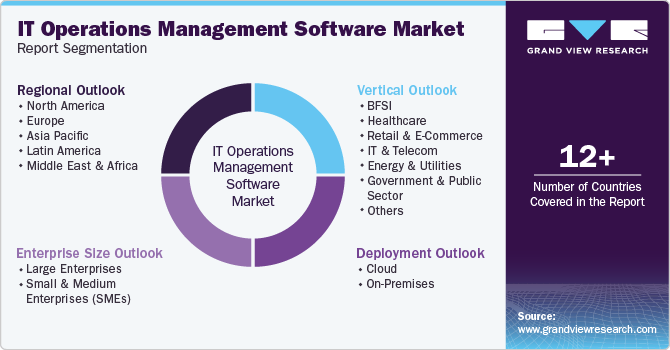

IT Operations Management Software Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-Premises), By Enterprise Size (Large Enterprises, SMEs), By Vertical (BFSI, IT & Telecom), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-439-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

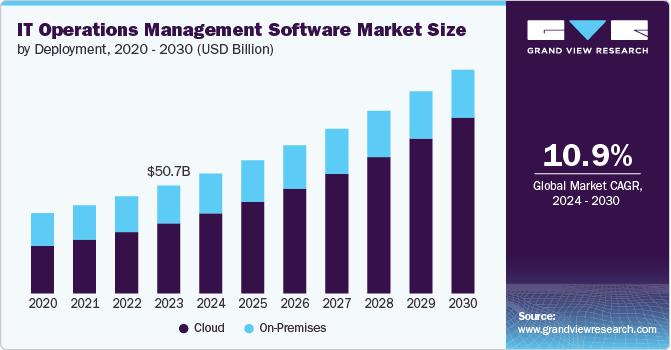

The global IT operations management software market size was estimated at USD 50.72 billion in 2023 and is projected to grow at a CAGR of 10.9% from 2024 to 2030,driven by the digital transformation across industries and the adoption of cloud and hybrid IT environments. Growing demand for automation and AI solutions is enhancing operational efficiency, while the need for improved user experience and regulatory compliance is fueling further adoption of IT operations management (ITOM) tools. These solutions are increasingly essential for managing complex IT ecosystems and ensuring performance, security, and service continuity. Enterprises are investing in advanced ITOM technologies to address rising IT complexity, optimize operations, and meet evolving security and compliance requirements.

The adoption of DevOps practices, expansion of IoT, and demand for real-time data analytics are driving the need for ITOM software as organizations strive to streamline operations and enhance decision-making. ITOM solutions help manage the growing complexity of IT environments, ensuring smooth collaboration between development and operations teams while optimizing the performance of connected devices. As businesses adopt multi-cloud and hybrid cloud strategies, ITOM tools are essential for managing diverse infrastructures, improving resource allocation, and enhancing operational coordination. The push for cost optimization further accelerates ITOM adoption, enabling automation, efficient resource utilization, and cost savings.

The rise of edge computing and 5G networks presents new opportunities and challenges, requiring advanced ITOM tools to ensure low latency and high-speed connectivity. AIOps is transforming IT operations by automating tasks such as anomaly detection and predictive maintenance, enhancing operational efficiency. Sustainability efforts are also gaining importance, with organizations adopting ITOM software to monitor energy consumption and reduce carbon footprints in data centers. In addition, the shift to remote work has increased IT complexity, making ITOM software essential for managing remote infrastructures, ensuring business continuity, and enhancing the remote workforce experience.

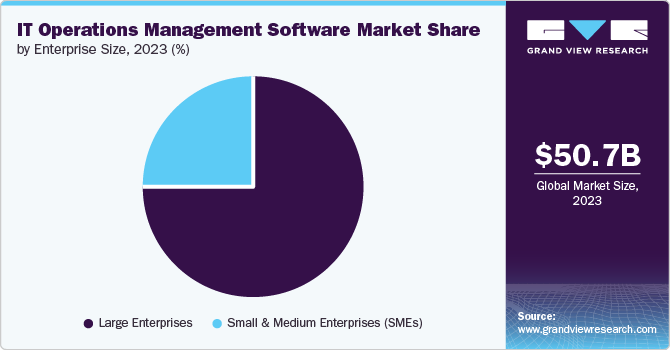

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 75.2% in 2023, due to their extensive and complex IT infrastructures. Their substantial IT budgets enable them to invest in comprehensive ITOM solutions that cover various vital functions such as automation, performance analysis, and experience management. The need for stringent compliance and security, particularly in regulated industries such as BFSI and healthcare, further drives their adoption of robust ITOM tools. In addition, large enterprises require scalable ITOM solutions to manage their extensive operations efficiently and support their digital transformation efforts involving advanced technologies. Their global presence and distributed operations necessitate advanced ITOM software to ensure seamless management and consistent service delivery across multiple regions.

The small & medium enterprises (SMEs) segment is anticipated to grow at a significant CAGR during the forecast period, due to the increased adoption of cloud-based solutions, which offer cost-effectiveness, scalability, and ease of deployment. SMEs benefit from cloud-based ITOM tools by reducing upfront hardware investments and effectively managing their IT operations. Focused on IT efficiency and cost reduction, SMEs use ITOM software for automation and monitoring, leading to operational savings. The availability of scalable and affordable ITOM solutions tailored for SMEs supports their digital transformation and IT modernization efforts.

Vertical Insights

Based on vertical, the IT & telecom segment led the market with the largest revenue share of 22.2% in 2023, due to the complexity of managing extensive IT infrastructures, including data centers, networks, and telecommunications equipment. The sector's high demand for network management, associated with rapid technological advancements such as 5G and edge computing, drives the need for advanced ITOM solutions. Ensuring uninterrupted service delivery and managing a high volume of data and transactions further increases the reliance on ITOM tools for real-time monitoring and performance optimization. Automation and efficiency improvements are essential as IT & telecom companies seek to streamline operations and reduce costs.

The retail & e-commerce segment is anticipated to grow at a significant CAGR during the forecast period, due to rapid digital transformation, with companies increasingly adopting online platforms, mobile apps, and digital payment systems. The rising demand for seamless customer experiences and the growing complexity of e-commerce operations are driving the need for ITOM solutions to ensure high performance, real-time monitoring, and automation. As more consumers shift towards online shopping, ITOM tools play a critical role in preventing downtime and maintaining operational efficiency during peak periods. In addition, retail companies are leveraging ITOM software to automate processes and optimize supply chains, enhancing overall efficiency.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 64.9% in 2023, driven by widespread adoption across industries seeking cost reduction, scalability, and flexibility. Cloud-based ITOM solutions provide the ability to efficiently manage cloud resources, enabling businesses to scale operations without substantial hardware investments. The lower total cost of ownership, combined with a pay-as-you-go model, has made cloud ITOM tools a preferred option for enterprises. The increased need for remote access and management, especially in the hybrid work era, has further fueled demand for these solutions.

The on-premises segment is expected to grow at a significant CAGR during the forecast period, due to persistent data security and privacy concerns, especially in regulated industries such as finance and healthcare. Organizations with legacy infrastructure often prefer on-premises solutions as they can seamlessly integrate with existing systems while maintaining high levels of control and customization. On-premises ITOM tools also offer better performance in latency-sensitive environments, making them ideal for industries requiring real-time processing. Long-term cost-effectiveness, mainly for large enterprises with extensive IT needs further drives demand for on-premises solutions.

Regional Insights

North America dominated the IT operations management (ITOM) software market with the largest revenue share of 40.2% in 2023, driven by the region's strong adoption of advanced technologies such as cloud computing, AI, and big data analytics. The presence of leading ITOM software providers such as IBM Corporation, Microsoft, and ServiceNow has contributed significantly to the region's dominance, as they continually innovate to meet the needs of businesses. The large enterprise base in North America invests heavily in ITOM solutions to manage their complex IT infrastructures, ensuring performance, scalability, and security. Furthermore, the region's well-established cloud infrastructure and widespread adoption of cloud services have fueled demand for ITOM software, especially cloud-based solutions.

U.S. IT Operations Management (ITOM) Software Market Trends

The IT operations management (ITOM) software market in the U.S. is expected to grow at a significant CAGR over the forecast period, due to the presence of major technology hubs like Silicon Valley, Seattle, and Boston, which drive innovation and competitive advancements in ITOM solutions. The expansion of the healthcare industry, fueled by digital initiatives such as electronic health records and telemedicine, increases the demand for ITOM software to manage complex systems and ensure compliance. The financial sector's reliance on ITOM solutions for high-volume transactions, system uptime, and regulatory compliance also drives substantial market growth. In addition, the extensive IT infrastructures of large U.S. enterprises require robust ITOM solutions for efficient management and optimization.

Europe IT Operations Management (ITOM) Software Market Trends

The IT operations management (ITOM) software market in Europe is expected to grow at a significant CAGR during the forecast period, driven by the need to comply with stringent GDPR and local data protection regulations. This leads to increased investments in ITOM solutions for data security and compliance. European initiatives focused on digital sovereignty and local cloud infrastructure have amplified the demand for ITOM tools that support local and hybrid cloud environments. The rise of smart city projects and investments in urban infrastructure are further fueling market growth, as these initiatives require advanced ITOM solutions for managing interconnected systems.

Asia Pacific IT Operations Management (ITOM) Software Market Trends

The IT operations management (ITOM) software market in Asia Pacific is poised to grow at a significant CAGR during the forecast period. In China, substantial investments in technology and infrastructure drive demand for ITOM solutions, while India’s Digital India initiative and Japan’s focus on technological innovation further boost market expansion. South Korea’s smart city projects, Australia’s cloud migration, and Southeast Asia’s growing digital economy also contribute to increased ITOM adoption. Rising cybersecurity threats and robust economic growth across APAC necessitate advanced IT management tools. In addition, government initiatives and the expanding SME sector in the region create ample opportunities for ITOM software vendors.

Key IT Operations Management Software Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in May 2024, SolarWinds Worldwide, LLC, a leading provider of secure, powerful, and user-friendly observability and IT management software, introduced SolarWinds AI to revolutionize IT operations and equip technology experts to handle the complexities of modern digital environments. The generative AI engine was specifically developed using SolarWinds' newly launched AI by Design framework, which focuses on ensuring privacy, security, and reliability in the development of advanced AI technologies.

Key IT Operations Management Software Companies:

The following are the leading companies in the IT operations management software market. These companies collectively hold the largest market share and dictate industry trends.

- BMC Software, Inc.

- Cisco Systems, Inc.

- Elasticsearch B.V.

- Freshworks Inc.

- IBM Corporation

- Microsoft

- ServiceNow

- SolarWinds Worldwide, LLC.

- Splunk Inc.

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In June 2024, Freshworks Inc. announced that it had completed the acquisition of Device42, a company known for providing complete, real-time visibility of assets across an organization’s whole IT infrastructure. This acquisition marks a major advancement in offering more holistic IT solutions, enabling organizations to enhance IT operations and achieve greater business success

-

In May 2023, SoftwareOne AG, a global provider of comprehensive software and cloud technology solutions, announced its agreement to acquire Beniva Consulting Group Inc., a prominent provider of IT and Operations Management (ITOM), ServiceNow, Configuration Management Database (CMDB), Cloud Advisory, and Application Services. This acquisition enhances SoftwareOne AG’s market-leading IT Asset Management (ITAM) services by adding advanced process automation and service management expertise.

-

In March 2023, Hewlett Packard Enterprise Development LP, an American multinational information technology company, entered into a definitive agreement for the acquisition of OpsRamp, LLC, an IT operations management (ITOM) company. The acquisition aims to reduce the operational complexity of multi-cloud and multi-vendor IT environments spanning public cloud, colocation, and on-premises setups.

IT Operations Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 56.34 billion |

|

Revenue forecast in 2030 |

USD 105.09 billion |

|

Growth rate |

CAGR of 10.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Enterprise size, vertical, deployment, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

BMC Software, Inc.; Cisco Systems, Inc.; Elasticsearch B.V.; Freshworks Inc.; IBM Corporation; Microsoft; ServiceNow; SolarWinds Worldwide, LLC.; Splunk Inc.; Zoho Corporation Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IT Operations Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global IT operations management (ITOM) software market report based on enterprise size, vertical, deployment, and region.

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare

-

Retail & E-Commerce

-

IT & Telecom

-

Energy & Utilities

-

Government & Public Sector

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global IT operations management software market size was estimated at USD 50.72 billion in 2023 and is expected to reach USD 56.34 billion in 2024.

b. The global IT operations management software market is expected to grow at a compound annual growth rate of 10.9% from 2024 to 2030 to reach USD 105.09 billion by 2030.

b. North America dominated the market in 2023, accounting for over 40.0% share of the global revenue, driven by the region's strong adoption of advanced technologies such as cloud computing, AI, and big data analytics.

b. Some key players operating in the IT operations management software market include BMC Software, Inc.; Cisco Systems, Inc.; Elasticsearch B.V.; Freshworks Inc.; IBM Corporation; Microsoft; ServiceNow; SolarWinds Worldwide, LLC.; Splunk Inc.; Zoho Corporation Pvt. Ltd

b. Key factors driving the growth of the IT Operations Management (ITOM) software market include the increasing complexity of IT environments and the rising demand for cloud optimization and management.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."