- Home

- »

- Medical Devices

- »

-

Kingdom Of Saudi Arabia Air Ambulance Market, Report, 2030GVR Report cover

![Kingdom Of Saudi Arabia Air Ambulance Market Size, Share & Trends Report]()

Kingdom Of Saudi Arabia Air Ambulance Market Size, Share & Trends Analysis Report By Type (Rotary-wing, Fixed-wing), By Service Model (Hospital Based, Community Based), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-358-4

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

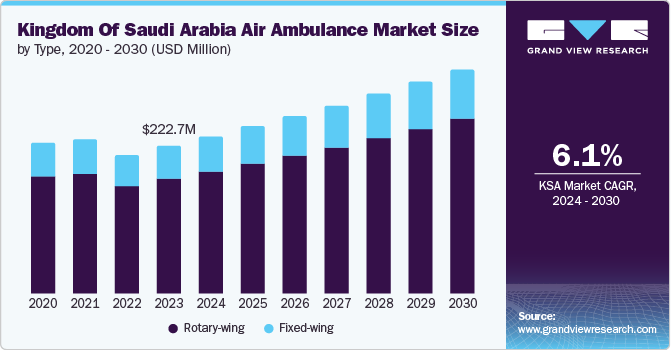

The Kingdom of Saudi Arabia air ambulance market size was valued at USD 222.7 million in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. The driving factors of the growth include rising incidences of chronic diseases, growing demand for air travel for medical reasons, and an increase in healthcare expenditures. The rise in chronic diseases such as cancer is expected to drive the market growth. According to the American Society of Clinical Oncology (ASCO) study published in January 2024, Saudi Arabia saw a rise in cancer cases from 27,885 in 2020 to 60,429 in 2040, projecting a growth of 116.7% in the cases. Such incidents demand for emergency air travel, contributing to the market growth.

In addition, the rising healthcare expenditure enables the country to provide advanced healthcare solutions such as air ambulance services. For instance, according to the International Trade Administration U.S. Department of Commerce report published in January 2024, the Kingdom of Saudi Arabia (KSA) accounts for 60% of Gulf Cooperation Council (GCC) countries health expenditures. The government spent approximately USD 50.4 billion on healthcare and social development in 2023, accounting for 16.9% of its yearly budget. Such increased healthcare expenses drive the air ambulance market growth.

The emergence of the COVID-19 pandemic evoked healthcare emergencies worldwide, encouraging healthcare facilities to provide rapid services. For instance, International SOS offered air ambulance service, providing medical evacuation support to the Kenyan nationals suffering from pulmonary embolism during the COVID-19 pandemic. Such instances are expected to encourage air ambulance services to grow, driving market growth.

Type Insights

Rotary-wing type dominated the market and accounted for a share of 77.7% in 2023 due to its advantages over other means of transport. The rotary wing type provides medical assistance for patients requiring immediate healthcare attention and need to be airlifted within a short distance. The rotary wing category, also known as helicopters, is a preferred choice due to their ability to land without tarmac. Such advantages make the rotary wing a suitable choice during medical emergencies, driving the segment growth.

The fixed wing segment is expected to grow significantly during the forecast period. The factors driving the fixed wing segment primarily include their ability to travel longer distances without refueling and their capability to fly despite weather conditions such as fog, avoiding delays in providing medical assistance in an emergency. In addition, the fixed wing allows more space to store the medical equipment and healthcare staff on board. This type of travel can fly at higher altitudes with less turbulence, providing a comfortable ride experience for the patient. Such advantages over other means of travel drive the segment growth.

Service Model Insights

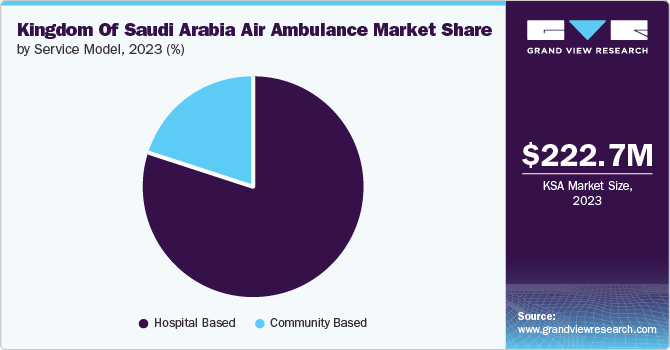

Hospital based segment dominated the market and accounted for a share of 80.0% in 2023. The factors driving the segment growth are primarily a lack of medical facilities in some areas or demand for better medical facilities that require the patient to be airlifted in critical conditions. Various medical aviation companies work with hospitals and offer air ambulance services worldwide. For instance, Horizon Air Ambulance provides air ambulance and air evacuation service to and from Kingdom of Saudi Arabia hospitals, including Jeddah National Hospital, King Faisal Specialist Hospital, King Abdulaziz Hospital, New Jeddah Clinic Hospital, and Jeddah Clinic Hospital. Such collaborative instances boost the segment growth.

Community based segment is expected to register the fastest CAGR over the forecast period. The community based service models are the charitable organizations that assist patients in critical care situations by providing air evacuation and ambulance services. For instance, the Saudi Red Crescent Authority (SRCA) offers national ambulance emergency services in the country and has invested in 30 new helicopters and an Airbus airplane for international healthcare work. In addition, the charity trust launched air ambulance service in June 2022 in cooperation with The Helicopter & Jet Company, owned by the Public Investment Fund (PIF). Such new developments in the area are expected to drive the segment growth.

Country Insights

The Kingdom of Saudi Arabia air ambulance market accounted for a 21.9% share of the Middle East and Africa market in 2023. The rise in health expenditure and growing cases of chronic diseases demand advanced facilities such as air ambulance services for patients in critical conditions. Charitable trusts and companies collaborate with strategic allies to provide air ambulance services. For instance, The Helicopter & Jet Company signed an agreement in February 2024 with AIRBUS for 120 Airbus helicopters, including various types such as H145 helicopters, which are anticipated to be used for emergency medical services (EMS) and corporate transport. Such strategic collaborations are expected to drive market growth in the country.

Key Kingdom Of Saudi Arabia Air Ambulance Company Insights

Some key companies in the Kingdom of Saudi Arabia air ambulance market include Fakeeh Care, Medical Rescue SAUDI ARABIA, International SOS, and Medical Air Service. Key companies are involved in strategic initiatives such as innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Medical Rescue SAUDI ARABIA provides medical and evacuation solutions specializing in ambulance transport. The company focuses on pre-hospital healthcare, including international air ambulance services equipped with advanced medical technologies.

-

International SOS offers emergency healthcare services such as medical and security evacuations. The firm has a group of companies, including Aspire Lifestyles, Iqarus, and MedAire, offering 24/7 access to emergency aviation with fully integrated medical and security services.

Key Kingdom Of Saudi Arabia Air Ambulance Companies:

- Fakeeh Care

- Medical Rescue SAUDI ARABIA

- International SOS

- Medical Air Service

- Air Ambulance Worldwide’s

- Plures Healthcare

Recent Developments

-

Saudi Red Crescent Authority (SRCA) launched an air ambulance service in June 2024 for the pilgrim season.

-

International SOS partnered with AIRBUS in March 2023 to launch the next-generation emergency medical service improvement program.

Kingdom Of Saudi Arabia Air Ambulance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 337.7 million

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service model

Country scope

Kingdom Of Saudi Arabia (KSA)

Key companies profiled

Fakeeh Care; Medical Rescue SAUDI ARABIA; International SOS; Medical Air Service; Air Ambulance Worldwide; Plures Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Kingdom Of Saudi Arabia Air Ambulance Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Kingdom of Saudi Arabia air ambulance market report based on type and service model.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotary-wing

-

Fixed-wing

-

-

Service Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Based

-

Community Based

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."