- Home

- »

- Medical Devices

- »

-

Japan Sports Medicine Market Size & Share Report, 2030GVR Report cover

![Japan Sports Medicine Market Size, Share & Trends Report]()

Japan Sports Medicine Market Size, Share & Trends Analysis Report By Product (Body Reconstruction & Repair, Body Support & Recovery), By Application (Knees, Shoulders), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-380-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Japan Sports Medicine Market Size & Trends

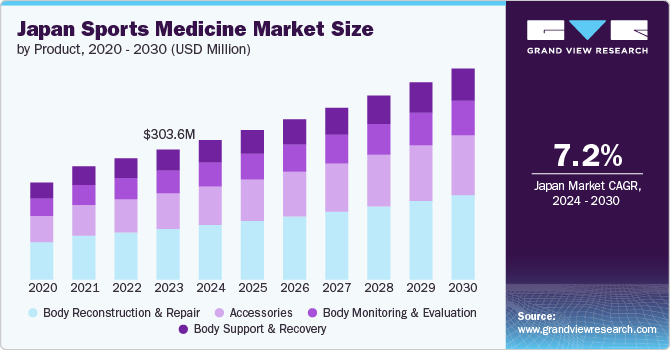

The Japan sports medicine market size was estimated at USD 303.6 million in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. There is a rising demand for sports medicine owing to the growing incidence of sports injuries and increasing participation in sports and fitness-related activities by individuals. Moreover, transitioning from proactive care to preventive care concerning sports injuries is further anticipated to propel the market. For instance, according to an article published by the International Journal of Sports Medicine in April 2022, the prevalence of sports injuries among college athletes was 59.7% in Japan.

The growing trend of pursuing sports careers is anticipated to be a significant driver of the market growth. As more individuals engage in professional sports, the demand for specialized medical care to prevent and treat sports-related injuries rises. For instance, according to a survey conducted by Saskawa Sports Foundation, 20.2% of people participated in physical and sports activities at least twice a week, with a duration of more than 30 minutes and with more than moderate intensity in 2022. In addition, 19.3% of people participated in physical and sports activities at least twice a week, with a duration of over 30 minutes.

Furthermore, growing career opportunities and a rising inclination toward fitness owing to rising health awareness have increased participation in sports activities, boosting the country's market growth. Following is the population that participated in various sports activities in percentage in 2022,

-

Strolling: 31.8%

-

Walking: 29.4%

-

Calisthenics and light exercises: 17.4%

-

Weight training: 16.4%

-

Jogging/Running: 8.9%

-

Fishing: 7.2%

-

Cycling: 7.0%

-

Golf on a course: 6.7%

-

Golf practice on a driving range: 6.1%

-

Bowling: 5.5%

Key companies are launching new products that fuel market growth. For instance, in September 2022, Smith+Nephew, a MedTech company, introduced the OR3O Dual Mobility System in Japan for revision and primary hip arthroplasty. It features a small-diameter femoral head that locks into a larger polyethylene insert, which offers an enhanced range of motion, lowers the risk of dislocation, and increases stability.

Moreover, increasing utilization of technologically advanced wearable devices such as fitness bands supports market growth. They enable real-time monitoring of stress loads, assisting in averting fatigue-induced injuries and ensuring athletes maintain peak performance levels. The market is undergoing a significant transformation, especially in rehabilitation. Thus, such advancements in technology lead rise in the adoption of such devices, which further drives the market growth.

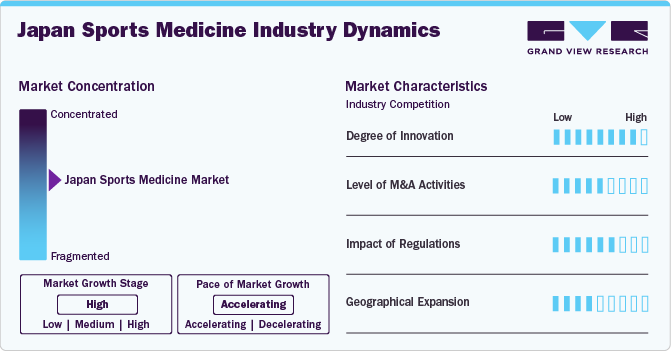

Market Concentration & Characteristics

The Japan sports medicine market is characterized by a high degree of innovation due to continuous development, significant innovation, and the introduction of new technologies. It has become a popular option as a minimally invasive procedure that provides lower pain and fatigue. Consequently, leading companies in the market are focusing on developing new technologies to strengthen their position in the market.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. These M&A facilitate access to expertise, complementary technologies, distribution channels, new product development, and capture a larger market share. For instance, in August 2022, CONMED Corporation entered into a def initive agreement to acquire privately held Biorez, Inc. (Biorez), a medical device company. Biorez and its BioBrace platform expanded CONMED Corporation's sports medicine portfolio for soft tissue healing.

Regulations play a crucial role in shaping the market, ensuring the safety, efficacy, and quality of sports medicine. In Japan, the Japanese Society of Physical Fitness and Sports Medicine (JSPFSM) aims to promote the progress and development of research relating to medical science for sports and physical fitness, cooperate with the spread of this research into the wider world, and also contribute to society through the application of research results. Moreover, the JSPFSM organized a public symposium entitled “Ethics and Laws Concerning Physical Fitness and Sports Medicine Research” in collaboration with the Subcommittee on Health and Sports Science and the Science Council of the Japan Committee on Health/Human Life Science .

Several companies are adopting this strategy to strengthen their position in the market and expand their manufacturing & distribution capacities. For instance, in April 2023, Smith+Nephew signed a distribution agreement with NAVBIT to market the NAVBIT SPRINT in Japan. It is used in primary hip arthroplasty.

Product Insights

By product, the body reconstruction & repair segment dominated the market in 2023 and accounted for the largest revenue share of 39.1%. The segment includes bone reconstruction devices, surgical equipment, and soft tissue repair equipment. Significant advancements in minimally invasive surgical techniques, increasing incidence of fragility fractures, and advanced orthopedic devices drive market growth. For instance, according to an article published by the National Center for Biotechnology Information (NCBI) in November 2023, the annual occurrence of hip fractures is approximately 193,400 in Japan, and the prevalence of osteoporosis is estimated to be 12.8 million in Japan.

The accessories segment is anticipated to witness the fastest CAGR over the forecast period. This segment is further divided into tapes, bandages, disinfectants, wraps, and other accessories, such as scissors, cutters, & blister packs. The segment growth can be attributed to the rising incidence of sports injuries and the growing need to prevent infections.

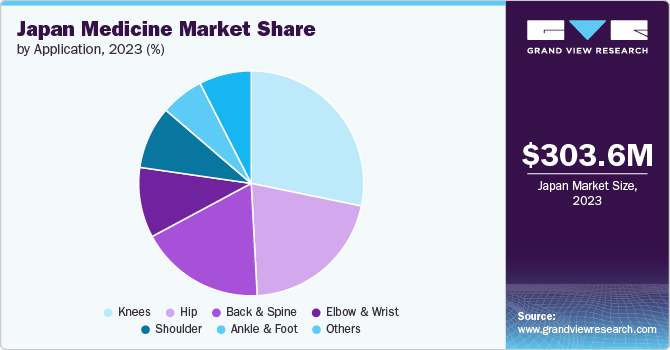

Application Insights

By application, the knees segment dominated the market in 2023 with a revenue share of 28.2% and is expected to experience the fastest CAGR over the forecast period. Knee injuries are quite common during sports or other physical activities. Excessive running and jumping lead to wear and tear of the knee joint. For instance, according to a survey conducted by Saskawa Sports Foundation, 28.3% of individuals participated in fitness-related activities such as walking, and 10.6% of individuals participated in jogging/running in 2020. Such participation leads to a rise in knee injury cases, further boosting segment growth.

The ankle & foot segment is anticipated to witness significant growth over the forecast period. The foot and ankle implants segment is anticipated to offer lucrative development opportunities due to the growing participation in sporting activities, the need for user-centric foot & ankle devices, rising demand for minimally invasive surgical procedures, increasing use of advanced technologies, such as Artificial Intelligence (AI) & robotics, and the rising prevalence of target diseases, such as osteoporosis.

Key Japan Sports Medicine Company Insights

Key participants in the market are focusing on developing innovative business growth strategies in the form of new product launches, mergers & acquisitions, partnerships & collaborations, and business footprint expansions.

Key Japan Sports Medicine Companies:

- Smith+Nephew

- Stryker

- Arthrex, Inc.

- Medtronic

- Cramer Products (Performance Health)

- Boston Scientific Corporation

- OMRON Healthcare, Inc.

- B. Braun SE

- CONMED Corporation

Recent Developments

-

In April 2024, OMRON Healthcare, Co., Ltd. acquired Luscii Healthtech, a remote consultation platform and digital health provider, to highlight the complex and rapidly changing demands of healthcare systems.

-

In October 2023,Smith+Nephew, a MedTech company, introduced its REGENETEN Bioinductive Implant in Tokyo at the 50 Annual Meeting of Japan Shoulder Society Meeting 2023. The company provided a healing option for patients with rotator cuff tears, from partial thickness tears to large (3-5cm) and massive (5cm+) full-thickness tears.

Japan Sports Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 325.5 million

Revenue forecast in 2030

USD 492.8 million

Growth Rate

CAGR of 7.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

Japan

Key companies profiled

Smith+Nephew; Stryker; Arthrex; Inc.; Medtronic; Cramer Products (Performance Health); Boston Scientific Corporation; OMRON Healthcare; Inc.; B. Braun SE; CONMED Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Sports Medicine Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Japan sports medicine market report based on product and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Body Reconstruction & Repair

-

Surgical Equipment

-

Soft Tissue Repair

-

Bone Reconstruction Devices

-

Body Support & Recovery

-

Braces and Other Support Devices

-

Compression Clothing

-

Hot & Cold Therapy

-

Body Monitoring & Evaluation

-

Cardiac

-

Respiratory

-

Hemodynamic

-

Musculoskeletal

-

Other monitoring devices

-

Accessories

-

Bandages

-

Tapes

-

Disinfectants

-

Wraps

-

Other accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Knees

-

Shoulders

-

Ankle & Foot

-

Back & Spine

-

Elbow & Wrist

-

Hips

-

Other applications

-

Frequently Asked Questions About This Report

b. The Japan sports medicine market size was estimated at USD 303.6 million in 2023 and is expected to reach USD 325.5 million in 2024.

b. The Japan sports medicine market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 492.8 million by 2030.

b. Body reconstruction & repair segment dominated the Japan sports medicine market in 2023 and accounted for the largest revenue share of 39.1%. Significant advancements in minimally invasive surgical techniques, increasing incidence of fragility fractures, and advanced orthopedic devices drive market growth

b. Some key players operating in the market include Smith+Nephew, Stryker, Arthrex, Inc., Medtronic, Cramer Products (Performance Health), Boston Scientific Corporation, OMRON Healthcare, Inc., B. Braun SE, CONMED Corporation

b. There is a rising demand for sports medicine owing to the growing incidence of sports injuries and increasing participation in sports and fitness-related activities by individuals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."