Japan Cyber Security Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Security Type, By Solution Type, By Deployment, By Organization Size, By End-use, By Approach, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-546-5

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2017 -2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Japan Cyber Security Market Size & Trends

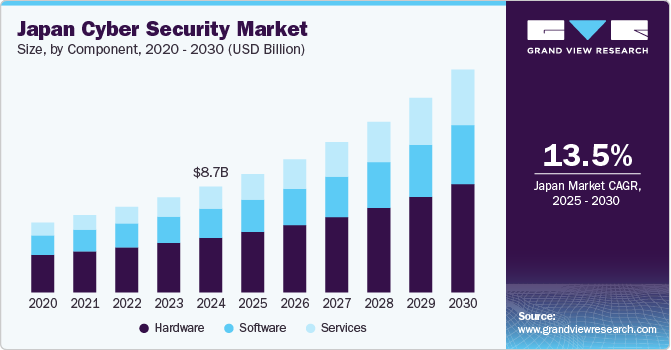

The Japan cyber security market size was estimated at USD 8.65 billion in 2024 and is projected to grow at a CAGR of 13.5% from 2025 to 2030. Government initiatives and regulatory frameworks are playing an important role in shaping the market, with policies aimed at enhancing digital infrastructure and cybersecurity capabilities. Cyber threats, such as state-sponsored attacks and ransomware, are becoming more severe, increasing awareness and investment in robust security measures across industries. In addition, Japan's rapid digital transformation has increased the demand for advanced cybersecurity solutions to protect critical sectors such as finance, healthcare, and energy.

Moreover, technological advancements are significantly influencing market growth. Adopting AI-driven security analysis and machine learning algorithms is becoming more prevalent, enabling more effective threat detection and response. Cloud computing and IoT integration drive demand for endpoint protection innovations, critical for securing diverse endpoints against evolving threats. Furthermore, the growth of mobile banking and digital payment platforms in the BFSI sector has expanded the attack surface for cyber threats, necessitating advanced cybersecurity solutions to protect against fraud and data breaches.

Furthermore, economic and regulatory factors are crucial in driving market growth. The Japanese government's economic stimulus package and increased defense spending underscore cybersecurity as a national priority. For instance, in February 2025, the Japanese Cabinet approved two bills to strengthen the nation's cybersecurity capabilities. These bills empower the Self-Defense Forces (SDF) and the police to enhance Japan's cyber defense mechanisms. This focus on enhancing digital infrastructure and cybersecurity capabilities is essential for safeguarding critical sectors against sophisticated cyber threats. The government's cloud-first policy has further accelerated the demand for network security solutions, as many end users leverage virtual environments. These initiatives, combined with the growing demand for cybersecurity professionals, position the market for significant expansion over the coming years.

Component Insights

The hardware segment led the market in 2024, accounting for over 50% of global revenue. The growth is driven by rising cyber threats targeting critical infrastructure, financial institutions, and government entities. Organizations invest heavily in firewalls, intrusion detection systems, and encrypted storage to enhance security measures. The Japanese government's stringent regulations, including the Cybersecurity Basic Act, mandate enterprises to strengthen their cybersecurity, fueling demand for advanced hardware solutions. Moreover, increasing cyberattacks have prompted businesses to implement zero-trust security frameworks, requiring hardware-based authentication and access control systems.

The services segment is expected to grow at the highest CAGR over the forecast period. The growth is driven by the increasing complexity of cyber threats, prompting organizations to seek Managed Security Services (MSS), incident response, and consulting solutions. With the rapid adoption of cloud computing, IoT, and digital transformation, businesses require continuous monitoring and threat intelligence to safeguard assets. In addition, the shortage of skilled cybersecurity professionals has led enterprises to outsource security operations to Managed Service Providers (MSPs) and Security Operations Centers (SOCs).

Security Type Insights

The infrastructure protection segment dominated the market with the highest revenue share in 2024. The increasing digitalization of infrastructure, including energy, transportation, and telecommunications, has made these sectors prime targets for cyber threats. Government initiatives, such as Japan’s Cybersecurity Strategy 2025, emphasize strengthening security frameworks for essential services. With the expansion of smart grids, automated rail systems, and industrial IoT, organizations are deploying Intrusion Detection Systems (IDS), network segmentation, and real-time monitoring to prevent cyber disruptions. The growing sophistication of state-sponsored cyberattacks has also heightened the need for threat intelligence and incident response mechanisms.

The artificial intelligence model/machine learning model security segment is anticipated to grow at the highest CAGR over the forecast period. As AI adoption accelerates across industries such as finance, healthcare, and manufacturing, securing AI and ML models from adversarial attacks, data poisoning, and model theft has become a foremost priority. The increasing use of AI-driven automation in cybersecurity, fraud detection, and predictive analytics has raised concerns about data integrity and algorithm manipulation. Japan’s government and regulatory bodies are also tightening compliance frameworks to ensure responsible AI deployment, pushing organizations to invest in secure AI development and monitoring.

Solution Type Insights

The Identity and Access Management (IAM) segment dominated the market with the highest revenue share in 2024. With the rise of digital transformation initiatives across industries, organizations implement advanced IAM solutions to ensure secure user authentication and access control. The financial sector, government agencies, and healthcare institutions are at the forefront of adopting Multi-Factor Authentication (MFA), Single Sign-On (SSO), and biometric verification to enhance identity security. Furthermore, Japan’s efforts to strengthen critical infrastructure cybersecurity have led to increased adoption of Privileged Access Management (PAM) solutions, reducing the risk of insider threats and unauthorized access to sensitive systems. As hybrid work models and cloud computing gain traction, enterprises integrate cloud-based IAM platforms to streamline identity governance across multiple applications and networks.

The risk and compliance management segment is anticipated to grow at a significant CAGR over the forecast period. Stringent data protection regulations and evolving cybersecurity laws are compelling organizations to enhance their compliance frameworks. Financial institutions, healthcare providers, and infrastructure operators are adopting Governance, Risk, And Compliance (GRC) solutions to meet industry standards such as FISC security guidelines and Japan’s Cybersecurity Strategy. The increasing reliance on third-party vendors and cloud services has further elevated compliance risks, driving demand for continuous risk assessment and automated compliance monitoring tools.

Organization Size Insights

The large enterprises segment dominated the market with the highest revenue share in 2024. The increasing adoption of cloud computing, IoT, and remote work solutions has introduced new security challenges, prompting large enterprises to enhance their cybersecurity strategies. These organizations face rising risks from ransomware, data breaches, and Advanced Persistent Threats (APTs), leading to investments in next-generation firewalls, AI-powered threat intelligence, and endpoint protection. The growing complexity of hybrid cloud environments also necessitates real-time monitoring and advanced incident response capabilities.

Small and Medium Enterprises (SMEs) is expected to grow at the highest CAGR over the forecast period. Cybersecurity investments among SMEs are rising due to the increasing frequency of cyberattacks targeting businesses with limited security resources. Many SMEs lack in-house cybersecurity teams, making them vulnerable to ransomware, phishing attacks, and data breaches. To address these challenges, SMEs are turning to cost-effective cloud-based security solutions, managed security services, and endpoint protection. The growing reliance on digital tools, e-commerce platforms, and remote work environments has expanded its attack surface, driving the demand for scalable cloud security solutions.

End Use Insights

The BFSI segment dominated the market with the highest revenue share in 2024. With the increasing adoption of digital banking, mobile payments, and fintech services, financial institutions are highly vulnerable to cyber threats such as phishing, ransomware, and account takeovers. The demand for multi-layered security frameworks, AI-powered fraud detection, and biometric authentication is rising to combat evolving cyber risks. Moreover, financial institutions invest in real-time transaction monitoring and endpoint security solutions to protect sensitive customer data and ensure regulatory compliance.

The automotive segment is expected to grow at a significant CAGR over the forecast period. The increasing adoption of connected vehicles, autonomous driving technologies, and IoT-enabled automotive systems has significantly elevated cybersecurity risks in the industry. Cyber threats such as hacking of vehicle control systems, data breaches, and ransomware attacks pose major concerns for automakers. To address these risks, automotive manufacturers invest in intrusion detection and prevention systems (IDPS), secure over-the-air (OTA) updates, and blockchain-based security frameworks to enhance vehicle cybersecurity. In addition, regulatory mandates, such as UNECE WP.29 cybersecurity requirements, are pushing automakers to integrate stringent security measures across vehicle production and software development processes.

Approach Insights

The traditional cyber defense/reactive cyber security segment dominated the market with the highest revenue share in 2024. Many organizations continue to rely on reactive cybersecurity measures to detect and respond to threats after they occur. This approach includes firewalls, antivirus software, and intrusion detection systems, which remain widely used due to their established effectiveness and cost efficiency. Industries with legacy IT infrastructures, such as government and manufacturing, often depend on traditional cybersecurity solutions to maintain security compliance.

The active cyber defense/proactive cyber security segment is expected to grow at the highest CAGR over the forecast period. This rapid expansion is driven by the increasing need for real-time threat detection, automated response systems, and predictive analytics to prevent cyberattacks before they occur. With the rise in cyber threats, businesses prioritize security investments that minimize attack surfaces and enhance resilience. Government regulations and compliance requirements further accelerate the adoption of proactive cybersecurity solutions.

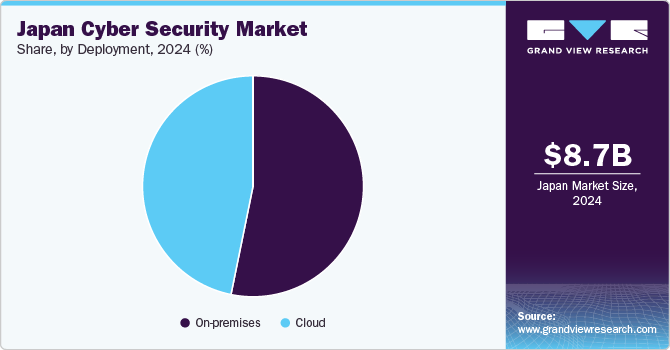

Deployment Insights

The on-premises segment dominated the market with the highest revenue share in 2024. Data control, regulatory compliance, and data sovereignty concerns drive the demand for on-premises security solutions. Industries such as finance, healthcare, and government prioritize on-premises deployments to meet strict security standards and reduce dependency on third-party cloud providers. Customizing security infrastructure and mitigating cloud vulnerabilities further support this preference. Technological advancements in on-premises security, including next-generation firewalls, Intrusion Detection Systems (IDS), and AI-driven threat intelligence, improve threat detection and response. The integration of automation and machine learning enhances real-time monitoring and risk mitigation.

The cloud segment is expected to grow at the highest CAGR over the forecast period. The increasing reliance on cloud infrastructure and services across industries drives the need for robust security measures. As Japanese enterprises migrate their operations to multi-cloud and hybrid cloud environments, ensuring data protection, compliance, and threat mitigation. The rise in cyber threats such as ransomware attacks, unauthorized access, and data breaches has pushed organizations to invest in advanced cloud security solutions such as cloud workload protection, encryption, and Identity and Access Management (IAM).

Key Japan Cyber Security Company Insights

Some key companies in the Japan cyber security industry are Akamai Technologies, Cybertrust Japan Co., Ltd., FFRI Security, Inc., and NEC Corporation.

-

Akamai Technologies plays a significant role in the Japan cybersecurity market by providing advanced cloud security solutions. For instance, their partnership with Macnica Solutions enhances security and cloud computing services for Japanese businesses expanding globally. Akamai's technologies, such as Guardicore Segmentation, are used by organizations such as the Daiwa Institute of Research to improve network visibility and access control, reducing internal attack surfaces. This integration helps Japanese companies strengthen their cybersecurity posture both locally and internationally.

-

NEC Corporation offers comprehensive security solutions to protect against digital disruptions in the Japan cybersecurity market. The company collaborates with domestic and international organizations to enhance cybersecurity capabilities and develop skilled security professionals. NEC's expertise includes setting up firewalls and intrusion detection systems, and they operate over 200 Security Operations Centers (SOCs) globally. Their "Cyber Security Factory" initiative analyzes evolving cyber threats and develops new defense solutions, contributing to the development of robust cybersecurity measures.

Key Japan Cyber Security Companies:

The following are the leading companies in the Japan cyber security market. These companies collectively hold the largest market share and dictate industry trends.

- Acalvio Technologies, Inc.

- Akamai Technologies

- Allure Security Technology

- Appier Inc.

- Netpoleon Group

- BBS Technology (BBSEC)

- CDNetworks Inc.

- Cequence Security, Inc.

- Cisco Systems, Inc.

- Cyber Security Cloud, Inc.

- CyberTrap

- Cybertrust Japan Co., Ltd.

- Dell Inc.

- F5 Inc.

- FFRI Security, Inc.

Recent Development

-

In February 2025, Rapid7 launched the PACT Partner Program to equip partners with tools, training, and resources for addressing cybersecurity challenges. This initiative introduces a modernized Partner Portal, specialized engagement programs, and a new Partner Training Academy to enhance collaboration and support growth.

-

In February 2025, Check Point Software Technologies Ltd. announced six AI-powered innovations for its Infinity Platform to enhance security management, strengthen threat prevention, and simplify operations. These updates introduce automated policy insights, identity management, security orchestration, and AI-driven monitoring to improve zero trust and threat response.

-

In August 2024, IBM Corporation released a generative AI-powered Cybersecurity Assistant for its Threat Detection and Response Services, built on the watsonx platform, to help security analysts accelerate threat investigation and response. Developed in collaboration with IBM Research, this assistant enhances automation, historical correlation analysis, and real-time insights, improving efficiency and security operations for clients.

Japan Cyber Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9.68 billion |

|

Revenue forecast in 2030 |

USD 18.24 billion |

|

Growth rate |

CAGR of 13.5% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, security type, solution type, deployment, organization size, end use, approach |

|

Key companies profiled

|

Acalvio Technologies, Inc.; Akamai Technologies; Allure Security Technology; Appier Inc.; Netpoleon Group; BBS Technology (BBSEC); CDNetworks Inc.; Cequence Security, Inc.; Cisco Systems, Inc.; Cyber Security Cloud, Inc., CyberTrap, Cybertrust Japan Co., Ltd., Dell Inc., F5 Inc., FFRI Security, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Japan Cyber Security Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Japan cyber security market report based on component, security type, solution type, deployment, organization size, and approach:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

Professional Services

-

Consulting

-

Governance, Risk, and Compliance (GRC)

-

Incident Response and Readiness

-

Implementation and Integration

-

Training & Education

-

Others

-

-

Managed Services

-

Managed Detection and Response

-

Managed Protection and Controls

-

Managed Security Functions

-

Others

-

-

-

-

Security Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Endpoint security

-

Cloud Security

-

Network Security

-

Application Security

-

Infrastructure Protection

-

Data Security

-

Artificial Intelligence Model/Machine Learning Model Security

-

Hardware Security

-

Others

-

-

Solution Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Unified Threat Management (UTM)

-

Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

-

Data Loss Prevention (DLP)

-

Identity and Access Management (IAM)

-

Security Information and Event Management (SIEM) & Security Orchestration, Automation & Response (SOAR)

-

DDoS

-

Risk and Compliance Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

IT and Telecommunications

-

Retail and E-Commerce

-

BFSI

-

Healthcare

-

Government and Defense

-

Manufacturing

-

Energy and Utilities

-

Automotive

-

Marine

-

Transportation and Logistics

-

Others

-

-

Approach Outlook (Revenue, USD Million, 2017 - 2030)

-

Traditional Cyber Defense/Reactive Cyber Security

-

Active Cyber Defense/Proactive Cyber Security

-

Frequently Asked Questions About This Report

b. The Japan cyber security market size was estimated at USD 8.65 billion in 2024 and is expected to reach USD 9.68 billion in 2025.

b. The Japan cyber security market is expected to grow at a compound annual growth rate of 13.5% from 2025 to 2030 to reach USD 18.24 billion by 2030.

b. The hardware segment dominated the Japan cyber security market with a share of over 50.0% in 2024. The growth is driven by rising cyber threats targeting critical infrastructure, financial institutions, and government entities.

b. Some key players operating in the Japan cyber security market include Acalvio Technologies, Inc.; Akamai Technologies; Allure Security Technology; Appier Inc.; Netpoleon Group; BBS Technology (BBSEC); CDNetworks Inc.; Cequence Security, Inc.; Cisco Systems, Inc.; Cyber Security Cloud, Inc.; CyberTrap; Cybertrust Japan Co., Ltd.; Dell Inc., F5 Inc.; FFRI Security, Inc.

b. Key factors that are driving the market growth include government initiatives & regulatory frameworks, increased awareness & investment in robust security measures, and rapid digital transformation.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."