- Home

- »

- Next Generation Technologies

- »

-

Japan Anime Merchandising Market Size, Growth, Report, 2023GVR Report cover

![Japan Anime Merchandising Market Size, Share & Trends Report]()

Japan Anime Merchandising Market Size, Share & Trends Analysis Report By Product (Figurine, Clothing, Books), By Distribution Channel (Online, Offline), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-196-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

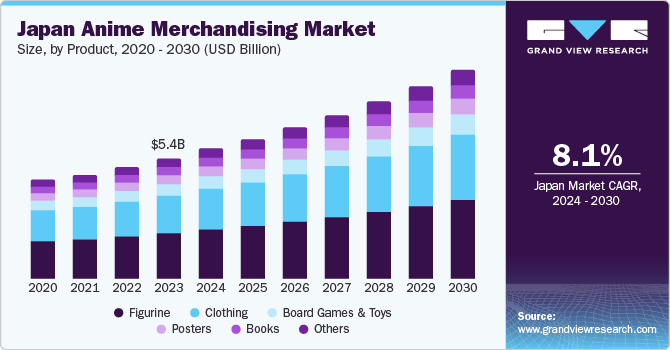

The Japan anime merchandising market size was estimated at USD 5.41 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. The increasing popularity of Japanese anime content, growing internet penetration, and increasing accessibility of anime content due to the expansion of digital platforms have led to an increased demand for anime merchandise. The merchandise includes clothes, toys, and limited edition collectibles based on respective anime characters and content due to the growing influence of otaku culture. The growing internet penetration worldwide has significantly widened the audience reach and accessibility of anime content.

With the increased high-speed internet connectivity in various regions, fans from diverse cultural backgrounds and geographical locations have unprecedented access to various anime series, movies, and related content. Streaming platforms dedicated to anime, such as Crunchyroll, Netflix, and Funimation, took advantage of this trend by offering extensive libraries of licensed anime titles that can be easily accessed and streamed on-demand, eliminating traditional barriers to physical distribution and localization.According to the World Population Review, in 2024, Japan is expected to have the highest percentage of its population that watches anime (75.9%). Internet platforms, such as Quriverse and Anime-Planet, support fan engagement by creating online communities around anime content.

Online communities connecting anime enthusiasts are crucial in cultivating a strong fellowship among fans. Providing a platform for fans to interact, share enthusiasm, and participate in discussions, encourages fans to get merchandise associated with their favorite franchises, driving market demand. Fan art creation and cosplay showcase within these communities also contribute to the growing popularity of anime and related merchandise. In addition,Japan anime merchandising market trends include the increase in internet-driven data analytics that enables online retailers to cater to anime fans' needs and preferences. Online retailers use insights to personalize anime merchandise recommendations based on user behavior and browsing patterns.

This data-driven approach ensures that fans are presented with a curated selection of products that align with their interests and preferences, effectively attracting them to purchase. As internet penetration expands, online retailers have a growing pool of data, enabling them to further refine their product offerings and marketing strategies, maximizing engagement and driving sustained growth in the market. Increasing demand for limited editions and collectibles is driving the market demand. The expansion of the merchandise market is further fueled by anime's frequent adaptation into various forms of media, including video games and comic books, providing fans with an extensive collection of merchandise options to explore. Influencers and social media play a crucial role in promoting anime merchandise, using their reach and engagement to attract fans to purchase.

The pandemic negatively impacted the industry due to disruptions in the release schedules of new anime content. Delays in the production and release of anime seasons, episodes, and movies resulted in delays in merchandise launches, obstructing the industry's ability to capitalize on timely promotional opportunities. In addition, safety concerns led to canceling or postponing anime conventions and events, depriving fans of engagement opportunities and reducing overall sales. Supply chain disruptions increased the challenges, impacting production, distribution, and availability, leading to shortages and a reduced variety of products. Offline retailers specializing in anime merchandise faced closures and decreased foot traffic. In contrast, Japanese anime merchandise online store platforms experienced a surge in sales as fans increasingly turned to e-commerce channels.

Market Concentration & Characteristics

Japan's anime merchandising market growth stage is medium and the pace of its growth is accelerating. The generative AI market in the region is characterized by an active and rapidly evolving landscape driven by a diverse range of products catering to fans' varied interests and collaborations with popular franchises and influencers.

Collaboration between anime studios, artists, and brands drives innovation in merchandise design and marketing strategies.In February 2023, Asics announced the launch of its latest shoe collection, the GEL-NYC. In collaboration with the anime series Naruto Shippuden, the company has also introduced an exclusive limited edition pair of sneakers featuring various iconography from the show.

The Japanese government, through organizations, such as the Ministry of Economy, Trade, and Industry (METI) and the Japan External Trade Organization (JETRO), provides support to promote Japanese culture, including anime, abroad. This assistance includes organizing trade missions, participating in international exhibitions and events, and offering export-related services to anime merchandise businesses to expand their reach in global markets. In October 2023, the Ikebukuro district of Tokyo witnessed the opening of a new anime culture hub. The Tokyo Metropolitan Government created the exhibition facility at approximately USD 3.34 million. The government intends to showcase valuable items from its archives, which contain around 50,000 items, including celluloid pictures, background drawings, scripts, and planning documents for nearly 120 animes.

Product Insights

Based on product, the market is further categorized into figurines, clothing, books, board games & toys, posters, and others. The figurine segment accounted for the largest revenue share of 38.0% in 2023 and is expected to grow significantly over the forecast period. The growth of this segment is attributed to the combination of unique design, exclusivity, quality craftsmanship, and the growing popularity of anime culture, making it a significant driver of growth and innovation within the broader anime merchandise industry. 3D printing technology has transformed the Japanese anime merchandise market, particularly in the figurine segment. In November 2023, Kaiyodo, a Japanese figurine manufacturer, launched and created two figurines from the 1984 Studio Ghibli anime film Nausicaä of the Valley of the Wind in 3-D form.

The books segment is expected to witness the fastest CAGR from 2024 to 2030. The segment growth can be attributed to the growing demand for anime series. It creates a strong demand for related books, such as manga adaptations, light novels, art books, and guidebooks. The popularity of anime adaptations based on manga and light novels fuels interest in their source material, creating a partnership that benefits both publishers and content creators. Readers collect physical copies as tangible representations of passion, leading to constant growth.

Distribution Channel Insights

Based on distribution channels, the market is segmented into online and offline channels. The online segment held the largest revenue share in 2023. It can be attributed to an increase in e-commerce websites, dedicated anime merchandise stores, and online marketplaces for easy access to various products. In addition, online platforms offer features, such as personalized recommendations, wish lists, and loyalty programs, which incentivize repeat purchases and customer loyalty. According to Japan’s Ministry of Economy, Trade and Industry (METI) annual e-commerce market survey released in August 2022, business-to-consumer e-commerce sales of goods grew in 2021 by 8.6% compared to 2020.

The offline segment is expected to witness the fastest CAGR from 2024 to 2030 due to the growing demand for specialty anime merchandise stores. Specialty anime merchandise stores, known as otaku shops, offer fans a unique shopping environment where various products are offered, allowing interaction with staff and face-to-face interactions with other enthusiasts. Many offline retailers offer exclusive collaborations, event-exclusive items, limited-edition releases, and the ability to cater to niche and specialized interests within the anime community, creating demand among buyers. Due to growing demand and popularity, market players are entering & strengthening their foothold in other countries. For instance, in November 2023, Bandai Namco, a Japanese company, announced plans to open a new store in London, followed by more outlets across the UK.

Key Japan Anime Merchandising Company Insights

Some of the key players operating in the market includeBandai Namco; Good Smile Company, Inc.;andKyoto Animation Co., Ltd.

-

Bandai Namco is a Japanese company that produces toys and holds licenses for popular anime brands, such as Tamagotchi, DragonBall, Vital Hero, Anime Heroes, Bandai Hobby, Gundam, and Studio Ghibli

-

Good Smile Company, Inc. is a Japanese company that specializes in producing and developing toys, goods, and figures. They also offer advertising, sales consulting, and business outsourcing services for goods, toys, and figures. They also offer packaging design, web design subcontracting services, and advertisement design for toys, goods, and figures, along with managing games and animation

-

Kyoto Animation Co., Ltd is a Japanese animation studio that designs, produces, retails, and wholesales anime and manga products and publishes light novels, comics, and visual books. The studio also creates and designs characters and produces packages

Key Japan Anime Merchandising Companies:

The following are the leading companies in the Japan anime merchandising market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Japan anime merchandising companies are analyzed to map the supply network.

- Bandai Namco

- Good Smile Company, Inc.

- Kodansha LTD.

- Kotobukiya Co., Ltd.

- Kyoto Animation Co., Ltd.

- P.A.WORKS Co., Ltd.

- Pierrot Co., Ltd.

- Production I.G

- Studio Ghibli, Inc.

- TOEI ANIMATION Co., Ltd.

- Ufotable Co., Ltd.

- VIZ Media, LLC.

Recent Developments

-

In October 2023, Good Smile Company announced the launch of a Nendoroid (figurine) of Aqua Hoshino and Kana Arima from Oshi no Ko. Both Nendoroids are expected to be released in April 2024, and each one comes with its own set of face plates and optional parts

-

In November 2023, Kodansha launched a new merchandise set that showcases a crossover collaboration between The Quintessential Quintuplets and Sanrio characters. This set includes five clear files and five wedding forms, each featuring a Nakano quintuplet member paired with Hello Kitty and other Sanrio characters

-

In March 2023, Shinchosha Publishing Co, Ltd., a Japanese publishing house, Japan’s first AI-generated science-fiction manga (comics or graphic novels) named Cyberpunk: Peach John. All the futuristic gadgets and characters in Cyberpunk: Peach John were crafted by Midjourney, an AI tool. This tool and others, such as Stable Diffusion and DALL-E 2, are used in creating art

Japan Anime Merchandising Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.84 billion

Revenue forecast in 2030

USD 9.36 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Bandai Namco; Good Smile Company, Inc.; Kodansha Ltd.; Kotobukiya Co., Ltd.; Kyoto Animation Co., Ltd.; P.A.WORKS Co., Ltd.; Pierrot Co., Ltd.; Production I.G.; Studio Ghibli, Inc.; TOEI ANIMATION Co., Ltd.; Ufotable Co., Ltd.; VIZ Media, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Anime Merchandising Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan anime merchandisingmarketreport based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Figurine

-

Clothing

-

Books

-

Board Games and Toys

-

Posters

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The Japan anime merchandising market size was estimated at USD 5.41 billion in 2023 and is expected to reach USD 5.84 billion in 2024

b. The Japan anime merchandising market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 9.36 billion by 2030.

b. The figurine segment accounted for the largest revenue share of 38.0% in 2023. It can be attributed to the combination of unique design, exclusivity, quality craftsmanship, and the growing popularity of anime culture.

b. Some key players operating in the Japan anime merchandising market include Bandai Namco, Good Smile Company, Inc., Kodansha LTD., Kotobukiya Co., Ltd., Kyoto Animation Co., Ltd., P.A.WORKS Co.,Ltd, Pierrot Co.,Ltd., Production I.G, Studio Ghibli, Inc., TOEI ANIMATION Co., Ltd., Ufotable Co., Ltd., VIZ Media, LLC

b. The increasing popularity of Japanese anime content, growing internet penetration, and increasing accessibility of anime content due to the expansion of digital platforms have led to an increased demand for anime merchandise

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."