Johne's Disease Diagnostics Market Size, Share & Trends Analysis Report By Animal Type (Cattle, Sheep), By Test Type (ELISA, PCR), By End-use (Veterinary Hospitals & Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-945-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Johne's Disease Diagnostics Market Trends

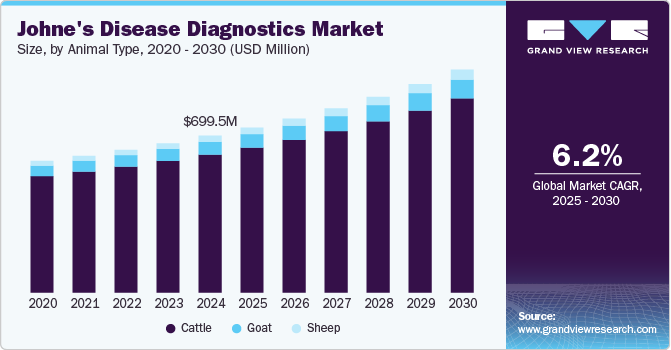

The global Johne’s disease diagnostics market size was estimated at USD 699.5 million in 2024 and is projected to grow at a CAGR of 6.21% from 2025 to 2030. Some of the key factors driving the market growth include increasing livestock population and supportive initiatives such as Johne’s disease eradication programs. The animal health sector, particularly the diagnosis of Johne's disease, has been impacted by the worldwide trend of digitization in healthcare. In order to minimize the challenges in operating the device, companies are investing in product development to include improved testing accuracy, verifying devices, increasing the test menu, and automating the process as much as feasible.

High-value targets are also presented by point-of-care diagnostics for infectious diseases, particularly if the sickness affects farmed animals or can be spread from animals to humans. The COVID-19 pandemic has negatively impacted the market. Lockdowns and social distancing measures reduced access to veterinary care, impacting routine Johne’s disease testing, diagnosis, and treatment, especially in areas heavily affected by COVID-19. Reduced access delayed testing schedules, creating a backlog that may have contributed to underdiagnosis and lower treatment rates. COVID-19 led to economic challenges for many farmers, resulting in budget cuts for herd health programs. Financial constraints led some farmers to deprioritize Johne’s disease management, reducing testing and preventive measures and delaying necessary interventions.

Johne's disease eradication programs, increased knowledge of paratuberculosis, and a rising cattle population are among the primary drivers influencing the industry growth. For example, the Irish cattle sector strongly supports the Irish Johne's Disease Control Programme, a long-term voluntary control effort for JD in Ireland. In order to tackle animal diseases that are not covered by EU laws, the organization makes use of Animal Health Ireland's establishment. In addition, it aims to prevent JD from spreading to farms that are not afflicted, lessen the severity of infection when it is present, guarantee JD control markets in Ireland, and advance calf health and farm biosecurity.

To prevent the disease from spreading to herds that are not afflicted, the Veterinary Services division of the Animal and Plant Health Inspection Service (USDA-APHIS-VS) of the US Department of Agriculture (USDA) has created a Johne's disease curtail program. It has developed a cooperative Federal-State-Industry initiative to assist farmers with risk assessments. It is also making an effort to support the development and validation of control measures. Furthermore, the industry is now being supported by continuous innovation in the veterinary diagnostics sector.

Market Concentration & Characteristics

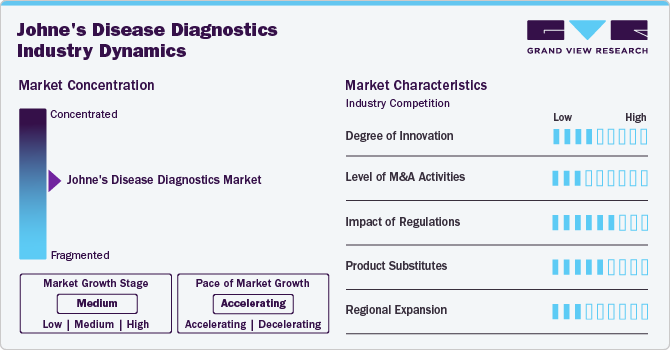

The industry is considered to be at a medium level in terms of growth stage, with significant market growth. The industry is growing owing to technological advancement in diagnosis. For instance, according to Frontiers Media S.A, Phage-based methods are a relatively recent addition to the PTB diagnostic toolbox. Phage-based assays leverage bacteriophages to identify live MAP bacteria. Specific bacteriophages infect MAP cells, allowing for replication and subsequent detection through assays like qPCR or phage amplification. Moreover, it provides a better understanding of how MAP interacts with the immune system.

The industry demonstrates a moderate degree of innovation. According to Cornell University, Johne's ELISA and fecal PCR are used in combination to determine a more accurate status in the herd by doing a more conclusive test on those identified as having a higher risk of infection due to elevated antibody levels. Additionally, ELISA can identify animals at a higher risk of progressive infection and is reasonably priced. Fecal PCR is used to further assess M. ptb shedding in those animals. Conclusive proof of shedding makes it easier to prioritize which animals are the greatest options for eliminating or other Johne's control decisions.

The industry experiences a moderate level of merger and acquisition activity, reflecting consolidation and strategic collaboration between industry leaders. For example, in February 2020, Zoetis acquired Ethos Diagnostic Science, a veterinary reference laboratory company that provides accurate, trustworthy results to researchers, the larger veterinary community, and top specialized animal clinics.

This industry is shaped by various regulatory frameworks aimed at ensuring the safety and efficacy of these kits for animal diagnosis. Favorable efforts, such as the Federal-State-Industry program in the United States. For example, certain programs were set up to help producers by assessing the risk of M. avium subsp. paratuberculosis transmission and creating herd management strategies to reduce hazards.

The industry experiences a moderate product substitute, owing to accurate results and sensitivity to minute changes, there is a move toward biological tests and processes in Johne's disease diagnostics, which aids in improved disease detection. The majority of animal diagnostic tests are technologically advanced and biological in origin. Many companies are currently working on diagnostics that are simple for farmers and veterinarians to use. Currently, the market contains a mix of old and new diagnostic approaches.

This industry is supported by the regional expansion initiatives. For example, in January 2022, PBD Biotech Ltd. expanded its business in North America. This supported the company’s regional expansion strategy and strengthened its presence in North America.

Animal Type Insights

The cattle segment dominated the market and accounted for the largest revenue share of more than 87% in 2024. Cows, bulls, oxen, calves, and buffaloes fall into this category. The industry growth is most likely to be driven by an increase in the incidence of zoonotic diseases in cattle. Every year, 4% of Georgia beef cattle tested positive for Johne's disease, according to animal agriculture. The need for precise and prompt diagnostic treatments is increasing along with awareness of Johne's disease. Farmers can manage and restrict the spread among herds by identifying diseased animals early owing to effective diagnosis.

More sophisticated technologies like PCR and ELISA, which provide quicker, more accurate results, are replacing or supplementing traditional diagnostic techniques like fecal culture and serology. This industry is growing as a result of veterinary labs and diagnostic companies being encouraged to innovate and improve their diagnostic tools due to the rise in illness prevalence.

The sheep segment is anticipated to grow at the fastest CAGR from 2025 to 2030. Although the disease can infect sheep at any age, it is more likely to affect younger sheep. Stress and other illnesses may also have an impact on susceptibility. Up to 70% of sick sheep may remain subclinical, meaning that while they don't exhibit any symptoms, the bacteria they excrete might spread to other sheep and contaminate the surrounding area.

Test Type Insights

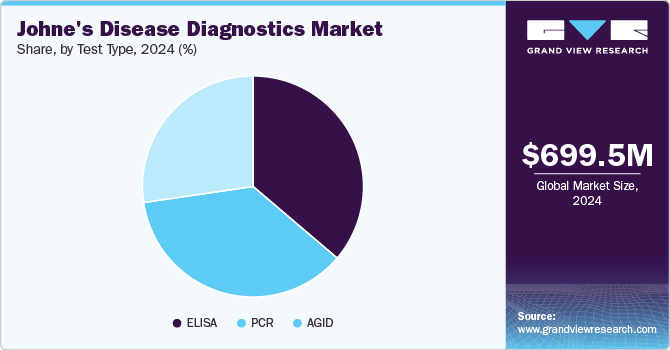

The PCR segment dominated the market and accounted for over 36.0% in 2024. The swift acceptance of testing and diagnostic technologies, as well as the increase in the livestock population, are the primary drivers anticipated to fuel the segment growth. Additionally, clinical immunology and microbiology labs commonly have PCR available. Compared to an antibody test, PCR has higher sensitivity and detects infections earlier. For example, the Animal Health Diagnostic Center (AHDC) offers the Johne's Direct Fecal PCR test. Veterinarian doctors can use this test, which is intended to alter the cultures of individual cows or goats, to control Johne's disease in the majority of herds through management therapies and testing.

The ELISA segment is anticipated to grow at the fastest CAGR from 2025 to 2030. The ELISA is a cost-effective and widely utilized diagnostic tool in veterinary healthcare. Its ability to accurately identify animals at a higher risk of advanced infection contributes significantly to the Johne's disease diagnostic market. ELISA can identify specific antigens or antibodies related to infections, allowing early detection of diseases. This capability is crucial for pinpointing animals that may develop advanced stages of an infection. Moreover, ELISA facilitates testing of large herds in a relatively short time, improving early detection and disease management at a population level.

End-use Insights

Veterinary hospitals and clinics dominated the market with the largest revenue share of over 53% in 2024. Hospitals and clinics have the infrastructure to conduct various diagnostic tests, such as ELISA and PCR, that detect Johne’s disease. Their accessibility enables quick testing, which is essential for disease management and containment. Hospitals and clinics employ veterinarians skilled in disease recognition and management, essential for identifying and treating Johne's disease. These professionals are crucial in promoting regular testing and preventive care among livestock owners.

Others segment is anticipated to grow at the fastest CAGR over the forecast period. Reference laboratories offer specialized diagnostic tests for Johne's disease, including advanced PCR (Polymerase Chain Reaction) and culture methods, which may not be available in regular veterinary clinics. Their ability to conduct precise and sensitive testing makes them essential for accurate disease diagnosis, especially in large-scale livestock operations.

Regional Insights

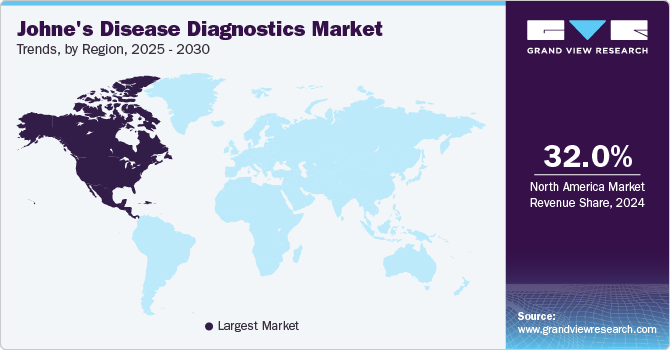

North America Johne’s disease diagnostics market dominated the global market and accounted for the largest revenue share of more than 32.0% in 2024. The existence of significant service providers, the implementation of numerous strategic measures to broaden industry penetration, and the growing number of cattle are the drivers responsible for market growth. Additionally, the major industry participants-Thermo Fisher Scientific, Inc., Zoetis, and IDEXX-that are engaged in developing and launching tests necessary for the diagnosis of Johne's illness have significantly increased their strategic activity. Furthermore, it is anticipated that acquisitions and partnerships between domestic and foreign businesses will support the region's market growth.

U.S. Johne’s Disease Diagnostics Market Trends

The Johne’s disease diagnostics market in the U.S. dominated the North America region in 2024. This is due to a wide range of significant initiatives implemented by the government's animal care groups, who are constantly working for overall improvements in ruminant health. For example, a March 2024 USDA article states that APHIS Veterinary Services has created a cooperative Federal-State-Industry program that assists producers by conducting risk assessments for the transmission of M. avium subsp. paratuberculosis and creating herd-management plans to reduce those risks. Additionally, research to create and validate control measures is being funded by APHIS Veterinary Services. Furthermore, APHIS Veterinary Services keeps track of the current infection levels in the US and organizes State operations.

Europe Johne’s Disease Diagnostics Market Trends

Europe Johne’s disease diagnostics market held the second-largest share in 2024 due to the presence of significant players operating in the region. Livestock production in the region has significantly increased. A significant number of production animals are raised on the more than half of Europe's land that is used for farming. Additionally, the EU Animal Health Law Regulation on Transmissible Animal Diseases was adopted by the European Parliament and the Council in 2016. Thus, it is anticipated that the aforementioned factors will increase the market for Johne's disease diagnostics in the region.

The Johne’s disease diagnostics market in Germany is growing owing to the adoption of veterinary animal diagnostics methods for their research by organizations and universities in Germany. Furthermore, it is anticipated that animal diagnostics technology conferences and workshops in Germany will propel market growth. In addition, major companies are using strategies like mergers and partnerships to expand their product lines and produce high-value products, which will boost demand for veterinary diagnostic kits throughout Germany.

Asia Pacific Johne’s Disease Diagnostics Market Trends

The Asia Pacific Johne’s disease diagnostics market is growing quickly, and this trend is anticipated to continue during the forecast period. Due to an increase in the number of manufacturing facilities in the region, countries like China and India are anticipated to experience substantial market growth. It is projected that increasing R&D expenditure by market participants for the production of value-added products will propel regional market growth. Furthermore, the market is anticipated to grow as the number of cattle and the prevalence of zoonotic illnesses rises. Thus, it is expected that the aforementioned factors will propel market growth.

The Johne’s disease diagnostics market in India is growing as India has a huge number of cattle, and its native cow breeds are significant in terms of culture, ethics, and the economy. According to an article published by The Pharma Innovation Journal, India is one of the world's most biodiversity-rich countries. The dense cattle population increases the risk of disease spread, necessitating effective diagnostic measures. Since Johne’s disease affects milk production and fertility, early diagnosis is essential to prevent significant economic losses in India's dairy sector, which contributes significantly to the economy. Programs focusing on livestock health and productivity often include measures to control and diagnose Johne’s disease, supporting market growth.

Latin America Johne’s Disease Diagnostics Market Trends

Latin America Johne’s disease diagnostics market is gaining traction, owing to larger number of herds and expanded market access. The livestock sector in Latin America has expanded swiftly over the years; overall demand for animal proteins is increasing. With increasing consumption of meat and dairy products across the region, there is heightened pressure on livestock producers to maintain herd health and productivity. Johne's disease, caused by Mycobacterium avium subspecies paratuberculosis, poses a serious threat to cattle, goats, and sheep by reducing milk production and weight gain, thereby directly impacting the supply of high-quality animal protein.

The Johne’s disease diagnostics market in Brazil is growing due to a number of factors, including the availability of a wide range of tests, better outcomes with prompt care, a decrease in time-dependent changes, and a growing trend of farm owners and visiting veterinarians choosing POC testing for routine disease diagnosis and animal health screening. Furthermore, it is projected that the country's high R&D expenditures and well-developed infrastructure will further expand the market growth.

Middle East & Africa Johne’s Disease Diagnostics Market Trends

The Middle East & Africa Johne’s disease diagnostics market includes South Africa, Saudi Arabia, UAE, and Kuwait. The region’s Johne’s disease diagnostics market is likely to grow at a CAGR of 6.3% during the forecast period, attributed to rising disposable income and increasing disease prevalence. In addition, it is anticipated that increasing demands for animal care and increased awareness of animal diseases will accelerate market growth.

The Johne’s disease diagnostics market in South Africa is anticipated to be driven by the country's sizable target population and rising need for Johne's disease diagnostics. Livestock has a significant economic and sociological impact on the well-being of households across the country. A November 2024 article published by Global Ag Media claims that South Africa's animal production has more than doubled in the last 30 years due to increased demand for meat. Sheep, pigs, dairy, layers, poultry, cattle, and wool are the main sectors in the livestock industry.

Key Johne's Disease Diagnostics Company Insights

The industry for Johne’s disease diagnostics is fairly competitive. Leading companies are involved in deploying strategic initiatives that include service expansion, competitive pricing strategies, sales and marketing initiatives, partnerships, and mergers and acquisitions. For instance, in July 2020, VMRD, Inc. gained USDA certification to test goat serum using its Johne's Antibody Test Kit. This new research supplemented the USDA's existing license for bovine blood and milk samples, allowing this test to be extensively used in laboratories across the United States and around the world.

Key Johne's Disease Diagnostics Companies:

The following are the leading companies in the johne's disease diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- PBD Biotech

- Zoetis

- IDEXX Laboratories

- IDVET

- VMRD Inc.

- Biomeriux SA.

- INDICAL BIOSCIENCE GmbH

- MV Diagnostics (Sure Farm Ltd)

- Tetracore, Inc.

Recent Developments

-

In January 2022, IDEXX expanded its reference laboratory options for different tests and services. This can enable veterinarians to meet the challenges in treating and diagnosing cancer.

-

In April 2020, Zoetis acquired Performance Livestock Analytics to improve its animal health solutions across the continuum of care for beef producers.

Johne’s Disease Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 735.65 million |

|

Revenue forecast in 2030 |

USD 994.07 million |

|

Growth rate |

CAGR of 6.21% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal type, test type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; PBD Biotech; Zoetis; IDEXX Laboratories; IDVET; VMRD Inc.; Biomeriux SA.; INDICAL BIOSCIENCE GmbH; MV Diagnostics (Sure Farm Ltd); Tetracore, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Johne’s Disease Diagnostics Market Report Segmentation

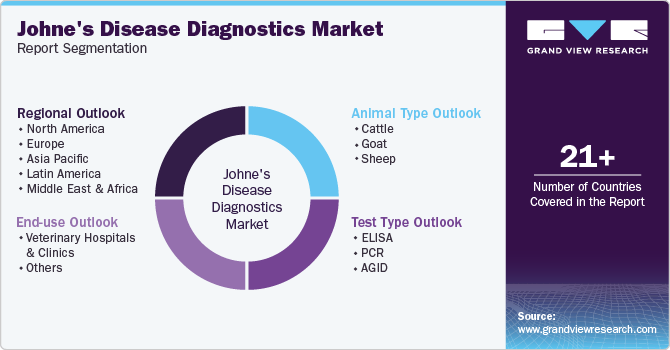

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Johne’s diseases diagnostics market report based on animal type, test type, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Goat

-

Sheep

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ELISA

-

PCR

-

AGID

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global Johne's disease diagnostics market size was estimated at USD 699.5 million in 2024 and is expected to reach USD 735.65 million in 2025.

b. The global Johne's disease diagnostics market is expected to grow at a compound annual growth rate of 6.21% from 2025 to 2030 to reach USD 994.07 million by 2030.

b. North America dominated Johne's disease diagnostics market with a share of 32.2% in 2024. This is attributable to a significant rise in veterinary healthcare expenditure, the presence of healthcare programs, and an increase in the number of initiatives to promote animal health.

b. Some key players operating in Johne's disease diagnostics market include Thermo Fisher Scientific, Inc., PBD Biotech, Zoetis, IDEXX Laboratories, IDVET, VMRD Inc., Biomeriux SA., INDICAL BIOSCIENCE GmbH, MV Diagnostics (Sure Farm Ltd), Tetracore, Inc

b. Key factors that are driving Johne's disease diagnostics market growth include the rising livestock population and Johne's disease eradication programs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."