- Home

- »

- Consumer F&B

- »

-

Juice Concentrates Market Size, Share, Growth Report, 2030GVR Report cover

![Juice Concentrates Market Size, Share & Trends Report]()

Juice Concentrates Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Fruit Concentrates, Vegetable Concentrates), By Form (Liquid, Powder), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-402-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Juice Concentrates Market Summary

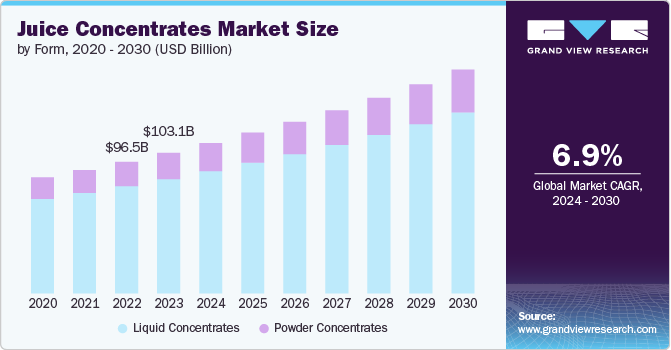

The global juice concentrates market size was estimated at USD 103,095.3 million in 2023 and is projected to reach USD 164,045.1 million by 2030, growing at a CAGR of 6.9% from 2024 to 2030. As the health and wellness trend continues to grow, the popularity of juice concentrates is increasing.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- In terms of segment, fruit concentrates accounted for a revenue of USD 103,095.3 million in 2023.

- Fruit Concentrates is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 103,095.3 Million

- 2030 Projected Market Size: USD 164,045.1 Million

- CAGR (2024-2030): 6.9%

- Europe: Largest market in 2023

Unlike juices made from freshly juiced fruits and vegetables, juice concentrates are produced by extracting the juice and then evaporating most of the water, resulting in a nutrient-dense and flavorful syrup. The rising demand for healthy and convenient food options is propelling the global juice concentrate market forward. Additionally, the growing demand for fruit concentrates as flavoring agents in baby food and indulgent bakery products is significantly contributing to market growth.

Consumers are increasingly focused on health and wellness, seeking beverages that provide nutritional benefits without added sugars or artificial ingredients. Juice concentrates, particularly those marketed as natural or organic, fit well into this trend. Additionally, juice concentrates offer a convenient and shelf-stable alternative to fresh Juice, which can spoil quickly. This makes them attractive for both consumers and food manufacturers looking for longer-lasting ingredients. The rising popularity of functional beverages that provide additional health benefits, such as enhanced energy, immunity support, and improved digestion, also drives demand for juice concentrates.

Furthermore, the overall growth of the beverage industry, including soft drinks, sports drinks, and ready-to-drink (RTD) beverages, boosts demand for juice concentrates as key ingredients. Also, with the rise in processed and packaged foods, manufacturers are using juice concentrates as natural flavorings and sweeteners in products like bakery items, dairy products, and snacks.

Manufacturers are continually innovating to meet consumer demand and differentiate their products. One major trend is the emphasis on clean-label products with fewer additives and preservatives. Companies are producing juice concentrates that are organic, non-GMO, and free from artificial ingredients. Another significant innovation is the development of cold-pressed juice concentrates, which retain more nutrients and fresh flavors compared to traditional pasteurized products. Blended juice concentrates are also gaining popularity as manufacturers create unique combinations of fruit and vegetable concentrates to cater to diverse taste preferences and nutritional needs.

Additionally, fortified juice concentrates with added vitamins, minerals, and other functional ingredients are becoming more common, particularly in products targeting specific health benefits like immunity or energy. Lastly, sustainable packaging innovations, such as recyclable and biodegradable materials, are increasingly being adopted as companies aim to reduce their environmental footprint.

Type Insights

Fruit juice concentrates accounted for a share of 76.3% in 2023. Consumers are becoming more health-conscious and are looking for nutritious options in their diets. Fruit juice concentrates are rich in vitamins, minerals, and antioxidants, making them an attractive choice for those seeking health benefits without added sugars or artificial ingredients.

Additionally, fruit juice concentrates are further divided into citrus fruits and tropical fruits. Citrus fruit juice concentrates accounted for a share of 65.4% in 2023. Citrus fruits are rich in vitamins, particularly vitamin C, which is known for boosting the immune system and providing antioxidants. The ongoing focus on health and wellness, especially post-COVID-19, has led consumers to seek out citrus products for their health benefits, driving up demand for citrus juice concentrates

Vegetable juice concentrates are expected to grow at a CAGR of 7.1% from 2024 to 2030. There is a rising trend in the consumption of functional beverages that offer additional health benefits, such as detoxification, improved digestion, and increased energy. Vegetable juice concentrates are often used in these products, appealing to consumers looking for beverages that provide more than just hydration.It provides a practical solution for those looking to maintain a healthy diet without the hassle of preparing fresh vegetables. They have a long shelf life, are easy to store, and can be quickly reconstituted or added to various recipes, making them a convenient option for busy lifestyles.

Form Insights

Liquid juice concentrates accounted for a revenue share of 81.4% in 2023. Liquid juice concentrates offer unparalleled convenience, as they are easy to store, transport, and use. They can be quickly reconstituted with water to create fresh-tasting juice, making them a popular choice for busy consumers looking for quick and easy beverage options. As consumers become more health-conscious, there is an increasing demand for natural and nutritious beverage options. Liquid juice concentrates, particularly those made from organic or non-GMO fruits and vegetables, align with these health and wellness trends. They offer a concentrated source of vitamins, minerals, and antioxidants without the need for added sugars or artificial ingredients.

Powdered juice concentrates are expected to grow at a CAGR of 7.2% from 2024 to 2030. Powdered juice concentrates are incredibly convenient and portable. They are lightweight, easy to store, and can be quickly reconstituted with water to create juice on the go. This makes them a popular choice for busy individuals, travelers, and those with limited storage space. Additionally, modern processing techniques often preserve the nutritional content of the original fruits and vegetables, allowing consumers to enjoy the health benefits of juice in a convenient, powdered form.

End-use Insights

Food processing accounted for a revenue share of 42.7% in 2023. Juice concentrates can be reconstituted to the desired strength by adding water, allowing manufacturers to produce a variety of products with different juice content. This versatility makes concentrates suitable for a wide range of applications, from beverages to sauces and baked goods.

Food service is expected to grow at a CAGR of 7.3% from 2024 to 2030. Food service channels typically offer juice concentrates in larger quantities at more competitive prices than retail outlets. This bulk purchasing option is more economical for businesses such as restaurants, cafes, and catering services. They provide a consistent supply of juice concentrates, which is crucial for maintaining uniform product quality and taste in commercial food and beverage operations.

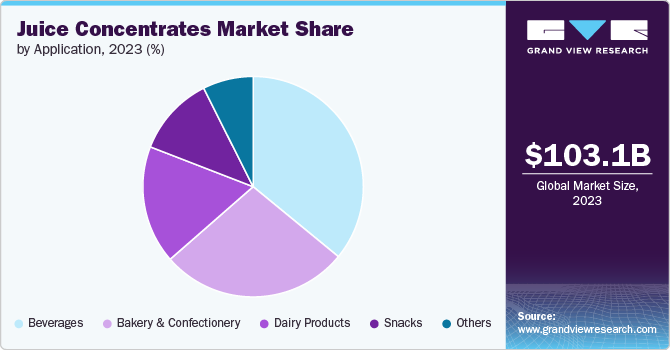

Application Insights

Beverages accounted for a revenue share of over 35% in 2023. Juice concentrates are easy to store, transport, and use, making them a convenient option for beverage manufacturers. They simplify the production process, reduce transportation costs due to their concentrated form, and help maintain a longer shelf life for the final product, making them a cost-effective solution for both producers and consumers. Additionally, there is a rising trend in the development of functional beverages that offer additional health benefits, such as improved digestion, enhanced immunity, or increased energy. Juice concentrates are a key ingredient in these products, enabling manufacturers to formulate innovative beverages that meet the growing consumer demand for functional and health-promoting drinks.

Bakery & confectionery is expected to grow at a CAGR of 7.6% from 2024 to 2030. Juice concentrates are versatile ingredients that can be used in a variety of applications, from cakes, cookies, and pastries to candies and chocolates. They enable bakers and confectioners to innovate and create new products with unique flavors and textures, meeting the diverse and evolving tastes of consumers. Additionally, they offer natural coloring, which appeals to consumers looking for products without artificial additives.

Regional Insights

North America juice concentrates market accounted for a revenue share of over 24% in 2023 of the global market. In recent years, North America has seen a significant shift toward healthier eating and drinking habits. People are becoming increasingly conscious of their dietary choices; this awareness has fueled the popularity of juice concentrates across the region.

U.S. Juice Concentrates Market Trends

The juice concentrates market in the U.S. is facing intense competition due to massive type innovation in juice concentrates. There is a rising awareness of health and wellness, driving interest in juice concentrates that offer nutritional benefits without compromising on taste. Consumers are increasingly looking for juice concentrates made with natural, organic, and non-GMO ingredients, reflecting a trend toward cleaner eating. Furthermore, innovative flavors and unique ingredient combinations are appealing to adventurous eaters, adding to the growing demand for healthier drinking options.

Europe Juice Concentrates Market Trends

The juice concentrates market in Europe is expected to grow at a CAGR of 7.1% during the forecast period. Europeans are increasingly focusing on health and wellness, leading to higher consumption of products perceived as nutritious. Juice concentrates, which can be a source of vitamins and minerals, align well with these health trends. The European market is seeing a rise in innovative products and formulations that use juice concentrates, such as functional beverages and health-focused drinks. This innovation drives consumer interest and demand.

Asia Pacific Juice Concentrates Market Trends

The juice concentrates market in Asia Pacific is expected to grow at a CAGR of 7.7% from 2024 to 2030. In Asia Pacific, juice concentrates have gained popularity due to their convenience and portability, meeting consumers' demand for grab-and-go options. The expansion of the beverage industry, including the rise of functional and ready-to-drink beverages, is driving demand for juice concentrates. These concentrates are used as ingredients in a variety of beverages, including soft drinks, energy drinks, and flavored water.

Key Juice Concentrates Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Juice Concentrates Companies:

The following are the leading companies in the juice concentrates market. These companies collectively hold the largest market share and dictate industry trends.

- AGRANA Beteiligungs-AG

- Döhler GmbH

- CitroGlobe S.r.l.

- Himalayan Food Park

- Lizaz Food Processing

- Old Orchard Brands, LLC.

- ADM

- SunOpta Inc.

- FruitSmart

- H&H Products Company

Recent Developments

-

In February 2024, Austria Juice showcased its range of organic juice concentrates at BioFach 2023, introducing innovative products such as a pomegranate berry mix and a lime guava drink. The company emphasizes the use of organic fruits, particularly red fruits and apples, in response to the growing demand for organic beverages. Their new offerings include organic mixtures that utilize organic sugar and flavors instead of traditional juice, as well as three types of completely organic energy drinks. This shift aligns with market trends toward converting conventional drinks into organic versions, including organic ciders and wines, with Austria Juice positioning itself as a partner for companies looking to make this transition.

-

In November 2021, Dole Sunshine India launched its 100% natural pineapple juice, offering consumers a pure and fruity beverage. The juice is made from the finest pineapples and contains no added sugar, preservatives, or artificial colors, ensuring a healthy and refreshing drinking experience. The launch aligns with the growing consumer demand for natural and healthy fruit juices in India. Dole Sunshine India aims to provide a premium pineapple juice option that delivers the authentic taste of the fruit without any compromises.

-

In September 2023, Kellanova’s RXBAR brand partnered with podcaster Maria Menounos to launch a limited edition RXBAR ManifX bars with customizable wrappers. The RXBAR ManifX bars are available in Chocolate Sea Salt flavor, made with 12g of protein.

Juice Concentrates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 110.22 billion

Revenue forecast in 2030

USD 164.05 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

AGRANA Beteiligungs-AG, Döhler GmbH, CitroGlobe S.r.l., Himalayan Food Park, Lizaz Food Processing, Old Orchard Brands, LLC., ADM, SunOpta Inc., FruitSmart, H&H Products Company

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Juice Concentrates Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global juice concentrates market report based on type, form, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit Concentrates

-

Citrus Fruits

-

Orange

-

Lemon

-

Grapefruit

-

Berries

-

Strawberry

-

Others

-

-

Tropical Fruits

-

Mango

-

Pineapple

-

Banana

-

Passion Fruit

-

Others

-

-

-

Vegetable Concentrates

-

Carrot

-

Tomato

-

Beetroot

-

Cucumber

-

Others

-

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Concentrates

-

Powder Concentrates

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Bakery & Confectionery

-

Dairy Products

-

Snacks

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Processing

-

Food Service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global juice concentrates market size was estimated at USD 103.10 billion in 2023 and is expected to reach USD 110.22 billion in 2024.

b. The global juice concentrates market is expected to grow at a compounded growth rate of 6.9% from 2024 to 2030 to reach USD 164.05 billion by 2030.

b. Fruit juice concentrates accounted for a share of 76.3% in 2023. Fruit juice concentrates are highly versatile and can be used in a wide range of food and beverage products. They are commonly utilized in beverages, bakery items, dairy products, snacks, and ready-to-drink products. This versatility increases their demand as they can enhance flavor and nutritional content across different food categories.

b. Some key players operating in juice concentrates market include AGRANA Beteiligungs-AG, Döhler GmbH, CitroGlobe S.r.l., Himalayan Food Park, and others

b. Key factors that are driving the market growth include increased consumption of fruits & vegetables, rising demand for on-the go beverages

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.