- Home

- »

- Consumer F&B

- »

-

Juicer Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Juicer Market Size, Share & Trends Report]()

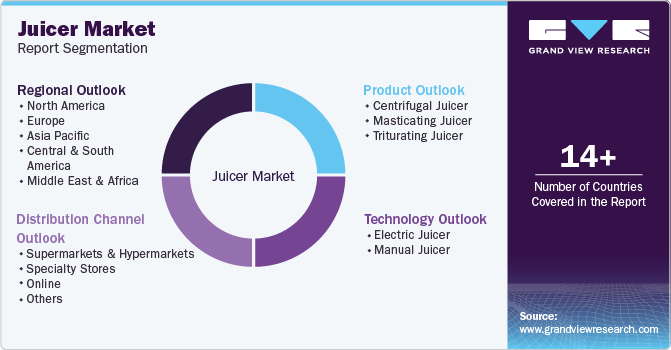

Juicer Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Centrifugal Juicer, Masticating Juicer), By Technology (Electric, Manual), By Distribution Channel (Super and Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-495-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Juicer Market Summary

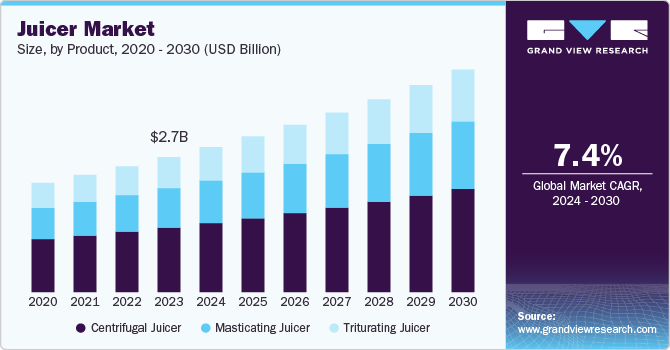

The global juicer market size was estimated at USD 2.85 billion in 2024 and is expected to reach USD 4.37 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The market is experiencing significant growth, driven by several key factors that reflect changing consumer behaviors and preferences.

Key Market Trends & Insights

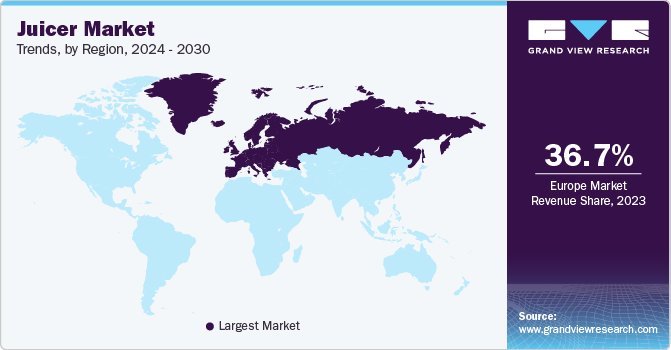

- Europe juicer market accounted for 36.7% market share in 2023.

- By product, centrifugal juicers segment accounted for the highest revenue of USD 1.27 billion in 2023.

- By technology, electric juicers segment accounted for a revenue share of 75 % in 2023.

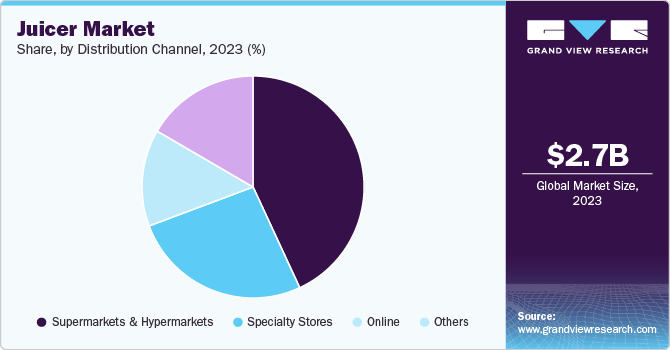

- By distribution channel, supermarkets & hypermarkets segment held highest revenue of USD 1.14 billion in 2023.

Market Size & Forecast

- 2024 Market Size: USD 2.85 Billion

- 2030 Projected Market Size: USD 4.37 Billion

- CAGR (2025-2030): 7.4%

- Europe: Largest market in 2023

One of the primary drivers is the increasing health consciousness among consumers, particularly millennials. This demographic is more inclined to incorporate fresh juices into their diets as part of a healthy lifestyle, influenced by rising awareness of the benefits of consuming fruits and vegetables. The trend towards wellness and fitness has led to a surge in demand for juicers as consumers seek convenient ways to prepare nutritious beverages at home.Millennials significantly influence the demand for juice extractors, driven by their health-conscious lifestyle and preferences for customization. This generation, characterized by a strong focus on wellness, is increasingly opting for fresh juices as part of their daily diet. Reports indicate that millennials are the largest consumers of cold-pressed juices in the U.S., highlighting their preference for beverages that align with their health goals.

As a result, the demand for juice extractors has surged as millennials seek to replicate the quality and freshness of store-bought juices at home. The emphasis on organic and clean-label products further shapes millennials' purchasing decisions. Studies show that a significant portion of this demographic is willing to pay a premium for juices that are organic or free from artificial ingredients. This trend has prompted retailers and manufacturers to highlight these attributes in their offerings, thereby increasing the attractiveness of juice extractors that can produce high-quality, organic juices at home.

Another significant factor contributing to the growth of the juicer industry is the rise of small and independent food enterprises. These businesses are increasingly adopting juicing as a part of their offerings, catering to health-conscious customers who prefer fresh, homemade products over processed alternatives. This influx of new entrants into the market boosts sales and fosters innovation in product designs and functionalities, further enhancing consumer interest in juicers.

Moreover, the industry is benefiting from advancements in technology and product innovation. Manufacturers are introducing juicers with improved features such as higher efficiency, ease of use, and enhanced nutritional retention. These innovations appeal to a broader audience, including those who may have previously been deterred by the complexity or inconvenience of using traditional juicers. As a result, modern juicers are becoming more accessible and appealing to a diverse range of consumers.

One of the most significant challenges is intense competition among manufacturers. With numerous brands vying for market share, companies are engaged in price wars and are under constant pressure to innovate. This fierce competition can lead to reduced profit margins, making it difficult for brands to maintain profitability while investing in research and development to differentiate their products from lower-priced alternatives. Quality control issues also pose a challenge for the juicer market.

As consumer expectations rise, manufacturers must ensure that their products are durable and reliable. Instances of product failures, such as motor burnouts or breakdowns, can severely damage a brand's reputation and lead to loss of customer trust. For example, Breville faced complaints regarding motor issues in some of its models, which necessitated improvements in their motor designs and quality control processes to retain consumer confidence.

Product Insights

Centrifugal juicers accounted for the highest revenue of USD 1.27 billion in 2023. One of the primary drivers for choosing centrifugal juicers is their speed and efficiency over other types, such as masticating or cold-press juicers. Centrifugal juicers operate at high speeds, typically between 6,000 to 14,000 RPM, allowing users to extract juice quickly. This rapid processing is particularly appealing to individuals with busy lifestyles who prioritize convenience and want to prepare fresh juice in minutes.

Another significant advantage is the ease of use and cleaning associated with centrifugal juicers. These machines often feature larger feed chutes, enabling users to insert whole fruits and vegetables without extensive chopping or prep work. This user-friendly design makes juicing less of a chore and encourages more frequent use.

Affordability is another compelling factor driving the demand for centrifugal juicers. Generally, these juicers are less expensive than masticating models, making them accessible to a broader range of consumers, including those on a budget. This cost-effectiveness does not significantly compromise quality. At the same time, centrifugal juices may have slightly lower nutrient retention than cold-pressed juices. However, they still provide a nutritious option for those looking to incorporate more fruits and vegetables into their diets.

Masticating juicers are expected to grow at a CAGR of 8% from 2024 to 2030. One of the primary advantages is their nutritional superiority. Masticating juicers operate at slower speeds, typically between 40 to 150 RPM, which minimizes heat generation and oxidation during juicing. This results in juice that retains more vitamins, minerals, and antioxidants than juices extracted by centrifugal juicers, making them an attractive option for health-conscious consumers who prioritize nutrient preservation. In addition, the lower oxidization levels also result in a longer shelf life for the juice.

Another significant driver for the masticating juicers is the higher juice yield they provide. The slow extraction process allows these juicers to extract more juice from the same produce, often yielding up to 30% more juice than centrifugal models. This efficiency not only maximizes the use of fruits and vegetables but can also lead to cost savings over time, as consumers need to purchase less produce to achieve their desired juice quantity.

Technology Insights

Electric juicers were the most popular form of juicers in the market and accounted for a revenue share of 75 % in 2023. One of the primary drivers is the demand for convenience. Electric juicers allow users to extract juice quickly and effortlessly, making them ideal for busy lifestyles. Unlike manual juicers, requiring significant effort and time, electric models can produce fresh juice in seconds, appealing to consumers who prioritize efficiency in their kitchen routines.

Another critical factor is the technological advancements in electric juicers. Modern electric juicers have various features, such as multiple speed settings, preset options, and improved motor designs that enhance performance and user experience. These innovations increase the efficiency of juice extraction and cater to a wider variety of fruits and vegetables, allowing consumers to experiment with different ingredients and recipes. Integrating easy-clean technology further boosts their appeal, as consumers increasingly look for appliances that simplify the cleaning process after use.

The rising disposable income in many regions, particularly in developing markets, contributes to the growth of the electric juicer segment. As consumers have more disposable income, they are more willing to invest in high-quality kitchen appliances that promote a healthy lifestyle. This trend is particularly evident in urban areas where health-focused cafes and juice bars are becoming increasingly popular, further driving consumer interest in owning an electric juicer at home.

Although not as popular as their electric counterparts, manual juicers are still popular due to their portability and nutritional integrity advantages. Manual juicers do not require electricity, making them ideal for use in various settings such as camping trips, picnics, or during power outages. Their portability allows users to enjoy fresh juice anywhere, anytime, without the need for electrical outlets. This feature is particularly attractive for individuals who lead active lifestyles or travel frequently.

One of the standout benefits of manual juicers is their ability to preserve the nutritional quality of the juice. The gentle extraction process minimizes heat generation, which can degrade vitamins and enzymes present in fruits and vegetables. As a result, juices produced with manual juicers often retain more nutrients compared to those made with electric juicers, which can generate heat during operation

Distribution Channel Insights

Supermarkets & hypermarkets held highest revenue of USD 1.14 billion in 2023. Supermarkets and hypermarkets are strategically located in urban and suburban areas, making them easily accessible to a large consumer base. This convenience encourages impulse purchases, as shoppers often buy kitchen appliances like juicers while grocery shopping. Juicers in these stores allow consumers to physically examine products, enhancing their buying confidence through direct interaction with the items.

Supermarkets and hypermarkets often engage in promotional activities such as discounts, demonstrations, and bundled offers that can significantly boost sales. In-store demonstrations allow customers to see the juicers in action, which can effectively highlight their features and benefits. In addition, seasonal promotions or health-focused campaigns can attract health-conscious consumers looking to invest in kitchen appliances that support their wellness goals. Major brands often leverage the visibility offered by supermarkets and hypermarkets to enhance brand recognition and consumer trust. Prominent placement on shelves or dedicated sections for kitchen appliances can influence consumer perception and encourage brand loyalty. This exposure is particularly beneficial for new product launches or when entering new markets.

Online sales of juicers are expected to grow at a CAGR of 8.4% from 2024 to 2030. One of the primary drivers for the segment’s growth is the unparalleled convenience offered by e-commerce platforms. Consumers can browse a wide range of juicer models from the comfort of their homes, compare prices, and read reviews without the need to visit physical stores. This accessibility particularly appeals to busy individuals or those living in remote areas where specialized kitchen appliances may not be readily available in local stores. The rise of direct-to-consumer (DTC) sales has further strengthened online retail as a distribution channel for juicers. Many manufacturers now sell their products directly through their websites or dedicated e-commerce platforms, eliminating intermediaries and allowing for better pricing strategies. This model enhances brand visibility and enables manufacturers to engage directly with consumers, gather feedback, and tailor their offerings based on consumer preferences.

Regional Insights

The North America juicer market held the revenue of more than USD 620 million in 2023 and is expected to grow at a CAGR of 6.9% over the forecast period. Consumer awareness regarding health and wellness is a significant driver of the juicer market's growth. As more people prioritize a balanced diet and seek to incorporate fresh fruits and vegetables into their meals, juicers have become essential kitchen appliances. The demand for fiber-rich, nutrient-dense juices aligns with consumers' goals of improving their overall health, boosting immunity, and enhancing digestion, thus driving sales of juicers in North America.

U.S. Juicer Market Trends

The U.S. juicer market is expected to grow at a CAGR of 7% from 2024 to 2030. A growing consumer preference for fresh and organic products has spurred interest in home juicing. Many consumers are willing to pay a premium for high-quality, nutrient-dense juices from fresh fruits and vegetables. This trend is further supported by the popularity of cold-pressed juices, which retain more nutrients than traditional juicing methods, appealing to health-conscious individuals.

Europe Juicer Market Trends

Europe juicer market accounted for 36.7% market share in 2023. The proliferation of juice bars and health-focused cafés across Europe has stimulated interest in home juicing. As these establishments promote fresh juices as part of a healthy lifestyle, they raise consumer awareness about the benefits of juicing. This trend encourages individuals to replicate similar experiences at home, leading to increased sales of juicers as consumers seek to recreate nutritious beverages from the comfort of their kitchens.

Asia Pacific Juicer Market Trends

The juicer market in Asia Pacific accounted for approximately 30% of the global market in 2023. The rise of social media has played a pivotal role in promoting health trends, including juicing. Health influencers and lifestyle bloggers often showcase the benefits of fresh juices, encouraging their followers to adopt similar habits. This social media influence drives demand for juicers as consumers look to replicate these healthy practices at home. The growing middle class in many Asian countries is leading to increased disposable incomes, allowing consumers to invest in kitchen appliances like juicers. As more individuals can afford quality juicing equipment, the market for both entry-level and high-end juicers is expanding.

Key Juicer Company Insights

The company landscape of the juicer industry is characterized by a diverse range of players, from established brands to emerging companies, each vying for market share in a rapidly growing industry. Continuous innovation is crucial in the industry, with companies focusing on enhancing product features such as speed settings, ease of cleaning, and multi-functionality. Introducing smart juicers integrating with mobile apps for improved user experience is becoming increasingly popular. Companies are investing heavily in research and development to create products that meet evolving consumer needs while emphasizing sustainability through eco-friendly materials.

Key Juicer Companies:

The following are the leading companies in the juicer market. These companies collectively hold the largest market share and dictate industry trends.

- Breville Group Ltd

- Cuisinart Inc.

- Electrolux AB

- Omega Juicers

- Hamilton Beach Brands Holding Co.

- Koninklijke Philips N.V.

- Panasonic Corporation

- Hurom America Inc.

- Midea Retail (PTY) Ltd.

- Bajaj Electricals Ltd.

- Borosil Ltd.

- DeLonghi Spa

- Joyoung Co. Ltd.

- Kuvings

- SEB SA Co.

Juicer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.06 billion

Revenue forecast in 2030

USD 4.37 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Breville Group Ltd; Cuisinart Inc.; Electrolux AB; Omega Juicers; Hamilton Beach Brands Holding Co.; Koninklijke Philips N.V.; Panasonic Corporation; Hurom America Inc.; Midea Retail (PTY) Ltd.; Bajaj Electricals Ltd.; Borosil Ltd.; DeLonghi Spa; Joyoung Co. Ltd.; Kuvings; SEB SA Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Juicer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global juicer market report based on product, technology, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifugal Juicer

-

Masticating Juicer

-

Triturating Juicer

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Juicer

-

Manual Juicer

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global juicer market size was estimated at USD 2.65 billion in 2023 and is expected to reach USD 2.85 billion in 2024.

b. The global juicer market is expected to expand at a CAGR of 7.4% from 2024 to 2030 to reach USD 4.37 billion by 2030.

b. Electric juicers were the most popular form of juicers in the market and accounted for a revenue share of 75 % in 2023. One of the primary drivers is the demand for convenience. Electric juicers allow users to extract juice quickly and effortlessly, making them ideal for busy lifestyles. Unlike manual juicers, requiring significant effort and time, electric models can produce fresh juice in seconds, appealing to consumers who prioritize efficiency in their kitchen routines.

b. Some prominent players in the juicer market include Breville Group Ltd; Cuisinart Inc.; Electrolux AB; Omega Juicers; Hamilton Beach Brands Holding Co.; Koninklijke Philips N.V.; Panasonic Corporation; Hurom America Inc.; Midea Retail (PTY) Ltd.; Bajaj Electricals Ltd.; Borosil Ltd.; DeLonghi Spa; Joyoung Co. Ltd.; Kuvings; SEB SA Co.

b. The market is experiencing significant growth, driven by several key factors that reflect changing consumer behaviors and preferences. One of the primary drivers is the increasing health consciousness among consumers, particularly millennials. This demographic is more inclined to incorporate fresh juices into their diets as part of a healthy lifestyle, influenced by rising awareness of the benefits of consuming fruits and vegetables. The trend towards wellness and fitness has led to a surge in demand for juicers as consumers seek convenient ways to prepare nutritious beverages at home.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.