IT Operations Analytics Market Size, Share & Trends Analysis Report By Type, By Application, By Deployment (On-premise, Cloud), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-931-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

IT Operations Analytics Market Trends

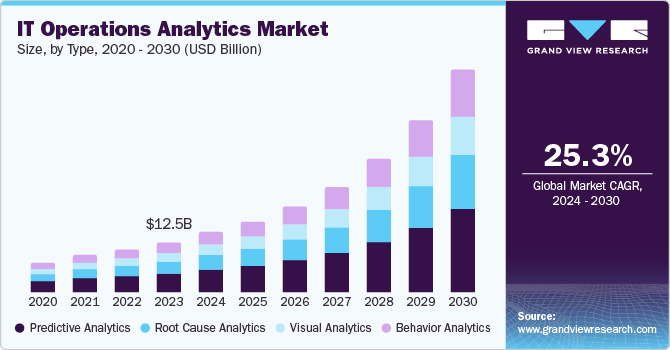

The global IT operations analytics market size was valued at USD 12.52 billion in 2023 and is projected to grow at a CAGR of 25.3% from 2024 to 2030. The rise of digital transformation across industries drives the demand for ITOA. As businesses continue to digitize their operations, there is a critical need for advanced analytics to manage the performance and availability of IT services. ITOA tools facilitate this by offering real-time monitoring, advanced data analytics, and predictive maintenance capabilities, essential for minimizing downtime and enhancing the user experience.

IT operations analytics tools also support the growing trend toward automation in IT operations, allowing for more efficient resource allocation and reducing the reliance on manual processes. This, in turn, leads to cost savings and improved operational agility, making ITOA an essential component of modern IT strategies.

The rise of DevOps and agile methodologies is also fueling the demand for ITOA. As organizations increasingly adopt DevOps practices to accelerate software development and deployment cycles, there is a growing need for tools that provide continuous monitoring and feedback. ITOA plays a crucial role in this ecosystem by offering real-time analytics that helps DevOps teams identify and resolve issues quickly, ensuring that software updates and new features are delivered with minimal disruption. The ability to monitor IT operations throughout the development lifecycle enhances collaboration between development and operations teams, leading to faster and more reliable software delivery.

Furthermore, the growing complexity of cybersecurity threats is a significant driver for ITOA adoption. With the increasing frequency and sophistication of cyberattacks, organizations need advanced tools to detect and respond to threats in real time. ITOA solutions provide comprehensive monitoring and analysis of IT operations, enabling organizations to identify suspicious activities, potential vulnerabilities, and security breaches as they happen. By integrating ITOA with security information and event management (SIEM) systems, businesses can enhance their cybersecurity posture, reducing the risk of data breaches and ensuring compliance with industry regulations.

Additionally, the shift towards edge computing is creating new opportunities for ITOA. As more organizations deploy edge computing solutions to process data closer to its source, the need for effective monitoring and management of these decentralized IT environments has grown. ITOA tools are increasingly being used to monitor the performance and reliability of edge devices and networks, ensuring that data is processed efficiently and securely at the edge. This capability is particularly valuable in manufacturing, healthcare, and retail industries, where edge computing is used to drive innovation and improve operational efficiency.

Type Insights

The predictive analytics segment held the largest market revenue share of 36.4% in 2023. Predictive analytics enables organizations to anticipate potential issues before they escalate into critical problems, reducing downtime and improving overall system reliability. This capability is particularly valuable as businesses increasingly rely on complex IT infrastructures that demand real-time monitoring and rapid response to potential threats. Moreover, with the growth of big data and advanced machine learning algorithms, predictive analytics tools have become more accurate and accessible, driving their adoption across industries.

The behavior analytics segment is expected to grow at the fastest CAGR over the forecast period. Behavior analytics helps identify unusual patterns or deviations in user and system behavior, often early indicators of security breaches or system failures. With the rise in sophisticated cyber threats and the complexity of IT environments, companies are increasingly relying on behavior analytics to detect and respond to potential issues proactively. Additionally, integrating artificial intelligence and machine learning into behavior analytics tools has made them more effective, further driving their adoption across various industries.

Application Insights

The network management segment held the largest market revenue share in 2023. Organizations increasingly rely on robust network management to ensure optimal performance, minimize downtime, and enhance security. With the rise in digital transformation initiatives, the volume of data traffic and the number of connected devices is surging, leading to a heightened need for advanced analytics to monitor, analyze, and optimize network operations. This trend is further fueled by adopting technologies such as IoT, AI, and 5G, which require sophisticated network management tools to handle the increased bandwidth, latency, and security demands, making network management a critical component of IT operations analytics.

The asset performance management segment is projected to grow at the fastest CAGR over the forecast period. The demand for asset performance management (APM) is increasing due to the growing need for organizations to optimize the performance and longevity of their critical assets. As businesses across industries become more reliant on digital infrastructure and advanced technologies, the importance of ensuring that these assets operate efficiently and with minimal downtime has escalated. APM solutions enable companies to monitor, analyze, and predict asset performance, allowing them to implement proactive maintenance strategies and reduce unexpected failures. This predictive capability enhances operational efficiency and results in significant cost savings by preventing costly breakdowns and extending the life of assets.

Deployment Insights

The cloud segment held the largest market revenue share in 2023. Cloud-based IT operations analytics platforms enable organizations to handle vast amounts of data from diverse sources without significant upfront investments in hardware and software. Additionally, the cloud offers enhanced accessibility, allowing teams to monitor and optimize IT operations from any location, critical in today’s increasingly remote and distributed work environments. The integration capabilities with other cloud services and the ability to leverage advanced analytics, such as AI and machine learning, further drive the adoption of cloud deployment in IT operations analytics.

The on-premise segment is projected to witness significant growth in the coming years. Organizations with stringent data security and compliance requirements often prefer on-premise solutions as they offer greater control over data management and privacy. This is particularly important for industries like finance, healthcare, and government, where sensitive information needs to be protected. Additionally, on-premise deployments allow for better customization and integration with existing IT infrastructure, which is crucial for businesses with complex or legacy systems. Moreover, some companies are concerned about the potential risks and costs associated with cloud downtime or vendor lock-in, leading them to favor on-premise solutions that provide more predictable performance and control.

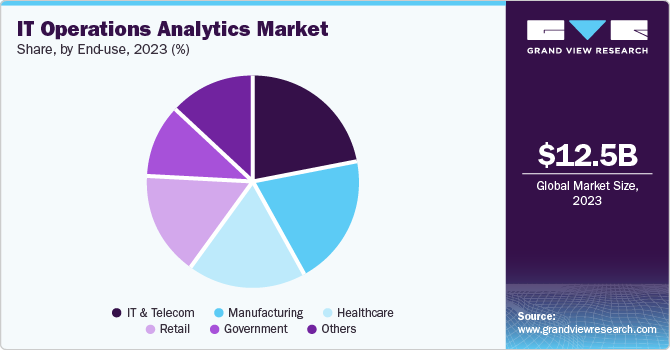

End Use Insights

The IT & telecom segment dominated the market in 2023. With the growing complexity of IT environments, telecommunications companies are increasingly relying on IT operations analytics to monitor network performance, predict and resolve issues before they affect customers, and optimize resource utilization. Additionally, the rise of 5G networks and the ongoing digital transformation across businesses have amplified the need for sophisticated analytics tools to maintain operational efficiency and deliver enhanced customer experiences. As a result, IT operations analytics has become indispensable for IT and telecommunications firms seeking to stay competitive and agile in a rapidly evolving technological landscape.

The government segment is expected to grow at the fastest CAGR over the forecast period. With the ongoing evolution of cyber threats, governments are prioritizing cybersecurity measures to safeguard sensitive information and critical infrastructure. Tools offered by IT operations analytics aid in the real-time detection of anomalies and possible security breaches. This ability is essential for government agencies that manage sensitive information and must adhere to strict rules concerning data security and privacy.

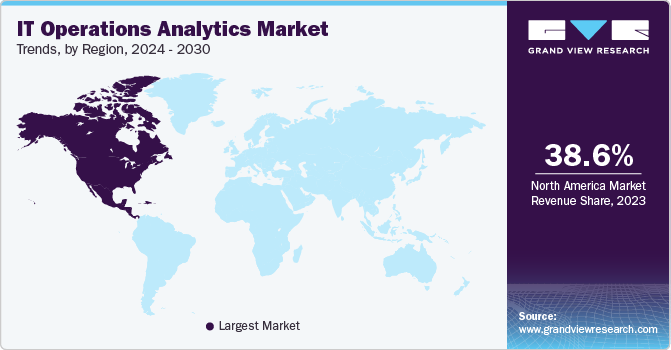

Regional Insights

North America market held the largest market revenue share of 38.6% in 2023. The region's rapid digital transformation and cloud computing adoption drives market growth. Businesses across various sectors increasingly rely on complex IT infrastructures, necessitating advanced analytics to manage and optimize operations. With the proliferation of data-driven decision-making, ITOA provides critical insights that help organizations enhance performance, ensure system reliability, and reduce operational costs. Additionally, the growing emphasis on cybersecurity and the need to proactively monitor and mitigate IT risks are further driving the adoption of ITOA solutions in North America, where regulatory compliance and data protection are top priorities.

U.S. IT Operations Analytics Market Insights

The U.S. held the largest market revenue share regionally in 2023. As a hub for tech innovation and home to numerous large enterprises, the U.S. is heightened in its focus on leveraging analytics to maintain competitive advantage and ensure system reliability amidst the growing complexity of IT infrastructures. This trend is further supported by the increasing emphasis on cybersecurity, where IT Operations analytics play a vital role in identifying and mitigating threats in real time.

Europe IT Operations Analytics Market Insights

Europe IT operations analytics market is expected to grow significantly over the coming years. European organizations prioritize adopting advanced technologies such as cloud computing, AI, and IoT, which generate vast amounts of data that must be efficiently managed and analyzed. IT operations analytics tools help these organizations optimize performance, enhance security, and ensure compliance with stringent data protection regulations such as GDPR. Moreover, the competitive business landscape in Europe is driving companies to leverage analytics to improve operational efficiency, reduce downtime, and deliver better customer experiences, further fueling the demand for IT operations analytics in the region.

The UK market is projected to grow significantly over the forecast period. As the UK economy embraces digital transformation, businesses rely more heavily on complex IT infrastructures to drive operations and innovation. This growing reliance on technology has heightened the need for sophisticated analytics tools to monitor, manage, and optimize IT environments. Moreover, the UK's robust regulatory landscape, particularly with data protection regulations such as GDPR, compels organizations to maintain high IT performance and security levels. ITOA helps companies ensure compliance by providing real-time insights and predictive capabilities that can preemptively address potential issues.

Asia Pacific IT Operations Analytics Market Insights

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The IT industry in the Asia Pacific region has grown rapidly due to emerging economies such as China and India. Increased adoption of cloud computing, IT infrastructure growth, and digitization have created a conducive environment for IT operations analytics solutions. Companies in this region are utilizing IT operation analytics to enhance overall effectiveness, reduce downtime, and gain insights into their IT activities.

India market is projected to grow rapidly over the coming years. The rapid digital transformation across various sectors, including banking, telecommunications, and e-commerce, drives market growth. As Indian enterprises increasingly adopt cloud computing, artificial intelligence, and big data technologies, the complexity of IT infrastructures has grown, necessitating advanced tools to monitor, manage, and optimize these environments. Additionally, the rise of remote work and the need for seamless, uninterrupted IT services have fueled ITOA solutions that provide real-time insights, predictive analytics, and automated responses to potential issues.

Key IT Operations Analytics Company Insights

Some key companies in the ITOA market include BMC Software, Inc.; ExtraHop Networks, Inc.; Glassbeam Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Microsoft; and others.

-

IBM provides a wide range of IT operations analytics solutions that aim to improve IT efficiency and effectiveness. IBM offers Instana for monitoring real-time application performance, Watson AIOps for automating IT operations with AI, and Cloud Pak for Watson AIOps, using machine learning to avoid outages and enhance performance. Furthermore, IBM Tivoli Monitoring and IBM Netcool Operations Insight offer enhanced monitoring and event management features.

-

Microsoft provides a range of IT operations analytics solutions designed to enhance operational efficiency and decision-making. Key offerings include Azure Monitor, which provides full-stack monitoring and advanced analytics for applications and infrastructure, and Azure Log Analytics, which helps collect and analyze data from various sources to gain insights and improve performance.

Key IT Operations Analytics Companies:

The following are the leading companies in the ITOA market. These companies collectively hold the largest market share and dictate industry trends.- BMC Software, Inc.

- ExtraHop Networks, Inc.

- Glassbeam Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft

- Oracle

- SAP SE

- Splunk Inc.

- Broadcom

Recent Developments

-

In July 2024, IBM Consulting announced a partnership with Microsoft to enhance security operations for clients, particularly in managing cloud identity threats. This partnership leverages IBM's cybersecurity services with Microsoft's security technologies, including Microsoft Sentinel and Defender, to modernize security operations and offer real-time threat detection.

-

In November 2023, Hewlett Packard Enterprise (HPE) announced a partnership with NVIDIA to launch a new enterprise-grade solution for generative AI (GenAI). This full-stack offering integrates HPE’s computing capabilities and AI software with NVIDIA’s advanced AI technologies. The collaboration aims to help businesses quickly and efficiently customize AI models using their data, facilitating smoother deployment across diverse environments, from edge to cloud.

IT Operations Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 15.02 billion |

|

Revenue forecast in 2030 |

USD 58.23 billion |

|

Growth Rate |

CAGR of 25.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, deployment, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

BMC Software, Inc.; ExtraHop Networks, Inc.; Glassbeam Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Microsoft; Oracle; SAP SE; Splunk Inc.; Broadcom |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IT Operations Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the IT operations analytics market report based on type, application, deployment, end use, and region.

-

IT Operations Analytics Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Predictive Analytics

-

Visual Analytics

-

Root Cause Analytics

-

Behavior Analytics

-

-

IT Operations Analytics Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asset Performance Management

-

Network Management

-

Security Management

-

Log Management

-

-

IT Operations Analytics Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

IT Operations Analytics Market End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Retail

-

Manufacturing

-

Government

-

IT & Telecom

-

Others

-

-

IT Operations Analytics Market Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."