- Home

- »

- Network Security

- »

-

IT Services Market Size And Share, Industry Report, 2030GVR Report cover

![IT Services Market Size, Share & Trends Report]()

IT Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Approach (Reactive IT Services, Proactive IT Services), By Type (Design & Implementation), By Application, By Technology, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-931-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

IT Services Market Summary

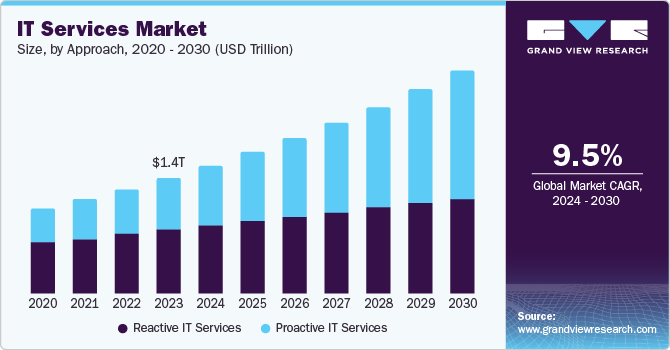

The global IT services market size was estimated at USD 1.50 trillion in 2024 and is projected to reach USD 2.59 trillion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The IT services industry is experiencing rapid growth, fueled by factors such as the widespread adoption of cloud computing and digital technologies, the surging demand for cybersecurity solutions, and the emphasis on innovation and automation.

Key Market Trends & Insights

- North Americas IT services market dominated the global market with a revenue share of over 35% in 2024.

- The U.S. IT services market dominated the regional market in 2024.

- By approach, the reactive it services segment dominated the market with a share of over 52% in 2024.

- By type, the operations & maintenance segment dominated the market with the largest revenue share in 2024.

- By application, the application management segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.50 Trillion

- 2030 Projected Market Size: USD 2.59 Trillion

- CAGR (2025-2030): 9.4%

- North Americas: Largest market in 2024

Increasing concerns regarding data security and privacy protection drive the demand for IT services from companies across various industry verticals. The market is driven by trends such as the increasing use of artificial intelligence and machine learning, the rising demand for data analytics and big data solutions, the focus on IoT and connected devices, and the need to comply with data privacy regulations.

The shift towards remote and hybrid work models has created a demand for IT solutions that support these new operational structures, leading to increased demand for tools and infrastructure from IT companies. Cloud computing has also seen substantial growth as businesses migrate their operations to cloud platforms, necessitating IT services to manage and secure these environments. Furthermore, the rise in cyber threats has spurred a higher demand for cybersecurity services as businesses seek to safeguard their data and systems from potential threats. For instance, Microsoft invests approximately USD 1 billion each year in cloud security, demonstrating its commitment to enhancing cybersecurity measures. Overall, these trends have accelerated the adoption of IT services and technology solutions, driving growth in the IT services industry.

In addition, the increase in IT expenditure, with the widespread adoption of software-as-a-service and the growing availability of cloud-based solutions, is driving the demand for the market. These services have increased the efficiency of business processes while allowing firms to concentrate on their core competencies without worrying about the installed IT infrastructure. Businesses use IT services for various purposes, from standard chores such as handling employee records to complex corporate processes such as supply chain and operations management.

Approach Insights

The reactive IT services segment dominated the market with a share of over 52% in 2024. This can be attributed to the increasing complexity of IT systems, which makes it challenging to prevent issues, prompting businesses to adopt robust reactive IT solutions. In addition, the rising cost of downtime pushes companies to invest in such services to avoid productivity and revenue losses. Cloud-based services further facilitate the implementation of reactive IT measures through monitoring, alerting, and incident management capabilities. As a result, the demand for reactive IT services is expected to continue increasing as organizations prioritize safeguarding their IT assets and maintaining uninterrupted operations during problems.

The proactive IT services segment is expected to grow at the highest CAGR over the forecast period, driven by multiple factors, including the complexity of IT systems, the escalating threat of cybercrime, and the desire for enhanced IT performance and agility. These services play a crucial role in helping businesses identify and resolve potential issues before they lead to downtime or data loss, bolster their security, optimize IT resources, and achieve greater IT agility. Moreover, it plays a crucial role in supporting remote work, maintaining compliance with regulations, improving customer experience, and optimizing costs, making it an essential investment for businesses. Thus, businesses are increasingly adopting proactive IT services to stay ahead of challenges and ensure smoother and more secure operations.

Type Insights

The operations & maintenance segment dominated the market with the largest revenue share in 2024. The segment is growing as cloud computing has driven a shift towards cloud-based operations & maintenance solutions, offering scalability and cost savings. Automation technologies such as RPA, machine learning, and AI enhance efficiency and resource utilization. Moreover, the growing importance of data analytics enables organizations to gain insights into IT system performance, preventing disruptions. Additionally, heightened security concerns prompt investments in robust security solutions to safeguard against evolving cyber threats. These trends continue to shape the IT services landscape, with businesses striving to optimize their operations & maintenance strategies for improved performance and resilience.

The design & implementation segment is expected to grow at a significant CAGR over the forecast period owing to the combination of technological advancements, increasing demand for user-centric solutions, and the pressing need for rapid IT deployment. Businesses are actively seeking IT service providers to assist them in designing and implementing their IT systems and applications. They are becoming indispensable partners for organizations seeking to navigate the complexities of modern technology landscapes and achieve seamless digital experiences, resulting in a rising demand for these services and subsequent market expansion.

Application Insights

The application management segment dominated the market with the largest revenue share in 2024. Businesses can leverage application management to enhance application performance and reliability, reduce ownership costs, strengthen application security, and maximize the overall value of their applications. Application management solutions play a pivotal role in effectively monitoring, optimizing, and maintaining the applications. In addition to enhancing performance and reliability, application management offers business cost-saving benefits. Moreover, robust application management practices help identify and mitigate potential security vulnerabilities, safeguard sensitive data, and ensure compliance with industry regulations.

The data management segment is expected to grow at the highest CAGR over the forecast period owing to the increasing volume of data generated by businesses and individuals, coupled with the need to leverage data for improved decision-making and gaining a competitive edge. The growing adoption of cloud computing, offering cost-effective and scalable data management solutions, further boosts the segment's expansion. Key growth areas within data management include cloud-based data management, big data handling, data analytics services, and data governance solutions. As these trends persist, the demand for data management services is anticipated to continue growing in the foreseeable future.

Technology Insights

The AI & machine learning segment dominated the market with the largest revenue share in 2024, driven by the vast availability of data that enables AI to analyze extensive datasets, extract valuable insights, and optimize decision-making processes. This leads to enhanced personalized customer experiences and streamlined operations. Decreasing computing power costs makes AI solutions more affordable for businesses, facilitating real-time fraud detection and predictive maintenance. The growing demand for automation fuels the implementation of AI and machine learning in tasks like customer service, freeing human resources for more complex roles. For instance, in January 2025, SuperOps, an Indian AI-focused SaaS company, secured USD 25 million in funding, positioning it for growth in AI research and expansion into new markets. This investment underscores the increasing interest in AI-driven solutions across industries.

The big data analytics segment is anticipated to grow at a significant CAGR over the forecast period. The rise of edge computing, where computation and data storage are brought closer to data sources, offers reduced latency and improved performance, creating new opportunities for specialized big data analytics providers. Additionally, the increasing importance of real-time analytics for quick decision-making in response to market changes presents prospects for IT service providers offering real-time analytics solutions. Moreover, the growing demand for cloud-based big data analytics solutions, with their scalability, flexibility, and cost-effectiveness advantages, offers a lucrative opportunity for IT service providers.

Deployment Insights

The cloud segment dominated the market with the largest revenue share in 2024 as businesses of all sizes increasingly adopt cloud computing, driving up the demand for cloud-based services such as disaster recovery, business continuity, and big data analytics. The availability of cloud-based infrastructure and platforms is also rising, further fueling the cloud's expansion. Moreover, the declining cost of cloud computing and the adoption of hybrid cloud and multi-cloud environments contribute to its popularity. Cloud-based managed services, analytics solutions, and security solutions are experiencing a surge in demand. Thus, the cloud segment is growing as businesses embrace its flexibility, scalability, and efficiency for their IT needs.

The on premise segment is expected to grow at a significant CAGR over the forecast period as many businesses prefer on-premises. It gives them greater control over their IT infrastructure, enabling them to manage data and applications more effectively. On-premises solutions offer the advantage of customization to meet specific business needs, allowing them to tailor their IT infrastructure precisely to their specific needs. Additionally, some companies perceive on-premises solutions to be more secure, as data is not stored on remote servers that could be susceptible to cyberattacks. Thus, the on-premises approach offers businesses control, customization, and security that aligns with their unique requirements.

Enterprise Size Insights

The Small and Medium Enterprises (SMEs) segment dominated the market with the largest revenue share in 2024. The availability of cloud-based IT services has played a crucial role in this growth, making it more accessible and affordable for SMEs to adopt new technologies. Cloud-based solutions offer on-demand access, which is advantageous for SMEs with limited resources to invest in costly IT infrastructure. Moreover, the rise of mobile technology has opened up new opportunities for SMEs, enabling them to utilize mobile devices for customer communication, inventory management, and sales tracking. Thus, the SME sector continues to grow as it leverages technology to fuel its growth and competitiveness in the IT services industry.

The large enterprises segment is expected to grow at a significant CAGR over the forecast period. As IT systems and infrastructure become more complex, specialized expertise and resources are essential for effective management, making large enterprises better equipped to handle these demands. Moreover, larger enterprises are better positioned to invest in new IT services, including cloud computing and other technologies, owing to their financial resources and scale of operations. Furthermore, with a growing focus on digital transformation, there is an increased demand for IT services that can enhance agility, efficiency, and customer experience, driving large enterprises to lead the market in seeking these solutions.

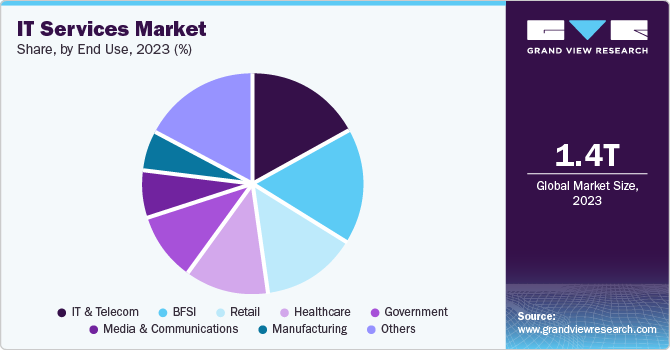

End Use Insights

The IT & telecom segment dominated the market with the largest revenue share in 2024. The IT & telecom sector is experiencing rapid growth in the market as telecom operators increasingly adopt cloud computing and other digital technologies to modernize their infrastructure and services. The growing demand for managed services and IT solutions from these operators also expands the sector. Moreover, the convergence of IT and telecom technologies is becoming more prevalent, leading to an increased need for specialized IT services that cater to the industry's evolving requirements. Thus, the IT & telecom sector is poised for substantial growth in the market as it continues to adapt and integrate various technologies.

The retail segment is expected to grow at the highest CAGR over the forecast period. The rising adoption of e-commerce and omnichannel retail strategies drives the demand for IT solutions in the retail sector that can support seamless online and offline customer experiences. The need for automation and streamlined operations also contributes to the increased demand for IT services in this sector. For instance, Customer Relationship Management (CRM) systems enable retailers to build stronger customer relationships and provide personalized services, while inventory management solutions help retailers track inventory levels and prevent stockouts. Thus, the retail industry's growing focus on efficiency and customer satisfaction drives a significant surge in demand for specialized IT services tailored to its unique needs.

Regional Insights

North Americas IT services market dominated the global market with a revenue share of over 35% in 2024. This dominance is driven by its robust IT infrastructure and the presence of major tech companies, including Amazon.com, Inc., Microsoft, and Google LLC. These companies not only provide a wide range of IT services but also drive innovation and digital transformation across various industries. The U.S. hosts a vibrant ecosystem of IT service providers, offering services such as cloud computing, cybersecurity, and digital transformation, which are crucial for optimizing business operations and enhancing customer experiences.

U.S. IT Services Market Trends

The U.S. IT services market dominated the regional market in 2024. This can be attributed to its strong IT infrastructure and a large pool of skilled professionals. The country's extensive cloud networks and advanced data centers support high-quality service delivery, meeting the increasing demand for digital solutions. Government initiatives aimed at expanding digital infrastructure and implementing cybersecurity regulations further bolster the market. This environment fosters a competitive landscape where IT service providers innovate and capitalize on emerging technologies such as AI and blockchain.

Europe IT Services Market Trends

Europe IT services market is anticipated to grow at a significant CAGR. This growth is driven by factors such as the increasing demand for IT infrastructure from SMEs and the adoption of AI and machine learning technologies. Rapid digital transformation across industries such as retail and healthcare has led businesses to adopt new technologies to ease operations and improve customer experiences. This trend supports the growth of the market by enhancing data management and application efficiency.

Asia Pacific IT Services Market Trends

Asia Pacific IT services market is expected to grow at the highest CAGR from 2025 to 2030. This growth is driven by the increasing adoption of cloud-based offerings and the rapid expansion of e-commerce in the region. Countries including China, Japan and India are leading this growth, with China dominating the regional market due to its strong AI and cloud computing adoption. The IT services industry in this region benefits from the growing demand for scalable and efficient IT solutions, particularly in sectors such as retail and manufacturing.

China IT services market dominated the regional market in 2024. This can be attributed to its growth in AI and cloud computing, as well as favorable government policies supporting the IT services industry. The government has established state-level software bases, which drive demand for high-value-added software services. This environment supports the development of the IT services industry by fostering innovation and investment in emerging technologies, thereby enhancing business operations and customer experiences across various sectors.

Key IT Services Company Insights

The global IT services industry features several key players who shape its landscape. Amazon Web Services, Inc. offers comprehensive cloud computing solutions. Microsoft provides cloud, AI, and cybersecurity services through Azure. IBM Corporation specializes in enterprise IT services, including AI and blockchain. Meanwhile, Cisco Systems, Inc. focuses on networking and cybersecurity, helping organizations build secure IT infrastructures. These companies play a significant role in shaping the IT services industry.

-

IBM Corporation is a multinational technology company that provides a wide range of IT services, including cloud computing, data analytics, and artificial intelligence. IBM offers infrastructure, hosting, and consulting services, with key areas of focus in analytics, AI, automation, blockchain, and cybersecurity. The company supports various industries such as automotive, banking, healthcare, and retail, helping them modernize applications and streamline operations through technology consulting and digital transformation initiatives.

-

Microsoft is a technology company that offers a suite of IT services, primarily through its Azure platform. Microsoft Azure provides cloud computing, AI, and cybersecurity solutions, supporting businesses in their digital transformation journeys. The company's services include cloud-based productivity tools such as Microsoft 365 and cloud gaming through Xbox. Microsoft's cloud offerings compete with other players in the IT services industry, focusing on scalability, security, and innovation

Key IT Services Companies:

The following are the leading companies in the IT services market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Avaya

- Cisco Systems, Inc.

- DXC Technology Company

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- Microsoft

- Broadcom (Symantec Corporation)

- Oracle

Recent Development

-

In March 2025, DXC Technology, a leading global technology services provider, was selected by Parfois Group, a prominent Portuguese fashion brand, to enhance customer experience through personalized, data-driven recommendations. This partnership reflects Parfois' commitment to innovation and aligns with its global Data Intelligence strategy. By leveraging data insights, Parfois aims to tailor shopping experiences and offer relevant product recommendations, thereby improving operational efficiency and customer satisfaction.

-

In March 2025, AWS announced the general availability of multi-agent collaboration for Amazon Bedrock, enabling developers to create networks of specialized AI agents that work together under the guidance of a supervisor agent. This capability facilitates the handling of complex, multi-step workflows by breaking them down into manageable tasks that can be executed in parallel, thereby enhancing the scalability and efficiency of AI-driven applications.

-

In May 2024, Tata Consultancy Services (TCS) and CrowdStrike formed a strategic partnership to enhance TCS's XMDR services using the AI-native CrowdStrike Falcon XDR platform. This collaboration allows TCS to utilize the Falcon platform's robust security capabilities, including cloud security and next-generation SIEM, to drive an AI-driven transformation of its Security Operations Centre (SOC). This transformation aims to significantly improve breach prevention capabilities, providing enhanced protection against sophisticated cyber threats.

IT Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.65 trillion

Revenue forecast in 2030

USD 2.59 trillion

Growth Rate

CAGR of 9.4% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Report updated

March 2025

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Approach, Type, Application, Technology, Deployment, Enterprise Size, End Use and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services, Inc.; Avaya; Cisco Systems, Inc.; DXC Technology Company; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM Corporation; Juniper Networks, Inc.; Microsoft; Broadcom (Symantec Corporation); Oracle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global IT services market report based on approach, type, application, technology, deployment enterprise size, end use, and region.

-

Approach Outlook (Revenue, USD Million; 2017 - 2030)

-

Reactive IT Services

-

Proactive IT Services

-

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Design & Implementation

-

Operations & Maintenance

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Systems & Network Management

-

Data Management

-

Application Management

-

Security & Compliance Management

-

Others

-

-

Technology Outlook (Revenue, USD Million; 2017 - 2030)

-

AI & Machine Learning

-

Big Data Analytics

-

Threat Intelligence

-

Others

-

-

Deployment Outlook (Revenue, USD Million; 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million; 2017 - 2030)

-

Small and Medium Enterprise (SMEs)

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Million; 2017 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Media & Communications

-

Retail

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IT services market size was estimated at USD 1.50 trillion in 2024 and is expected to reach USD 1.65 trillion in 2025.

b. The global IT services market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 2.59 trillion by 2030.

b. North America dominated the IT services market with a share of 36.1% in 2024. This is attributable to technological advancements, digital transformation initiatives, and the increasing reliance on technology across various industries.

b. Some key players operating in the IT services market include Amazon Web Services, Inc.; Avaya; Cisco Systems, Inc.; DXC Technology Company; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM Corporation; Juniper Networks, Inc.; Microsoft; Broadcom (Symantec Corporation) ; Oracle

b. Key factors that are driving the IT services market growth include increase in demand for cloud services, and increased investment by small and medium enterprises in IT support services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.