Japan Inbound Wholesale Roaming Market Size, Share & Trends Analysis Report By Services (Data, SMS, Voice, And IoT), By Type (Pre-paid And Post-paid), By Application, By Inbound Countries, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-327-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

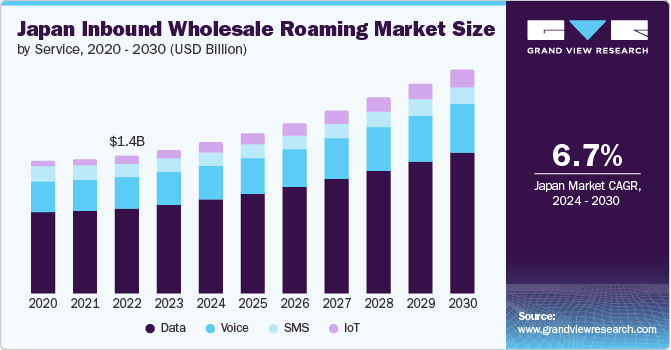

The Japan inbound wholesale roaming market size was estimated at USD 1.51 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. The rapid adoption of advanced technologies, such as 5G, significantly enhances mobile connectivity quality and speed, making roaming services more reliable and attractive. Japan's status as a major global travel destination contributes to a high demand for seamless international roaming services, accommodating millions of inbound tourists and business travelers annually. Strategic partnerships and agreements between Japanese mobile network operators and international carriers facilitate robust roaming infrastructure and interoperability. A solid regulatory framework and government initiatives support technological innovation and market competitiveness, further bolstering the growth of the inbound wholesale roaming market in Japan.

This surge in international visitors necessitates reliable and high-quality roaming services, driving the demand for advanced mobile connectivity. Service providers increasingly offer diverse roaming services tailored to meet varying customer requirements. For instance, in March 2023, Rakuten Mobile, Inc. launched Inbound Roaming Service, a new international mobile roaming service for tourists visiting Japan. This mobile service allows tourists with existing mobile contracts from international roaming partners to access Rakuten Mobile's nationwide 5G and 4G voice and data services while in Japan.

Rising advancements in Low Power Wide Area Networks (LPWAN) technology for IoT applications further enhance the roaming market's potential. LPWANs provide extended range, minimized power consumption, and efficient data transmission, making them ideal for M2M communication and remote asset monitoring, even in areas with limited conventional network coverage. These trends pave the way for innovative business models within the roaming market. MNOs can form strategic partnerships with IoT solutions to deliver comprehensive connectivity solutions, including device management, data analytics, and secure roaming services.

The increasing prevalence of smartphones and data-driven applications has led to substantial demand for data roaming services. Mobile operators are responding by offering cost-effective data roaming options, driving the growth of the wholesale roaming market in Japan. This growth is further supported by the expansion of 5G networks, which enhance data speeds and connectivity, and strategic partnerships that ensure seamless service for international travelers. Regulatory support promoting fair competition and infrastructure sharing also plays a crucial role in the market expansion.

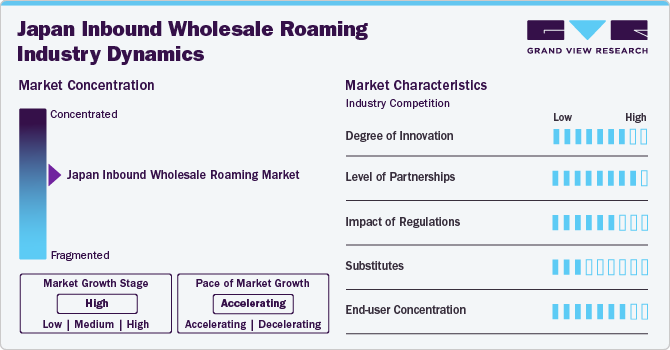

Industry Dynamics

Japan has consistently positioned itself as a global leader in technological innovation, impacting various sectors including telecommunications. Technologies such as network slicing and virtualization enable mobile network operators to create virtual networks on their existing infrastructure. This approach allows for the dedication of specific network slices to roaming traffic, ensuring improved quality of service and more efficient resource allocation for roaming users.

There is a significant rise in initiatives such as partnerships among market players to integrate the latest technologies into their respective Japan inbound wholesale roaming market to enhance their service offerings and capabilities. For instance, in April 2024, Rakuten Mobile, Inc. and RADCOM LTD. renewed their multi-year partnership. The renewed partnership envisaged RADCOM LTD. continuing to provide Rakuten Mobile, Inc. with its existing solution offerings, including advanced Artificial Intelligence (AI)- powered analytics, such as automated root cause analysis and anomaly detection, for proactive identification and prevention of service degradations, allowing Rakuten Mobile, Inc. to maintain high quality of service, enhance network operations efficiency, and monitor network automation effectively.

With increasing concerns about cybersecurity and data privacy, regulators impose stricter requirements on MNOs to protect users' personal information and ensure secure communication channels, especially for roaming services.

The threat of substitutes in the Japan wholesale roaming market is low. Roaming services are essential for providing mobile connectivity to customers when they travel internationally, and there are few viable alternatives to traditional roaming agreements. While technologies such as Wi-Fi calling and local SIM cards may offer partial substitutes, they cannot fully replicate the coverage and convenience of roaming services.

Buyers demand high-quality roaming services to ensure a seamless experience for their subscribers. They look for reliable network coverage, fast data speeds, and minimal disruptions while roaming in Japan and abroad. Further, buyers seek customized roaming packages tailored to the specific needs of their subscriber base. This may include options for data-only roaming, voice and text bundles, or special rates for frequent travelers.

Service Insights

The data segment accounted for the largest market share of over 62% in 2023. The segment is growing in the Japan inbound wholesale roaming market due to the increasing demand for mobile data services among international travelers and businesses. Japan's unique culture, technology, and infrastructure make it a popular destination for tourists and business travelers, who rely heavily on their mobile devices to stay connected. As a result, mobile operators are offering an increasing number of high-quality data service plans to cater to the growing demand.

The IoT segment is expected to register a CAGR of 10.6% from 2024 to 2030. The growing deployment of Low-Power Wide-Area (LPWA) and 5G technologies is significantly driving the usage of interconnected and eSIM-enabled consumer IoT gadgets, including NarrowBand-Internet of Things (NB-IoT)-enabled door locks, smoke alarms, intelligent home appliances, 4G connected cameras, multilingual translators, and 5G FWA CPEs. IoT devices are being more frequently outfitted with eSIM technology to ease the activation of a broad selection of isolated devices. eSIM technology enables the automation of the process in a safe and streamlined manner. The marked rise in the adoption of eSIMs is fueling the expansion of the IoT segment in the Japan wholesale roaming market by assuring dependable and effective global device activation and usage.

Roaming Type Insights

The pre-paid segment accounted for the largest market share of over 62% in 2023 in the Japan inbound wholesale roaming market. The growth of the pre-paid roaming segment can be attributed to factors such as the increasing number of tourists visiting Japan, who prefer the convenience and cost control that pre-paid roaming offers. With Japan being a popular destination, especially for travelers from neighboring Asian countries, the demand for accessible and affordable communication options has surged. Pre-paid roaming provides a straightforward solution, allowing tourists to avoid unexpected charges and manage their expenses more effectively, thus driving its popularity and growth in the market.

The post-paid segment is expected to register a CAGR of 7.0% from 2024 to 2030. Japan is one of the major hubs for business travel. Post-paid plans provide a more convenient and cost-effective solution for business travelers, allowing them to stay connected with colleagues and clients while on the road. Japanese mobile operators are capitalizing on this trend by offering post-paid plans catering to business travelers' specific needs.

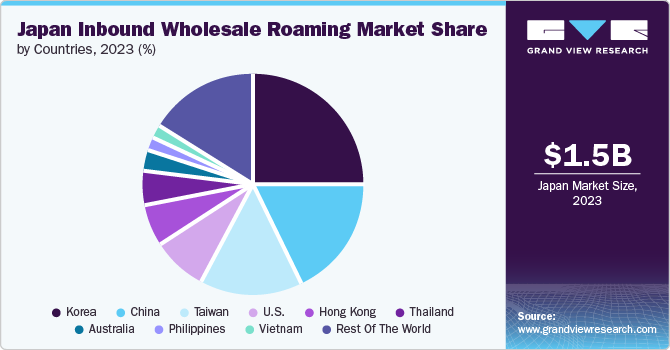

Inbound Countries Insights

The South Korea accounted for the largest market share of over 25% in 2023 in the Japan inbound wholesale roaming market. South Korea is poised for significant growth and would contribute noticeably to the growth of the Japan wholesale roaming market, driven by the tech-savvy nature of South Korean tourists. As South Koreans continue to embrace the latest advances in mobile technology, they are expected to demand seamless connectivity, even when abroad, to enhance their travel experience, thereby fueling the growth of the wholesale roaming market between South Korea and Japan. The increasing number of South Korean tourists traveling to Japan is particularly amplifying this trend. With a tech-savvy population that prioritizes connectivity, the usage of roaming services is expected to rise, leading to higher revenues for Japanese mobile operators.

The China is expected to register the fastest CAGR of 8.8% from 2024 to 2030. In China, the expanding economy, the growing population, and the rapidly increasing middle class are significantly influencing the growth of various industries, including international travel. As the levels of disposable income are rising in China, more Chinese citizens are traveling abroad to explore international destinations, with Japan emerging as a popular destination. Apart from bolstering Japan's tourism industry, the influx of Chinese tourists visiting Japan is encouraging Japanese mobile operators to capitalize on this trend by offering tailored roaming packages to cater to the needs of Chinese visitors.

Application Insights

The MNO telco roaming segment accounted for the largest market share of over 55% in 2023 in the Japan inbound wholesale roaming market. Strategic partnerships and collaborations between Japanese Mobile Network Operators (MNOs) and international carriers play a crucial role in driving the growth of the segment. By establishing robust agreements with global operators, Japanese MNOs can ensure better coverage and service quality for inbound roamers. These partnerships often include negotiated rates and enhanced technical cooperation, which help reduce costs and improve service delivery. Therefore, more international travelers choose roaming services provided by Japanese MNOs, further fueling market growth.

The mobile router usage roaming segment is expected to register a CAGR of 9.8% from 2024 to 2030. The mobile router usage roaming segment benefits from the increasing demand for reliable internet connectivity among international travelers. Mobile routers offer a convenient solution for tourists, business travelers, and expatriates who require continuous internet access without relying on local SIM cards or public Wi-Fi networks. This surge in demand is driven by the need for seamless communication, access to online services, and the convenience of connecting multiple devices simultaneously.

Key Japan Inbound Wholesale Roaming Company Insights

Some of the key players operating in the market include NTT DOCOMO and SoftBank Corp. among others.

-

NTT DOCOMO provides comprehensive service offerings, including voice, text, and data roaming, underpinned by its early adoption of 5G technology, which provides higher speeds and lower latency. NTT Docomo's strategic partnerships with international mobile operators and technology providers ensure seamless roaming services for both inbound and outbound travelers.

-

SoftBank Corp.’s extensive investment in advanced technologies, including 5G, ensures high-speed and reliable connectivity for its roaming services. SoftBank's comprehensive range of services and innovative solutions, such as VoLTE and IoT connectivity, cater to consumer and enterprise needs.

Sakura Mobile andInbound Platform Corp. are some of the emerging market participants in the Japan inbound wholesale roaming market.

-

Sakura Mobile is an emerging company in the inbound wholesale roaming market, excels through its advanced technology and extensive partnerships with major carriers, ensuring reliable and high-speed connectivity. Their market strategy focuses on flexible, cost-effective roaming packages for tourists, business visitors, and expatriates. By continuously innovating and adapting to market trends, Sakura Mobile secures a significant market share, offering superior service and value to its customers.

-

Inbound Platform Corp. excels with its advanced network infrastructure, strong regulatory compliance, and customer-centric approach. The company leverages partnerships with global carriers to ensure seamless connectivity for travelers. Its market strategy focuses on innovative roaming solutions, competitive pricing, and continuous technological advancements to enhance user experience and maintain industry leadership.

Key Japan Inbound Wholesale Roaming Companies:

- NTT DOCOMO

- SoftBank Corp.

- KDDI CORPORATION

- Rakuten Mobile, Inc. (Rakuten Group, Inc.)

- Internet Initiative Japan Inc.

- Sakura Mobile

- Asahi Net, Inc.

- Sony Network Communications Inc. (So-net)

- WirelessGate Inc.

- Inbound Platform Corp.

Recent Developments

-

In March 2023, Rakuten Mobile, Inc. launched Inbound Roaming Service, a new international mobile roaming service for tourists visiting Japan. The new mobile service was designed to allow tourists with existing mobile contracts from international roaming partners to access the company’s nationwide 4G and 5G voice and data services during their stay in Japan. The service was initially launched with 3 Hong Kong, the company’s first international roaming partner, at a time when Japan's borders were opening up more to international travel. Plans for the near future envisaged the company gradually expanding the roster of its international roaming partners.

-

In September 2023, NTT DOCOMO and LIVE BOARD, INC., an operator of a Digital Out-Of-Home (DOOH) advertising network that emphasizes data-driven targeting and effectiveness verification, collaborated to allow LIVE BOARD, INC. to successfully utilize NTT DOCOMO's carrier roaming data (roaming ID data) to analyze the location information of inbound tourists, identifying signs of a recovery in foreign travelers visiting Japan. Apart from the existing criteria for Out-Of-Home (OOH) media planning, such as circulation data and the reputation of the area, LIVE BOARD, INC. integrated this analytical data into DOOH media planning to help advertisers with more sophisticated and efficient advertisement delivery.

-

In May 2023, KDDI CORPORATION, Rakuten Mobile, Inc., and Okinawa Cellular Telephone Company announced a new roaming agreement. To foster fair competition among mobile network operators in Japan, KDDI CORPORATION committed to providing roaming services via its au network to Rakuten Mobile, Inc. from the launch of 4G mobile communication services until the end of March 2026.

Japan Inbound Wholesale Roaming Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.59 billion |

|

Market Value forecast in 2030 |

USD 2.35 billion |

|

Growth rate |

CAGR of 6.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Market Value in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Market Value forecast, company Share, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, roaming type, application, inbound country |

|

Key companies profiled |

NTT DOCOMO; SoftBank Corp.; KDDI CORPORATION. Rakuten Mobile, Inc. (Rakuten Group, Inc.); Internet Initiative Japan Inc.; Sakura Mobile; Asahi Net, Inc.; Sony Network Communications Inc. (So-net); WirelessGate Inc.; Inbound Platform Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Japan Inbound Wholesale Roaming Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the Japan inbound wholesale roaming market report based on service, roaming type, application, and inbound countries:

-

Japan Inbound Wholesale Roaming Service Outlook (Revenue; USD Million, 2018 - 2030)

-

Data

-

SMS

-

Voice

-

IoT

-

-

Japan Inbound Wholesale Roaming Type Outlook (Revenue; USD Million, 2018 - 2030)

-

Pre-paid

-

Post-paid

-

-

Japan Inbound Wholesale Roaming Application Outlook (Revenue, USD Million, 2018 - 2030)

-

MNO Telco Roaming

-

Travel SIM Roaming

-

Mobile Router Usage Roaming

-

-

Japan Inbound Wholesale Roaming Inbound Countries Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

China

-

Korea

-

Taiwan

-

Hong Kong

-

Thailand

-

Australia

-

Philippines

-

Malaysia

-

Vietnam

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The Japan inbound wholesale roaming market size was estimated at USD 1.51 billion in 2023 and is expected to reach USD 1.59 billion in 2024.

b. The Japan inbound wholesale roaming market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 2.35 billion by 2030.

b. The data segment accounted for the largest market share of over 62% in 2023. The segment is growing in the Japan inbound wholesale roaming market due to the increasing demand for mobile data services among international travelers and businesses. Japan's unique culture, technology, and infrastructure make it a popular destination for tourists and business travelers, who rely heavily on their mobile devices to stay connected.

b. Some key players operating in the Japan inbound wholesale roaming market include NTT DOCOMO; SoftBank Corp.; KDDI CORPORATION. Rakuten Mobile, Inc. (Rakuten Group, Inc.); Internet Initiative Japan Inc.; Sakura Mobile; Asahi Net, Inc.; Sony Network Communications Inc. (So-net); WirelessGate Inc.; Inbound Platform Corp.

b. The rapid adoption of advanced technologies, such as 5G, significantly enhances mobile connectivity quality and speed, making roaming services more reliable and attractive. Japan's status as a major global travel destination contributes to a high demand for seamless international roaming services, accommodating millions of inbound tourists and business travelers annually.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."