- Home

- »

- Clinical Diagnostics

- »

-

Italy In Vitro Diagnostics Market Size & Share Report, 2030GVR Report cover

![Italy In Vitro Diagnostics Market Size, Share & Trends Report]()

Italy In Vitro Diagnostics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Services), By Technology, By Application (Infectious Disease, Diabetes, Oncology/Cancer), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-016-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

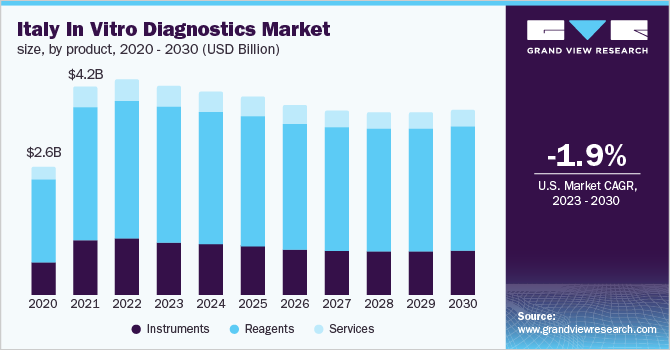

Italy in vitro diagnostics market size was valued at USD 4,361.79 million in 2022 and is expected to decline at a compound annual growth rate (CAGR) of -1.90% from 2023 to 2030. The exponential decline in demand for IVD products for the detection of COVID-19 infection in the coming years is likely to impede the market’s growth. Whereas the rising prevalence of chronic diseases in the country and the surge in investments by leading players in R&D to develop cutting-edge technologies for exploring new ways to detect diseases are also expected to fuel growth. For instance, in April 2021, Italian test maker DiaSorin put down about USD 1.8 billion for molecular test manufacturer Luminex.

The prevalence of various diseases such as cancer, autoimmune diseases, myocardial infarctions, arrhythmia, and inflammatory conditions is increasing in Italy, which is expected to drive the demand for IVD testing. For instance, according to Globocan, in 2020, about 415,269 new cancer cases and around 174,759 were reported in Italy. Breast cancer, prostate cancer, colorectal cancer, lung, and bladder cancer are some of the most common cancers diagnosed in Italy. Similarly, according to the International Diabetes Federation, in 2022, there were around 4.4 million diabetes cases in the adult population in the country. Unhealthy dietary habits, high tobacco & alcohol consumption, obesity, and a sedentary lifestyle are likely to augment the prevalence of target diseases in the country.

The changes in regulatory policies are expected to fuel in vitro diagnostics market growth in the coming years. For instance, in September 2022, the Government of Italy revised its national regulatory framework regarding IVD products in the country. The change in policies is expected to ensure a higher level of safety of IVD products in the country. Moreover, in September 2021, governments of France and Italy tied up for the distribution of the LoopDeeLab device, based on the RT Lamp molecular biology techniques, in Italy. This device can detect COVID-19 infection in a span of 45 minutes. Such innovative developments promise robust growth for the Italy in vitro diagnostics market during the forecast period.

Favorable government initiatives, the high incidence of target diseases, and the flourishing pharmaceutical & biotechnology sector in the country attract market players to offer their innovative IVD products in the country. For instance, in August 2022, DIESSE Diagnostica Senese and Grifols signed an agreement for the distribution of Grifols' Promonitor assays portfolio, either on point-of-care technology or as ELISA microplate tests for biological drug monitoring in the country. Moreover, universal health coverage in the country is anticipated to increase the adoption of novel diagnostic tests in the coming years.

Technological advancements regarding high accuracy, portability, and cost-effectiveness are likely to propel the Italy IVD market growth. For instance, in April 2020, Arrow Diagnostics Srl signed an agreement with the Italian government to supply Allplex SARS-CoV-2 Assay. This assay can detect five genes, including coronavirus genes. Moreover, in November 2022, Arrow Diagnostics was selected to supply diagnostic reagents to the regional government of Tuscany, Italy.

Product Insights

Based on product, the reagent segment held the largest share of 64.18% of the Italy IVD market in 2022 and is anticipated to hold the maximum market share during the forecast period. The growth of the segment can be attributed to the availability of advanced diagnostic solutions, increasing demand for technologically advanced tests, and the presence of a robust product portfolio from local manufacturers. For instance, Adaltis S.r.l. is a leading clinical diagnostic company in Italy that offers a range of reagents for molecular diagnostics tests of infectious diseases and genomics and nucleic acid extraction.

In addition, the higher demand for consumables such as test kits and other consumables owing to the increasing incidence of target diseases is encouraging market players to introduce novel products in the market. For instance, in June 2022, Agilent Technologies Inc. launched IVDR-compliant reagents & kits for diagnostic laboratories in the EU and Italy.

The instruments segment was the second largest shareholder in 2022. Rising technological advancements, a surge in demand for POC testing instruments, and the availability of robust portable instruments are fueling the market uptake of the instrument segment in the coming years.

Technology Insights

Factors such as rapid evolution in technology, rising demand for point-of-care diagnostics, and increasing burden of viral & bacterial diseases in Italy are expected to contribute to the high revenue share of 40.39% of the molecular diagnostic segment in 2022. In addition, the continuous engagement of major IVD market participants in molecular diagnostics technologies, advancements in molecular diagnostics, and a surge in product launches have increased the market share of the segment significantly. For instance, in May 2022, Dante Labs received a grant from the Italian Ministry of economic development for the development of a fully CE-IVD, clinically approved WGS test in the country. Moreover, the demand for the molecular diagnostic test has increased in the last 2-3 years due to the outbreak of COVID-19.

Moreover, in October 2021, ELITechGroup launched ELITe BeGenius, a real-time PCR solution to improve the efficiency of labs in the country. This newly launched solution made molecular diagnostics accessible to every lab.

The immunoassay segment was the second-highest revenue contributor. Factors such as the easy availability of technologically advanced diagnostic techniques, a surge in incidences of chronic diseases, and increasing adoption of these tests in POC settings are expected to boost segment demand during the projected period. Moreover, the rising introduction of technologically advanced products in the market is also anticipated to cater to segment expansion. For instance, in May 2021, Sentinel Diagnostics launched two novel serological tests to quickly assess the immune response to SARS-CoV-2.

Application Insights

The infectious disease segment lead the market share in the application segment in 2022. The high IVD market share of the infectious disease segment is owing to the rising incidence of infectious diseases and the increasing uptake of IVD products for the detection of infectious diseases. The increasing infection rate of hepatitis, pneumonia, tuberculosis, HIV and other infectious diseases is driving the segment growth. In addition, certain strategic developments undertaken by leading market participants are also expected to boost segment uptake during the forecast period. For instance, in April 2021, Abacus Diagnostica signed an agreement with Pantec Srl for the distribution of GenomEra CDX, a real-time PCR system for the detection of infectious diseases in Italy.

However, the drug testing and oncology segment are likely to exhibit a faster growth rate throughout the projected period owing to the rising cases of drug abuse, medication errors, and surge in demand for personalized healthcare. Moreover, the surge in the prevalence of cancer and rising awareness about early disease diagnosis of diseases is also expected to boost segment expansion.

End-use Insights

The core lab segment dominated the Italy IVD market in 2022, with a revenue share of 27.6%. It is likely to be the highest revenue contributor in the coming years. The growth of the core lab segment is attributed to the increasing number of core laboratories performing diagnostic tests in hospitals, laboratories, clinics, and other healthcare facilities. In addition, the ability to perform a large number of diagnostic tests, technological advancements, and a surge in demand for affordable services are other factors contributing to the segment expansion.

Whereas the blood banks segment is anticipated to grow at the fastest rate during coming years owing to factors such as rising demand for IVD tests in blood banks for donor screening and favorable government initiatives pertaining to blood banks. In addition, increasing concern about the safety and quality of blood and its derived products facilitates segment expansion.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, merger & acquisition, and partnership to increase their market share. For instance, in September 2020, MeMed Diagnostics and DiaSorin collaborated to commercialize a test that is capable of distinguishing between viral and bacterial infections. Moreover, DiaCarta Inc signed an agreement with Arrow Diagnostics for the distribution of the ColoScape test in Italy. Some prominent players in the Italy in vitro diagnostics (IVD) market include:

-

F. Hoffmann-La Roche Ltd

-

Abbott

-

bioMerieux SA

-

Danaher

-

QIAGEN

-

BD

-

Sysmex Corporation

-

DiaSorin S.p.A.

-

The Menarini Group

-

SENTINEL CH. SpA

-

Quidel Corporation

Italy In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4,224.01 million

Revenue forecast in 2030

USD 3.74 billion

Growth rate

CAGR of -1.90% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use

Country scope

Italy

Key companies profiled

F. Hoffmann-La Roche Ltd; Abbott; bioMerieux SA; Danaher; QIAGEN, BD; Sysmex Corporation; DiaSorin S.p.A.; The Menarini Group; SENTINEL CH. SpA; Quidel Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy In Vitro Diagnostics Market Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends, and opportunities in each of the sub-segment from 2017 to 2030. For this report, Grand View Research has segmented the Italy in vitro diagnostics market based on product, technology, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

By Product

-

Instruments

-

Reagents

-

Services

-

-

By Technology

-

Radioimmunoassay (RIA)

-

Enzyme Immunoassays (EIA)/ELISA

-

Chemiluminescence Immunoassays (CLIA)

-

-

Fluorescence Immunoassays (FIA)

-

Rapid Test

-

Others

-

-

-

Hematology

-

By Product

-

Instruments

-

Reagents

-

Services

-

-

Clinical Chemistry

-

By Product

-

Instruments

-

Reagents

-

Services

-

-

-

Molecular Diagnostics/Genetics

-

By Product

-

Instruments

-

Reagents

-

Services

-

-

By Technology

-

Polymerase Chain Reaction (PCR)

-

Sequencing

-

Hybridization

-

Chips & Microarrays

-

TMA

-

INAAT

-

Mass Spectrometry

-

Others

-

-

-

Coagulation

-

By Product

-

Instruments

-

Reagents

-

Services

-

-

-

Microbiology

-

By Product

-

Instruments

-

Reagents

-

Services

-

-

-

Others

-

By Product

-

Instruments

-

Reagents

-

Services

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Disease

-

Diabetes

-

Oncology/Cancer

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Core Lab

-

SWA (Serum Work Area)

-

By Location

-

Public Hospitals

-

Large Private Hospitals

-

Private

-

-

By Location

-

Clinical Chemistry

-

Immunochemistry

-

-

-

Hematology

-

By Location

-

Public Hospitals

-

Large Private Hospitals

-

Private

-

-

-

Coagulation

-

By Location

-

Public Hospitals

-

Large Private Hospitals

-

Private

-

-

-

Urine Test

-

By Location

-

Public Hospitals

-

Large Private Hospitals

-

Private

-

-

-

Others

-

-

Molecular Lab

-

HPV

-

Herpetics

-

Hepatitis

-

HIV

-

NIPT

-

Others

-

-

Pathology Lab

-

Anatomic Pathology

-

Advanced Staining (Immunohistochemistry)

-

By Location

-

Public Hospitals

-

Large Private Hospitals

-

Private

-

-

-

Primary Staining (Hematoxylin Eosin and Histochemistry)

-

By Location

-

Public Hospitals

-

Large Private Hospitals

-

Private

-

-

-

-

Others

-

-

Blood Banks

-

SWA (Serum Work Area)

-

Molecular Test

-

-

Point of Care (PoC)

-

Clinics

-

Hospitals

-

-

Retail

-

Military Premises

-

Airports

-

Others

-

-

Others

-

NGS

-

Mass Spectrometry

-

Others

-

-

Frequently Asked Questions About This Report

b. Italy in vitro diagnostics market size was estimated at USD 4,361.79 million in 2022 and is expected to reach USD 4,224.01 million in 2023.

b. Italy in vitro diagnostics market is expected to grow at a compound annual growth rate of -1.9% from 2023 to 2030 and is expected to reach USD 3.74 billion by 2030.

b. The molecular diagnostics segment is expected to dominate Italy in vitro diagnostics market with a share of 40.4% in 2022 due to the increasing adoption of technologically advanced tests, increasing penetration of POC tests, and surge in product launches.

b. Some key players operating in Italy in vitro diagnostics market include F. Hoffmann-La Roche Ltd, Abbott, bioMerieux SA, Danaher, QIAGEN, BD, Sysmex Corporation, and DiaSorin S.p.A. among others.

b. The rising prevalence of chronic diseases, increasing investment by key market players in the country, the introduction of advanced tests, and favorable government initiatives are the major factors driving Italy in vitro diagnostics market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.