- Home

- »

- Homecare & Decor

- »

-

Kids Water Bottle Market Size, Share & Growth Report, 2030GVR Report cover

![Kids Water Bottle Market Size, Share & Trends Report]()

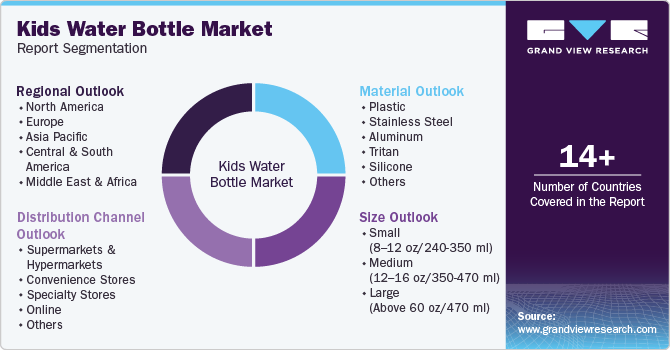

Kids Water Bottle Market Size, Share & Trends Analysis Report By Material (Plastic, Stainless Steel, Tritan, Aluminum), By Size (Small, Medium), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-476-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Kids Water Bottle Market Size & Trends

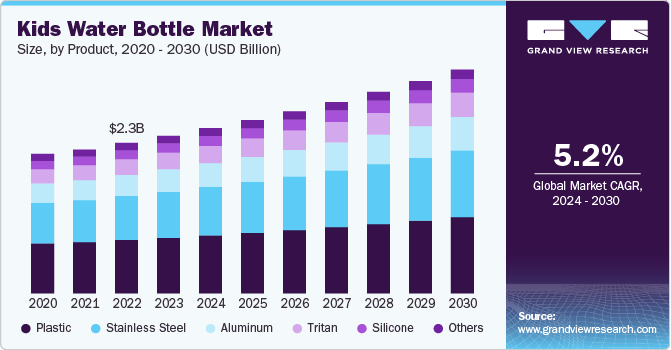

The global kids water bottle market size was estimated at USD 2.41 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. The kid's water bottle market is witnessing growth driven by the increasing emphasis on health and hydration. Parents are becoming more aware of the importance of keeping their children hydrated throughout the day, especially with concerns about sugary drinks and obesity on the rise. This has led to a surge in demand for reusable water bottles designed specifically for children, promoting healthier lifestyles and encouraging good hydration habits from an early age. In addition, bottles with built-in measurement tools help track water intake, making it easier for parents to monitor their kids hydration levels.

The rise of eco-consciousness is also playing a significant role in shaping the kid's water bottle market. As environmental concerns grow, parents are moving away from disposable plastic bottles and opting for reusable alternatives. This trend has encouraged manufacturers to create sustainable, BPA-free, and eco-friendly water bottles, often made from stainless steel, glass, or recycled materials. Water bottles that are durable and long-lasting, yet safe for children, are becoming more popular as consumers look for products that align with their environmental values.

Design and functionality are crucial drivers in the kid's water bottle market. Brands are increasingly focused on creating bottles that appeal to both children and parents, incorporating vibrant colors, cartoon characters, and playful designs that make hydration fun for kids. Functionality is equally important, with leak-proof lids, easy-to-carry handles, and spout designs that are tailored to small hands. Parents are drawn to features such as these that make the bottles both practical and appealing to children, ensuring that they are more likely to use them consistently.

The rise of on-the-go lifestyles has fueled the need for portable, easy-to-use water bottles for kids. As families become more active, whether in school, sports, or travel, the demand for durable, spill-proof bottles that can withstand daily wear and tear has grown. These bottles are designed to be compact enough to fit in lunchboxes or backpacks, yet robust enough to last through playground adventures and sports activities, appealing to busy families who prioritize convenience and reliability.

Innovation in water bottle technology is another key trend driving the market. Smart water bottles, which can track hydration levels, remind children to drink water, and even sync with apps, are gaining traction among tech-savvy parents. These high-tech options not only make hydration more interactive but also appeal to parents who want to instill healthy habits through the use of modern technology. This integration of digital features with traditional water bottles is creating a new niche in the kid’s water bottle market.

Material Insights

In the kid’s water bottle market, plastic bottles account for a share of about 35% in 2023. Plastic bottles dominate the kid's water bottle market due to their affordability, lightweight nature, and wide availability. Parents often prefer plastic bottles because they are easy to replace if lost or damaged, which is a common occurrence with children's items. In addition, plastic bottles come in a variety of designs, colors, and sizes that cater to kids' preferences, making them more attractive for daily use. Many plastic bottles are also designed to be durable and resistant to impact, appealing to parents looking for practical, budget-friendly options for their children.

Demand for aluminum kid’s bottles is set to rise at a CAGR of 6.0% from 2024 to 2030. Aluminum bottles are seen as a healthier option because they are typically free from harmful chemicals such as BPA and phthalates, which are often found in plastics. They also offer better insulation, keeping drinks cooler for longer periods, which is appealing for parents sending their children to school or outdoor activities. As environmental concerns and sustainability become more prominent, aluminum bottles are increasingly favored for their recyclability and long-lasting nature, aligning with the growing demand for greener product choices.

Size Insights

In the kid’s water bottle market, small (8-12 oz/240-350 ml) bottles accounted for a share of about 42% in 2023. This size is perfect size younger children, making them easy to hold, carry, and drink from without being too heavy or cumbersome. Parents often prefer these smaller sizes as they fit well in lunchboxes, backpacks, and cup holders, making them ideal for school or short trips. In addition, younger children generally require less hydration, so smaller bottles suffice for their daily needs, while offering portability and convenience.

Demand for medium (12-16 oz/350-470 ml) kid’s bottles is set to rise at a CAGR of 5.6% from 2024 to 2030. These bottles are more suitable for older kids who are more active, spending longer hours at school, in sports, or on outings, requiring larger quantities of water. Medium-sized bottles also strike a balance between portability and capacity, offering enough hydration without being too bulky. As parents seek versatile, long-lasting products that can transition as their children age, medium bottles are becoming more appealing.

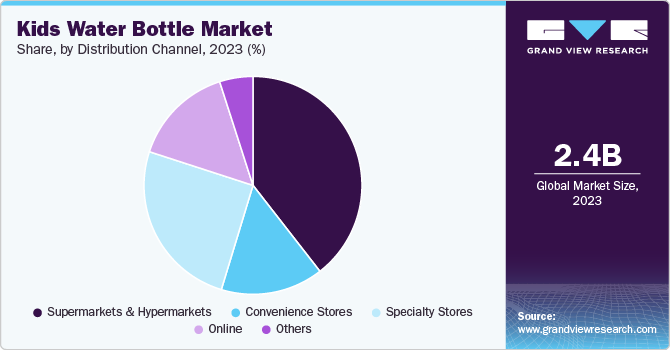

Distribution Channel Insights

The sales of kid’s water bottles through hypermarkets & supermarkets accounted for a market share of 38% in 2023. This is owing to their wide customer base and wide range of products. These retail spaces give customers the opportunity to shop for a variety of water bottle options in one convenient location. The ease of making an instant purchase and the opportunity to examine things in person boost customer trust in their selections. These shops also frequently provide bulk-buying choices and special discounts, which draw customers who want to restock on these necessities.

Online sales of kid’s water bottle are expected to grow at a CAGR of 5.5% from 2024 to 2030. Shopping websites facilitate the comparison and selection of kid-friendly bottles by providing a wide range of items with comprehensive descriptions, user reviews, and competitive price, all from the convenience of one's home. This expansion is also being fueled by the emergence of internet shopping trends and improvements in delivery and logistics. Personalized recommendations and targeted marketing are also possible with online purchasing, which improves the entire customer experience and helps this channel grow.

Regional Insights

The kids water bottle market in North America accounted for a market share of around 27% in 2023 in the global market. The North American kid’s water bottle market is prevalent due to a strong focus on health-conscious parenting and eco-friendly lifestyles. The region’s high awareness around hydration, nutrition, and sustainability drives demand for reusable water bottles designed for children. In addition, rising concerns over plastic waste have prompted a shift from disposable to reusable options. Manufacturers in North America also cater to a diverse market by offering bottles with fun designs, ergonomic features, and sustainable materials that appeal to both children and parents, making these products widely adopted.

U.S. Kid’s Water Bottle Market Trends

The kids water bottle market in the U.S. accounted for market share of around 81% in 2023 in the North American market. In the U.S., the kid's water bottle market is further fueled by the increasing adoption of eco-conscious behaviors and the growing trend of smart water bottles that promote healthier hydration habits. Parents are particularly drawn to bottles that are BPA-free, durable, and safe for their kids. The emphasis on reducing sugary drink consumption among children also encourages the use of water bottles. U.S. consumers also value convenience, with a high demand for bottles that fit into lunchboxes or backpacks, and smart bottles that track water intake are gaining popularity among tech-savvy families.

Europe Kids Water Bottle Market Trends

The kids water bottle market in Europe accounted for a market share of around 20% in 2023 in the global market. In Europe, the kid’s water bottle market is driven by strong environmental awareness and regulatory efforts to reduce single-use plastic consumption. European consumers place significant value on eco-friendly materials such as stainless steel and aluminum, aligning with sustainability goals across the region. Countries in the European Union have strict guidelines on plastic waste, leading to a preference for durable, recyclable water bottles. In addition, parents in Europe prioritize health and safety, favoring non-toxic materials, which has fueled the demand for higher-quality reusable bottles that meet these standards.

Asia Pacific Kids Water Bottle Market Trends

The kids water bottle market in Asia Pacific is anticipated to rise at a CAGR of 5.7% from 2024 to 2030. Demand in the Asia-Pacific (APAC) region is expected to rise due to increasing urbanization, rising disposable incomes, and growing health awareness. Parents in APAC are becoming more conscious of the need to promote hydration and healthier lifestyles for their children, leading to a greater demand for functional and durable water bottles. The region is also seeing a shift toward sustainable consumption, with more consumers preferring reusable options over single-use plastics. In addition, the rapid growth of e-commerce platforms in APAC has made kid’s water bottles more accessible to a wider audience, further driving demand in the market.

Key Kids Water Bottle Company Insights

The kid’s water bottle market is fragmented.Market players are enhancing their share by innovating product designs, such as offering smart and aesthetic kid’s water bottles. They are also expanding their distribution channels, including e-commerce platforms, and leveraging marketing strategies that emphasize convenience, sustainability, and aesthetic appeal to attract a broader customer base.

Key Kids Water Bottle Companies:

The following are the leading companies in the kids water bottle market. These companies collectively hold the largest market share and dictate industry trends.

- CamelBak

- Tupperware

- Thermos

- Contigo

- Nalgene

- Hydro Flask

- Klean Kanteen

- S'well

- Skip Hop

- Zojirushi

Recent Developments

-

In August 2024, Air Up launched its first children’s bottle, the Mini Sipper, featuring an easy-to-use cap and leak-proof design. Priced at USD 30 on Air Up’s website, each bottle comes with one Gummy Bear, Cola, and Peach flavor pod, lasting up to five liters of water. Available in three vibrant colors, the bottle uses Scentaste technology to add flavor through scent, without additives or flavorings.

-

In July 2024, Owala released a kid's version of their popular FreeSip water bottle, at Target for USD 23. The 16 oz stainless steel bottle features a leakproof design with two drinking options-a built-in straw and a standard opening. The push-to-open lid keeps the spout clean, and it's dishwasher-safe. Available in various colors, including Wacky Watermelon and Party Princess, it quickly became a popular parents and children alike.

Kids Water Bottle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.53 billion

Revenue forecast in 2030

USD 3.43 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, size, distribution channel

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

CamelBak; Tupperware; Thermos; Contigo; Nalgene; Hydro Flask; Klean Kanteen; S'well; Skip Hop; Zojirushi

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kid’s Water Bottle Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global kids water bottle market report on the basis of material, size, distribution channel, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Stainless Steel

-

Aluminum

-

Tritan

-

Silicone

-

Others

-

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small (8-12 oz/240-350 ml)

-

Medium (12-16 oz/350-470 ml)

-

Large (Above 60 oz/470 ml)

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global kids water bottle market was estimated at USD 2.41 billion in 2023 and is expected to reach USD 2.53 billion in 2024.

b. The global kids water bottle market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 3.43 billion by 2030.

b. Asia Pacific dominated the kids water bottle market with a share of around 39% in 2023. The industry is prevalent due to rapid urbanization, rising disposable incomes, and growing health awareness among parents.

b. Key players in the kids water bottle market are CamelBak; Tupperware; Thermos; Contigo; Nalgene; Hydro Flask; Klean Kanteen; S'well; Skip Hop; Zojirushi

b. Key factors driving the kids water bottle market include increasing health awareness, eco-conscious consumption, and demand for reusable, durable, and safe hydration solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."