Japan Medical Device Cleaning Market Size, Share & Trends Analysis Report By Device Type (Non-Critical, Critical), By Technique (Cleaning, Disinfection), By EPA Classification, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-437-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

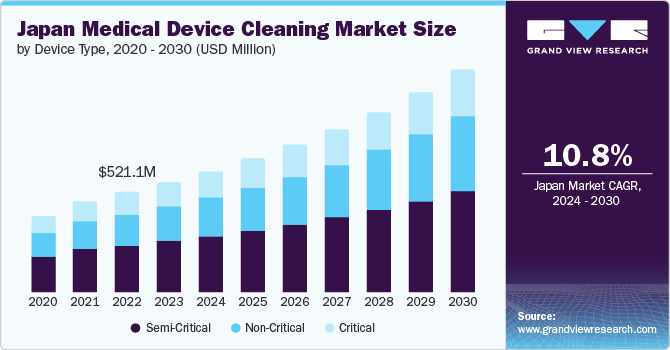

The Japan medical device cleaning marketsize was valued at USD 572.95 million in 2023 and is projected to grow at a CAGR of 10.83% from 2024 to 2030. The growth can be attributed to the increasing prevalence of chronic diseases and the rising prevalence of the geriatric population. According to a September 2023 article by the World Economic Forum, approximately 33% of the individuals living in Japan are over 65 years old, and more than 10% of the population in Japan are over 80 years old.

The rising prevalence of chronic disorders is anticipated to drive market growth in the coming years. Chronic diseases often need frequent hospitalizations and medical device use, which creates a demand for effective disinfection and cleaning procedures. According to a study published by the National Library of Medicine in December 2023, cancer prevalence in Japan is estimated to reach 3,665,900 cases, a 13.1% rise from 2020 to 2050.

Moreover, the rising occurrence of hospital-acquired infections (HAIs) and the increasing efforts to prevent them are anticipated to boost the need for medical device cleaning products in Japan. According to data published by the BMJ Publishing Group Ltd in May 2023, one in 14 hospital patients in Japan has active healthcare-acquired infections (HAIs).

In addition, the growing efforts to prevent the spread of hospital-acquired infections are anticipated to propel the demand for medical device cleaning products. Several studies are being published focusing on the prevention of HAIs. For instance, a John Wiley & Sons, Inc. study published in December 2022 proposed a technique to prevent surgical site infections (SSIs) in line with the current status of SSIs in thyroid surgery in Japan. The rising emphasis on preventing healthcare-acquired infections (HAIs) through such posted studies is expected to propel market growth in the coming years.

The growing focus on developing and manufacturing medical devices is expected to create lucrative opportunities for Japan's medical device cleaning industry. Many industry stakeholders are taking steps to promote the development of medical devices in the country. For instance, in April 2024, Kobe University, a Japan-based institution, revealed its plans to set up a Department of Medical Device Engineering in April 2025. The increasing number of medical device manufacturing and engineering facilities will need medical device cleaning solutions in the future for reprocessing, sterilization, and cleaning. Therefore, the expanding development of medical devices is anticipated to boost market growth over the forecast period.

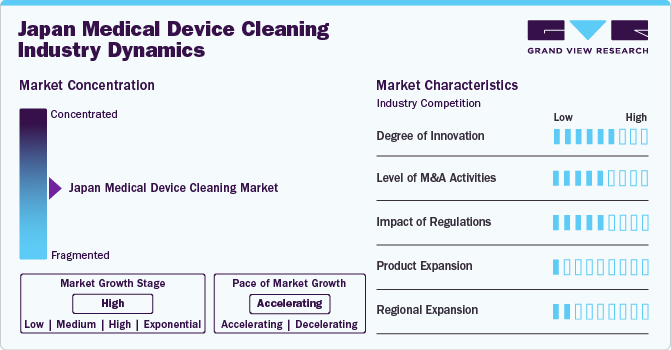

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is characterized by a high degree of growth owing to the increasing focus on introducing advanced materials and methods for reprocessing medical equipment and the rising prevalence of geriatric patients in the country.

Companies in the industry are focusing on technological advancements to innovate their product offerings and continuously improve their products. Manufacturers offer technologically advanced products to gain a competitive advantage. For instance, Getinge offers Getinge GSS67H, a steam sterilizer with advanced technology that reduces processing time by up to 30% and minimizes energy consumption and environmental impact. Such availability of products with advanced technologies from established companies is anticipated to drive innovation in the market in the coming years.

In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour, and Welfare (MHLW) set safety and quality standards for regulating medical devices, including medical device cleaning products. There is an increasing emphasis on regulating remanufactured single-use devices in Japan. In October 2023, PMDA, a regulatory authority, released a document emphasizing the cleaning, inspection, disassembly, and sterilization of previously used single-use medical devices for potential reuse.

Manufacturers in Japan medical device cleaning industry are launching new products or improving existing ones to meet changing customer needs and market demands. They are expanding their product range by advancing their products. For instance, ASP (Fortive Corporation) offers sterilization products such as STERRAD 100NX with ALLClear Technology, STERRAD 100S, and STERRAD NX with ALLClear Technology.

Industry players are acquiring other companies to strengthen their position in the market. For instance, in November 2023, HOYA Corporation, a Japan-based organization, acquired WASSENBURG Medical B.V., a manufacturer of endoscope reprocessing products. Such acquisitions are anticipated to propel market growth in the coming years.

The Japan market is consolidated due to the presence of established players such as ASP (Fortive Corporation), Getinge, Syntegon Technology GmbH, and Yoshida Pharmaceutical, among others. These companies compete based on price, product differentiation, and product quality. Manufacturers in the country offer various products, including cleaning, sterilization, and disinfection products.

Device Type Insights

The semi-critical segment dominated the market, accounting for 46.02% of the revenue in 2023 due to the increasing number of therapeutic and diagnostic procedures. Semi-critical devices include endoscopes that come in contact with mucous membranes but do not penetrate sterile tissue. These devices need high-level disinfection to control the transmission of infections. Moreover, the growing prevalence of HAIs is anticipated to support the segment growth over the forecast period.

The critical segment is expected to grow fastest, with the fastest CAGR during the forecast period due to the aging population and high infection control awareness. The Ministry of Internal Affairs and Communications reported that as of September 15, 2023, there were 36.2 million seniors aged 65 or over in Japan. Thus, Japan's growing number of older individuals is anticipated to drive the segment growth in the coming years.

Technique Insights

The disinfection segment dominated the market in 2023, accounting for 49.53% of the revenue share. The segment's growth can be attributed to the stringent regulations and standards that need to be followed for healthcare facilities. Furthermore, the growing demand for surgical procedures that require intricate and delicate medical instruments is anticipated to propel the demand for disinfection processes.

The sterilization segment is expected to grow fastest during the forecast period due to its vital role in ensuring the efficacy and safety of medical devices. The growing demand for high-quality, safe, and effective medical devices and advancements in sterilization technologies, such as low-temperature plasma sterilizers and improved steam sterilizers, are anticipated to support the segment's growth over the forecast period.

EPA Classification Insights

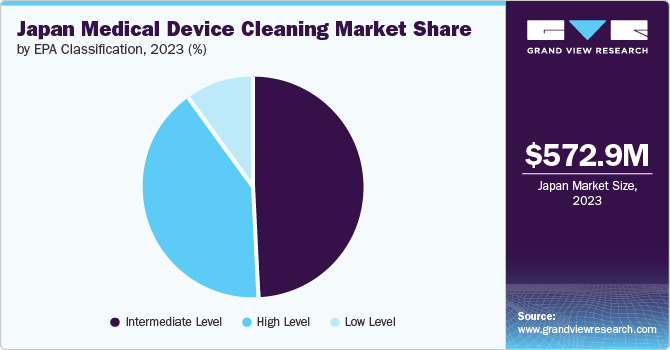

The intermediate-level segment dominated the market and accounted for the largest revenue share, at 48.84% in 2023. These disinfectants are easy to integrate into routine cleaning protocols and provide the necessary level of microbial control, making them the preferred choice. In addition, they are cost-effective. Thus, the cost-effectiveness and ease of use associated with these disinfectants are anticipated to propel the segment's growth in the coming years.

The high-level segment is expected to grow with the fastest CAGR during the forecast period. The segment growth can be attributed to the rising focus on infection control, patient safety, and regulatory compliance in healthcare facilities. Moreover, the rising awareness of hospital-acquired infections (HAIs) and their impact on patient outcomes is anticipated to propel the segment growth over the forecast period.

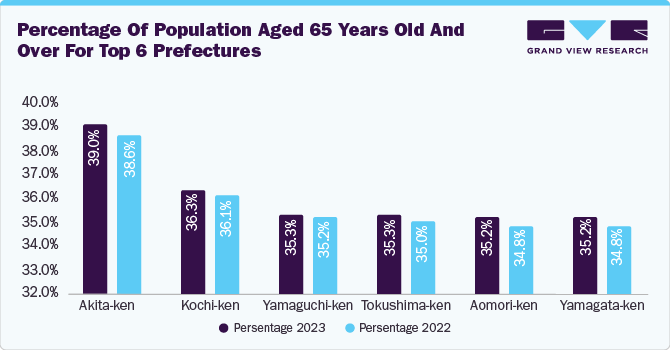

Growing Aging Population

The graph shows the increasing elderly population in different prefectures throughout Japan. The highest percentage of individuals aged 65 and above was found in Akita-ken, while the lowest was in Tokyo-to. This age group witnessed an increase in 44 prefectures. As of October 2023, around 29.1% of Japan's population was aged 65 and over, representing approximately 36,227 thousand individuals. In addition, the European Parliament projects that by 2036, approximately 33.33% of Japan's population will be 65 years and older. The older population is more susceptible to chronic diseases that can lead to increased hospitalizations. As a result, the increasing burden of the older population and the rising number of hospitalizations are anticipated to boost the demand for medical device cleaning products in the coming years.

Key Japan Medical Device Cleaning Company Insights

ASP (Fortive Corporation), Getinge, Syntegon Technology GmbH, Udono Limited, Yoshida Pharmaceutical, AMTEC CO., LTD., and Clean Chemical Co., Ltd. are some of the major players in the market. The industry players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the Japanese market.

Key Japan Medical Device Cleaning Companies:

- ASP (Fortive Corporation)

- Getinge

- Syntegon Technology GmbH

- Udono Limited

- Yoshida Pharmaceutical

- AMTEC CO., LTD.

- Clean Chemical Co., Ltd.

Recent Developments

-

In July 2024, Getinge collaborated with Medical Bear to incorporate Getinge's T-DOC sterile supply management solution into Medical Bear's operations. With this integration, the company adopted the digitalization of sterile supply flows, which highlights the increasing focus of companies on digitalizing sterile workflows.

-

In July 2024, Innovative Health, Inc. partnered with MC Healthcare to develop a single-use medical device reprocessing program in Japan.

Japan Medical Device Cleaning Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 631.05 million |

|

Revenue forecast in 2030 |

USD 1,169.49 million |

|

Growth rate |

CAGR of 10.83% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis |

|

Segments covered |

Device type, technique, EPA classification |

|

Country Scope |

Japan |

|

Key companies profiled |

ASP (Fortive Corporation), Getinge, Syntegon Technology GmbH, Udono Limited, Yoshida Pharmaceutical, AMTEC CO., LTD., Clean Chemical Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Japan Medical Device Cleaning Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan medical device cleaning market report based on device type, technique, and EPA classification:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Critical

-

Semi-Critical

-

Critical

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Cleaning

-

Detergents

-

Buffers

-

Chelators

-

Enzymes

-

Others

-

-

Disinfection

-

Chemical

-

Alcohol

-

Chlorine & Chorine Compounds

-

Aldehydes

-

Others

-

-

Metal

-

Ultraviolet

-

Others

-

-

Sterilization

-

Heat Sterilization

-

Ethylene Dioxide (ETO) Sterilization

-

Radiation Sterilization

-

-

-

EPA Classification Outlook (Revenue, USD Million, 2018 - 2030)

-

High Level

-

Intermediate Level

-

Low Level

-

Frequently Asked Questions About This Report

b. The Japan medical device cleaning market size was estimated at USD 572.95 million in 2023 and is expected to reach USD 631.05 million in 2024.

b. The Japan medical device cleaning market is expected to grow at a compound annual growth rate of 10.83% from 2024 to 2030 to reach USD 1,169.49 million by 2030.

b. The disinfection segment held the largest revenue share of 49.53% in the market in 2023 due to the stringent regulations and standards that healthcare facilities need to follow.

b. Some key market players operating in the Japan medical device cleaning market include ASP (Fortive Corporation), Getinge, Syntegon Technology GmbH, Udono Limited, Yoshida Pharmaceutical, AMTEC CO., LTD., and Clean Chemical Co., Ltd.

b. The growth of the Japan medical device cleaning market can be attributed to the increasing prevalence of chronic diseases, the growing focus on preventing hospital-acquired infections, and the rising prevalence of the older population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."