- Home

- »

- Disinfectants & Preservatives

- »

-

Isopropyl Alcohol Market Size, Share, Industry Report, 2033GVR Report cover

![Isopropyl Alcohol Market Size, Share & Trends Report]()

Isopropyl Alcohol Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Antiseptic & Astringent, Cleaning Agent, Solvent, Chemical Intermediate), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-474-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Isopropyl Alcohol Market Summary

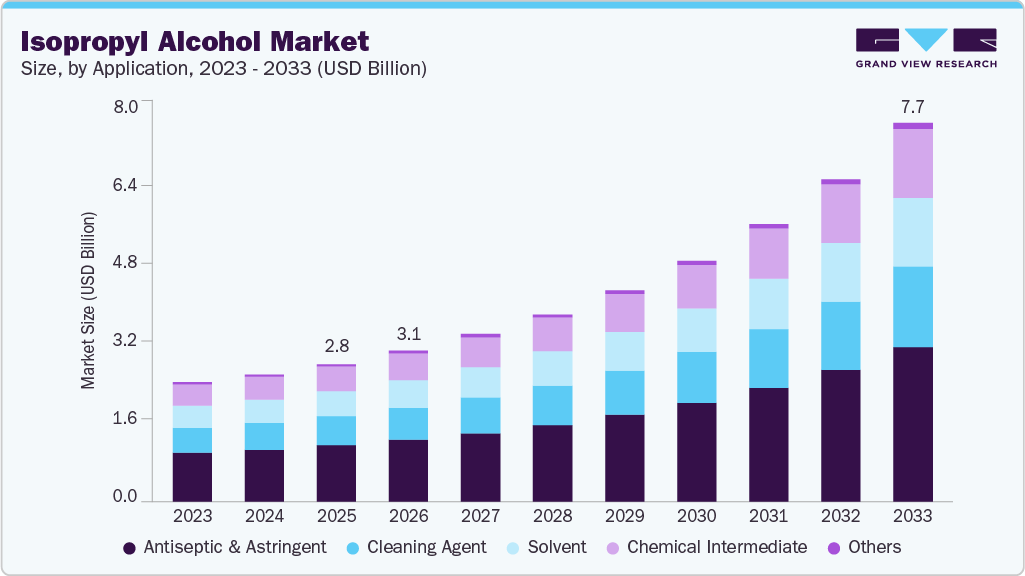

The global isopropyl alcohol market size was estimated at USD 2.78 billion in 2025 and is projected to reach USD 7.65 billion by 2033, growing at a CAGR of 14.1% from 2026 to 2033. The surging demand for cleaning and sanitization products significantly propelled isopropyl alcohol use.

Key Market Trends & Insights

- Asia Pacific dominated the global isopropyl alcohol market with the largest revenue share of 40.4% in 2025.

- The isopropyl alcohol industry in the U.S. is expected to grow at a substantial CAGR of 12.3% from 2026 to 2033.

- By application, the antiseptic and astringent segment led the market with the largest revenue share of 40.8% in 2025.

- By end use, the paints & coatings segment is expected to grow at the fastest CAGR of 14.2% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 2.78 billion

- 2033 Projected Market Size: USD 7.65 billion

- CAGR (2026-2033): 14.1%

- Asia Pacific: Largest Market in 2025

Its widespread use in disinfectants and sanitizers became critical during the COVID-19 pandemic, driving a surge in demand. Moreover, the expansion of the pharmaceutical and healthcare sectors further drives its usage. Isopropyl alcohol is essential for sterilization and the production of medical devices and pharmaceuticals. These combined factors underscore the robust growth and increasing importance of isopropyl alcohol, highlighting its vital role in maintaining hygiene and healthcare standards.

Growth in personal care and cosmetics, and advancements in chemical production, are driving the use of isopropyl alcohol. The escalating demand for products such as hand sanitizers, cosmetics, and personal hygiene items has boosted their use. Innovations in chemical manufacturing processes have also enhanced production efficiency and broadened the applications of isopropyl alcohol. These advancements highlight the essential role of isopropyl alcohol across everyday consumer products and industrial applications, propelling its growth and expanding its market.

Application Insights

The antiseptic and astringent segment led the market with the largest revenue share of 40.8% in 2025, propelled by its widespread use in medical and personal care applications. Isopropyl alcohol is a key ingredient in products such as hand sanitizers, disinfectants, and wound cleaning solutions. Its efficacy in killing bacteria and viruses makes it indispensable in healthcare settings. In addition, its astringent properties make it valuable in skincare and cosmetic products. The strong demand in both medical and consumer markets has driven this segment's growth and dominance within the isopropyl alcohol industry.

The cleaning agent segment is expected to expand rapidly over the forecast period, driven by its essential role in hygiene and sanitation. With increasing awareness about the importance of cleanliness, the demand for cleaning products containing isopropyl alcohol is escalating. This segment is crucial for households, industries, and healthcare settings. As hygiene becomes a top priority globally, the cleaning agent segment's growth is expected to accelerate, notably contributing to the expansion of the market.

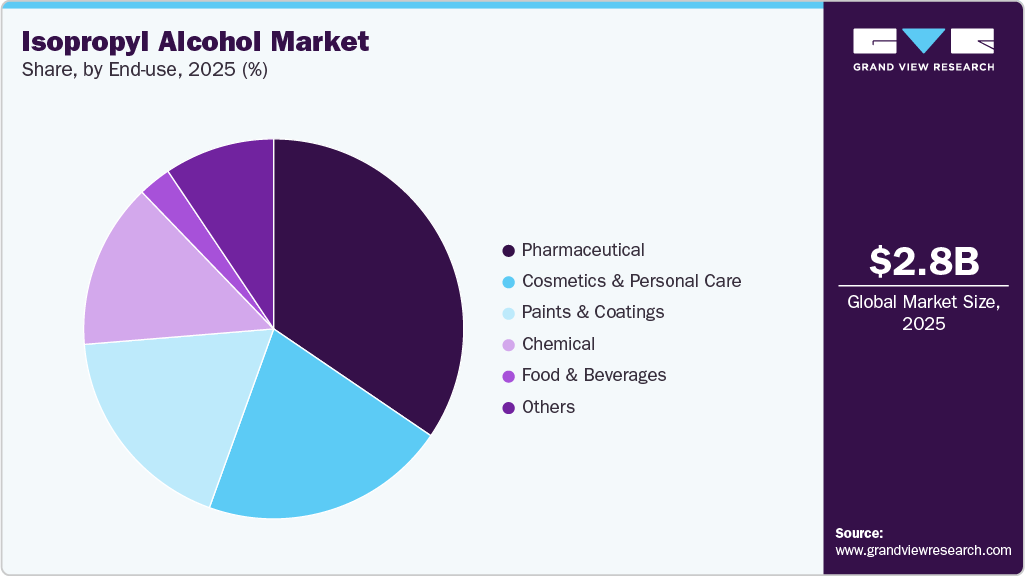

End Use Insights

The pharmaceutical segment led the market with the largest revenue share of 34.5% in 2025, owing to its vital role in healthcare and medical applications. Isopropyl alcohol is essential for sterilization, disinfection, and the production of various pharmaceutical products and medical devices. Its effectiveness in killing bacteria and viruses makes it indispensable in hospitals, clinics, and laboratories. The ongoing advancements in the pharmaceutical industry, coupled with the growing need for stringent hygiene practices, have further reinforced the dominance of this segment, underscoring its crucial role in maintaining health and safety standards.

The paints and coatings segment is anticipated to grow at the fastest CAGR of 14.2% during the forecast period, driven by its key role as a solvent. Isopropyl alcohol ensures optimal application and finishing in various paint and coating formulations. With the growth of the construction and automotive industries, demand for high-quality paints and coatings is surging. Innovations in paint technology and an increased focus on aesthetics and protection are fueling this segment's expansion. The paints and coatings segment is poised for significant growth, underscoring its growing importance in the isopropyl alcohol industry.

Regional Insights

The isopropyl alcohol market in the North America is expected to grow at a significant CAGR of 12.4% from 2026 to 2033, driven by the region's strong industrial base and advancements in healthcare. The region's commitment to hygiene and sanitation is driving increased demand for isopropyl alcohol in pharmaceuticals and personal care products. Burgeoning investments in research and development are enhancing production capabilities. As industries focus on effective disinfection and sanitation solutions, North America is poised for significant expansion in isopropyl alcohol use, underscoring its growing importance in the industry.

U.S. Isopropyl Alcohol Market Trends

The isopropyl alcohol market in the U.S. is expected to grow at a substantial CAGR of 12.3% from 2026 to 2033, due to its advanced healthcare infrastructure and a significant industrial base. High demand from the pharmaceutical and personal care sectors has fueled substantial consumption of isopropyl alcohol. Also, the U.S. has seen continuous innovations in production processes and a strong emphasis on hygiene and sanitation, further boosting demand. Major industries, coupled with increased investments in research and development, have reinforced the U.S.'s leading position, demonstrating its substantial role in this market.

Asia Pacific Isopropyl Alcohol Market Trends

Asia Pacific dominated the global isopropyl alcohol market with the largest revenue share of 40.4% in 2025 and is anticipated to grow at the fastest CAGR of 17.1% during the forecast period, attributed to fast-paced industrialization and urbanization. The region's robust growth in the pharmaceutical, personal care, and healthcare sectors has substantially increased the demand for isopropyl alcohol. Major economies like China, India, and Japan have seen a surge in production and consumption. In addition, the region's key emphasis on hygiene and sanitation, especially in light of recent global health challenges, has further strengthened its dominant position, showcasing its substantial influence in the global market.

The isopropyl alcohol market in China accounted for the largest market revenue share in the Asia Pacific in 2025, attributed toits expansive industrial base and fast-paced urbanization. The country's burgeoning healthcare and pharmaceutical sectors are generating substantial demand for isopropyl alcohol. With an increased emphasis on hygiene and sanitation, its use in personal care products is escalating. Continuous investments in research and development are enhancing production capabilities. China's focus on innovation and maintaining high-quality standards is expected to drive significant growth in the use of isopropyl alcohol.

Europe Isopropyl Alcohol Market Trends

The isopropyl alcohol market in Europe accounted for a remarkable share in 2025, driven by the region’s advanced industrial and healthcare sectors. Stringent hygiene standards and high demand for pharmaceutical, personal care, and sanitization products have fueled significant consumption. Key economies like Germany, France, and the UK contribute substantially through continuous innovations and robust production capacities. Europe's dedication to quality and safety regulations has further reinforced its leading position, underscoring its critical role in the industry. The region's strategic focus and resources have made it a substantial contributor to the isopropyl alcohol industry.

The Germany isopropyl alcohol market is projected to establish a notable presence by 2030, fueled by its strong industrial base and technological advancements. The country's focus on high-quality manufacturing processes and hygiene standards is boosting demand for isopropyl alcohol in pharmaceuticals and personal care products. With significant investments in research and development, Germany is enhancing its production capabilities. The nation's growing emphasis on effective disinfection and sanitization solutions positions it for substantial growth, marking its emerging importance in the isopropyl alcohol industry.

Latin America Isopropyl Alcohol Market Trends

The isopropyl alcohol market in Latin America is driven by steady demand from pharmaceuticals, personal care, industrial cleaning, and coatings applications. Countries such as Brazil and Mexico account for the majority of regional consumption due to their established manufacturing bases. Market growth is supported by rising use of IPA as a solvent and disinfectant, although demand remains sensitive to economic cycles. Limited local production capacity results in dependence on imports, which in turn influences price volatility across the region.

Middle East & Africa Isopropyl Alcohol Market Trends

The isopropyl alcohol market in the Middle East & Africa is relatively small but is growing gradually, supported by rising consumption in pharmaceuticals, healthcare, and industrial cleaning applications. The Middle East benefits from downstream petrochemical integration, while Africa’s demand is driven by expanding healthcare infrastructure and sanitation initiatives. Import reliance remains high in several African countries, impacting supply consistency. Overall, the market shows moderate growth potential tied to industrialization and healthcare development.

Key Isopropyl Alcohol Company Insights

Some of the key companies in the isopropyl alcohol industry include Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, ExxonMobil Corporation, and others.

-

Dow Chemical offers a wide range of innovative materials science solutions across various industries. Their products include performance materials, industrial intermediates, and plastics.

-

Ecolab provides comprehensive, science-based solutions to help customers in over 170 countries maintain clean and safe environments, advance food safety, and optimize water conservation and energy use.

Key Isopropyl Alcohol Companies:

The following key companies have been profiled for this study on the isopropyl alcohol market.

- Dow Chemical

- Mistral Industrial Chemicals

- INEOS Corporation

- ReAgent Chemicals Ltd.

- LyondellBasell Industries

- Linde Gas

- Ecolab

- Royal Dutch Shell

- ExxonMobil Corporation

Recent Developments

-

In August 2024,Eastman introduced a new electronic-grade solvent for superior quality. The electronic-grade isopropyl alcohol (IPA), part of the EastaPure line, provides U.S. semiconductor manufacturers with a reliable and domestically made solvent.

-

In June 2024, Cepsa began constructing Spain's first isopropyl alcohol (IPA) plant, diversifying its chemicals business. The new plant will produce IPA for use in hydroalcoholic gels and household and industrial cleaning products.

Isopropyl Alcohol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.05 billion

Revenue forecast in 2033

USD 7.65 billion

Growth Rate

CAGR of 14.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Netherlands; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; and South Africa

Key companies profiled

Dow Chemical; Mistral Industrial Chemicals; INEOS Corporation; ReAgent Chemicals Ltd.; LyondellBasell Industries; Linde Gas; Ecolab; Royal Dutch Shell; ExxonMobil Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Isopropyl Alcohol Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends across sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global isopropyl alcohol market report based on application, end use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Antiseptic & Astringent

-

Cleaning Agent

-

Solvent

-

Chemical Intermediate

-

Other

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Cosmetics & Personal Care

-

Pharmaceutical

-

Food and Beverages

-

Paints and Coatings

-

Chemical

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global isopropyl alcohol market size was estimated at USD 2.78 billion in 2025 and is expected to reach USD 3.05 billion in 2026.

b. The global isopropyl alcohol market is expected to grow at a compound annual growth rate of 14.1% from 2026 to 2033 to reach USD 7.65 million by 2033.

b. Asia Pacific secured the largest market share of 40.4% in 2025, attributed to fast-paced industrialization and urbanization. The region's robust growth in the pharmaceutical, personal care, and healthcare sectors has substantially increased the demand for isopropyl alcohol.

b. Some key players operating in the isopropyl alcohol market include Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, and ExxonMobil Corporation

b. The surging demand for cleaning and sanitization products significantly propelled isopropyl alcohol use. Its widespread application in disinfectants and sanitizers became critical during the COVID-19 pandemic, leading to a surge in demand. Moreover, the expansion of the pharmaceutical and healthcare sectors further drives its usage. Isopropyl alcohol is essential for sterilization and the production of medical devices and pharmaceuticals

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.