Kimchi Market Size, Share & Trends Analysis Report By Product (Baechu Kimchi, Kkakdugi Kimchi, Chonggak Kimchi), By End Use (Households/Retail, Food Service), By Distribution Channel (B2C, B2B), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-346-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Kimchi Market Size & Trends

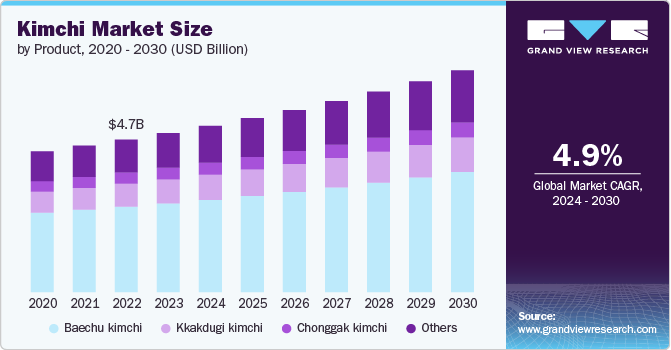

The global kimchi market size was estimated at USD 4,942.7 million in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030.This growth is driven by increasing consumer awareness of probiotic-rich foods, rising demand for fermented products, and growing interest in Korean cuisine globally. Factors such as health benefits associated with probiotics and the culinary versatility of kimchi are key drivers driving market growth during this period.

The global popularity of kimchi, driven by factors such as its health benefits and cultural influence through Korean entertainment like K-dramas and K-pop, has significantly boosted South Korean kimchi exports. In 2023, exports reached a record high of 44,041 tons, with the U.S. and Japan leading as top importers. The rise in kimchi consumption abroad reflects a growing interest in fermented foods and Korean cuisine, supported by efforts from both businesses and the South Korean government to promote and capitalize on this culinary export.

The market is traditionally dominated by South Korea, and also faces challenges from China's rapidly expanding exports. While South Korea historically led global exports, particularly to Japan and the U.S., increasing imports of cheaper Chinese kimchi have altered the market dynamics. Despite a decline in domestic consumption among younger South Koreans due to changing dietary preferences, overall demand in South Korea has risen, driven by population growth. However, South Korean kimchi exports to key markets like Japan have declined amidst currency fluctuations and geopolitical tensions.

Key players in the Asia-Pacific market is Daesang Corporation. They are increasingly expanding their production capacities to meet growing demand. For instance, in June 2024, Daesang's investment in Vietnam (USD 21.8 million) includes expanding kimchi production alongside other convenience foods like spring rolls and banh bao. This strategic move not only aims to enhance Daesang's share in the market but also to cater to local preferences with products like Jongga Kimchi and tailored offerings.

Product Insights

The baechu kimchi segment led the market with the largest revenue share of 55.80% in 2023. This significant share is attributed to its widespread recognition and preference as a staple in Korean cuisine, appealing to both domestic and international consumers. Baechu kimchi’s versatility in culinary applications, its rich nutritional profile, and the growing global trend towards fermented and probiotic foods have driven its popularity. In addition, its prominent presence in K-culture, through media and global events, has further boosted its consumption worldwide.

The kkakdugi kimchi segment is projected to grow at the fastest CAGR of 5.4% from 2024 to 2030. This growth is driven by increasing consumer interest in diverse and traditional Korean flavors, as kkakdugi offers a distinct crunchy texture and a unique taste profile compared to napa cabbage kimchi. Its appeal is further enhanced by the rising popularity of Korean cuisine and the health benefits associated with fermented foods. In addition, its versatility in pairing with various dishes and its refreshing flavor make it a favorite in both Korean households and global markets.

End Use Insights

Based on end use, the households/retail sector segment led the market with the largest revenue share of 72.30% in 2023.This is largely due to the growing trend of home cooking and the incorporation of kimchi into everyday meals, driven by its health benefits and versatility. In addition, the increasing availability of kimchi in convenient packaging and various flavors in supermarkets and online channels has made it more accessible and appealing to consumers worldwide.

The food service sector segment is expected to grow at the fastest CAGR of 5.5% from 2024 to 2030, driven by its rising popularity in global cuisines and diverse dining experiences. Restaurants and food outlets are increasingly incorporating kimchi into their menus to meet consumer demand for exotic and healthy options. In addition, the expanding footprint of Korean cuisine and fusion dishes in the international food scene boosts its demand in the food service industry.

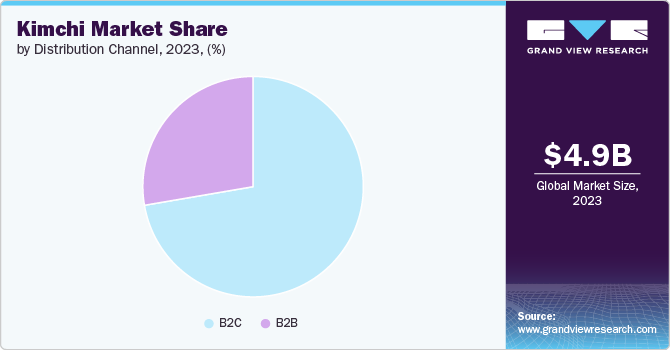

Distribution Channel Insights

Based on distribution channel, the hypermarkets and supermarkets segment led the market with the largest revenue share of 54.10% in 2023.Major Korean kimchi brands like CJ Bibigo, Daesang Jongga, and Pulmuone are now widely available in prominent retail chains and stores such as Costco, Walmart, Ralphs, and Vons. This widespread availability has been crucial in catering to the rising popularity of kimchi, supported by promotional efforts and the perception of kimchi as a healthy, probiotic-rich food.

In Southern California's Korean supermarket industry, the presence of Korean kimchi has notably increased, with kimchi sales accounting for over 50% of the kimchi section's total sales as of 2024, highlighting a robust market growth and competition among imported brands.

The online channel segment is expected to grow at the fastest CAGR of 5.6% from 2024 to 2030.This growth is driven by increasing consumer preference for convenience and accessibility, especially among younger demographics familiar with online shopping platforms. The trend is further supported by the global popularity of Korean cuisine, bolstered by cultural exports like K-pop and K-dramas, which enhance the appeal and accessibility of kimchi to international markets through e-commerce channels.

Regional Insights

North America dominates the kimchi market with the largest revenue share of 16.15% in 2023. The demand for kimchi in North America is surging, reflecting a broader fascination with Korean cuisine. Kimchi exports to the U.S. reached USD 29 million in 2022, with sales up 41.2% from January to September that year, highlighting its growing appeal. This rise is driven by the "K-food" wave, popularized through Korean pop culture and media, which has spurred interest in authentic and health-boosting foods like kimchi. Restaurants and food service providers are increasingly incorporating kimchi into diverse dishes, from traditional Korean meals to innovative fusion fare, fueling further market growth.

U.S. Kimchi Market Trends

The kimchi market in the U.S. is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. The U.S. market experienced substantial growth in 2023, with South Korean exports reaching a record high of USD 40 million, marking a 37.4% increase from the previous year. This surge reflects a steady rise in demand driven by the perception of kimchi as a healthy, probiotic-rich food, increased by its integration into mainstream American culinary culture. The popularity of Korean entertainment content, such as K-dramas, has further boosted kimchi's appeal, contributing to its widespread availability in major retail chains across the country like Costco and Walmart.

Asia Pacific Kimchi Market Trends

The kimchi market in Asia Pacific is expected to grow at the fastest CAGR of 5.1% from 2024 to 2030. Key Asian market players such as Daesang Corporation are investing in expanding its manufacturing capabilities in Vietnam, which is poised to drive growth in the Asia Pacific market. Daesang aims to capitalize on the increasing demand for Korean cuisine in Asia by increasing production capacities at its Daesang Vietnam and Daesang Duc Viet subsidiaries, particularly with new facilities for kimchi production and other convenience foods.

The South Korea kimchi market is projected to grow at the significant CAGR of 4.5% from 2024 to 2030, driven by increasing consumer preferences for healthier, fermented foods rich in probiotics. The domestic market is also benefiting from innovative product variations and enhanced packaging that appeal to younger and health-conscious consumers.

Key Kimchi Company Insights

The market is concentrated due to the presence of leading players such as Daesang Corporation and CJ CheilJedang Corp.Key players are focusing on expanding their production capabilities, innovating product varieties, and enhancing global distribution networks. Companies like Daesang, CJ CheilJedang, and Pulmuone are leading the way by investing in new manufacturing plants and developing convenient, ready-to-eat kimchi products to meet rising consumer demand. These players are also leveraging the popularity of K-food culture and emphasizing the health benefits of fermented foods to attract a broader international audience.

Key Kimchi Companies:

The following are the leading companies in the kimchi market. These companies collectively hold the largest market share and dictate industry trends.

- Daesang Corporation

- CJ CheilJedang Corp.

- Pulmuone U.S.A.

- Lucky Foods

- Weifang Jiahe Food Co., Ltd

- Sinto Gourmet

- JONGGA

- Choi's Kimchi LLC

- NONGSHIM CO., LTD.

- Cosmos Food Co., Inc.

Recent Developments

-

In June 2024, Franklin Farms, a division of Keystone Natural Holdings, launched Organic Shredded Kimchi, expanding its plant-based offerings. This new product is crafted with fresh cabbage fermented with onions, garlic, carrots, red chili pepper, and spices, catering to consumers seeking probiotic-rich, vegan, kosher, and gluten-free options. Available at Price Chopper & Market 32 stores in the Northeast U.S., Organic Shredded Kimchi is positioned as a versatile condiment ideal for enhancing various cuisines, from burgers and tacos to stir-fried rice

-

In February 2024, Cleveland Kitchen launched Kimchi Pickles in 466 Whole Foods Market stores in the U.S., combining the tangy flavors of kimchi with the crunch of pickles. Positioned as a fusion of culinary traditions, these Kimchi Pickles cater to both pickle enthusiasts and those curious about kimchi, offering a versatile and probiotic-rich option that can be enjoyed on its own or incorporated into various dishes like sandwiches, grain bowls, and pizza

-

In April 2024, Mrs Elswood, part of the Empire Bespoke Foods portfolio leveraged 75 years of vegetable preservation expertise to launch a new range of Kimchi in three flavors—Classic, Turmeric, and Beetroot—available from April 2024. Embracing Korean cuisine's rising popularity in Britain, these Kimchi offerings are crafted using authentic fermentation methods, resulting in crunchy vegetables with a distinct lactic tang and spicy chili heat

Kimchi Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5,161.5 million |

|

Revenue forecast in 2030 |

USD 6,888.4 million |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, Volume in Metric Tons, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S; Canada; Germany; UK; Netherlands; Poland; South Korea; China; Japan; India; Indonesia; Thailand; Vietnam; Brazil; South Africa |

|

Key companies profiled |

Daesang Corporation; CJ CheilJedang Corp.; Pulmuone U.S.A.; Lucky Foods; Weifang Jiahe Food Co., Ltd; Sinto Gourmet; JONGGA, Choi's Kimchi LLC; NONGSHIM CO., LTD.; Cosmos Food Co., Inc. |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Kimchi Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kimchi market report based on product, end-user, distribution channel, and region.

-

Product Outlook (Revenue, USD Million; Volume, Metric Tons, 2018 - 2030)

-

Baechu Kimchi

-

Kkakdugi Kimchi

-

Chonggak Kimchi

-

Others

-

-

End Use Outlook (Revenue, USD Million; Volume, Metric Tons, 2018 - 2030)

-

Households/Retail

-

Food Service

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Metric Tons, 2018 - 2030)

-

B2C

-

Hypermarkets/Supermarkets

-

Specialty Food Stores

-

Online

-

Others

-

-

B2B

-

-

Regional Outlook (Revenue, USD Million; Volume, Metric Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Netherlands

-

Poland

-

-

Asia Pacific

-

South Korea

-

China

-

Japan

-

India

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global kimchi market size was estimated at USD 4,942.7 million in 2023 and is expected to reach USD 5,161.5 million in 2024.

b. The global kimchi market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 6,888.4 million by 2030.

b. Asia Pacific held a significant share of 65.70% of the overall market revenue in 2023 due to the high consumption of traditional fermented foods like kimchi in countries such as South Korea, Japan, and China, coupled with increasing consumer awareness about the health benefits of probiotic-rich diets.

b. Some of the key players operating in the kimchi market include CJ CheilJedang, Daesang Corporation, Dongwon F&B, Lotte Foods, Pulmuone, and Cosmos Food Co., Ltd.

b. Key factors driving the demand for kimchi include its probiotic benefits promoting gut health and its growing popularity due to global interest in Korean cuisine and fermented foods.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."