- Home

- »

- Medical Devices

- »

-

Italy Dental Implant Market Size, Share, Trends, Report, 2030GVR Report cover

![Italy Dental Implant Market Size, Share & Trends Report]()

Italy Dental Implant Market Size, Share & Trends Analysis Report By Implant Type (Titanium, Zirconia), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-201-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Italy Dental Implant Market Size & Trends

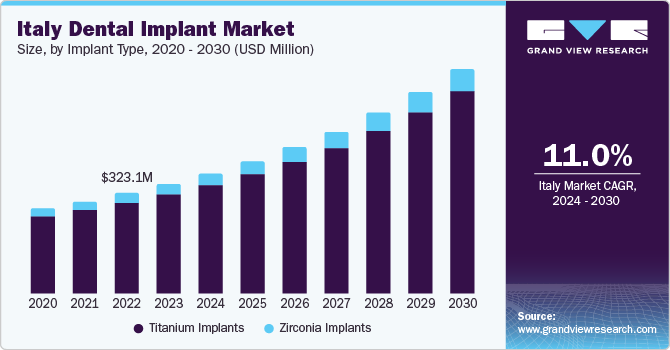

The Italy dental implant market size was valued at USD 352.93 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.0% from 2024 to 2030. The adoption rate for dental implants is increasing among patients and dental surgeons due to limitations of removable prostheses (dentures, veneers, etc.), such as discomfort, lack of natural appearance, and need for maintenance. Increasing applications of dental implants in various therapeutic areas and rising demand for preventive & restorative dental care are key factors expected to boost the industry growth.

Implants are the only dental restorative product that preserves and stimulates natural bone and provides stable prosthetics support. An increasing number of dental injuries due to road accidents and sports injuries is one of the major factors favoring the demand for dental implants. The World Health Organization (WHO) data suggests that nearly 10 million people are injured or disabled due to road accidents yearly.

According to the National Institutes of Health (NIH), over 24% of the total population in Italy was estimated to be 65 years and above as of January 2022. According to NIH, one in five adults in the country suffers from severe periodontal disease. These factors are likely to drive the dental implant market in Italy.

Oral healthcare is mainly offered in private health facilities in the country. The public healthcare system offers only 5% to 8% of oral healthcare services, and this percentage varies across different cities in the country. Oral healthcare costs are covered only for specific groups, such as children and people who are physically challenged & those in the low-income range. These factors are likely to drive the Italy dental implant market.

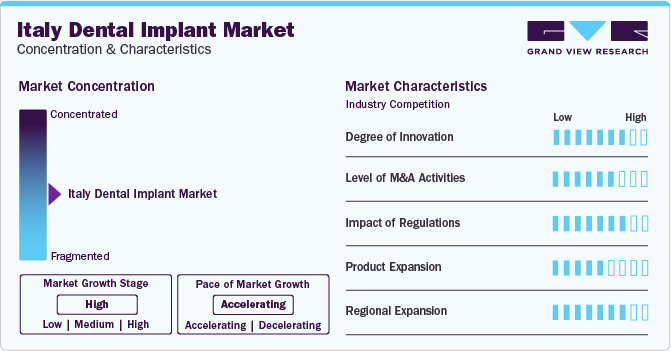

Market Concentration & Characteristics

Technological advancements supported new product development procedures through Computer-aided Design & Computer-aided Manufacturing (CAD/CAM). All major companies use CAD/CAM systems to improve the design and creation of dental restorations. Dental CAD/CAM techniques are rapidly replacing die casting in terms of technological superiority, which is expected to drive market growth.

The Italy Dental Implant Market is characterized by a high level of M&A activities undertaken by leading players. Several companies are expanding their array of dental implant products, emphasizing the importance of widespread product diversification within the industry. These firms are introducing novel products, strategic initiatives, and services to navigate market competition adeptly. For instance, in June 2023, Metrika announced acquiring the majority stake in Agliati. This acquisition enabled the launch of the first production hub in Italy for dental implants and prosthetics.

The dental implant market is experiencing heightened regulatory scrutiny, with various regulatory and government authorities actively working to implement more rigorous guidelines. Stringent monitoring of manufacturing process of dental implants and post-marketing assessment by regulatory bodies including the FDA is likely to limit the market growth.

Some of the key players in the market are focusing on introducing novel implants that can cater to specific needs of patients. For instance, in 2022, Bredent Medical announced the launch of a new generation whiteSKY zirconia dental implants. The whiteSKY implant is suitable for a wide range of indications such as short-span bridges in the molar and premolar region, and single restorations in the esthetic zone.

Key companies in the Italian market are also focusing on market expansion in European and Asian countries. For instance, in 2021, Henry Schein, manufacturer and distributor of dental equipment and one of the significant players in the European market, stated that they are increasingly collaborating with large DSOs in Europe to boost the number of customers the company is serving. This can positively impact its revenue growth and increase regional penetration of products.

Implant Type Insights

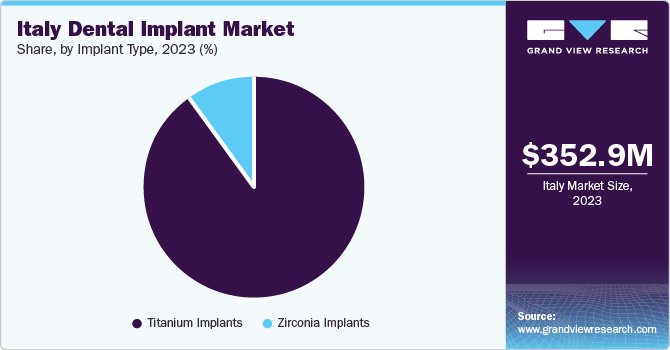

The titanium segment dominated the market with a revenue share of 90.07% in 2023. The biocompatible nature of the pure form of titanium is the main advantage of its use in dental implants. Titanium is a strong and lightweight metal having high inertness & corrosion resistance. Several dental reports state that titanium dental implants have lasted for over 30 years in good functional condition. According NCBI, many studies have repeatedly proven titanium implants to be superior to other implants in terms of biocompatibility and osseointegration.

The zirconium segment is the fastest-growing segment. Zirconium functions with nearly the same features as titanium. According to NCBI, zirconia dental implants have emerged as effective substitutes for titanium implants, and this is attributed to the potential of these implants to osseointegrate. They also provide other compositional benefits such as translucency and bleached white color, which mimics the appearance of natural teeth and, thus, are widely used in esthetic dentistry. The implant can be visualized very easily on radiographs, like titanium, due to its radiopaque properties. Bacterial build-up on zirconia implants is found to be comparatively lower than that of titanium, as they are hypoallergenic and resist bacterial growth. Some studies have also stated that zirconia has higher biocompatibility as compared to titanium, as the latter is likely to erode the implant site and result in tooth sensitivity.

Key Italy Dental Implant Company InsightsSome of the key players in the market include Envista Holdings Corporation (Nobel Biocare Services AG), Dentsply Sirona, Institut Straumann AG, and Zimmer Biomet, among others. Competition between key players is likely to get intense in the coming years as they are focusing more on geographical expansion, strategic collaborations, and partnerships through mergers & acquisitions. For instance, In May 2020, Straumann Group announced a collaboration with Southern Implants for new zygomatic implant solution for patients with severe jawbone loss. The new solution combines proven implant design features with the advantages of Straumann’s BLX and BLT implant prosthetic range.

Key Italy Dental Implant Companies:

The following are the leading companies in the Italy dental implant market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Italy dental implant companies are analyzed to map the supply network.

- BioHorizons IPH, Inc.

- Nobel Biocare Services AG

- Zimmer Biomet Holdings, Inc.

- OSSTEM IMPLANT

- Institut Straumann AG

- Bicon, LLC

- Leader Italy

- Anthogyr SAS

- DENTIS

- DENTSPLY Sirona

- DENTIUM Co., Ltd.

- T-Plus Implant Tech. Co.

- KYOCERA Medical Corp.

Recent Developments

-

In March 2023, Dentsply Sirona unveiled the launch of ‘DS OmniTaper Implant System’. The solution forms a part of the company’s EV Implant Family, alongside the ‘DS PrimeTaper Implant System’ and the ‘Astra Tech Implant System’.

-

In March 2022, Nobel Biocare announced the addition of creos syntoprotect to the company’s regenerative portfolio. The creos syntoprotect dense PTFE membranes are designed for withstanding exposure to the oral cavity for extraction socket management when primary closure is not possible.

Italy Dental Implant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 386.84 million

Revenue forecast in 2030

USD 724.94 million

Growth Rate

CAGR of 11.0% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Implant type

Country scope

Italy

Key companies profiled

BioHorizons IPH, Inc.; Nobel Biocare Services AG; Zimmer Biomet Holdings, Inc.; OSSTEM IMPLANT; Institut Straumann AG; Bicon, LLC; Leader Italy; Anthogyr SAS; DENTIS; DENTSPLY Sirona; DENTIUM Co., Ltd.; T-Plus Implant Tech. Co.; KYOCERA Medical Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Dental Implant Market Report Segmentation

This report forecasts revenue growth in the Italy market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Italy Dental Implant Market based on implant type:

-

Implant Type (Revenue in USD Million, 2018 - 2030)

-

Titanium Implants

-

Zirconia Implants

-

Frequently Asked Questions About This Report

b. The Italy dental implants market is estimated at USD 352.93 million in 2023 and is expected to reach USD 386.84 million in 2024.

b. The Italy dental implants market is expected to grow at a CAGR of 11.0% from 2024 to 2030 to reach USD 724.94 million in 2030.

b. The titanium segment dominated the market with a revenue share of 90.07% in 2023. The biocompatible nature of the pure form of titanium is the main advantage of its use in dental implants.

b. Some of the key players in the market include Envista Holdings Corporation (Nobel Biocare Services AG), Dentsply Sirona, Institut Straumann AG, and Zimmer Biomet, among others.

b. The adoption rate for dental implants is increasing among patients and dental surgeons due to limitations of removable prostheses (dentures, veneers, etc.), such as discomfort, lack of natural appearance, and need for maintenance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."