Kids Bicycle Market Size, Share & Trends Analysis Report By Product (Battery Operated), By Type (Mountain Bikes), By Distribution Channel (Supermarkets & Hypermarkets), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-190-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Kids Bicycle Market Size & Trends

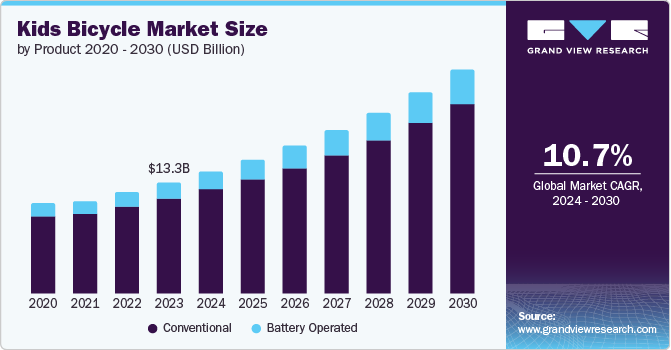

The global kids bicycle market size was valued at USD 13.31 billion in 2023 and is projected to grow at a CAGR of 10.7% from 2024 to 2030. The kids bicycle market is driven by demographic trends such as population growth and urbanization, economic factors such as rising household incomes, technological advancements including innovative designs and e-bikes, and increasing awareness of health and fitness benefits. In addition, growing environmental consciousness encourages parents to opt for eco-friendly transportation options such as bicycles.

Healthy and environmentally friendly initiatives are becoming popular, such as raising people's awareness to incorporate cycling into their daily activities and ensuring they travel in safe conditions. This involves developing a bike-friendly city infrastructure with specific lanes and green spaces, making cycling more accessible and attractive for families. For instance, Paris was expected to launch its ambitious 2024-2030 Climate Plan to become a more sustainable and cyclist-friendly city, focusing on localized and equitable climate actions. This plan, set for presentation and approval in 2024, aims to make impactful daily changes for residents.

The kids bicycle market is driven by demographic trends such as population growth, which increases the number of potential young riders, and urbanization, where families seek bicycles for recreation and transportation in city environments. According to the United Nations, the global population grew from 2.5 billion in 1950 to 8.0 billion in 2022, and it was projected to reach 9.7 billion by 2050 and peak at 10.4 billion by the mid-2080s. This represents an addition of 1 billion people since 2010 and 2 billion since 1998.

Product Insights

The conventional segment dominated the market and accounted for a share of 85.6% in 2023 owing to the easily accessible products of the various brands at different prices based on the set specifications. In addition, ecologists have done their best to explain to little ones the environmental advantages of cycling. In medical terms, various research has focused on the benefits of cycling among children. According to The Victorian Government, cycling reduces blood fat levels, lowers resting pulse, and strengthens heart muscles. Studies indicate that cyclists experience two to three times less pollution than car commuters, enhancing lung function. A 14-year Danish study involving 30,000 participants aged 20 to 93 found that regular cycling reduces the risk of heart disease.

The battery-operated segment is expected to register the fastest CAGR of 11.8% during the forecast period. This is owing to the more power they produce compared to regular bicycles; therefore, children can ride easily. In addition, battery-operated bicycles target children of all ability levels, thus promoting cycling in children with disabilities.

Type Insights

The road bikes segment dominated the market in 2023 driven by the increasing interest in outdoor leisure activities and growing trend towards adult health and fitness, which also influenced the global kids bicycle market while parents demanded similarly high-quality, performance-oriented bikes for their kids. In addition, advances in bicycle technology and materials have made road bicycles more popular. For instance, in March 2024, Raleigh UK Ltd. launched Juniper kids bikes have lightweight aluminum frames in various colors and sizes (12" to 26" wheels) for kids ages 3 to 12.

The mountain bikes segment is projected to grow at the fastest CAGR of 11.2% over the forecast period. Such an increase can be explained by the desire and thrill mountain bikes give children for off-road and difficult terrains. In addition, design and technology in mountain bikes have improved bicycle designs, making them lighter, smaller, and loaded with more features to attract young riders. For instance, in November 2023, SUPURB launches the Bo24+, a dropper-post trail bike for future shredders. Designed for riders from 135cm tall (62cm inseam) with kid-specific geometry and parts, it comes in fox red, bee yellow, gecko green, and badger blue.

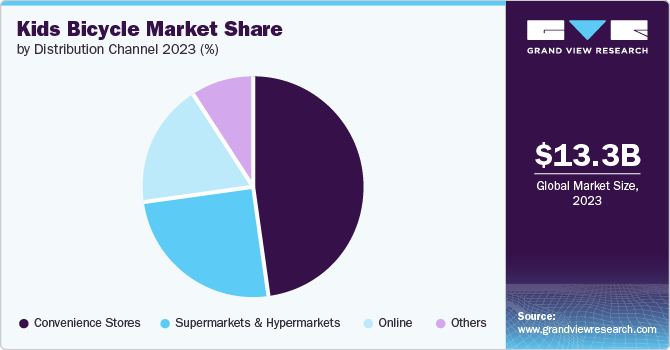

Distribution Channel Insights

The specialty stores segment dominated the market in 2023. The products are followed by advice and an individual approach, which helps customers choose the proper size and model of bicycle for their child. In addition, such stores offer various types of bicycles with different price ranges that help customers choose from. Kids have started preferring test rides before the purchase of the product. Moreover, parents are conscious of the safety of their children and prefer authenticating the product before buying. For instance, in February 2024, Giant Bicycles are expected to be available at 25 DICK's Sporting Goods specialty stores (House of Sport, Public Lands, Moosejaw), offering kids bikes, mountain bikes (including electric options), and cycling gear. This expands the selection of brands offered by Dick's.

The online segment is projected to grow at the fastest CAGR of 12.1% over the forecast period. This is attributable to the numerous bicycles of different brands available in online retail shops, which simplifies the selection process since parents can easily find a bicycle of their choice at a reasonable price. In addition, the availability of online shops and delivery services guarantees that the required product will be delivered on time.

Regional Insights

North America kids bicycle market is anticipated to witness significant growth due to environmental concerns, with bicycles being an eco-friendly transportation option. Increasing ecological consciousness encourages parents to choose bikes over motorized toys for their children. For instance, in December 2023, countries in the UNECE Air Convention agreed to update the Gothenburg Protocol to fight air pollution more effectively. This is expected to lead to stricter air quality regulations in Europe and North America.

U.S. Kids Bicycle Market Trends

The U.S. kids bicycle market was identified as a lucrative country in 2023. Economic factors drive the market. Higher disposable incomes allow families to spend more on recreational items such as bicycles. In addition, stable economic conditions enhance consumer confidence and increase spending on non-essential goods such as children's bicycles. According to the Bureau of Economic Analysis, in 2023, in the third quarter, disposable personal income was USD 143.5 billion; in the fourth quarter, it increased by 2.9% to USD 211.7 billion (4.2%). Real disposable personal income grew by 2.5%, compared to a 0.3% increase previously.

Europe Kids Bicycle Market Trends

Europe kids bicycle market was identified as a lucrative region in 2023. This is due to the large stress on anti-incidents and safety issues in European countries; thus, there is increased concern about advancing healthy lifestyles for children. Cycling is gradually becoming a favorite among kids because it is safe. In addition, there is a friendly cycling environment in many European countries with specific bicycle lanes, bike paths, and green areas for cycling. This makes cycling for families more appealing and is anticipated to drive market growth. For instance, in January 2024, the European Union (EU) informed Spanish cities to enhance bicycle and pedestrian infrastructure in 2024 or risk losing funding. This comes after the EU granted subsidies in 2021 for climate adaptation and sustainable growth, with millions invested in green mobility initiatives such as pedestrian areas, low-emissions zones, and bike lanes.

Asia Pacific Kids Bicycle Market Trends

The Asia Pacific kids bicycle market dominated in 2023. This is attributable to large populations with a growing middle class, which translates to more possible child cyclists. According to the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), at 4.3 billion in 2013, Asia Pacific held 60% of the world's population. By 2023, China (1.4 billion) and India (1.25 billion) remained the most populous within a region, totaling 4.8 billion spread across subregions.

The Chinese kids bicycle market held a substantial market share in 2023 owing to the easy availability of manufacturing plants in China, which enables cheap bicycle production and thus creates greater access to bicycles within China and the international market.

Key Kids Bicycle Company Insights

Some of the key companies in the global kids bicycle market Giant Bicycles, Dynacraft Wheels, Trek Bicycle Corporation, SCOTT Sports SA, Cycling Sports Group, Inc., GT Bicycles, MERIDA BIKES, Atlas Cycles (Haryana) Ltd., Avon, and Islabikes. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Dynacraft Wheels is a distributor of bicycles in the U.S., especially well known for its popular character, attractive designs and children’s bikes ranging from classic bikes to mountain bikes to battery powered bikes for different ages.

-

Giant Bicycles, is the bicycle manufacturer, that offers an amazing range of bikes for all ages. From high-performance road bikes and hot mountain bikes to luxury cruisers and innovative e-bikes, Giant caters to cyclists who want everything from casual riding to competition

Key Kids Bicycle Companies:

The following are the leading companies in the kids bicycle market. These companies collectively hold the largest market share and dictate industry trends.

- Giant Bicycles

- Dynacraft Wheels

- Trek Bicycle Corporation

- SCOTT Sports SA

- Cycling Sports Group, Inc.

- GT Bicycles

- MERIDA BIKES

- Atlas Cycles (Haryana) Ltd.

- Avon

- Islabikes

Recent Developments

-

In June 2024, Liv Cycling launched Faith, its first full-suspension mountain bike for young riders. Designed to boost confidence and skills, these bikes let girls tackle tougher trails and have more fun.

-

In August 2022, All Kids Bike (Strider Education Foundation), a program that brings cycling education to schools, expanded its reach. Their Learn-to-Ride Program helps individuals of all ages and abilities, including those with developmental delays or neurodiversity, learn to ride a bike and experience the joy of cycling.

Kids Bicycle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 14.57 billion |

|

Revenue forecast in 2030 |

USD 26.75 billion |

|

Growth Rate |

CAGR of 10.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

Giant Bicycles; Dynacraft Wheels; Trek Bicycle Corporation; SCOTT Sports SA; Cycling Sports Group, Inc.; GT Bicycles; MERIDA BIKES; Atlas Cycles (Haryana) Ltd.; Avon; Islabikes |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Kids Bicycle Market Report Segmentation

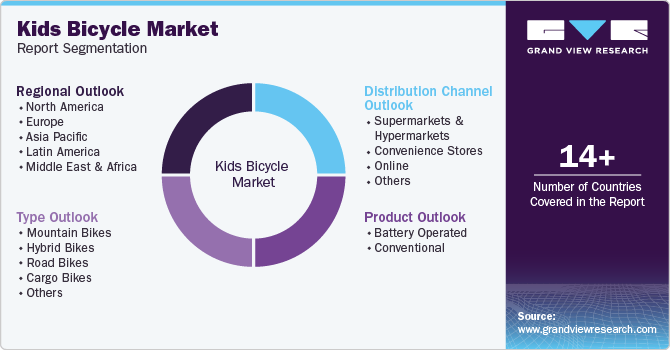

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kids bicycle market report based on product, type, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Operated

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mountain Bikes

-

Hybrid Bikes

-

Road Bikes

-

Cargo Bikes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."