- Home

- »

- Homecare & Decor

- »

-

Kitchen Lighting Market Size, Share And Trends Report, 2030GVR Report cover

![Kitchen Lighting Market Size, Share & Trends Report]()

Kitchen Lighting Market Size, Share & Trends Analysis Report By Product (Ceiling, Under Cabinet), By Source (LED, CFL), By Type, By End Use, By Technology, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-480-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Kitchen Lighting Market Size & Trends

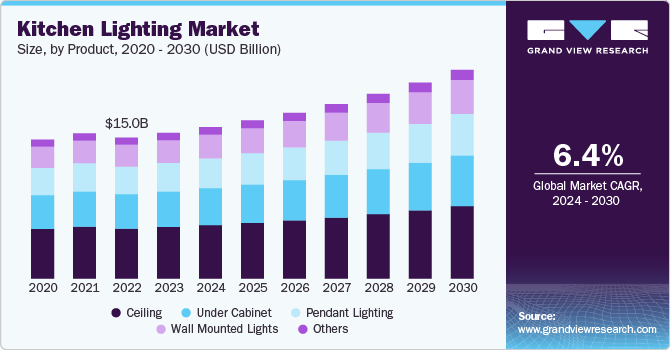

The global kitchen lighting market size was estimated at USD 15.69 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. The growing trend toward multifunctional living spaces drives the demand for kitchen lighting. Kitchens are no longer confined to cooking alone but are used for dining, socializing, and even as makeshift workspaces. This transformation has placed a higher emphasis on effective kitchen lighting that can serve various purposes. Consumers seek customizable lighting solutions that can adapt to different activities, such as task lighting for cooking, dimmable options for a cozy dining atmosphere, and brighter lights for social gatherings or work.

The rise in sustainable and energy-efficient living has further fueled the demand for kitchen lighting solutions. With the growing awareness of environmental concerns, consumers are prioritizing lighting solutions that are energy-efficient and environmentally friendly. The widespread adoption of LED technology has played a key role here, as these lights consume far less electricity, last longer, and reduce overall energy costs. Many homeowners also switch to energy-efficient lighting to meet green building standards, reflecting the increased global focus on sustainability.

Furthermore, integrating smart home technologies has created new opportunities for market growth. Smart lighting systems allow users to control the brightness and color temperature and even schedule lighting routines using apps or voice commands, adding convenience and flexibility. This level of automation is in line with modern consumer lifestyles, where comfort, convenience, and efficiency are highly valued. The increased adoption of Internet of Things (IoT)has further enhanced the appeal of smart kitchen lighting. Many consumers look for smart integrations across various home devices, including lighting, which has led to its increased adoption.

The increase in home renovation and remodeling activities has also significantly impacted kitchen lighting demand. With more homeowners looking to upgrade their living spaces, kitchen renovations have become a top priority, and lighting plays a crucial role in these projects. Whether it's upgrading to sleek, modern lighting fixtures or adding under-cabinet lights for better task illumination, lighting has become an essential part of kitchen makeovers. This trend is particularly notable in developed countries, where home improvement culture continues to grow, supported by increased disposable income and the popularity of DIY home projects. According to an article by Today's Homeowner in 2023, demand for kitchen renovations has been steadily growing, accounting for a large percentage of home improvement projects. Around 81% of homeowners perform at least some remodeling on their kitchens, and a minor kitchen remodel yields an average return on investment (ROI) of about 77%. The trend toward DIY kitchen projects has been rising, with about 30% of homeowners renovating without professional contractors. The total spending on kitchen renovations ranges from USD 10,000 to over USD 50,000, depending on the scale and materials used.

Product Insights

Ceiling lights accounted for about 35.23% of the market. As modern kitchen designs focus on aesthetics and functionality, ceiling lights provide an effective solution for bright and even illumination. The trend toward open-concept living spaces has further boosted the use of ceiling lights, as they help define the kitchen area while enhancing overall home lighting. In addition, advancements in LED technology have made ceiling lights more energy-efficient and long-lasting, which appeals to environmentally conscious consumers. The growing preference for smart lighting systems also plays a role, as ceiling lights can easily integrate with these systems, providing customizable lighting options for kitchen activities.

The under-cabinet lights segment is expected to grow at a CAGR of about 7.1% from 2024 to 2030. Under-cabinet lights provide focused illumination on countertops without occupying valuable space, making them suitable for smaller kitchens or kitchens with open shelving. The rising interest in personalized lighting experiences further fuels demand. Under-cabinet lighting, especially with dimmable and color-adjustable features, allows homeowners to customize lighting levels based on time of day or specific tasks, enhancing convenience and comfort. Architects and interior designers increasingly recommend under-cabinet lights as a design solution for achieving a clutter-free and sophisticated look.

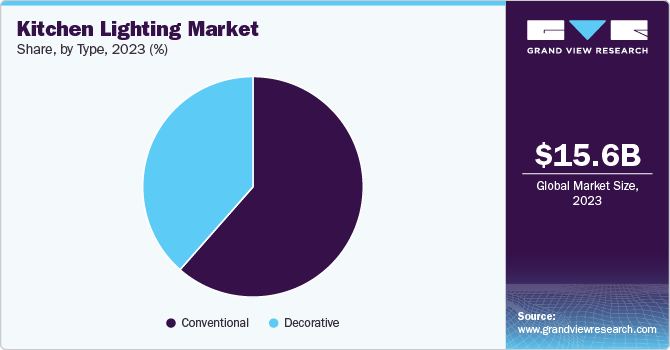

Type Insights

The conventional type segment accounted for a share of 62.66% in 2023. Many consumers prefer conventional lighting options, such as incandescent and halogen lights, for their familiar warmth and color rendering, enhancing kitchen spaces' ambiance. In addition, conventional lights are often more affordable upfront than LED alternatives, making them an attractive choice for budget-conscious homeowners or those renovating on a smaller scale. In certain regions, the availability of conventional light fixtures and the ease of replacement parts also contribute to their sustained demand, especially among households that have not yet transitioned to energy-efficient lighting systems.

Decorative lighting type is projected to grow at a significant CAGR of 6.7% from 2024 to 2030. Decorative lighting, such as pendant lights, chandeliers, and statement fixtures, adds visual appeal and serves as a design focal point, elevating the kitchen's overall look. As open-concept kitchen designs become more popular, decorative lights create distinct zones and add character to multifunctional spaces. In addition, the growing trend of integrating style with functionality drives consumers to choose decorative lights that illuminate and enhance the kitchen's décor. This focus on design and advancements in light fixture materials and styles have fueled the rising demand for decorative lighting solutions in modern kitchens.

Source Insights

LED lights in the source category held a revenue share of 65.58% in 2023. The increased demand is attributed to their energy efficiency, longer lifespan, and versatility in design. LEDs consume significantly less power than traditional lighting options, which helps consumers save on electricity costs, making them a favored choice for eco-conscious homeowners. Moreover, LEDs offer a variety of color temperatures, allowing for customized lighting that can enhance the aesthetic and functionality of kitchen spaces. The reduced heat emission from LEDs also contributes to a cooler kitchen environment, improving comfort.

The CFL lights segment is expected to grow at a CAGR of 6.4% from 2024 to 2030. CFLs use significantly less electricity than incandescent bulbs while providing comparable brightness levels, making them a preferred option for budget-conscious consumers. In addition, they have a longer lifespan than traditional bulbs, reducing the frequency and cost of replacements. CFLs also offer a range of light color options, from warm to cool, which allows homeowners to tailor their kitchen lighting to their preferences. As consumers seek more efficient lighting solutions that offer functionality and affordability, CFLs remain a strong option in the kitchen lighting market.

End Use Insights

The residential segment in the end use category accounted for a share of 71.80% in 2023. The increasing emphasis on personalized and customizable lighting solutions fuels the demand for unique lighting solutions in the residential segment. In addition, the growing adoption of LED technology encourages more households to upgrade their kitchen lighting systems. Furthermore, integrating ambient and task lighting to improve functionality and ambiance draws consumers, as modern kitchens are increasingly viewed as multifunctional spaces for cooking, dining, and entertainment.

The commercial demand is expected to grow at a CAGR of 7.2% from 2024 to 2030. Commercial kitchens require high-quality, durable lighting systems that enhance visibility, improve safety, and withstand rigorous conditions. In addition, businesses invest in advanced lighting solutions such as LED and smart lighting systems to reduce operational costs through lower energy consumption and maintenance. The growing trend of open kitchens in restaurants, where lighting is vital in creating an inviting ambiance for customers, further drives the demand. Moreover, enhanced lighting solutions contribute to better productivity and hygiene in commercial kitchens, making it a key priority for business owners.

Technology Insights

The conventional segment accounted for a share of 62.66% in 2023. Many consumers and businesses continue to choose conventional lighting due to its straightforward installation and compatibility with existing fixtures, eliminating the need for costly upgrades. Conventional lighting options such as fluorescent and halogen lights are often perceived as offering better brightness levels for task-focused areas in kitchens, appealing to those who prioritize immediate illumination over energy savings. Some regions with limited access to newer technologies continue to rely on conventional lighting as an accessible and affordable solution. The initial lower cost of conventional lighting compared to energy-efficient alternatives remains significant, especially for budget-conscious buyers in residential and commercial settings.

Smart kitchen lighting is expected to grow at a CAGR of 6.9% from 2024 to 2030. The growing adoption of smart home technologies and the desire for greater control and customization of lighting solutions fuels the demand for smart lighting. Smart kitchen lighting systems offer advanced features like remote control, voice activation, and programmable lighting schedules, providing users with convenience and energy efficiency. These systems can be integrated with other smart home devices, creating a seamless, interconnected home environment. In addition, the ability to adjust lighting intensity, color, and mood through mobile apps or smart assistants enhances the kitchen’s functionality as a multipurpose space. For instance, in June 2024, Cync announced the launch of new undercabinet smart lights aimed at enhancing kitchen ambiance. These slim LED fixtures offer customizable lighting with up to 16 million RGB colors and white light temperatures reaching 7,000 Kelvin. Available in multiple sizes, including a puck light, the fixtures support Bluetooth and Wi-Fi for easy control through the Cync app, with no hub required.

Distribution Channel Insights

The specialty stores segment accounted for a share of 30.27% in 2023. These stores offer a curated selection of high-quality, unique lighting products catering to niche customer preferences. Shoppers also benefit from personalized service and expert guidance, often needing more in larger retail outlets. Moreover, specialty stores provide access to custom solutions and exclusive designs that appeal to homeowners and designers seeking distinctive lighting fixtures. Their focus on high-end, premium products and a superior customer experience drives demand in this segment.

The online segment is expected to grow at a CAGR of 7.4% from 2024 to 2030. The increasing reliance on e-commerce platforms provides a broader range of products, including unique and customizable lighting solutions, that may not be available in physical stores. Furthermore, the ability to shop at any time, combined with convenient home delivery options, attracts consumers to online channels. Digital platforms offer customer reviews and detailed product descriptions, helping buyers make more informed decisions.

Regional Insights

The kitchen lighting market in North America accounted for a global market share of around 28.27% in 2023. The growing trend toward energy-efficient home solutions fuels the demand for kitchen lights in the region, with many households opting for LED and smart lighting to reduce electricity costs and environmental impact. In addition, increased interest in home renovations, particularly kitchen remodels, has been fueled by higher disposable incomes and government incentives for energy-efficient upgrades. The rise of open-plan kitchens in modern North American homes, which require layered and flexible lighting, is also contributing to the demand growth.

U.S. Kitchen Lightning Market Trends

The kitchen lighting market in the U.S. held a dominant share of the North American market in 2023. Home renovation trends, particularly in kitchen renovations, drive the demand, fueled by a growing focus on functionality and aesthetics. For instance, in 2023, home renovations in the U.S. saw a significant increase, with 48% of homeowners planning upgrades. DIY projects were particularly popular, especially among middle- and lower-income households. Kitchen and bathroom renovations were top priorities, emphasizing functional and aesthetic improvements.

Europe Kitchen Lighting Market Trends

The kitchen lighting market in Europe accounted for a share of 25.34% in 2023. European homeowners increasingly invest in modern lighting solutions to create aesthetically pleasing, energy-efficient, and functional kitchen environments. The rising demand for open-plan kitchens has amplified the need for layered lighting solutions, including task, ambient, and accent lighting, to enhance style and utility. The European focus on sustainability has also led to a growing preference for energy-efficient LED lighting, further driving market demand. Urbanization and smaller living spaces also prompt innovative lighting to optimize kitchen areas, adding to the demand.

The kitchen lighting market in the UK accounted for a significant regional share in 2023. British homeowners seek to create more personalized and multifunctional kitchen spaces where lighting plays a crucial role in setting the atmosphere and improving functionality. Moreover, the rise in home improvement projects, spurred by remote working and increased time spent at home, has driven interest in upgrading kitchen lighting to reflect modern styles, such as industrial or minimalist designs, that enhance the overall aesthetic. According to a report from Insight DIY UK, home renovation activity and spending have reached a four-year high, with 52% of homeowners undertaking renovations in 2021. This surge follows the COVID-19 pandemic, as many spent more time at home and focused on upgrading their living spaces.

Asia Pacific Kitchen Lighting Market Trends

The kitchen lighting market in Asia Pacific accounted for a significant share of 31.46% in 2023. The expanding real estate sector, particularly in countries such as China, India, and Vietnam, has led to new residential complexes prioritizing modern, well-lit kitchen spaces. The influence of global design trends promoted by social media and international home decor brands has also led to a rising preference for stylish and customized kitchen lighting among homeowners. Moreover, the region's booming e-commerce industry has made it easier for consumers to access various lighting options, further boosting demand.

The kitchen lighting market in China accounted for a significant regional share in 2023. The rapid urbanization and the country's growing middle-class population are driving a shift towards modern, well-designed homes. As more people move into urban areas and purchase new homes, there is an increased focus on interior design, including kitchen lighting that complements the overall aesthetic. China's increasing adoption of smart home technologies is also crucial, as consumers seek advanced lighting solutions that offer energy efficiency and can be integrated with home automation systems.

India kitchen lighting market is expected to grow at a significant CAGR from 2024 to 2030. The significant rise in nuclear families and the construction of smaller, urban apartments drive the market for kitchen lighting. The ongoing real estate boom in urban centers has also led to a surge in modern housing projects, which often prioritize contemporary kitchen designs with integrated lighting solutions. Furthermore, the growing influence of interior design professionals and architects in India and consumers' increased exposure to global design aesthetics through digital platforms has sparked a demand for customized and premium kitchen lighting.

Key Kitchen Lighting Company Insights

Some of the key companies include Butler Lighting USA., EGLO Leuchten GmbH (Austria), and Signify Holding (Philips Lighting); Inter IKEA Systems B.V.

-

Butler Lighting USA provides lighting solutions, offering various products and services tailored to the kitchen lighting market. The company delivers functional and aesthetic lighting options, including pendants, under-cabinet, chandeliers, and recessed lighting. These offerings cater to various kitchen styles, from modern to traditional, ensuring the right balance between design and practicality. Butler Lighting USA also provides expert consultation services, assisting customers in selecting the best lighting solutions to enhance the ambiance and efficiency of their kitchen spaces. Through a combination of quality products and personalized services, the company aims to meet the unique needs of homeowners and designers in creating well-lit kitchen environments.

-

Signify Holding, formerly known as Philips Lighting, is a global provider of lighting solutions that offers an extensive range of products in the kitchen lighting market. The company's offerings include energy-efficient LED lighting systems, smart lighting solutions, and fixtures such as under-cabinet, pendants, and recessed lights. Under the Philips Hue brand, signify's smart lighting solutions allow users to control kitchen lighting through mobile devices, providing customized brightness and color settings to match different moods and tasks.

Key Kitchen Lighting Companies:

The following are the leading companies in the kitchen lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Butler Lighting USA.

- EGLO Leuchten GmbH (Austria)

- Signify Holding. (Philips Lighting)

- Inter IKEA Systems B.V.

- Alcon Lighting Inc.

- Hubbell.

- HEAL'S PLC

- Argos Limited

- Crompton Greaves Consumer Electricals Limited.

- Lumens inc.

View a comprehensive list of companies in the Kitchen Lighting Market

Recent Developments

-

In June 2021, Philips Hue announced the launch of a redesigned smart light app with a streamlined interface for easier navigation. New tools include advanced automation for controlling lights, enhanced room and zone management, and improved widget integration. The app also introduces customization options, such as setting dynamic scenes and controlling lights based on location.

Kitchen Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.44 billion

Revenue forecast in 2030

USD 23.85 billion

Growth Rate (Revenue)

CAGR of 6.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, source, end use, technology, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, & Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Butler Lighting USA.; EGLO Leuchten GmbH (Austria); Signify Holding (Philips Lighting); Inter IKEA Systems B.V.; Alcon Lighting Inc.; Hubbell; HEAL'S PLC; Argos Limited; Crompton Greaves Consumer Electricals Limited.; lumens inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kitchen Lighting Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kitchen lighting market report based on product, type, source, end use, technology, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceiling

-

Under Cabinet

-

Wall Mounted Lights

-

Pendant Lighting

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Decorative

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

LED

-

Halogen

-

CFL

-

Fluorescent

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Smart

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Home Improvement Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global kitchen lighting market was estimated at USD 15.69 billion in 2023 and is expected to reach USD 16.44 billion in 2024.

b. The global kitchen lighting market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030, reaching USD 23.85 billion by 2030.

b. Asia Pacific dominated the kitchen lighting market, with a share of around 31.46% in 2023. This market is driven by increasing urbanization, rising demand for energy-efficient lighting solutions, and growing consumer interest in modern home aesthetics and smart lighting technologies.

b. Key players in the global kitchen lighting market are Butler Lighting USA., EGLO Leuchten GmbH (Austria), Signify Holding. (Philips Lighting), Inter IKEA Systems B.V., Alcon Lighting Inc., Hubbell. , HEAL'S PLC, Argos Limited, Crompton Greaves Consumer Electricals Limited., lumens inc.

b. Key factors that are driving the kitchen lighting market growth include the growing demand for energy-efficient and smart lighting solutions, advancements in LED technology, and increasing consumer focus on home decor and kitchen aesthetics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."