- Home

- »

- Petrochemicals

- »

-

Isobutene Market Size, Share & Trends Analysis Report 2030GVR Report cover

![Isobutene Market Size, Share & Trends Report]()

Isobutene Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Methyl Tert-butyl Ether, Ethyl Tert-butyl Ether), By Application (Automotive, Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-174-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Isobutene Market Size & Trends

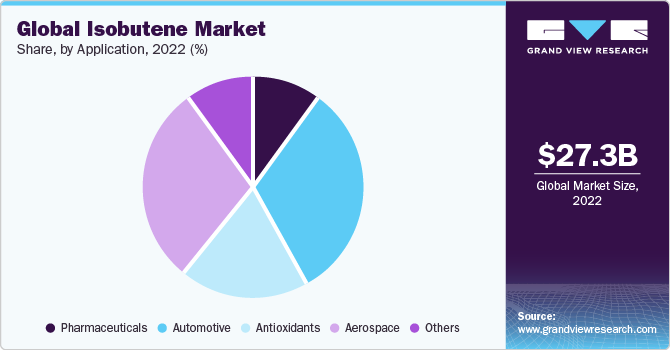

The global isobutene market size was valued at USD 27.3 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. High product demand from end-use industries such as automotive and aerospace is expected to drive the industry over the forecast period. The chemical is widely used in rubber tires and tubes and as a fuel additive in aerospace applications. Isobutene or isobutylene is majorly utilized for the production of polybutylene (butyl rubber) and as an intermediate for manufacturing methyl tert-butyl ether. These products are widely utilized in plastic packaging, hot melt adhesives, compounding, and masterbatches, as well as niche areas such as electrical insulation, compression packaging, and wires and cables.

As a hydrocarbon of industrial importance, the chemical’s wide application scope ranges across industries, including automotive, aerospace, and pharmaceutical. It is produced during the fractionation of refinery gases and using catalytic cracking of methyl tert-butyl ether. The global market is expected to witness strong growth due to its use in numerous applications, ranging from fuel additives and polymers to agriculture industries. Bio-based alternatives are overcoming sustainability issues associated with isobutene and its derivatives in the market. Various governments are fostering these developments by providing incentives and tax benefits for the renewable production of isobutene.

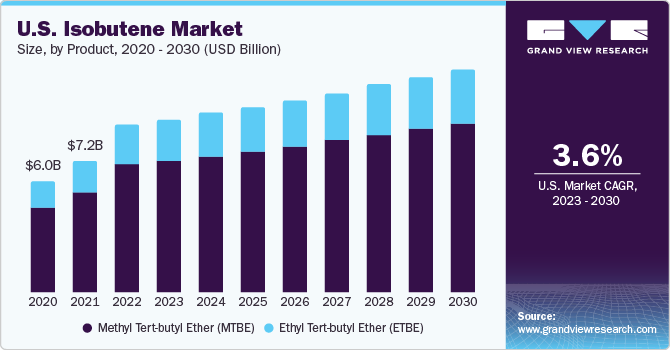

Product Insights

The methyl tert-butyl ether (MTBE) segment accounted for the largest revenue share of 78.9% in 2022 and is expected to advance at the fastest CAGR of 4.6% during the forecast period. The product has a wide application scope in end-use industries such as automotive and aerospace. The product is refined to manufacture butyl rubber by polymerization of isobutylene and isoprene. Butyl rubber is used extensively in the automotive and pharmaceutical industries.

Ethyl tert-butyl ether (ETBE) is primarily a biofuel derived from isobutylene and ethanol. It has high octane content, as well as low vapor pressure and boiling point, making it a favorable component in petrol blending. This enables refiners to meet octane content and bio-component requirements. Its usage also allows companies to meet environmental standards and adjust to changes in gasoline trade dynamics. This is done using chemicals to upgrade naphtha to petrol or to improve lower octane grades to higher ones.

The rising global demand for higher quality gasoline, owing to numerous reasons such as growing awareness regarding improvement in vehicle performance and stringent regulatory norms mandating consumers to use environment-friendly fuel is expected to drive the demand for ETBE over the forecast period.

Application Insights

The automotive segment accounted for the largest revenue share of 32.5% in 2022. Elastomers based on isobutylene exhibit properties unique to automotive applications. These include minimal permeability in gases and liquids, chemical resistance, and superior damping. These elastomers, when halogenated, improvise in their thermal performance as well.

Brominated isobutylene-co-para-methylstyrene exhibits similar properties, but also has inherent ozone resistance. These properties give the material a distinct advantage in automotive applications, which include dynamic parts, hoses, and inner liners of tires. Furthermore, its chemical properties have been a major factor in its extensive usage as an anti-knocking agent in automotive fuel.

The aerospace segment is expected to expand at the fastest CAGR of 4.6% during the forecast period. Isobutene, on alkylation with butane, produces isooctane, which is extensively used as a fuel additive in aviation fuel. The civil aviation industry, in particular, is witnessing significant expansion due to factors such as liberalization in trade activities, declining fares, opening up of economies for foreign direct investment, and advancements in information technology.

Aircraft engine manufacturers recommend certain types of oil for use in different application areas, such as engine usage, engine design, climate, and location. The growing importance of regional connectivity, along with rapid urbanization, has supported the growth of the aviation industry over the past couple of decades.

Regional Insights

North America dominated the global isobutene market and accounted for the largest revenue share of 41.3% in 2022. The strong contribution of North America to this industry is owing to a higher spending on passenger cars and light vehicles, increasing per capita disposable income, and a strong and sustained manufacturing sector growth in the region in recent years.

On the other hand, the Asia Pacific region is expected to expand at the fastest CAGR of 5.2% during the forecast period. A significant contribution from Southeast Asian countries such as Thailand, Malaysia, and Vietnam is expected to further drive the regional market. Emerging countries in the region are making efforts to rapidly develop their automobile sector. Governments in these nations are continuously focusing on trade liberalization programs and policy frameworks.

Key Companies & Market Share Insights

Major companies are integrated along the value chain to provide raw materials, as well as supply other products manufactured from isobutene to other end-use industries. Not only do these companies gain an edge over their competitors in terms of raw material availability, but they are also able to maintain direct contact with end-users. Some prominent players in the global isobutene market include:

-

BASF

-

Evonik

-

ExxonMobil

-

ABI Chemicals

-

Global Bioenergies

-

Praxair

-

Syngip BV

-

LanzaTech

-

Honeywell International

-

LyondellBasell Industries

Recent Developments

-

In July 2023, Exxon Mobil Corporation announced the acquisition of Denbury Inc. With this acquisition, ExxonMobil now operates the largest carbon dioxide (C02) pipeline network in the U.S.

-

In June 2023, Axens signed a licensing alliance agreement with ExxonMobil Catalysts and Licencing LLC, which allows Axens to incorporate ExxonMobil's MTBE Decomposition technology for high-purity isobutylene in its portfolio. Axens has been granted the worldwide right to market, license, and offer engineering work and technical assistance for the design, construction, and startup of additional MTBE Decomposition units

-

In June 2022, Global Bioenergies received its first order from Shell to conduct tests on bio-isobutene derivatives. The product has a wide range of applications, from cosmetics and fine chemicals to commodities and fuels

-

In March 2021, BASF and OMV developed and began operations of the ISO C4 plant for the direct manufacturing of high-purity isobutene. The plant's novel production technology claims to offer remarkable energy efficiency, saving 20,000 metric tons of CO2 emissions

Isobutene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 28.4 billion

Revenue forecast in 2030

USD 38.4 billion

Growth Rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America (CSA); MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Netherlands; China; Japan; India; South Korea; South East Asia; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

BASF; Evonik; ExxonMobil; ABI Chemicals; Global Bioenergies; Praxair; Syngip BV; LanzaTech; Honeywell International; LyondellBasell Industries

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

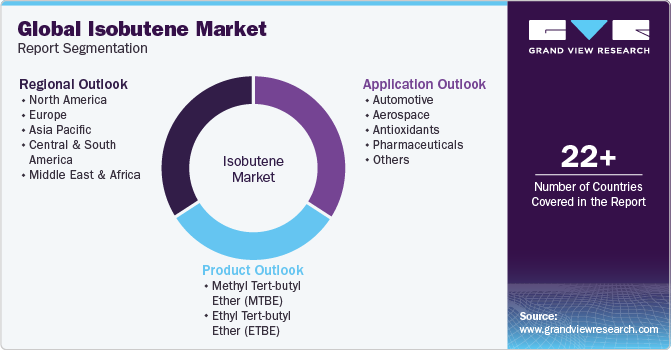

Global Isobutene Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global isobutene market report based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Methyl tert-butyl ether (MTBE)

-

Ethyl tert-butyl ether (ETBE)

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Antioxidants

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

South East Asia

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global isobutene market size was estimated at USD 27.3 billion in 2022 and is expected to reach USD 28.4 billion in 2023.

b. The global isobutene market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 38.4 billion by 2030.

b. Asia Pacific dominated the isobutene market with a share of 41.31% in 2022. This is attributable to increasing per capita disposable income, coupled with strong manufacturing sector growth in the region.

b. Some key players operating in the isobutene market include BASF, Evonik, ExxonMobil, ABI Chemicals, Global Bioenergies, Praxair, Syngip BV, LanzaTech, Honeywell International, and LyondellBasell Industries.

b. Key factors that are driving the market growth include high demand for manufacturing of rubber tires & tubes and as a fuel additive in automotive & aerospace industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.