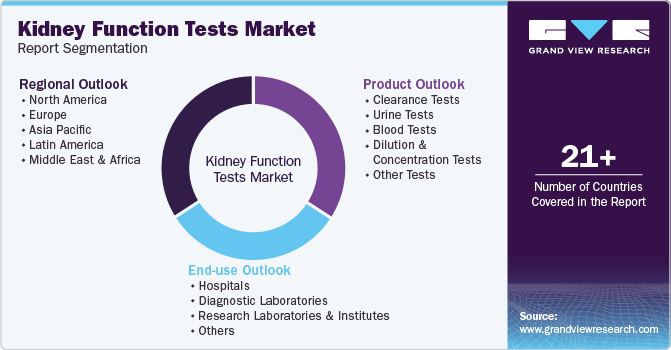

Kidney Function Tests Market Size, Share & Trends Analysis Report By Product (Clearance Tests, Urine Tests, Blood Tests), By End Use (Hospitals, Diagnostic Laboratories, Research Laboratories And Institutes), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-721-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Kidney Function Tests Market Size & Trends

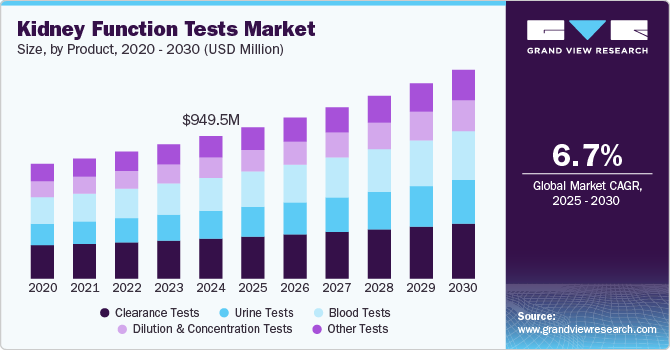

The global kidney function tests market size was estimated at USD 949.5 million in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. Several factors are anticipated to drive market growth, including increased investments by industry players, growing research and development efforts, a high prevalence of renal diseases, government initiatives, and advancements in technology. For instance, in February 2024, Simple HealthKit launched a new renal evaluation test for diabetes. The test is available for clinics and at home settings. Such developments are likely to propel the growth of kidney function tests industry.

During the COVID-19 pandemic, the incidence of renal injury cases saw a notable increase. Research highlighted that the individuals with pre-existing renal conditions faced a higher risk of severe complications and poorer outcomes upon contracting COVID-19. Ongoing studies on the long-term effects of COVID-19 have also revealed its potential lasting impact on renal health. However, the pandemic disrupted healthcare services for renal disease patients, as lockdowns and social distancing mandates led to temporary closures of non-emergency medical services. This resulted in delays in diagnosing renal diseases due to the suspension of routine visits and diagnostic tests during peak pandemic phases.

The rising prevalence of acute kidney injury (AKI) and its progression to CKD is expected to propel the kidney function tests industry in the coming years. CKD refers to persistent structural and functional abnormalities in the kidneys lasting at least three months. Conditions such as lifestyle-related diseases and kidney injuries are major contributors to CKD, which remains a global health burden and a leading cause of morbidity and mortality worldwide. According to the World Health Organization (WHO), renal disease has risen to become one of the top 10 leading causes of death globally over the past decade. Additionally, the National Kidney Foundation reports that approximately 37 million people in the U.S., or over one in seven adults, are affected by some form of renal disease.

The growing adoption of digital urinalysis emphasizes the increasing demand for home-based diagnostics, which is contributing significantly to market growth. For instance, Healthy.io, an Israel-based digital health start-up, developed an FDA-approved at-home smartphone urinalysis test designed to detect kidney-related issues such as proteinuria. Early detection through this test can prevent complications arising from renal diseases. Their urinalysis product, Dip.io, combines disposable cups and strips with smartphone cameras to analyze and interpret results. A trial conducted with Geisinger Health and the National Kidney Foundation (NKF) demonstrated a 71% adherence rate among hypertension patients who had never undergone prior testing. This innovation is fueled by advancements in smartphone technology.

In addition, increasing R&D efforts for developing innovative renal care solutions are anticipated to accelerate the growth of the renal function tests industry during the forecast period. KidneyX, a collaboration between the U.S. Department of Health and Human Services and the American Society of Nephrology, is focused on advancing the diagnosis, treatment, and prevention of renal diseases. This initiative aims to improve outcomes for the 850 million people affected globally by driving innovation in renal devices, drugs, biologics, and other therapies. Similarly, Canada’s largest kidney research initiative, the Can-SOLVE Chronic Kidney Disease Network, received USD 11.8 million in funding to support its work through 2027. This partnership between researchers, healthcare providers, and patients is dedicated to finding solutions for nearly 4 million Canadians living with CKD.

Technological advancements in renal function tests industry are expected to create significant growth opportunities during the forecast period. For instance, in August 2022, Bloom Diagnostics introduced a smart diagnostic system capable of detecting various medical conditions, including its latest addition, the Bloom Kidney Test. This test measures cystatin C levels in the blood to assess the glomerular filtration rate (GFR), an essential indicator of renal function. The system classifies results into three categories: mildly decreased function, normal function, and decreased function. Such innovative developments are likely to enhance diagnostic accuracy and accessibility, further driving market growth.

Product insights

The clearance tests segment accounted for the largest revenue share of 28.1% in 2024. Clearance tests are considered the gold standard for assessing and monitoring glomerular filtration rate (GFR). These include creatinine and inulin tests, which serve as valuable supplements to traditional diagnostic methods, offering high accuracy in results. Their optimal sensitivity and precision minimize performance variability, ensuring reliable outcomes. Additionally, the affordability and widespread availability of these tests in the market have contributed to their growing adoption.

The urine tests segment is anticipated to experience the fastest growth of 8.0% in the coming years. Urea quantification is one of the most commonly employed methods for evaluating renal function. Analyzing urea levels in urine, plasma, and serum is essential for identifying renal disorders and dysfunction. Urine tests, often paired with creatinine determination, play a pivotal role in diagnosing pre-renal, renal, and post-renal uremia. Additionally, increasing investments in renal function testing are expected to drive market growth. For instance, in January 2020, Sweden-based Elypta AB secured USD 7.0 million in seed financing to develop the first urine test for detecting renal cancer, highlighting the potential for innovation in this field.

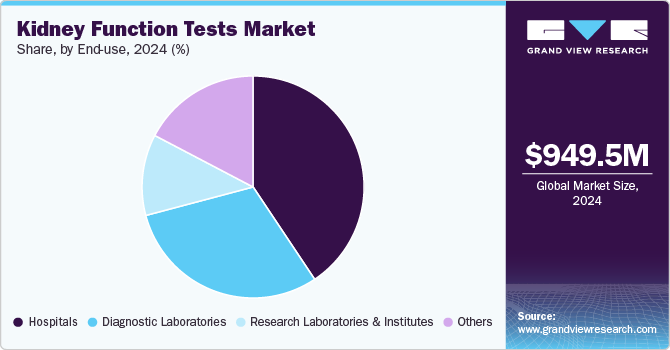

End Use Insights

The hospitals segment captured the highest revenue share of 40.6% in 2024. Large number of tests being performed and processed in the hospitals is the major reason for the segment dominance. Diagnostic centers often operate in collaboration with hospitals, many of which have their in-house diagnostic setups. The continuous improvement of healthcare infrastructure is expected to enhance hospital facilities, allowing them to expand their diagnostic services. This expansion is likely to increase the demand for products like renal function tests, thereby driving market growth. Furthermore, favorable reimbursement policies and global initiatives by healthcare organizations to encourage the adoption of advanced diagnostic tests are expected to further accelerate growth of the kidney function tests industry.

The diagnostic laboratories segment is predicted to grow at an exponential CAGR of 7.7% over the forecast years. The rising awareness of CKD, increasing demand for affordable diagnostic services, and rapid technological advancements are key factors anticipated to drive segment growth. In addition, government initiatives aimed at improving access to diagnostic facilities, including reimbursement for renal function tests, further contribute to market expansion. These efforts are expected to enhance the availability and affordability of advanced diagnostic solutions, fueling growth in the segment.

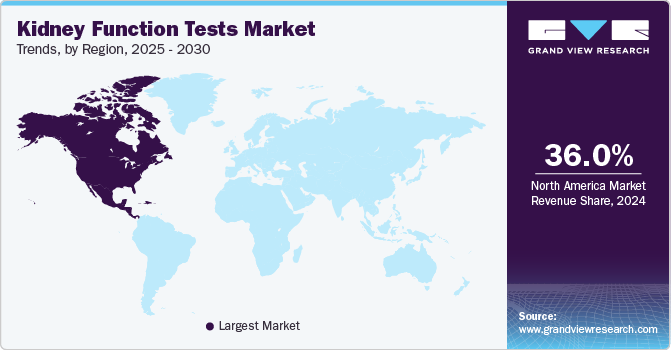

Regional Insights

North America kidney function tests industry dominated and accounted for a 36.0% share in 2024. This market dominance can be attributed to well-established healthcare infrastructure, heightened awareness of CKD, and supportive reimbursement policies coupled with government initiatives. Additionally, key manufacturers in the region are emphasizing innovation. For instance, in November 2021, HealthTab, Inc. entered into a pilot supplier distribution agreement with Abbott for the i-STAT Alinity, a handheld blood chemistry analyzer. This agreement allows HealthTab to distribute Abbott's point-of-care i-STAT Alinity system and associated creatinine tests in Canadian pharmacies, enabling patients to access critical information about their renal function conveniently.

U.S. Kidney Function Tests Market Trends

The kidney function tests market in the U.S. is projected to grow significantly during the forecast period, driven by several factors, including the rising prevalence of CKD and related conditions like diabetes and hypertension, which are major risk factors. Increasing awareness of early diagnosis and management of renal diseases has led to a higher demand for advanced diagnostic tools. renal diseases are a major cause of mortality in the U.S., with an estimated 37 million people, or about 1 in 7 Americans, living with CKD. However, nearly 40% of individuals with impaired renal function are unaware of their condition. Contributing factors include underlying health issues such as diabetes and high blood pressure, as well as genetic and environmental influences. Additionally, public health crises like the COVID-19 pandemic, along with health and social disparities, particularly racial inequities, have underscored the widespread impact of renal diseases.

Europe Kidney Function Tests Market Trends

The Europe kidney function tests market is likely to emerge as a lucrative region. Europe has high prevalence of geriatric population, and aging is a significant risk factor for renal disease. As the elderly population grows, there is a higher demand for renal function tests to monitor and manage age-related renal functions.

The kidney function tests market in the UK is projected to grow during the forecast period. CKD is becoming more widespread in the UK, primarily driven by the rising incidences of diabetes, hypertension, and obesity. According to Kidney Research UK, more than 7 million people are living with CKD which is likely to grow to 8.3 million by 2032. This high prevalence is fueling demand for renal function tests for early detection and better disease management.

France kidney function tests market is expected to show steady growth over the forecast period. Well-developed healthcare infrastructure, including robust diagnostic capabilities, facilitates the widespread availability of renal function tests across the country.

The kidney function tests market in Germany is projected to expand during the forecast period. Germany has one of the oldest populations in Europe, and age is a key risk factor for CKD. As the elderly population increases, there is a higher need for regular renal function testing to monitor age-related decline in renal function. This demographic shift is likely to be a major contributor to the rising demand for renal function tests in the country.

Asia Pacific Kidney Function Tests Market Trends

The Asia Pacific kidney function tests market is expected to experience the highest growth rate of 7.6% CAGR during the forecast period. Factors such as rising rates of diabetes, hypertension, and obesity, which are common in the region, are contributing to a higher incidence of CKD. Countries like China, India, and Japan are seeing a significant rise in kidney-related diseases, which is fueling demand for renal function tests.

China kidney function tests market is projected to expand throughout the forecast period. The Chinese government has launched several initiatives to raise awareness about kidney disease and promote early detection. National health campaigns aimed at reducing the prevalence of chronic diseases, including kidney disease, and improving access to healthcare services are likely to fuel market growth.

The kidney function tests market in Japan is anticipated to grow during the forecast period, driven by its large geriatric population. As kidney function naturally declines with age, the demand for regular kidney function testing is increasing among the elderly. With an aging demographic, there is a rising need for early diagnosis and monitoring of CKD, making kidney function tests more crucial in the country.

Latin America Kidney Function Tests Market Trends

The Latin America kidney function tests market is likely to show significant growth over the forecast period. The aging population, particularly in countries like Brazil and Argentina, is further contributing to this growth.

The kidney function tests market in Brazil is anticipated to grow during the forecast period. Technological advancements are also helping to drive market growth. The adoption of point-of-care (POC) testing devices and home-based monitoring kits is increasing in Brazil, allowing individuals to track their kidney function at home and reducing the need for hospital visits.

Middle East and Africa Kidney Function Tests Market Trends

The Middle East and Africa Kidney Function Tests Market is likely to show lucrative growth. The rising prevalence of chronic kidney disease (CKD), driven by the increasing prevalence of diabetes, hypertension, and obesity, is a major contributor. These conditions are particularly widespread in countries like Saudi Arabia, the UAE, and South Africa, creating a growing demand for diagnostic solutions. Additionally, rising awareness campaigns and government initiatives aimed at early diagnosis and regular monitoring of kidney health have further boosted the market.

The kidney function tests market in Saudi Arabia is anticipated to experience substantial growth in coming years. The government has been actively addressing the rising burden of kidney disease through various initiatives. The Ministry of Health (MOH) has implemented national programs aimed at improving awareness of kidney diseases and encouraging early detection, especially among high-risk populations.

Key Kidney Function Tests Company Insights

Key players in this industry are implementing various strategies including new product launches, geographical expansion, partnerships, and collaborations to expand their industry presence. For instance, in November 2024, a group of researchers at Chung-Ang University in South Korea have developed reliable test for detection of SDMA in urine which acts as an accurate indicator for kidney health detection.

Key Kidney Function Tests Companies:

The following are the leading companies in the kidney function tests market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Danaher

- F. Hoffmann-La Roche Ltd.

- Sysmex Corporation

- Siemens Healthineers

- Randox Laboratories Ltd

- Quest Diagnostics

- ACON Laboratories, Inc.

- Nova Biomedical Corporation

- Laboratory Corporation of America Holdings

Recent Developments

-

In February 2024, Simple HealthKit launched kidney test program to study kidney function at home and at a medical center. The Kidney Health Evaluation for Patients with Diabetes initiative focuses on a new kidney health test aimed at helping insurers enhance patient outcomes. This initiative can contribute to improved performance in key metrics, such as Healthcare Effectiveness Data and Information Set and Medicare Advantage star ratings.

-

In December 2023, NGAL biomarker developed at the Cincinnati Children’s received U.S. FDA approval for pediatric use. The NGAL test, also referred to as the ProNephro AKI test, is designed to assist healthcare providers in identifying patients who are at risk of developing or currently experiencing moderate to severe acute kidney injury (AKI) within 48-72 hours, particularly in intensive care settings.

-

In May 2024, Boditech Med signed a MOU with Bio Preventive Medicine Corp for license of DNlite-IVD103 biomarker for detection of diabetic kidney disease. The test allows early detection of kidney damage up to 5 years prior to actual damage.

Kidney Function Tests Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.00 billion |

|

Revenue forecast in 2030 |

USD 1.39 billion |

|

Growth rate |

CAGR of 6.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa |

|

Key companies profiled |

Abbott; Danaher; F. Hoffmann-La Roche Ltd.; Sysmex Corporation; Siemens Healthineers; Randox Laboratories Ltd; Quest Diagnostics; ACON Laboratories, Inc.; Nova Biomedical Corporation; Laboratory Corporation of America Holdings |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Kidney Function Tests Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global kidney function tests market report based on the product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Clearance Tests

-

Urine Tests

-

Blood Tests

-

Dilution And Concentration Tests

-

Other Tests

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Research Laboratories And Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global kidney function tests market size was estimated at USD 949.5 million in 2024 and is expected to reach USD 1,008.2 million in 2025.

b. The global kidney function tests market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 1.39 billion by 2030.

b. The clearance tests segment dominated the market for kidney function tests and accounted for the largest revenue share of 28.1% in 2024.

b. Some key players operating in the kidney function tests market include Abbott, Danaher, F. Hoffmann-La Roche Ltd., Sysmex Corporation, Siemens Healthcare GmbH, Randox Laboratories, Quest Diagnostics, and Laboratory Corporation of America Holdings.

b. Key factors that are driving the kidney function tests market growth include the growing prevalence of chronic kidney diseases and technological advancements in renal function tests.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."