Isostearic Acid Market Size, Share & Trends Analysis Report By Applications (Personal Care, Chemicals Esters, Lubricant & Greases), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-347-8

- Number of Report Pages: 103

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Isostearic Acid Market Size & Trends

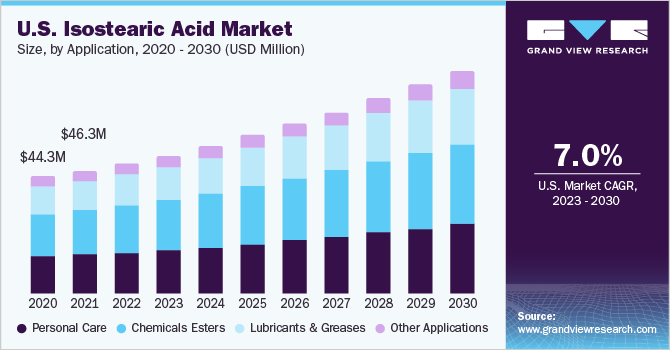

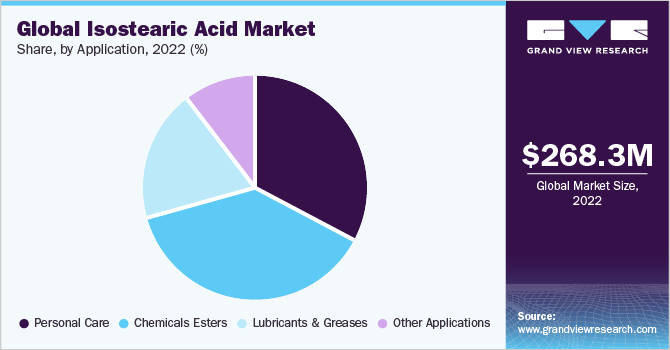

The global isostearic acid market size was valued at USD 268.28 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The increasing demand for cosmetics and personal care products all over the globe especially in Asia Pacific and Europe regions is expected to have a positive impact on the global market. Isostearic acid is widely used in food & beverages, personal care products, pharmaceuticals, cosmetics, industrial cleaners, coatings, and other industries. Companies, including Croda International Plc; Oleon NV; Emery Oleochemicals; Kraton Corporation; and Jarchem Industries, Inc., are the key manufacturers of isostearic acid globally.

The existing technology for isostearic acid involves clay-catalyzed oligomerization of tall oil fatty acids (TOHF). TOHF is majorly used in the production of oleic acid through which the product is manufactured. This existing process involves reactions with small amounts of water performed in a stainless steel reactor at high temperatures of about 180-260ºC and pressure of up to 10 bars. This process does not involve any chemical additives in the reactor and the resultant isostearic acid is 100% derived from parent fat or oil.

An increasing supply of sustainable raw materials in the form of oilseed is expected to increase isostearic acid production. This in turn is expected to provide wide horizons for isostearic acid-based applications and thus increase market penetration. Isostearic is predominately manufactured from oleic acid which is a form of unsaturated acid. Major sources of oleic acid raw material sources include rapeseed oil, soybean oil, safflower oil, sunflower oil, palm oil tall oil, and beef tallow.

Numerous isostearic-based chemical esters such as isostearyl isostearate, isopropyl isostearate, and glycerol monostearate, are preferred as ingredients in personal care products. Isostearic acid is used in personal care product applications such as hair care, skincare, sin-protection creams, and lipsticks. Skin care applications for personal care products dominated the segment over the past few years. Population expansion coupled with the per-capita increase in middle-class disposable income particularly in emerging economies of Asia Pacific and Latin America is expected to drive the market for personal care product applications.

The COVID-19 outbreak led to many uncertainties in the isostearic acid market. The market witnessed a considerable decline in revenue during the initial phase of the pandemic in the year 2020. Rising COVID-19 infection resulted in strict lockdowns across most countries globally. As a result, the manufacturers had to shut their operations for long periods. The market sustained a decline of 4% in the year 2020, however, recorded decent growth in the following year with relaxation in lockdown owing to declining cases of infection across the globe.

Application Insights

The chemical esters application segment dominated the market and accounted for the highest revenue share of 37.92% in 2022. Chemical esters have properties such as pigment adhesion promoters, ingredient solubilizers, enhanced dispersion, quick absorption rates, low residual amount, and plasticizers. These factors help contribute toward chemical esters in personal care and industrial applications.

Chemical esters along with polyhydric alcohols such as glycerol and propylene glycol are utilized as emulsifiers in confections of the oil-in-water type. They also improve the dryness and meltdown stability in ice milk. Some of the chemical esters such as pentaerythritol tetraisostearate can be a component of synthetic greases.

Isostearic acid is used in personal care applications such as cosmetics, skincare, hair care, baby care, liquid soaps, and sun protection creams. Properties such as odor and oxidation stability contribute towards its use for personal care products requiring longer shelf-life. Isostearic acid’s branching structure improves dispersing power for pigment stabilization in cosmetic applications. Its functions in personal care applications include cleansing agents, emollients, and emulsifiers.

Increasing dependency on renewable materials owing to depleting fossil fuel reserves is expected to drive isostearic acid demand for lubricants and greases over the forecast period. Isostearic acid, as the monoamide of N-2 hydroxyethyl 1-1, 2-ethylenediamine is also expected to be a potential gasoline detergent. Isostearic acid forms amide with polyamides which furnish a superior ashless detergent lubricant having pour-point depressant properties.

Regional Insights

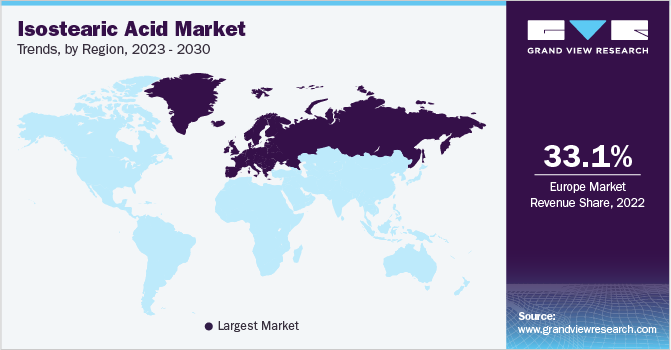

Europe region dominated the market with a revenue share of 33.07% in 2022. This is attributable to the increasing cosmetics demand coupled with the growth of the bio-lubricant industry, which is expected to remain a key driving factor for the regional market growth over the forecast period. Stringent environmental regulations to reduce greenhouse gases (GNG) in the atmosphere are also expected to positively influence market growth. Bio-lubricant-based hydraulic oil is extensively used across various applications in Europe followed by bio-based chainsaw oils.

Asia Pacific captures the revenue share of 28.4% in 2022. Increasing personal care product demand, particularly in emerging economies of China, India, and Indonesia is expected to drive the regional market over the next six years. The personal care segment includes products such as hygiene, skincare, hair care, and cosmetics. Increasing per capita middle-class disposable income coupled with population expansion in countries such as China and India are expected to augment Asia Pacific’s isostearic acid industry growth over the next six years. Increasing consumer awareness regarding health concerns coupled with renewable materials used in products is expected to fuel Asia Pacific isostearic demand over the forecast period.

Increasing bio-lubricant demand coupled with stringent government regulations to reduce carbon footprints in the atmosphere is expected to drive North America isostearic acid demand over the forecast period. North America was the leading bio-lubricant market for the past few years and is expected to continue its dominance over the forecast period. Bio-lubricants are used for applications such as automotive, industrial, process oils, metalworking, and greases.

Key Companies & Market Share Insights

The global isostearic acid industry is highly consolidated with top manufacturers including Croda International and Arizona Chemical accounting for the majority share of the global market. Other key players operating in the market include Oleon NV; Emery Oleochemicals; Nissan Chemicals; and Jarchem Industries, Inc. Some prominent players in the global isostearic acid market include:

-

Croda International Plc

-

KOKYU ALCOHOL KOGYO CO., LTD.

-

Oleon NV

-

Nissan Chemical Corporation

-

Emery Oleochemicals

-

Jarchem Innovative Ingredients LLC

-

KLK EMMERICH GmbH

-

Santa Cruz Biotechnology, Inc.

-

Vantage Specialty Chemicals

-

Foreverest Resources Ltd.

-

SysKem Chemie GmbH

-

KRATON CORPORATION

Isostearic Acid Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 285.60 million |

|

Revenue forecast in 2030 |

USD 458.90 million |

|

Growth Rate |

CAGR of 6.9% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

June 2023 |

|

Quantitative units |

Revenue in USD million, volume in tons, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Singapore; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Croda International Plc; KOKYU ALCOHOL KOGYO CO., LTD.; Oleon NV; Nissan Chemical Corporation; Emery Oleochemicals; Jarchem Innovative Ingredients LLC; KLK EMMERICH GmbH; Santa Cruz Biotechnology, Inc.; Vantage Specialty Chemicals; Foreverest Resources Ltd.; SysKem Chemie GmbH; KRATON CORPORATION |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Isostearic Acid Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global isostearic acid market report based on application, and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Chemicals Esters

-

Lubricants & Greases

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global isostearic acid market size was estimated at USD 268.28 million in 2022 and is expected to reach USD 285.60 million in 2023.

b. The global isostearic acid market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 458.90 million by 2030.

b. Europe dominated the isostearic acid market with a share of 31.86% in 2022. This is attributable to increasing cosmetics demand in Germany, UK, France, and Italy coupled with the growth of the personal care industry in East European countries such as Poland, Russia and Ukraine.

b. Some key players operating in the isostearic acid market include Arizona chemicals, Croda International, Oleon NV, Nissan Chemicals, Jarchem Industries, Inc. and Emery Oleochemicals.

b. Key factors that are driving the isostearic acid market growth include increasing bio-ingredient-based products on account of growing consumer awareness regarding the hazardous nature of petrochemicals-derived products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."