Irrigation Automation Market Size, Share & Trends Analysis Report By Automation, By Component, By Irrigation, By Application (Agricultural, Non-Agricultural), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-153-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Irrigation Automation Market Size & Trends

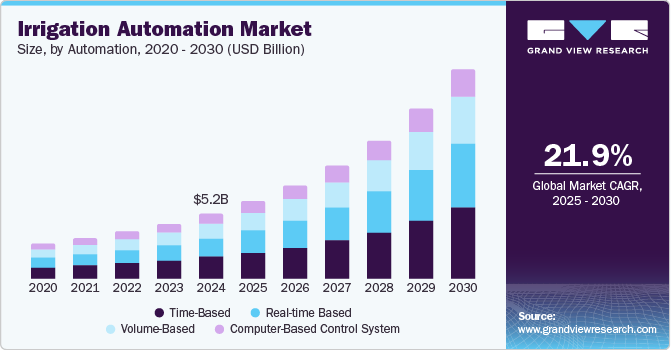

The global irrigation automation market was valued at USD 5.22 billion in 2024 and is projected to grow at a CAGR of 21.9% from 2025 to 2030. Increasing adoption of advanced technologies in the agriculture sector, growing demand for fresh produce, and enhanced availability and accessibility to information regarding irrigation automation applications are adding to the growth.

A significant increase in government support for embracing technological advancements, automation, and enhanced agricultural processes has driven the growth of this market. Increasing awareness regarding water conversation, rising water scarcity in multiple countries, and development in the availability of smart irrigation systems are also contributing to the growth.

Labor, energy, and other costs associated with agricultural processes have grown significantly in recent years. This has stimulated farmers and large-scale operators in the industry to seek cost-effective technology solutions such as irrigation automation. The emergence of modern technologies and new product launches by companies operating in the digital agriculture solutions industry has also resulted in growth opportunities for this market.

For instance, in November 2024, CropX Inc., one of the participants in the agriculture technology market, launched a newly developed sensor technology that monitors real-time plant water utilization. Using evapotranspiration (ET) and features of the agronomic farm management system offered by CropX, the technology provides unique insights to users regarding water use, the need for water by crops, and more. This is expected to assist users in developing data-based irrigation schedules and monitoring the process remotely while enhancing water efficiency.

Adopting various irrigation types, such as sprinklers, drip, and surface irrigation, has helped farmers worldwide. Additionally, smart irrigation systems and irrigation automation technology are widely used by non-agricultural users, such as sports facilities, golf courses, residential estates, and more. To maintain the quality of grass and ground areas, facility management bodies use automated irrigation system, as it offers improved performances and reduced costs while ensuring maximized efficiency.

Automation Insights

The time-based irrigation segment dominated the global irrigation automation industry with a revenue share of 33.8% in 2024. This technology uses a pre-determined schedule to water crops across the field. The process is driven by the required volume of water, average flow rate, and delivery time. The timer of these systems automatically starts and stops based on these parameters. Farmers with large lands and those cultivating consistent crops with certain and estimated water requirements prefer time-based irrigation automation systems. Cost-effectiveness, ease of use for large-scale operations, and enhanced availability have attracted multiple non-agriculture industry users to this segment.

The real-time-based segment is expected to experience the highest CAGR during the forecast period. This is attributed to the increasing availability of technology solutions that feature real-time analytics and remote monitoring in irrigation automation. For instance, in November 2024, Christensen Irrigation (S) Pte. Ltd, known as Cisgenics, launched CisgenX, its flagship product in the international market. The product utilizes Internet of Things (IoT) technology, sensors, and machine learning features to generate real-time data analysis to ensure improved water management. Users usually embrace real-time-based systems in areas where severe water scarcity or unusual climate changes are recorded. Farmers prefer real-time-based systems to respond quickly to changes and unexpected environments.

Component Insights

The controllers segment held the largest revenue share of the global irrigation automation industry in 2024. A controller is a device that uses programmed information sets to turn the irrigation process on and off. Smart irrigation controllers and internet-driven devices have become widely available in the market. Multiple companies are launching software-controlled irrigation systems and mobile applications, adding to the growth. The ubiquity of smartphones, enhanced internet availability, and accessibility to high-speed connections are anticipated to generate growth in demand. Portfolio expansions by various market participants are expected to add growth. For instance, in July 2024, Mobitech Wireless Solution Private Limited launched Dcon Ag AIR, a newly developed controller for irrigation systems and motors. This series of products is expected to assist farmers in remote monitoring irrigation systems and provide real-time soil moisture data and other insights.

The sensors segment is projected to experience the fastest growth during the forecast period. This is attributed to the increasing adoption of technology-driven irrigation systems controlled with software-based systems or smart devices requiring sensors as key components. The irrigation automation systems use sensors to sense temperature differences, collect water use and requirements data, and assist in remote monitoring. This includes a variety of sensors such as soil humidity sensors, light intensity sensors, wireless sensors, temperature sensors, and others. New launches by numerous companies are adding to the growth opportunities. For instance, in October 2024, Centro Tecnológico, a participant in the irrigation automation technology industry, launched smart sensor technology, which assists in optimizing the coverage of irrigation ponds.

Irrigation Insights

The drip irrigation segment dominated the global irrigation automation industry in 2024. This segment's growth is primarily influenced by the benefits offered by drip irrigation, including higher water efficiency, suitability in areas where water scarcity and resource crunch are at their peak, and reduced labor requirements. The availability of advanced systems and software-driven technology-based products adds to the growing adoption.

The sprinkler irrigation segment is expected to experience significant growth over the forecast period. This method is extensively used where water and energy are available in desired quantities without frequent interruptions. Non-agricultural users, such as large football or cricket grounds, golf courses, and residential estates, also use smart sprinkler irrigation systems.

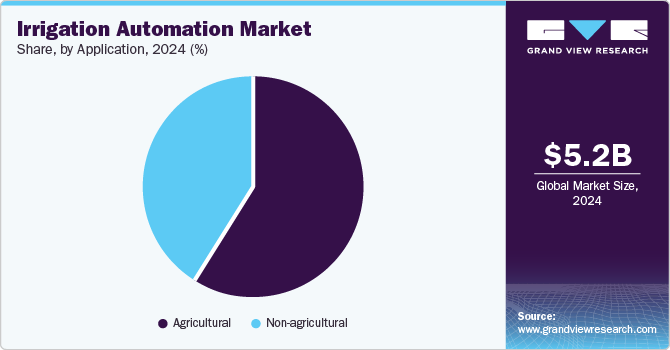

Application Insights

The agricultural segment held the largest revenue share of the global irrigation automation industry in 2024. This is attributed to the increasing focus of farmers operating larger lands compared to average farming lands on cost reduction, technology adoption, and water efficiency. Automated irrigation systems have been adding technology assistance in scheduling, water management, soil moisture measurements, data analysis, and more. These aspects are expected to generate greater demand for irrigation automation solutions in the forecast period. Significant growth in costs associated with irrigation, labor, energy, and transportation, as well as challenges experienced by farmers in gaining suitable prices for the produce in markets, have resulted in a rising focus on cost reductions.

The non-agricultural segment is projected to experience the highest CAGR during the forecast period. This is attributed to factors such as increasing utilization by non-agricultural users such as sports stadiums, grounds, local authorities, facility management companies, golf courses, race courses, and residential users. Primarily, these users deploy sprinkler irrigation systems equipped with technology assistance and remote monitoring capabilities.

Regional Insights

Asia Pacific dominated the global irrigation automation market with a revenue share of 28.9% in 2024. Countries such as China, Australia, and others, with a strong agriculture industry, higher technology adoption, and increasing participation in the global trade of various crops and finished goods based on the agriculture industry, contribute to this dominance. Many farmers with large-scale operations, entry of corporate businesses in contract farming, used by the region's food & beverages industry-owned farms, and enhanced availability driven by technology advancements are expected to add lucrative growth opportunities.

China Irrigation Automation Market Trends

China held the largest revenue share of the regional industry in 2024. China is one of the top producers of multiple agricultural products, such as cereals, fruits, vegetables, cotton, rice, and more. Significant increase in government support, a large number of collaborations and tie-ups with other countries and global businesses, and a series of agricultural reforms implemented in the country are primarily driving the growth of the irrigation automation market in China.

North America Irrigation Automation Market Trends

North America irrigation automation market held noteworthy revenue share of the global industry in 2024. This market is primarily influenced by factors such as robust engineering, technology, and innovation industries operating in the region and increasing demand for grain driven by the growing population and immigration. In recent years, multiple companies operating in the area have launched products and solutions associated with irrigation automation. The presence of numerous sports facilities and a large number of sports events hosted in the region also contribute to the growth opportunities for this market.

The U.S. dominated the regional irrigation automation market in 2024. The increasing availability of technology and the presence of multiple manufacturers in the country mainly drive this market. According to the USDA Census of Agriculture, 2022, 1.9 million farms are operated by families, family corporations, family partnerships, and individual owners in the rural parts of America. Notable increases in costs, the focus of multiple farmers on cost reductions, and the ease of use and convenience offered by the solutions are expected to generate a surge in utilization for this market.

Europe Irrigation Automation Market Trends

Europe irrigation automation market is expected to experience noteworthy growth during the forecast period. According to the European Environment Agency, agriculture areas comprising pastures, mosaic farmlands, and arable lands account for nearly 39% of the total EU’s land. Organic farming is growing at a rapid rate in the region. These factors are expected to generate greater demand for irrigation automation systems. Increasing focus on performance enhancements, cost reductions, and technology adoption are likely to develop growth for this market during the forecast period.

The UK held the largest revenue share of the regional industry in 2024. This market is mainly influenced by the country's increasing demand for fresh produce and grain, positive regulatory scenarios, and increasing emphasis on cost reductions. The availability of advanced technology-driven automation systems in the domestic market is adding to the growth opportunities for this market.

Key Irrigation Automation Companies Insights

Some of the key companies operating in the global irrigation automation industry include NETAFIM, Rivulis, Nelson Irrigation Corporation, Calsense, Galcon, and others. To address growing competition and increasing demand for technology-driven automation irrigation systems, key market participants are embracing strategies such as acquisitions, new product launches, collaborations, and others.

-

NETAFIM, a company owned by Orbia Group, manufactures irrigation equipment and offers a wide variety of products and solutions. These include drippers and driplines, filters, sprinklers, valves, flexible and PE pipes, connectors, accessories, water tanks, water meters, digital farming, and others.

-

Rivulis specializes in microirrigation products and operates nearly 20 manufacturing facilities and three research and development centers in Greece, the U.S., and Israel. Its portfolio offerings include drip tapes, drip lines, online drippers, sprinklers, jets, lay flats, pipes, filters, valves, automation and fertigation, and connectors and accessories.

Key Irrigation AutomationCompanies:

The following are the leading companies in the irrigation automation market. These companies collectively hold the largest market share and dictate industry trends.

- CALSENSE

- Galcon (PLASSON)

- HUNTER INDUSTRIES

- Hydropoint Data Systems

- Rivulis

- Lindsay Corporation

- Mottech Water Solutions Ltd.

- Nelson Irrigation Corporation

- NETAFIM

- Orbit Irrigation Products

- Rain Bird Corporation

- The Toro Company

- Valmont Industries

- Weathermatic

Recent Developments

-

In November 2024, NETAFIM, a precision agriculture business by Orbia and Bayer, declared the expansion of the strategic collaboration between the two by introducing newly designed digital farming solutions. Simplified primary data collection and generation of actionable insights regarding crop production and resource optimization for fruits and vegetable farmers are some of the key features of the new offerings.

-

In November 2024, NETAFIM Italia acquired Tecnir S.r.l., an irrigation system design and installation company. The company's portfolio mainly featured tailored solutions for the agriculture industry. This acquisition is expected to strengthen NETAFIM's precision irrigation portfolio in the Italian market.

-

In April 2023, Rivulis, one of the irrigation industry’s market participants, announced the completion of the acquisition process of Jain Irrigation’s International Irrigation Business. This is anticipated to strengthen Rivulis’ modern irrigation and digital farming solutions portfolio.

Irrigation Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.58 billion |

|

Revenue forecast in 2030 |

USD 17.67 billion |

|

Growth Rate |

CAGR of 21.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Automation, component, irrigation, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, Russia, China, India, Japan, Australia, Brazil, Argentina, South Africa, Saudi Arabia |

|

Key companies profiled |

CALSENSE; Galcon (PLASSON); HUNTER INDUSTRIES; Hydropoint Data Systems; Rivulis; Lindsay Corporation; Mottech Water Solutions Ltd.; Nelson Irrigation Corporation; NETAFIM; Orbit Irrigation Products; Rain Bird Corporation; The Toro Company; Valmont Industries; Weathermatic |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Irrigation Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global irrigation automation industry report based on automation, component, irrigation, application, and region.

-

Automation Outlook (Revenue, USD Million, 2018 - 2030)

-

Time-Based

-

Volume-Based

-

Real-time Based

-

Computer-Based Control System

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Controllers

-

Sensors

-

Valves

-

Sprinklers

-

Others

-

-

Irrigation Outlook (Revenue, USD Million, 2018 - 2030)

-

Sprinkler Irrigation

-

Drip Irrigation

-

Surface Irrigation

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agricultural

-

Open Fields

-

Greenhouses

-

Others

-

-

Non-agricultural

-

Golf Courses

-

Residential

-

Sports Grounds

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."