- Home

- »

- Advanced Interior Materials

- »

-

Iron And Steel Market Size, Share & Growth Report, 2030GVR Report cover

![Iron And Steel Market Size, Share & Trends Report]()

Iron And Steel Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Iron Ore, Steel), By Region (NA, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-978-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Iron And Steel Market Summary

The global iron and steel market size was valued at USD 1,676.24 billion in 2022 and is projected to reach USD 2,253.52 billion by 2030, growing at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030. Rising investment in residential construction is expected to augment the market growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific held the largest revenue share of over 59.0% of the global iron & steel market in 2022.

- The Middle East & Africa market is expected to register high growth over the forecast period.

- Based on the product, the iron ore segment is expected to register a growth rate of 2.0% across the forecast period.

- Based on application, the steel segment held a revenue share of over 96.0% in 2022.

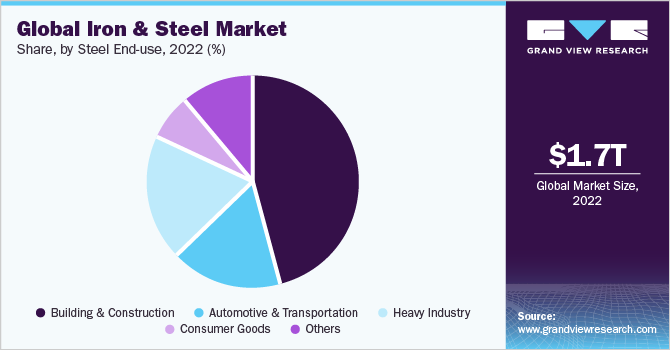

- Based on end-use, the building & construction segment held a revenue share of over 45.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1,676.24 Billion

- 2030 Projected Market Size: USD 2,253.52 Billion

- CAGR (2023-2030): 3.8%

- Asia Pacific: Largest market in 2022

- Middle East & Africa: Fastest growing market

Iron & steel products possess a high strength-to-weight ratio, allowing them to bear heavy loads and resist compression, tension, and bending forces. This characteristic makes it ideal for supporting the weight of tall buildings and transferring the load to the foundation. The products are highly durable and resistant to corrosion, weathering, and pests. This durability ensures the longevity of the building and reduces the need for frequent maintenance and repairs, making it a cost-effective choice for the construction industry.

The U.S. is one of the largest consumers of iron & steel in North America owing to rising demand from the various end-use industries such as construction & infrastructure, automotive & transportation, heavy machinery, and consumer goods. According to the U.S. Census Bureau, the total construction spending in the country for the first 5 months of 2023, amounted to USD 740.8 billion, which was approximately 2.9% higher than the same period of 2022.

Also, various initiatives by the government are expected to drive the demand for products in the country. For instance, in April 2022, the U.S. government introduced a mandate requiring that iron and steel used in government-funded infrastructure projects, under Job’s Act, must be manufactured in the country. This means that all the stages involved in making iron and steel, such as melting and coating, must occur within the country.

Furthermore, rising demand for heavy machinery is projected to augment the consumption of products across the forecast period. For instance, the new order of manufactured durable goods in May 2023, increased by 1.7%, and transportation equipment increased by 3.9% compared to April 2023.

The ongoing conflict between Russia and Ukraine has indeed had a detrimental effect on the iron & steel industry, leading to a significant rise in prices for these commodities. The United Nations Conference on Trade and Development reported that global energy prices experienced a substantial increase due to a reduction in the supply of oil, gas, and coking coal from Russia. Consequently, this has resulted in a decline in the consumption of various products across different end uses.

Product Insights

Based on the product, iron ore segment is expected to register a growth rate of 2.0% across the forecast period. Around 96% of the iron ore is used in crude steel manufacturing globally. Thus, fluctuation in steel demand impacts its consumption. For instance, the consumption of iron ore has increased in crude steel production in China due to higher scrap prices, which is expected to result in higher imports for iron ore in the country, after three years.

The steel market is expected to register a higher growth rate across the forecast period. The segment growth is attributed to the growing demand from the building & construction industry. For instance, in June 2023, Adel Hassan's AMHT Group unveiled its new real estate venture called Viola, in El Banafseg city, New Cairo, Egypt. The project, worth around EGP 600 million (~USD 19.42 million), will have a versatile four-story building covering a vast area of 14,000 square meters. The project is anticipated to be completed by 2025.

Iron Ore Application Insights

Based on application, the steel segment held a revenue share of over 96.0% in 2022. Rising construction activities are projected to drive the segment growth. For instance, in September 2022, Arada, a property developer in Sharjah, announced to invest USD 1.71 billion to develop an office park in Sharjah and develop 5 new residential projects in the UAE. The construction of the first phase of the business started in Q1 2023 and is anticipated to be finished in 2025. The overall project is expected to be completed by 2028.

The others segment is expected to register the fastest growth over the forecast period. The segment comprises black iron oxide, powdered iron, iron blue, and iron 59. Powdered iron finds widespread use as a raw material in manufacturing processes. It is frequently combined with other substances to form alloys or utilized in powdered metallurgy techniques to produce components like gears, magnets, and sintered parts.

Steel End-Use Insights

Based on end-use, the building & construction segment held a revenue share of over 45.0% in 2022. The rising investment in building construction is expected to augment the demand for steel products during the forecast period. For instance, in April 2023, Hiranandani Group announced an investment of INR 1,000.0 crore (USD 120.7 million) to construct a housing project in Mumbai, India. The company's objective is to create a residential space of 1 million square feet in this project, which will encompass approximately 700 units.

The automotive & transportation segment is expected to register a growth rate of 4.2%, in terms of revenue, across the forecast period. The American Iron and Steel Association reports that steel makes up approximately 54% of the overall composition of an average vehicle. The product is vital in producing various automotive components, including door panels, chassis, frames, and support beams.

The product is used in various consumer goods such as refrigerators, air conditioners, and microwaves. Rising investment in expanding consumer goods production is expected to augment the market growth over the forecast period. For instance, in February 2022, Panasonic Holdings Corporation announced to invest JPY 100 billion (~USD 867 million) in the air conditioning business over five years.

Regional Insights

Asia Pacific held the largest revenue share of over 59.0% of the global iron & steel market in 2022. Market growth will likely be augmented by increased investments in the housing and commercial sectors of developing economies such as China and India. For instance, in 2022, TARC Limited, announced an investment of INR 250 crore (USD 30.23 million) to construct a luxury residential project in New Delhi, India.

North America is expected to register a CAGR of 4.2% in terms of revenue, over the forecast period. Rising investment in the production of electric vehicles is expected to propel the demand for iron powder, electric steel, and other components during the coming years.

The Middle East & Africa market is expected to register high growth over the forecast period. The growth in the region can be attributed to the rising investments by both government and private entities across industries like tourism, construction, manufacturing, and infrastructure. The countries in the region are undergoing rapid industrialization and urbanization, which is driving their development at a fast pace.

Key Companies & Market Share Insights

The market consists of many companies, both small and large, operating in different parts of the world. These companies aim to expand their global presence through acquisitions and increasing their production capacity. For instance, in January 2022, Steel Dynamics acquired a 45% share of New Process Steel. According to Steel Dynamics, the minority equity interest in New Process Steel is expected to help the company to expand its exposure to value-added manufacturing opportunities. Some prominent players in the global iron and steel market include:

-

Arcelor Mittal S.A.

-

China BaoWu Steel Group Corporation Limited

-

Nippon Steel Corporation

-

HBIS Group

-

Jiangsu Shagang Group

-

POSCO HOLDINGS INC.

-

Tata Steel Limited

-

JFE Steel Corporation

-

Shougang Group

Iron And Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,723.40 billion

Revenue forecast in 2030

USD 2,253.52 billion

Growth Rate

CAGR of 3.8% from 2023 to 2030

Market size volume in 2023

4,229.51 million tons

Volume forecast in 2030

4,953.98 million tons

Growth Rate

CAGR of 2.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative Units

Volume in kilotons, Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, iron ore application, steel end-use, and region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Spain; Italy; Russia; Turkey; India; China; Japan; South Korea; Argentina; Brazil; Iran

Key companies profiled

Arcelor Mittal S.A., China BaoWu Steel Group Corporation Limited; Nippon Steel Corporation; HBIS Group; Jiangsu Shagang Group; POSCO HOLDINGS INC.; Tata Steel; JFE Steel Corporation; Shougang Group; Nucor Corporation; JSW; SAIL; NLMK; Techint Group; U.S. Steel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Iron And Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global iron and steel market report on the basis of product, iron ore application, steel end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Iron Ore

-

Steel

-

-

Iron Ore Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Steel

-

Other

-

-

Steel End-Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Heavy Industry

-

Consumer Goods

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global iron and steel market size was estimated at USD 1,676.23 billion in 2022 and is expected to reach USD 1,723.40 billion in 2023.

b. The global iron and steel market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 2,253.52 billion by 2030.

b. Based on product, steel had a revenue share of over 81.0% in 2022 of the global iron and steel market. Its rising significance and usage in the construction industry are propelling its growth.

b. Some of the key players operating in the iron & steel market include ArcelorMittal; China BaoWu Steel Group Corporation Limited; Nippon Steel Corporation; HBIS Group; Jiangsu Shagang Group; POSCO; Tata Steel; JFE Steel Corporation; Shougang Group; Nucor Corporation, JSW; SAIL; NLMK; Techint Group, and U.S. Steel Corporation.

b. Low interest rates for mortgage loans along with government subsidies are expected to drive the residential and commercial construction and thus drive the growth of the iron and steel market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.