- Home

- »

- Organic Chemicals

- »

-

Isophorone Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Isophorone Market Size, Share & Trends Report]()

Isophorone Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Paints And Coatings, Printing Inks, Artificial Leather & Adhesives), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-389-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Isophorone Market Summary

The global isophorone market was estimated at USD 1.36 billion in 2023 and is projected to reach USD 1.92 billion by 2030, growing at a CAGR of 5.1% from 2024 to 2030. In adhesive formulations, the product serves as a hardening agent.

Key Market Trends & Insights

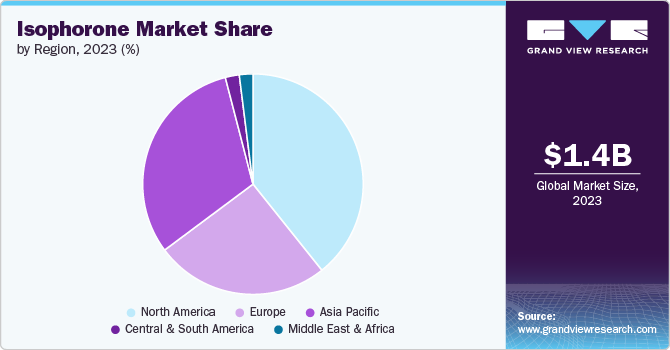

- North America isophorone market dominated the market segment with a revenue share of 39.3% in 2023.

- The isophorone market in the Asia Pacific held the second-largest share and was valued at USD 424.7 million in 2023.

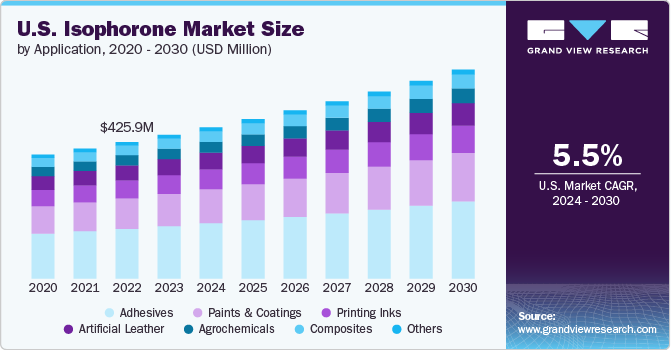

- By application, adhesives segment dominated the market with a revenue share of 35.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.36 Billion

- 2030 Projected Market Size: USD 1.92 Billion

- CAGR (2024-2030): 5.1%

- North America: Largest market in 2023

Adhesives are employed in various end-user applications, such as polyvinyl chloride, plastics, polystyrene, etc. Rising demand for this application is further expected to increase the product demand globally.

The product market is also driven by its increasing significance in printing inks and artificial leather due to its excellent solvency and chemical stability. In printing inks, the product acts as a solvent that efficiently dissolves various resins and pigments ensuring sooth ink formation. Whereas, during the production of artificial leather the product is used to impart desired texture, flexibility and durability.

Isophorone is an unsaturated colorless to yellowish cyclic ketone with a characteristic smell. It is used as a solvent and an intermediate in organic synthesis. The product also occurs naturally in cranberries,

The product is used as an intermediate in manufacturing polyurethane field compounds, mainly isophorone diamine and isophorone diisocyanate. It is also used as a chemical intermediate and ingredient in wood preservatives and floor sealants. In addition, the product is used in formulating pesticides and herbicides as an inert ingredient.

Application Insights

Adhesives application dominated the market with a revenue share of 35.7% in 2023 owing to its wide product usage in the formulation of adhesives. The product increases the wetting and adhesion properties of adhesive and helps in creating a strong bond between adhesive and substrate. Moreover, the product has a good solvency for a variety of resins including vinyl, polyurethanes, epoxy and acrylic resins. This makes it effective in dissolving and dispersion of the resins resulting in adhesives with improved performance.

In some of the adhesives the product is used as a plasticizer, enhancing the flexibility and durability of the adhesive film. This is particularly useful in applications where the adhesive needs to withstand mechanical stress or environmental changes. In addition, the adhesives formulated using the product exhibit good thermal stability.

Regional Insights

North America isophorone market dominated the market segment with a revenue share of 39.3% in 2023, owing to rapidly growing end use industries in the region including paints & coatings and adhesives. The growing construction industry in the region is the major driver for the paints and adhesive markets.

The construction industry in North America is expected to witness significant growth over the coming years owing to high demand for non-residential construction projects which, in turn, is expected to boost the demand for architectural and decorative paints and coatings in the region over the forecast period.

National policies promoting the recovery of the housing sector are expected to positively impact future construction trends. Reconstruction activities in the U.S. coupled with infrastructure development in Canada and Mexico as a result of rapid industrialization are expected to provide immense market potential in North America over the forecast period

As per U.S. Census Bureau, construction spending in the U.S. increased every year from 2018 to 2023. This trend is anticipated to continue over the forecast period as well owing to several factors contributing to it, including the rising number of infrastructure development projects in the country that is spurred by new import tariffs and ongoing smart city developments. Additionally, the stable economic conditions, and robust financial sector in the U.S. are expected to further contribute to the growth of the construction industry in the country. This, in turn, is anticipated to drive the substantial demand for paints & coatings and adhesives in the U.S. in the coming years which in turn will fuel the product demand in the country.

Asia Pacific Isophorone Market Trends

The isophorone market in the Asia Pacific held the second-largest share and was valued at USD 424.7 million in 2023. This is mainly attributed to robust product adoption in adhesive and paint & coating companies in China and India. For instance, the 2023 paint and coatings market in Asia Pacific was estimated to be USD 88 billion wherein decorative paints and coatings accounted for 38.7% of the market as per coatings world, further bolstering the product demand. India has overtaken Japan as Asia's second-largest market for paints and coatings. Moreover, it stands out globally as the fastest-growing major market in this industry. According to Coatings World, both the decorative and industrial coatings sectors within India are experiencing rapid expansion.

China is the largest geographic sub-region of the Asia Pacific coatings market accounting for 55% of the region’s total revenue share. Japan & Korea is the next largest region at 15% (Japan is an estimated 10% of the market and South Korea is 5% of the market).

Europe Isophorone Market Trends

Europe isophorone marketis poised for significant growth, driven by the growing automotive industry in the region. The paints and adhesives are extensively used in the automotive industry which further drives the product market growth. According to Autobei Consulting Group, Germany dominates the automotive market in Europe with 41 engine production plants in 2023, and assembly that contribute to one-third of the total automobile production in the region

Key Isophorone Company Insights

Some of the key players operating in the market include BASF SE, Arkema Group, Covestro AG, Evonik Industries, and Jiangsu Huanxin High Tech Materials Co. Ltd.

-

BASF SE, a Germany-based chemicals manufacturing company, holds a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments namely: industrial solutions, chemicals, surface technologies, materials, nutrition & care, agricultural solutions.

-

Evonik Industries AG is a prominent specialty chemicals company headquartered in Germany. Evonik specializes in producing a wide range of specialty chemicals that enhance the performance of everyday products, including tires, mattresses, medications, and animal feeds. Evonik has a significant focus on isophorone chemistry, which plays a crucial role in various applications, including coatings, adhesives, and plastics.

Key Isophorone Companies:

The following are the leading companies in the isophorone market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema Group

- CHAIN FONG

- Evonik Industries

- Jiangsu Huanxin High Tech Materials Co. Ltd

- Prasol Chemicals Pvt Ltd

- SI Group Inc.

- BASF SE

- Covestro AG

- Krasiklal

- DHALOP CHEMICALS

- Indian Organic Corporation

Recent Developments

-

In January 2024, Evonik Crosslinkers production site in North America receives ISCC PLUS sustainability certification for the production of renewable isophorone

-

In January 2022, Brenntag Specialties and BASF expand collaboration as Brenntag becomes exclusive distributor in the United States and Canada for BASF’s Polyetheramines and Baxxodur portfolio which includes isophorone

Isophorone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.43 billion

Revenue forecast in 2030

USD 1.92 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Australia, Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Arkema Group; CHAIN FONG; Evonik Industries

Jiangsu Huanxin High Tech Materials Co. Ltd; Prasol Chemicals Pvt Ltd; SI Group Inc. ; BASF SE ; Covestro AG ; Krasiklal; DHALOP CHEMICALS ; Indian Organic Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Isophorone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global isophorone market report based on application & region.

-

Application Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Paints and Coatings

-

Printing Inks

-

Artificial Leather

-

Adhesives

-

Agrochemicals

-

Composites

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global isophorone market size was estimated at USD 1.36 billion in 2023 and is expected to reach USD 1.43 billion in 2024.

b. The global isophorone market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 1.92 billion by 2030.

b. North America dominated the market segment with a revenue share of 39.3% in 2023, owing to rapidly growing end use industries in the region including paints & coatings and adhesives.

b. Some key players operating in the isophorone market include Arkema Group , CHAIN FONG , Evonik Industries, Jiangsu Huanxin High Tech Materials Co. Ltd , Prasol Chemicals Pvt Ltd ,SI Group Inc. , BASF SE , Covestro AG , Krasiklal, DHALOP CHEMICALS , Indian Organic Corporation

b. Key factors that are driving the market growth include owing to its rising demand in the formulation of adhesives. In adhesive formulations, the product serves as a hardening agent. Adhesives are employed in various end-user applications, such as polyvinyl chloride, plastics, polystyrene, etc. Rising demand for this application is further expected to increase the product demand globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.