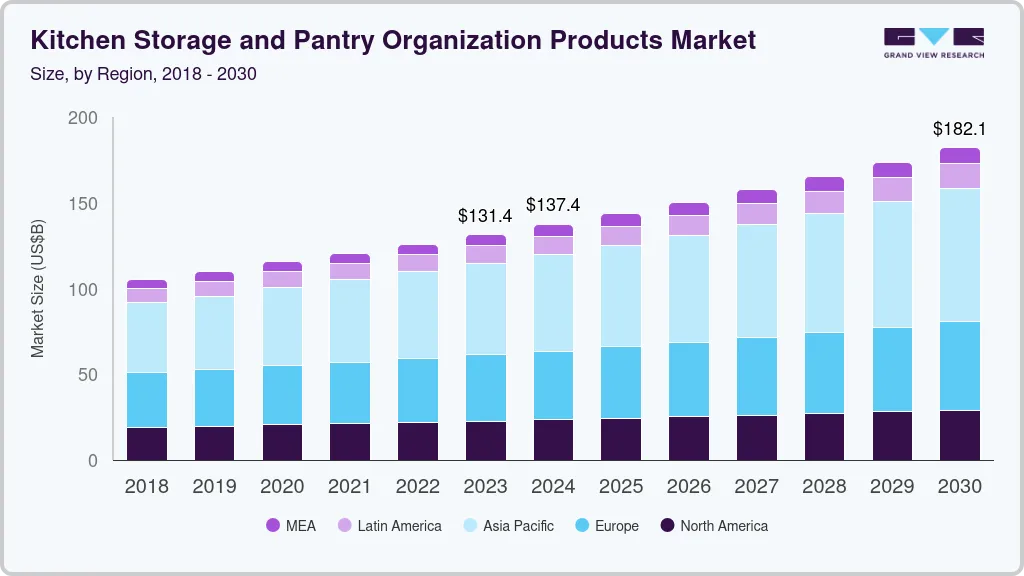

The global kitchen storage and pantry organization products market size was estimated at USD 131.43 billion in 2023 and is projected to reach USD 182.08 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. The market is experiencing significant growth, driven by increasing consumer focus on maximizing kitchen space and improving functionality.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- The kitchen storage and pantry organization products market in the U.S. is expected to grow significantly.

- By product, the jars and containers accounted for a share of about 27% in 2023.

- By material, the plastic-made products accounted for a share of about 36% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 131.43 Billion

- 2030 Projected Market Size: USD 182.08 Billion

- CAGR (2024-2030): 4.8%

- Asia Pacific: Largest market in 2023

As homes evolve to include multifunctional kitchens, products like stackable containers, shelving units, and drawer dividers have become essential. The rise in smaller living spaces, particularly in urban areas, has further fueled demand for space-saving solutions. Innovations in material, design, and customization are also making storage products more attractive to consumers, who seek both practicality and aesthetic appeal. This trend is especially visible in the surge of eco-friendly and sustainable storage options.One of the key drivers in this market is the growing trend of home cooking, reinforced by the pandemic and the rise of health-conscious lifestyles. As more people prepare meals at home, the need for efficient storage to organize ingredients, spices, and cooking tools has become more important. Additionally, the rise of meal prepping and bulk buying has led to a demand for products that keep food fresh for longer, such as airtight containers and bins. This consumer shift has motivated manufacturers to introduce new products that cater to evolving kitchen organization needs.

Another significant factor pushing the market forward is the influence of social media, where platforms like Instagram and Pinterest promote aesthetically pleasing kitchen setups. Influencers and home organization experts share tips and products, driving consumer interest in maintaining tidy and visually appealing kitchens. This has led to a demand for customizable and stylish storage solutions that enhance both the organization and the design of kitchens. As a result, manufacturers are increasingly focused on offering products that combine form and function, catering to the aesthetic aspirations of consumers.

The emphasis on sustainability is also shaping the kitchen storage and pantry organization market. Consumers are becoming more eco-conscious, leading to a preference for products made from recyclable, reusable, and biodegradable materials. Brands are responding by launching eco-friendly storage options, such as bamboo drawer dividers, glass storage containers, and reusable silicone bags. The growing awareness of plastic waste and its environmental impact is driving this trend, influencing both product development and consumer buying decisions.

Product Insights

Jars and containers accounted for a share of about 27% in 2023. These are popular for kitchen and pantry organizations due to their practicality and versatility. They help maintain freshness by providing airtight seals, making them ideal for storing dry goods, spices, and perishable foods. Their transparent designs, particularly in glass and plastic options, allow easy visibility of contents, promoting better organization and reducing food waste. Additionally, jars and containers come in various sizes and materials, catering to different storage needs, from bulk ingredients to small spices. Their aesthetic appeal also adds a decorative element to the kitchen, making them a preferred choice for both functionality and style.

The demand for cabinet organizers is expected to rise at a CAGR of 6.0% from 2024 to 2030. These are set to gain popularity due to their ability to enhance kitchen efficiency and maximize storage space. With increasing emphasis on decluttering and optimizing home environments, these organizers offer practical solutions for managing cookware, dishes, and pantry items. Features like pull-out racks, adjustable drawers, and under-shelf baskets streamline access and improve organization, addressing common storage challenges. As consumers seek to create more functional and aesthetically pleasing kitchens, the demand for innovative and versatile cabinet organizers will continue to rise, making them essential components of modern home design.

Material Insights

Plastic-made products accounted for a share of about 36% in 2023. This is due to their affordability, versatility, and durability. They are lightweight, making them easy to handle, and ideal for a variety of storage needs, from pantry items to cookware. Plastic containers are resistant to breakage and often come in a range of sizes and shapes, catering to different organizational needs. Additionally, many plastic products are designed with airtight seals and stackable features, enhancing their functionality and appeal for consumers seeking practical storage solutions.

The demand for glass storage and pantry organization products is expected to rise at a CAGR of 5.3% from 2024 to 2030. These are growing in popularity due to their health, environmental, and durability benefits. Unlike plastic, glass is inert and does not release harmful chemicals, ensuring safer food storage. It is also highly durable and recyclable, offering a more sustainable option compared to plastic. Additionally, glass containers are freezer and oven-safe, providing versatile storage solutions. As consumers become more health-conscious and eco-friendly, the demand for glass products is expected to rise, making them a preferred choice for modern kitchens.

Application Insights

Residential applications held the largest share of about 68% in 2023. This is due to the increasing emphasis on home organization and personal wellness. Homeowners are investing in solutions that enhance kitchen efficiency and aesthetics, leading to a surge in demand for various storage products like glass containers and drawer organizers. The growing trend of DIY home improvement and the desire for customized storage solutions further drive this dominance, as individuals seek to optimize their living spaces for functionality and style.

The demand for kitchen storage and pantry organization products in commercial spaces is anticipated to grow at a CAGR of 5.3% from 2024 to 2030. This sector is poised for growth as businesses in the food service and hospitality sectors seek to improve their storage practices and operational efficiency. Restaurants, hotels, and catering services require robust and hygienic storage solutions to manage large quantities of ingredients and supplies. Advances in storage technology and the need for compliance with health regulations are pushing commercial entities to adopt more effective and sustainable storage products. This increased demand for optimized organization and preservation solutions is expected to drive significant growth in the commercial segment of the industry.

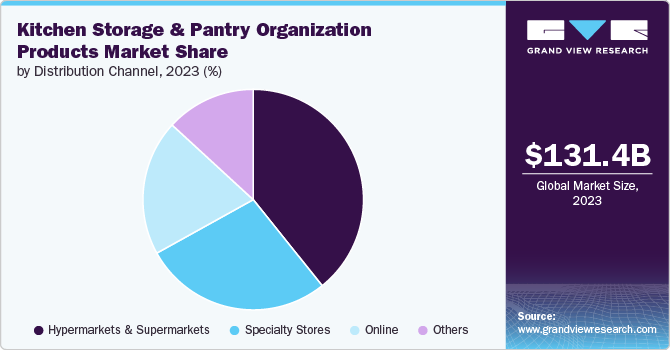

Distribution Channel Insights

The sales of kitchen storage and pantry organization products through hypermarkets & supermarkets accounted for a market share of 39% in 2023. This is due to their extensive reach and diverse product offerings. These retail formats provide a one-stop shopping experience, allowing consumers to explore a wide range of storage solutions under one roof. The convenience of immediate purchase and the ability to physically inspect products enhance consumer confidence in their choices. Additionally, these stores often feature promotional discounts and bulk-buying options, making them an attractive destination for shoppers looking to stock up on storage essentials.

Online sales of kitchen storage and pantry organization products are expected to grow at a CAGR of 11.0% from 2024 to 2030. E-commerce platforms offer a vast array of products with detailed descriptions, customer reviews, and competitive pricing, making it easier for consumers to compare and select storage solutions from the comfort of their homes. The rise of digital shopping trends, coupled with advancements in logistics and delivery services, is further driving this growth. Online shopping also allows for personalized recommendations and targeted marketing, enhancing the overall consumer experience and contributing to the expansion of this channel.

Regional Insights

North America kitchen storage and pantry organization products market accounted for a market share of around 17% in 2023 in the global market. The industry here is very prevalent due to a combination of high consumer spending power and a strong focus on home improvement. The region's emphasis on maintaining well-organized and efficient living spaces drives demand for a variety of storage solutions. Additionally, the high rate of home ownership and renovation activities in North America contributes to the strong market presence, as consumers seek products that enhance both functionality and aesthetic appeal in their kitchens.

U.S. Kitchen Storage and Pantry Organization Products Market Trends

The kitchen storage and pantry organization products market in the U.S. accounted for a market share of around 85% in 2023 in the North American market. The region’s large consumer base and high levels of disposable income are factors contributing to the market’s growth. Americans' focus on home organization, coupled with a culture of consumerism and frequent home renovations, fuels the demand for innovative storage solutions. The extensive retail network, including major hypermarkets, supermarkets, and online platforms, provides easy access to a wide range of products, further boosting market activity and growth in the U.S.

Asia Pacific Kitchen Storage and Pantry Organization Products Market Trends

The kitchen storage and pantry organization products market in Asia Pacific is anticipated to rise at a CAGR of 5.6% from 2024 to 2030. The region is undergoing rapid urbanization, growing middle-class populations, and increasing disposable incomes. As cities expand and living spaces become more compact, there is a heightened need for efficient storage solutions. The rise in home ownership and modernization trends across countries like China and India also drive demand. Additionally, the region's growing e-commerce sector enhances accessibility to a wide range of storage products, supporting the overall market dominance in Asia Pacific.

Key Kitchen Storage And Pantry Organization Products Company Insights

The kitchen storage and pantry organization products market is fragmented. Market players are enhancing their share by innovating product designs, such as offering multifunctional and customizable storage solutions. They are also expanding their distribution channels, including e-commerce platforms, and leveraging marketing strategies that emphasize convenience, sustainability, and aesthetic appeal to attract a broader customer base.

Key Kitchen Storage And Pantry Organization Products Companies:

The following are the leading companies in the kitchen storage and pantry organization products market. These companies collectively hold the largest market share and dictate industry trends.

- The Container Store

- Newell Brands Inc. (Rubbermaid)

- OXO

- Tupperware Brands Corporation

- Sterilite Corporation

- ClosetMaid

- Spectrum Diversified Designs, LLC.

- Rev-A-Shelf LLC

- Progressive International

- Honey-Can-Do International

Recent Developments

-

In January 2024, IKEA introduced the KLIPPKAKTUS, an innovative under-shelf fridge organizer designed to maximize space and streamline fridge storage. Priced between USD 5-6, this budget-friendly solution helps users efficiently organize their fridge, reducing food waste and making items easier to find. The KLIPPKAKTUS was available both in-store and online, offering a practical and cost-effective way to improve kitchen organization.

-

In September 2022, Lifewit launched its adjustable plastic seasoning jar organizer, designed to fit various drawer sizes and offer customizable storage. This organizer, featuring three tiers and a capacity for 24 spice jars, allowed users to view all their spices at a glance. The durable, transparent plastic construction made it a lightweight and easy-to-clean addition to kitchen storage solutions.

-

In March 2021, Godrej Locks launched SKIDO, a new line of smart kitchen storage solutions designed specifically for Indian kitchens. Aimed at capturing a share of the growing modular kitchen market, SKIDO offered innovative products such as drawers and organizers tailored to local cooking styles. The company sought to capitalize on the increasing demand for customized and functional kitchen solutions. The SKIDO range reflected extensive research and includes products like drawers, hinges, baskets, etc.

Kitchen Storage And Pantry Organization Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 137.36 billion

Revenue forecast in 2030

USD 182.08 billion

Growth Rate (Revenue)

CAGR of 4.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, material, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, & Middle East & Africa

Country scope

U.S, Canada, Mexico, U.K., Germany, France, Italy, Spain, Japan, China, India, Brazil, Argentina, South Africa, and Saudi Arabia

Key companies profiled

The Container Store; Newell Brands Inc. (Rubbermaid); OXO; Tupperware Brands Corporation; Sterilite Corporation; ClosetMaid; Spectrum Diversified Designs, LLC.; Rev-A-Shelf LLC; Progressive International; and Honey-Can-Do International

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kitchen Storage And Pantry Organization Products Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kitchen storage and pantry organization products market report on the basis of product, application, material, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Jars and Containers

-

Racks and Shelves

-

Trolleys and Carts

-

Countertop/Desk Organizers

-

Cabinets Organizers

-

Refrigerator Organizers

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Metal

-

Wood

-

Glass

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online/E-commerce

-

Others (Department Stores, etc.)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global kitchen storage and pantry organization products market was estimated at USD 131.43 billion in 2023 and is expected to reach USD 137.36 billion in 2024.

b. The global kitchen storage and pantry organization products market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 182.08 billion by 2030.

b. Asia Pacific dominated the kitchen storage and pantry organization products market with a share of around 40% in 2023. The region's growing e-commerce sector, growing urbanization in nations like China and India, along with living spaces becoming more compact, are driving the market.

b. Key players in the kitchen storage and pantry organization products market are The Container Store; Newell Brands Inc. (Rubbermaid); OXO; Tupperware Brands Corporation; Sterilite Corporation; ClosetMaid; Spectrum Diversified Designs, LLC.; Rev-A-Shelf LLC; Progressive International; Honey-Can-Do International.

b. Key factors that are driving the kitchen storage and pantry organization products market growth include increasing consumer demand for efficient storage solutions, rising urbanization leading to smaller living spaces, growing focus on home organization and decluttering, and innovations in storage product designs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.